The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

In October 2023, the genesis block of dYdX was created by validators, marking the official launch of the dYdX chain.

Just two months earlier, the total trading volume of dYdX had surpassed $1 trillion. Despite being the largest decentralized perpetual contract exchange, dYdX's ambition is to create a product more competitive than centralized exchanges. If an independent application chain can provide the performance needed for this product and achieve true decentralization, migration is the inevitable choice.

In this issue, we will delve into the development of dYdX Chain after its launch and analyze how dYdX is building the best contract exchange.

dYdX was also one of the "early adopters": in 2021, using StarkEx reduced dYdX's gas fees to 1/50 of the original, increased the supported trading pairs by 10 times, and saw trading volume grow rapidly. Moving to L2 made dYdX one of the most commendable DeFi products, but this was not all dYdX wanted because its order book and matching engine were still centralized.

As the business further developed, dYdX needed infrastructure more suited to its products, which StarkEx's iteration speed could not achieve.

IOSG once made a vivid analogy:

"Ethereum Rollup is like an old building in the city center; the advantage is it’s in a bustling business district (composability), but the drawback is the outdated infrastructure (slow infrastructure iteration), and no renovations allowed (no support for application-customized nodes). dYdX is a major tenant of this building, with no social interactions (not relying on composability). Therefore, they decided to move to the suburbs to build a small villa. At this time, they happened to meet a good renovation team (Cosmos SDK), so they hit it off and left Rollup aside.

From a tenant to a homeowner, dYdX not only saved a lot of rent (sharing profits with StarkEx) but also gained space for independent play. On June 22, 2022, dYdX officially announced the development of an independent application chain to achieve complete decentralization and provide the best trading experience.

The key to the dYdX v4 upgrade is using Cosmos SDK to build its application chain, optimizing application layer performance through control of the underlying layer.

The Cosmos SDK is an open-source toolkit that allows developers to build an independent blockchain using composable modules. The Tendermint consensus algorithm ensures a secure network and minimal latency, allowing Cosmos to process thousands of transactions per second. More importantly, developers can modify and optimize their blockchain according to their needs: for example, dYdX needs an independent verification system that allows validator nodes to maintain the order book off-chain. The independent application chain allows its tokens (instead of ETH) to pay transaction fees and eliminates gas fees.

Such an application chain can obviously support dYdX in further improving product experience, and the improvement of v4 compared to v3 is also obvious.

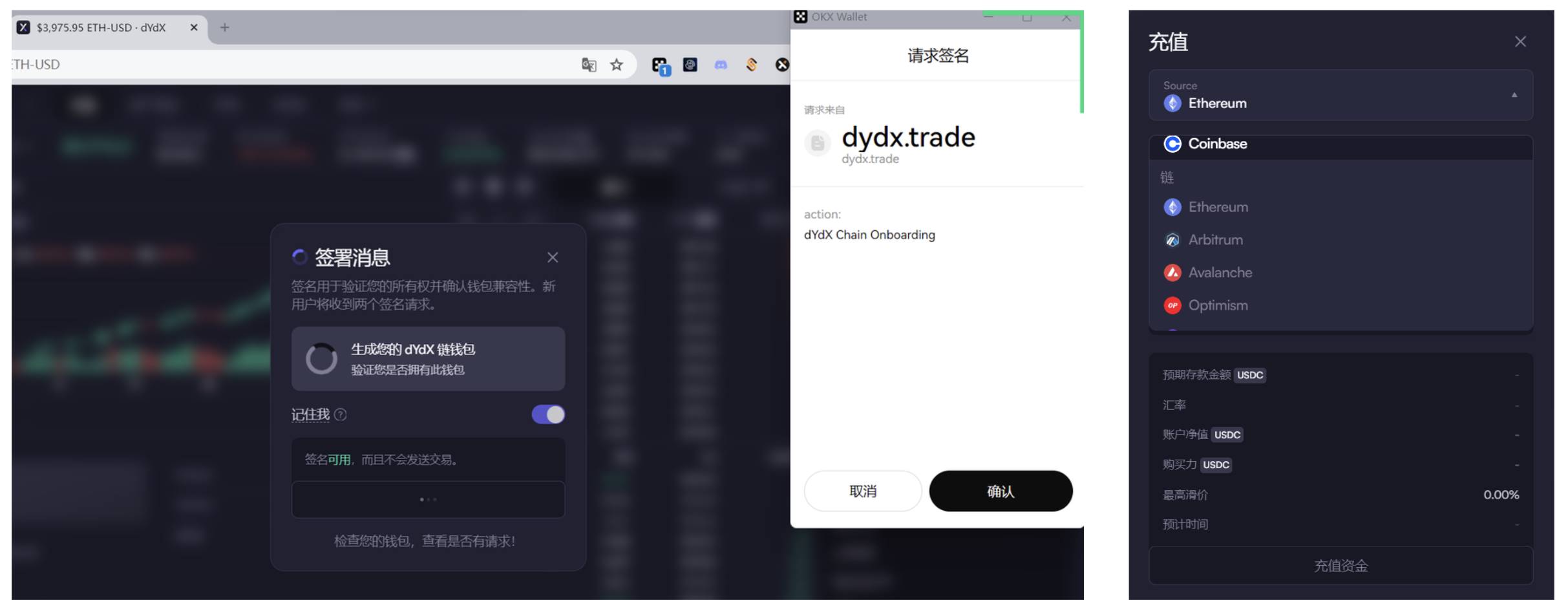

When dYdX announced its independent application chain, there were also some doubts: for example, leaving the vast user and ecosystem of Ethereum, would it lead to user loss? Through practical testing, the author found that in terms of product experience, users still use mainstream wallets like Metamask and OKX Web3 to log in to the v4 version; and compared to v3 which only supported ETH network deposits, the v4 version also supports deposits from Coinbase and L2 cross-chain to dYdX.

While migrating to Cosmos to leverage its high performance and flexibility, dYdX places great emphasis on user experience consistency. By continuing to use familiar deposit routes and trading, users can switch to the new v4 version without concerning about which chain their assets come from.

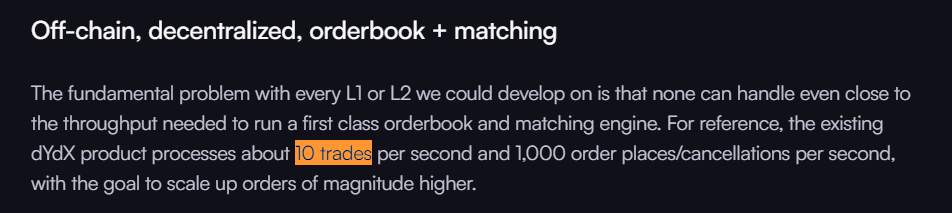

The custom application chain of Cosmos allows dYdX to exclusively enjoy the performance of the entire chain, better meeting the needs of dYdX's high throughput trading and hedging system. Before migration, dYdX could only process about 10 transactions per second and 1,000 order/cancel requests. After migration, dYdX can process up to 2,000 transactions per second.

High-frequency trading involves many orders and cancellations, and the gas payment feature of on-chain trading obviously cannot attract professional traders to give up CEX. In the v4 version of dYdX, fees are only charged after order matching is successful and transaction results are on-chain, and transaction fees are charged as a percentage, making the experience more akin to centralized exchanges.

dYdX v3 is a hybrid decentralized exchange: most contracts and code are open-source and on-chain, but the order book and matching engine are still centralized.

The v4 version makes dYdX completely decentralized with off-chain order books and matching engines: 60 active global validators perform network verification and block creation, each maintaining an off-chain order book. When orders are matched in real-time, new blocks are created, and when 2/3 of validator nodes vote to pass, consensus is reached. Data is updated and returned to the front end through an indexer.

In the v3 version, the main purpose of the dYdX token was to get discounts on fees, whereas the decentralization of v4 offers greater empowerment for the token.

From a governance perspective, dYdX token holders can define the function of the token, add or remove markets, and modify the parameters of dYdX v4.

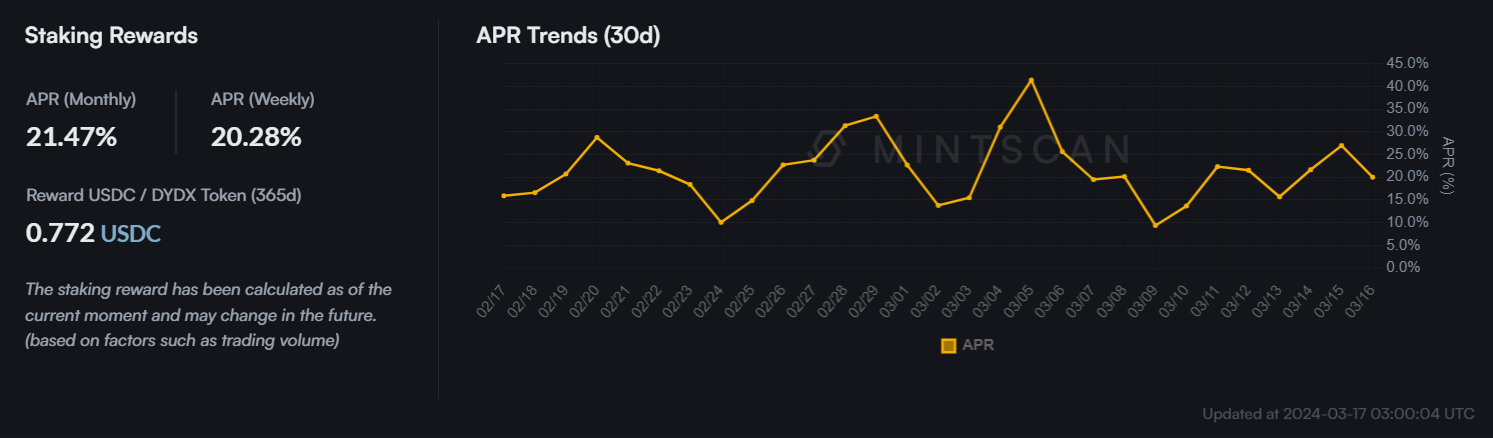

From a staking perspective, the dYdX chain requires validators to stake dYdX tokens to operate and protect the chain. The income of dYdX is distributed to stakers: currently, the APY for stakers is as high as 20%, paid in USDC.

More importantly, v4 has achieved permissionless listing, with a much richer variety of supported token contracts compared to v3. It currently supports contracts for over 60 tokens, and in March added new tokens such as GRT, MANA, ALGO, HBAR, IMX, RNDR, and AGIX. The founder stated on Twitter that plans are to support trading for over 500 tokens by the end of 2024.

Advanced technology is the foundation, but allowing users to perceive the convenience brought by technology requires specific product implementation, market promotion, and operational activities to educate users.

In addition to providing a better trading experience and more tokens, v4 also offers a series of incentive activities to help smoothly transition users from the v3 version. Based on the risk preference from high to low, the author summarized three ways users can participate in the dYdX ecosystem and receive incentives:

At the end of November, Chaos Labs launched a $20 million dYdX chain early adopter incentive plan for six months, with 80% used to reward trading activities. Each successful transaction rewards traders with dYdX.

If you don't want to take on long or short directional risk in trading, you can opt for hedging to earn funding rates: opening short positions on dYdX while holding spot positions on CEX to earn dYdX funding rates.

You can also earn up to 20% APR by simply staking dYdX, with rewards paid in USDC. Currently, dYdX has distributed over 8.2 million USDC to 15,000 stakers—all real revenue distribution from trading fees.

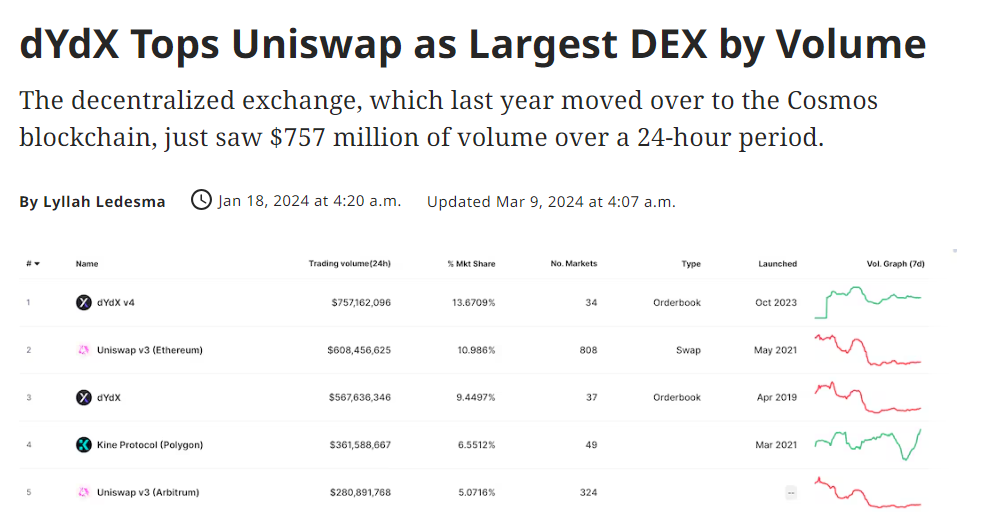

dYdX's incentive activities have effectively attracted users and transactions: within three months of launch, the total trading volume of dYdX v4 has approached $80 billion. On January 18, dYdX Chain even surpassed Uniswap, becoming the DEX with the largest trading volume.

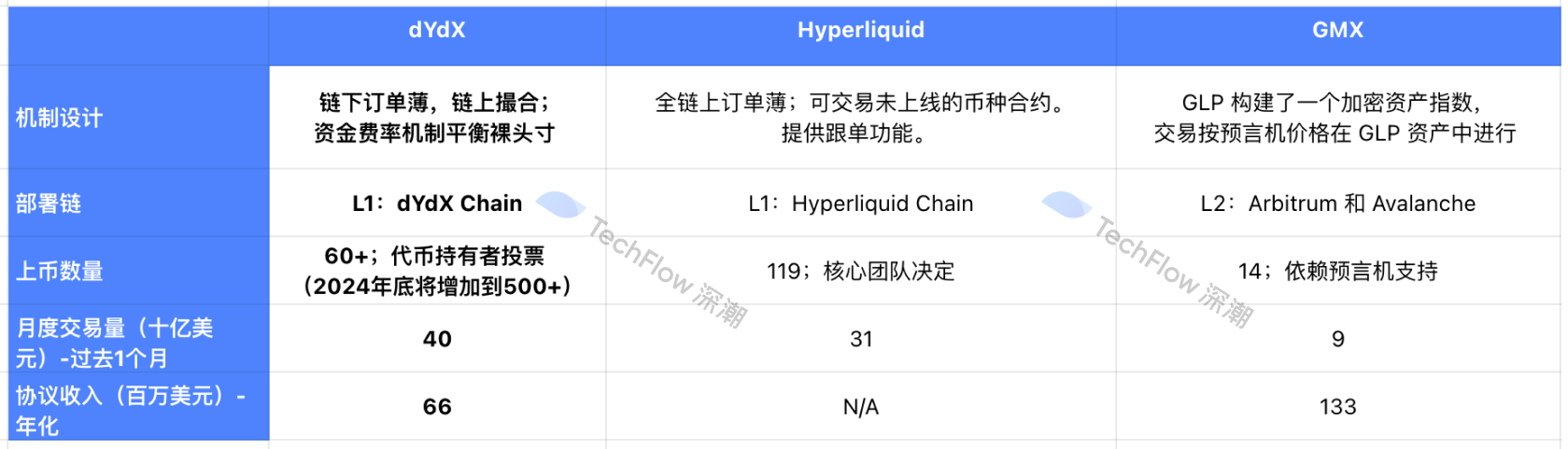

The on-chain derivatives trading market has a larger market space than spot trading and thus faces fierce competition, with various protocols showcasing their strengths. We listed a few competitive protocols in this field.

GMX is known for offering 30X leverage and large trades with no slippage. However, the V1 mechanism has a risk of small token manipulation leading to GLP losses. V2 avoids this with mechanisms like separate liquidity pools and position size limits but still has limitations in offering more trading tokens. Additionally, GMX's trading fees are higher compared to the others.

Hyperliquid has gained attention for launching futures trading and copy trading features for popular assets like Friend.Tech. Mechanistically similar to dYdX, it currently has tokens and core values entirely decided by the team, like modifying Friend.Tech's futures formula to avoid price manipulation. It’s less decentralized and mature compared to dYdX.

Hyperliquid is an emerging player, capturing traffic through novel features and quick token listings; but from the perspective of product experience and decentralization, dYdX has the upper hand, making it more favored by professional traders. Although the decentralized perpetual contract exchange race is not yet decided, in terms of trading volume, dYdX still leads over other competitors.

Most L1s follow the path of building infrastructure first and then attracting developers, but dYdX made a successful application first and then customized the application chain for further development. The application chain not only allows dYdX to break through performance bottlenecks but also brings greater development space: StarkEx’s interaction with other ETH ecosystems is more complex, while Cosmos allows dYdX to interoperate with other IBC-supported Cosmos blockchains.

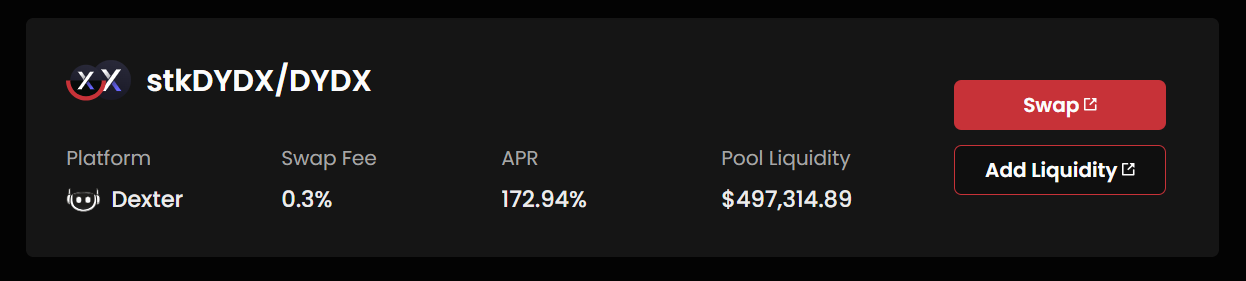

For example, liquid staking: due to the significant fee income distributed to stakers by dYdX, over 106M dYdX tokens are staked. However, staking locks up liquidity, with a 30-day wait for redemption. This huge potential demand has attracted three lsd protocols to offer dYdX liquid staking.

Take pStake for example: users who stake dYdX on pStake not only have their staking rewards automatically reinvested but can also add liquidity pools on Dexter to earn an APR as high as 173%, including PSTAKE token rewards.

Another example is the integration with Squid, a cross-chain infrastructure solution from Axelar Interoperability Network, allowing users to enter the Cosmos application chain from Ethereum L1, L2 Rollup, and centralized exchanges. The quick integration of cross-chain bridges and liquid staking functionalities is due to Cosmos’ unparalleled interoperability. In the future, we can expect more possibilities from the combination of dYdX with other protocols in the Cosmos ecosystem.

From v3 to v4, dYdX has undergone a transformative change from a dApp to a custom application chain.

The performance and flexibility of a custom application chain allow it to offer users lower transaction costs and faster transaction speeds; on the other hand, it allows token holders to participate in verification and chain protection, governance voting, and income distribution, taking a significant step towards true decentralization.

Finally, as an application chain, dYdX has the potential to develop its ecosystem. From the first quarter data recently released by dYdX, we can see significant breakthroughs in trading volume, supported tokens, and staking volume.

Thanks to Cosmos' unparalleled cross-chain interoperability, each Cosmos chain can seamlessly interact. As dYdX's token distribution is based on real revenue and can participate in governance, it has already been integrated into liquid staking and DeFi protocols in the Cosmos ecosystem.

dYdX may no longer be the dApp we once knew, but an application chain with more ecological possibilities. As DeFi returns to the public eye this year, we look forward to more developments from dYdX Chain.

For more details, refer to: dYdX Official Website | dYdX Official Twitter

Recommendation

Tranchess

Tranchess Strategic Analysis: DeFi Innovation Through Chess-like Gameplay

Nov 11, 2024 15:46

When 9 of the Top 100 Market Caps Are Memes, Embracing Attention Investing Is Clearly the Way Forward

Jul 07, 2024 14:12

NAVI

NAVIs Rise in Sui Ecosystem: Building on Lending + LST Success, Ready to Scale as Native USDC Launch

Nov 11, 2024 15:34