The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by David,TechFlow

On the eve of the Bitcoin spot ETF decision, the crypto market experienced a flash crash this week.

Despite the panic, Ethereum ecosystem tokens like LDO and ARB quickly rebounded, with smaller Ethereum L2 tokens such as Metis even reaching new highs. This indicates strong market confidence in the Ethereum ecosystem.

However, with L2 tokens already on the rise and most liquid staking projects only offering beta yields, what other narratives within the Ethereum ecosystem can be explored?

One significant yet unfulfilled catalyst is restaking and EigenLayer.

Derived from liquid staking, restaking has evolved into a more complex, nested-doll version of Liquid Staking Tokens (LST) in the relentless pursuit of capital efficiency and higher returns: Liquid Restaking Tokens (LRT).

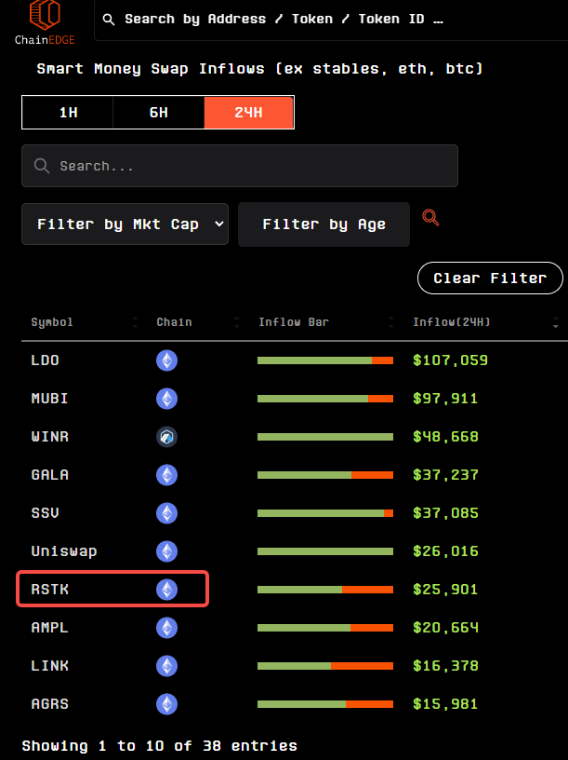

Recently, some LRT-related tokens have shown notable gains outside of centralized exchanges.

Does this sound familiar yet somewhat confusing?

In this article, we will help you quickly grasp the logic of restaking and LRT and explore projects with lower market caps or those that have yet to release tokens.

Restaking is not a new concept.

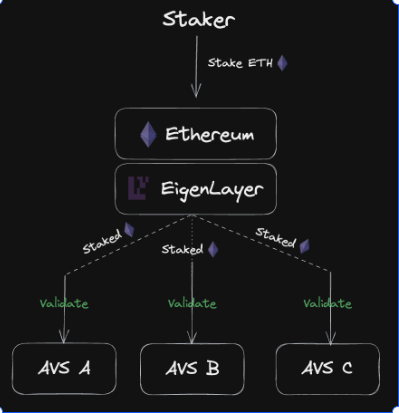

As early as June last year, EigenLayer introduced the concept of restaking on Ethereum. It allows users to restake their already staked Ethereum or Liquid Staking Tokens (LST) to provide additional security to various decentralized services on Ethereum and earn extra rewards for themselves.

Without delving into the technical principles of EigenLayer, we assume readers have a basic understanding of it. (Related reading: Analysis of Restaking Pioneer: EigenLayer’s Business Logic and Valuation)

If you're not focused on the internal technical details of EigenLayer, it's easier to grasp the logic of liquid staking and restaking:

In simple terms:

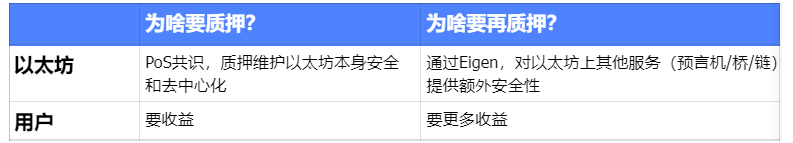

For Ethereum, staking maintains security, while restaking provides additional security.

For investors, staking seeks yields, while restaking aims for even higher yields.

From an investment perspective, how is this yield-seeking method implemented? The diagram below provides a simplified understanding:

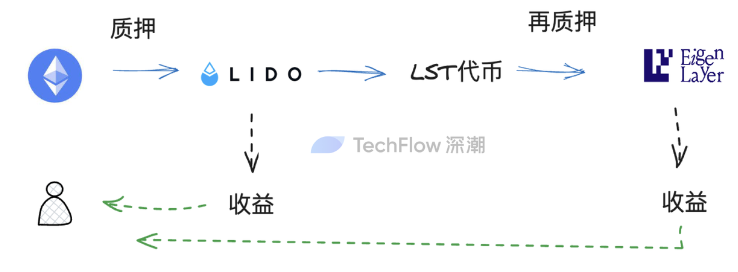

I have ETH, which I stake with a Liquid Staking Service provider like Lido;

I receive LST (e.g., stETH);

I restake stETH on EigenLayer;

I earn rewards from both steps 1 and 3.

Clearly, before EigenLayer, my LST could only generate one layer of yield. With EigenLayer, I get an additional layer of yield, theoretically risk-free.

However, there is a key issue in this mature restaking process: liquidity is locked.

Restaking LST in EigenLayer locks its liquidity, preventing further yield opportunities elsewhere.

EigenLayer, as a restaking layer, provides returns on the staked assets but doesn't offer the same liquidity as holding the tokens.

In the crypto market, where capital efficiency is paramount, liquidity never sleeps. The speculative nature of the market doesn't tolerate tokens being fully locked up without the ability to move.

So, the current method of "staking-restaking" to seek yields isn't perfect.

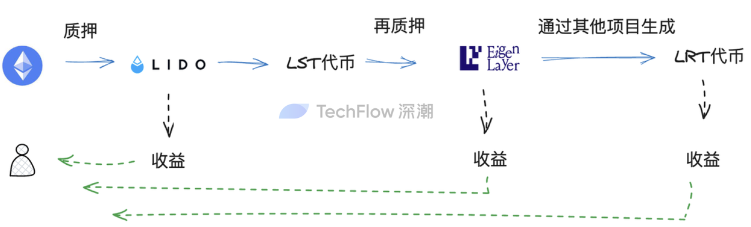

To enhance token liquidity and create more opportunities, Liquid Restaking Tokens (LRT) came into play. The concept behind LRT is pretty simple and can be compared to collateral certificates.

With ETH, I can obtain LST (stETH) through liquid staking. This stETH acts like a collateral certificate, proving "I have staked ETH," but the underlying asset remains ETH.

Similarly, with LST, I can get a new collateral certificate through restaking, proving "I have restaked stETH," while the original asset is still ETH.

This new collateral certificate is the LRT, which enables further financial operations like collateralization and lending, effectively solving the liquidity lockup issue in restaking.

If this concept is still unclear, think of it like a set of nested dolls with three layers:

Using ETH, I can get LST.

Using LST, I can get LRT.

Holding all three layers lets me do various things—staking, restaking, and other yield-generating activities—each layer giving me more liquidity options.

As Ethereum gains more attention, tackling the capital efficiency issue in EigenLayer restaking could lead to a new LRT narrative.

Projects related to LRT, aiming to solve capital efficiency issues, are gaining attention, and some have already shown impressive price performance.

However, from a research perspective, we tend to avoid projects that are already fully priced in, such as SSV. Therefore, we'll focus on two types of projects:

Projects with tokens and low market caps

Projects without tokens

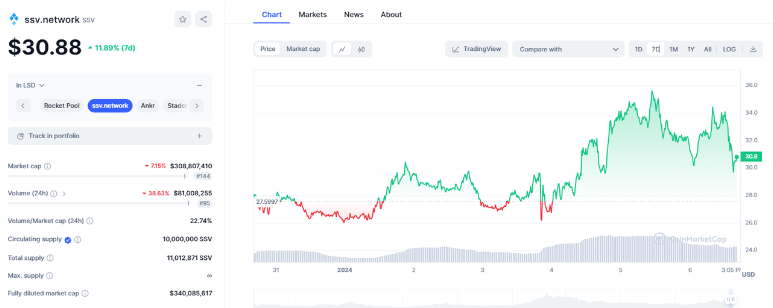

SSV Network ($SSV): Seamless Transition in Liquid Staking

Previously, liquid staking projects involved in staking can seamlessly transition to restaking, effectively leveraging their existing expertise.

SSV exemplifies this logic perfectly.

On January 4, SSV announced on Twitter that they are entering the restaking business. This move allows the responsibilities of EigenLayer validators to be distributed across SSV, leveraging SSV's distributed and non-custodial features to enhance validator performance and security. This not only boosts the resilience and distribution of validator operations but also improves fault tolerance and performance, ultimately giving users greater rewards and higher security.

Additionally, users can earn extra rewards on their staked ETH assets.

It's worth noting that SSV's restaking nodes are highly distributed, currently offering services in partnership with four nodes: ANKR, Forbole, Dragon Stake, and Shard Labs.

However, the SSV token hasn't seen significant gains over the past week. Considering its established reputation in the liquid staking sector and its natural fit with the restaking business, a market cap of around $300 million isn't particularly high. There's still plenty of potential for growth within the restaking narrative.

Restake Finance ($RSTK): The First Modular Liquid Restaking Protocol on EigenLayer

As the name suggests, Restake Finance specializes in providing restaking services related to EigenLayer.

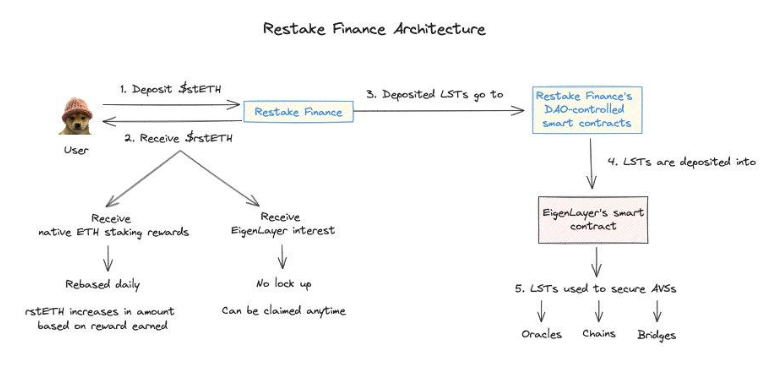

Here's how it works:

Users deposit Liquid Staking Tokens (LST) from liquid staking into Restake Finance.

Restake Finance helps users deposit their LST into EigenLayer and generates restaked ETH (rstETH) as restaking certificates.

Users can then use rstETH to earn yields across various DeFi protocols while also accumulating reward points from EigenLayer (since EigenLayer hasn't issued its own token yet).

This straightforward model leverages the LRT operational logic to maximize user benefits.

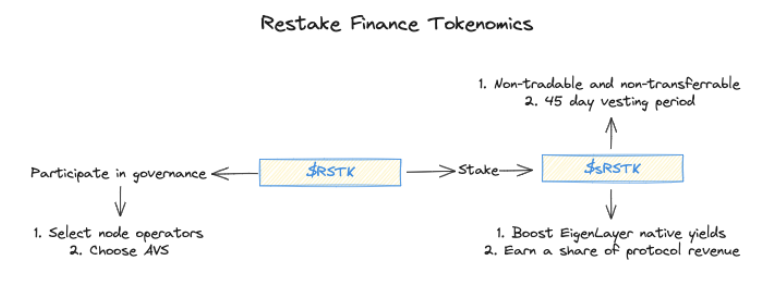

The project also features its native token, RSTK, built on Ethereum. Here's a breakdown of its functions in governance, staking, and boosting yields:

Governance:

$RSTK holders can take part in selecting node operators and Actively Validated Services (AVSs), thereby helping secure Ethereum-related components.

Increasing Yields:

Staking $RSTK boosts the yields generated by EigenLayer. Restake Finance distributes 5% of the EigenLayer restaking rewards accumulated on its platform to stakers, along with a share of the income from the Restake protocol.

When you stake $RSTK, you receive $sRSTK, which tracks governance and revenue-sharing rights. These tokens can't be traded or transferred. If you want to redeem your $RSTK, there's a 45-day unlock period.

Designed to reflect EigenLayer's success, $RSTK is expected to increase in value with the addition of more AVSs, wider adoption of EigenLayer, higher yields, and increased protocol revenue.

Overall, the token's design isn't groundbreaking; it mainly focuses on the traditional concept of staking to earn extra rewards.

That said, RSTK has recently seen a remarkable surge in performance.

Since its launch on December 20, RSTK has surged nearly 20 times in value. As of the time of writing, its market cap is still only around $38 million. Based on my observations, there has been a steady influx of smart money buying varying amounts of RSTK daily over the past week.

Is RSTK Undervalued?

Considering that SSV Network has also entered the restaking business and has a market cap of $330 million, RSTK might have significant growth potential. If restaking becomes mainstream for mature liquid staking projects, RSTK could see up to 10 times the growth. Comparing it to LDO, which leads in liquid staking derivatives, suggests even more potential, although LDO's established dominance makes this comparison less fair.

From a long-term perspective, there aren't many new token projects in the current LRT narrative worth betting on. Seamless transitions for LSD projects might offer modest yields, but projects like RSTK, focused on restaking from the start, seem more promising.

In the short term, the uncertainty surrounding the Bitcoin ETF could increase market volatility. From a research standpoint, waiting for stability and finding a good entry point might be a better strategy.

Stader Labs X KelpDAO ($SD): Supporting New Organizations in Restaking

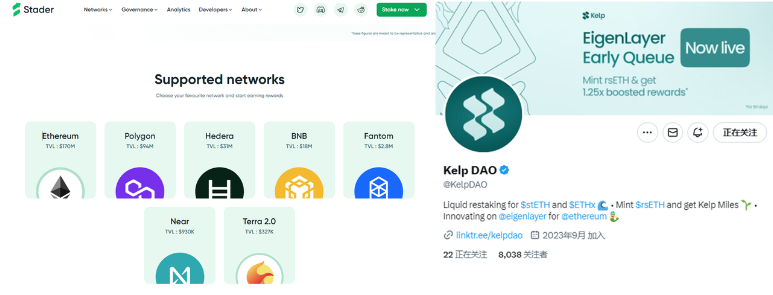

Stader Labs is not a new name; it gained prominence during last year's Shanghai upgrade-driven liquid staking narrative. What sets Stader apart is its support for multi-chain staking. According to its website, it supports staking not only on Ethereum but also on various L1 and L2 chains.

This versatile player, Stader, has smoothly transitioned into the LRT restaking business.

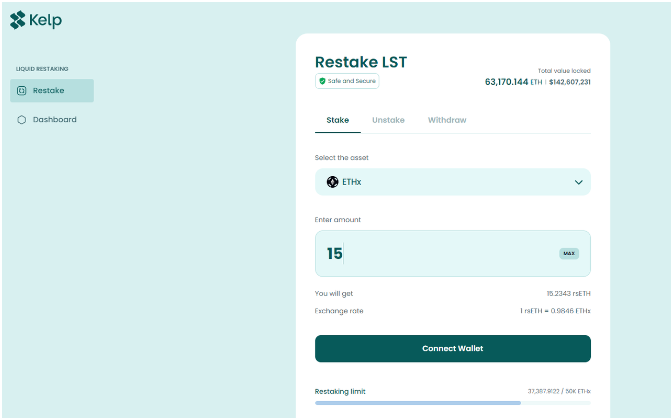

Stader also supports an organization called Kelp DAO, which focuses on liquid restaking. Its business model is quite similar to Restake Finance:

Users deposit stETH and other LST into the Kelp protocol to receive rsETH tokens.

These rsETH tokens can then be used for additional yield-generating activities.

Furthermore, through integration with EigenLayer, users can earn EigenLayer points from restaking, while leveraging LRT for liquidity and enjoying the yields from LST.

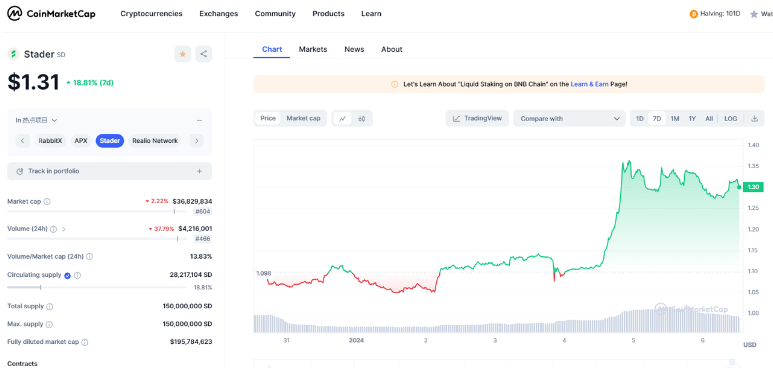

Since Kelp DAO currently doesn't have a token, Stader Labs' token, SD, stands out due to its clear association.

In the past week, SD has seen a roughly 20% increase in value, with a market cap similar to RSTK at around $35 million.

However, unlike RSTK, SD is an older token experiencing renewed interest thanks to the restaking narrative. Given that Kelp DAO is actively involved in the restaking business but hasn't issued a token yet, there might be future opportunities for interactions between SD and a potential Kelp token, such as airdrops.

Prisma ($PRISMA): An Alternative LSDFi Option, Not Entirely Related to LRT

The two tokenized projects mentioned above focus on unlocking liquidity directly through EigenLayer, but that's not the only method available.

Another approach in the market doesn't rely on EigenLayer but instead uses its own resources to generate liquidity and yields. A prime example of this is Prisma.

Strictly speaking, Prisma isn't an LRT project; it's more of an LSDFi initiative. (Related reading: Prisma Finance: Unlocking the Potential of Liquid Staking Tokens)

Prisma gained attention six months ago, largely due to its impressive lineup of investors and endorsements:

The project has backing from the founders of Curve Finance, Convex Finance, Swell Network, and CoingeckoFinance, along with investments from top-tier names like Frax Finance, Conic Finance, Tetranode, OK Venture, Llama Airforce, GBV, Agnostic Fund, Ankr Founders, MCEG, and Eric Chen.

Although the funding amount hasn't been disclosed, it's clear that Prisma has garnered support from some of the leading DeFi projects in the space.

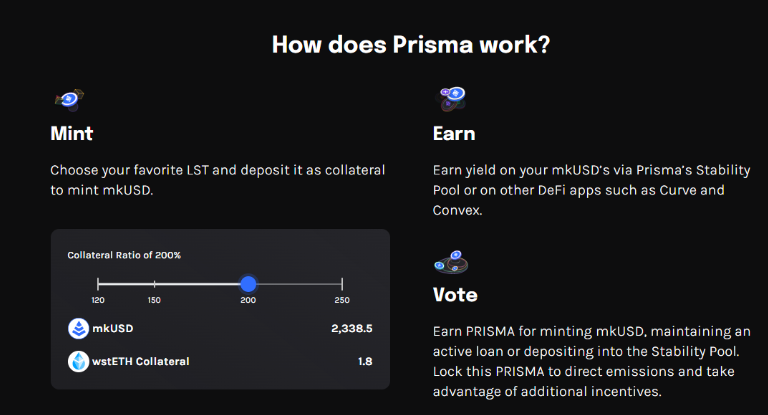

Prisma unlocks LST liquidity through a simple process:

Deposit your LST into the Prisma protocol.

Mint a stablecoin called mkUSD.

Use mkUSD in various DeFi protocols for staking, lending, and other yield-generating activities, thereby releasing the liquidity of LST.

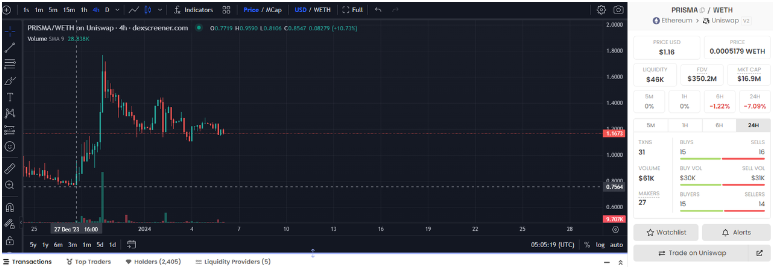

PRISMA's token has seen significant fluctuations over the past month, with more than a 100% swing between its highs and lows, making its price highly volatile. However, it has shown a decent increase over the past week.

With a market cap of only around $17 million, the token is highly susceptible to news-driven spikes and drops.

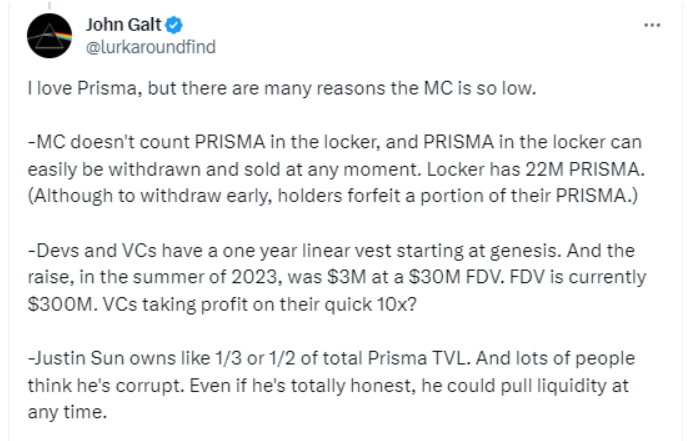

Given its impressive list of backers, why is PRISMA's market cap still so low? While the LSDFi narrative is attractive, it doesn't necessarily mean the project is undervalued. Here are a few factors to consider:

PRISMA's circulating market cap doesn't include around 22 million locked tokens.

These locked tokens can be released and sold at any time, potentially impacting the price.

According to Twitter user @lurkaroundfind, Justin Sun owns between one-third and one-half of PRISMA's total value locked (TVL), adding another layer of instability.

However, the combination of instability and a small market cap can also present trading opportunities.

Overall, PRISMA has a low market cap but boasts impressive backing and fits well within the LSDFi narrative. Transitioning to an LRT model wouldn't involve significant costs, so there's potential to leverage this narrative for market movement.

A smart strategy would be to allocate a small position in PRISMA to capitalize on potential pump-and-dump cycles.

Picca Network ($PICA): Leading Liquid Restaking on Solana

If the Ethereum liquidity restaking projects seem too crowded, another option could be to explore similar opportunities within the popular Solana ecosystem.

One promising project in this space is Picca Network.

Picca Network aims to support multiple Layer 1 blockchains, primarily facilitating cross-ecosystem Inter-Blockchain Communication (IBC) between ecosystems like Polkadot, Kusama, and Cosmos, while also extending to other networks such as Ethereum and Solana.

However, the project is currently targeting the untapped liquidity restaking niche within the Solana ecosystem, leveraging its IBC capabilities to enable restaking on Solana.

To execute this, Picca Network is launching a Restaking Vault plan. In simpler terms, think of Picca Network as a Solana-based version of EigenLayer. Here’s how it works:

Through Picca's Solana<>IBC connection, it offers a validator specifically for Solana

Users can restake LST tokens like mSOL, jSOL, Orca LP, and bSOL from Solana liquid staking projects (such as Marinade, Jito, Orca, and Blaze) into this validator.

This setup allows users to earn restaking yields while securing the network.

A key opportunity is that Solana's liquid staking rate is lower than Ethereum's, with about 8% of SOL still unstaked. This benefits both liquid staking and liquidity restaking.

Given that Solana's liquid staking projects have previously experienced widespread growth, if the Ethereum restaking narrative gains traction, market funds might also flow into Solana's restaking narrative.

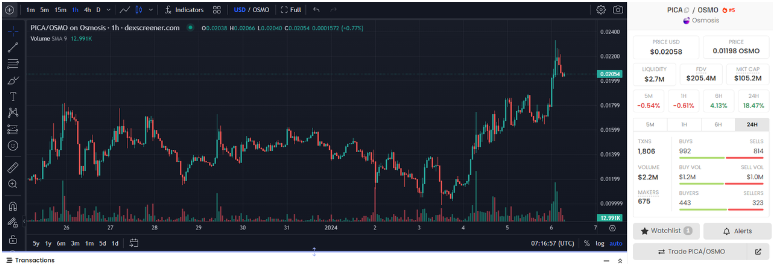

In terms of tokens, Picca has seen nearly a 100% increase in the past week, bringing its market cap to around $100 million. This is relatively high compared to some Ethereum-based liquidity restaking projects mentioned earlier. However, considering Picca's IBC capabilities and its broader range of services beyond just liquidity restaking, its market cap can't be directly compared to similar Ethereum projects.

Considering that Solana-related projects haven't been as impressive as their Ethereum counterparts in the past week, Picca can be a backup option in your investment portfolio. Keep an eye on the flow of funds into Solana before making any moves.

Potential Projects Without Tokens

In addition to the previously mentioned projects, there are several LRT projects that don't yet have tokens but are actively working in the restaking space.

Here's a brief overview due to space constraints. For more information, interested readers can check out the projects' social media and websites.

Puffer Finance: Lowering Validator Thresholds with Native Restaking

EigenLayer typically requires a minimum of 32 ETH for restaking nodes to run AVS.

Puffer Finance aims to lower this threshold to below 2 ETH, making it more accessible for smaller nodes.

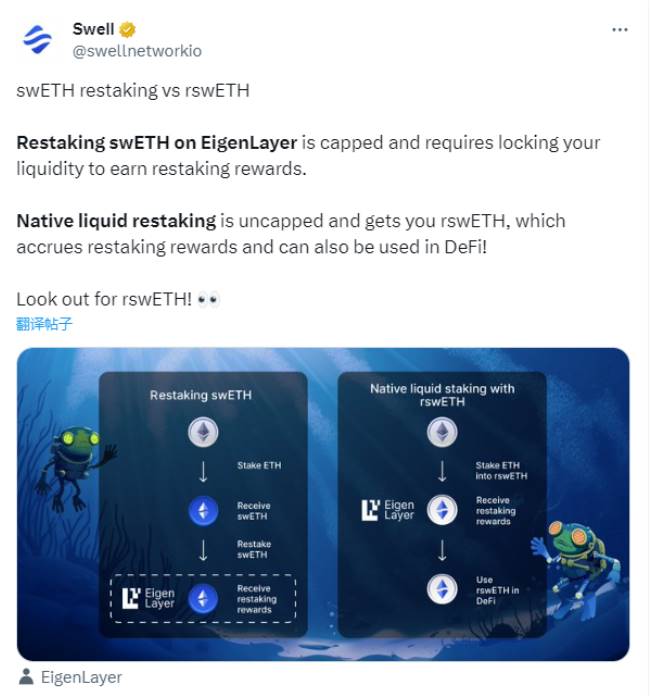

Swell: From Liquid Staking to Restaking, Earning Points for Potential Airdrops

Swell, which previously focused on liquid staking on Ethereum, recently introduced a restaking feature. Now, users can deposit ETH and receive rswETH in return.

Given that Swell hasn't issued a token yet, users could previously exchange LSD for points. Now, participating in restaking provides additional opportunities to earn more points.

ether.fi: Offering a Seamless Restaking Experience

Similar to Swell and Puffer in functionality, ether.fi currently has a total staked TVL of around $120 million.

There are also several other projects not listed here due to space constraints. However, if LRT continues to gain popularity, these unlisted projects will likely actively market themselves to attract users to restake. It's only a matter of time before they get noticed.

In conclusion, while researching these projects, I've been considering whether liquidity restaking is truly a step forward.

From Ethereum's perspective, it enhances the security of various projects through EigenLayer.

However, practically speaking, it feels more like speculative leverage for liquidity. This leverage means that while the original asset remains a single unit, through token mapping and rights locking, multiple derivative certificates can be created from the original ETH, continuously leveraging it.

On the positive side, these derivatives can significantly boost liquidity in favorable conditions, benefiting market speculation.

On the downside, the interconnected protocols issuing these derivatives create a network of dependencies. Holding asset A allows borrowing asset B, which can then be used to activate asset C. If protocol A faces issues (like a hack or internal fraud) and is substantial enough, the resulting risks are interconnected and amplified.

When the market's bullish, it's all about stacking leverage. But when things turn bearish, it's every man for himself.

Ethereum has created a vast open field, and EigenLayer has built a racetrack on it. For liquidity seeking returns and those willing to take risks, providing a reason to run on this track is ideal.

Liquidity never sleeps, and catering to liquidity is the eternal theme of the crypto market.

Recommendation

Korean

Insights from Korean Crypto: A Quest for Exit Liquidity

Sep 09, 2024 14:33

Exploring the Real Japanese Crypto Market: Coexistence of Isolation and Contradiction, Where are the Opportunities?

Jun 06, 2024 18:47

Meme,Murad

Will Meme Coins Reach a Trillion-Dollar Market Cap? Meet Murad, The New Meme King in Crypto

Oct 10, 2024 15:41