The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

During the period when memes dominate and AI is less prominent, what other popular narratives are worth paying attention to?

Chain abstraction is certainly one of the most promising areas.

As the demand for applications that work seamlessly without users needing to understand the underlying blockchain increases, chain abstraction and intents are gaining widespread attention. Numerous participants, including leading projects, VCs, and research institutions, are actively exploring the possibilities in this field.

However, chain abstraction faces major challenges such as the fragmentation of cross-chain liquidity and the high cost of transferring funds between different chains. These issues make asset transfers between blockchain.

As is often the case in the crypto world, the first projects to solve these problems are more likely to gain attention.

Yesterday, the former cross-chain communication protocol Connext announced its rebranding to Everclear and proposed a so-called new primitive "Clearing Layers" to address the high cost of fund transfers in chain abstraction and cross-chain intents.

As soon as the news was released, the project's token NEXT responded by rising 20% within 24 hours, indicating that the secondary market interpreted this business change as a positive development.

So, what exactly is Everclear? What problems can this new concept of Clearing Layers solve?

It all begins with the fundamental ideas of chain abstraction and cross-chain intent.

Cross-Chain Intent indicates the user's aspiration for seamless operation and asset transfer across diverse blockchains.

Gone are the worries about which chain you're currently navigating; from point A to point B, the transition is smooth and effortless.

However, a chasm yawns between this visionary concept and present-day reality.

To start, cross-chain liquidity stands deeply fragmented. For the end-user, assets residing on distinct blockchains are strewn across a multitude of independent chains, resulting in intricate liquidity management quandaries during cross-chain transactions.

Secondly, the cost of rebalancing funds between different chains presents a significant challenge.

But what exactly is rebalancing?

From a business standpoint, rebalancing entails distributing funds across various blockchains to ensure each chain possesses adequate liquidity to support user transactions.

Given the dynamic nature of demand and supply on each chain, cross-chain bridges and liquidity providers must frequently reallocate funds between chains. Achieving effective rebalancing necessitates integration with bridges, aggregators, centralized exchanges (CEXs), over-the-counter (OTC) platforms, and any other available liquidity sources for each supported chain and asset.

These operations not only entail complexity but also incur substantial transaction and bridging fees.

Ultimately, these costs are transferred to users, rendering the cross-chain experience expensive and less user-friendly.

Consequently, amidst inter-chain dynamics and within local liquidity pools, participants find themselves engaged in a competitive landscape similar to player-versus-player (PVP) gaming.

Hence, there arises an urgent demand for a solution capable of orchestrating fund flows and settlements between chains, effectively addressing the rebalancing challenge.

Everclear's solution hinges on net settlement.

While the term might initially seem intricate, an example can illuminate its essence.

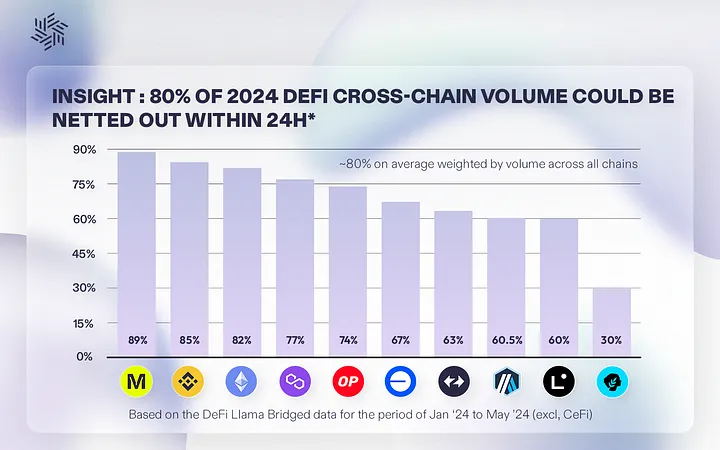

Connext, in prior research, noted a fascinating trend in global fund movements across blockchains: roughly 80% of daily cross-chain inflows and outflows could be effectively offset through netting.

In simpler terms, incoming and outgoing flows possess the potential to balance each other out.

To illustrate, for every $1 entering a blockchain on a daily basis, approximately $0.80 is concurrently transferred out.

So, when you transfer funds in and I transfer funds out, these individual actions effectively yield a net inflow of $0.20 for a specific chain. However, despite our independent actions, this net effect occurs.

By facilitating easier collaboration among existing participants, Everclear aims to augment the net reserves of funds on a chain, thereby addressing the rebalancing challenge highlighted earlier.

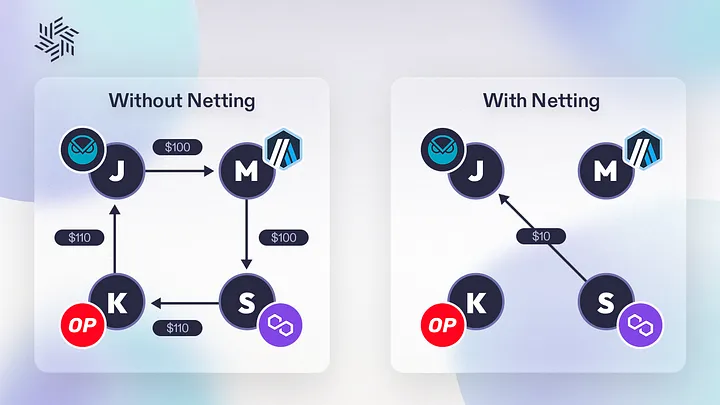

Hence, Everclear's utilization of net settlement optimizes fund flows by aggregating the net value of multiple transactions, thereby minimizing unnecessary fund transfers.

For instance, if User A intends to transfer assets from Chain X to Chain Y while User B needs to transfer assets from Chain Y to Chain X, Everclear can employ net settlement to directly reconcile between Chain X and Chain Y internally, eliminating the need for actual fund transfers. This streamlined approach significantly diminishes transaction costs and complexity.

Here's a breakdown of how Everclear operates:

Centralized Coordination: The Everclear system acts as a central hub, gathering and scrutinizing all cross-chain transaction requirements from participants. It identifies transactions that can effectively offset each other, streamlining the process.

Net Settlement: Through meticulous calculation of the net worth of these transactions, Everclear facilitates internal adjustments between chains. This mechanism significantly mitigates the necessity for tangible fund transfers, enhancing efficiency.

Liquidity Management: Leveraging smart contracts and sophisticated algorithms, Everclear autonomously oversees and fine-tunes liquidity across diverse chains. This ensures that each chain maintains sufficient funds to support user transactions seamlessly.

Let's illustrate the advantages of Everclear's approach with a simple scenario:

Alice aims to transfer 100 DAI from the Polygon chain to the Gnosis chain.

Alice kicks off the transaction via a cross-chain protocol integrated with Everclear, intending to move 100 DAI from Polygon to Gnosis. Everclear steps in to optimize this process.

Everclear evaluates the overall fund movements across the network and identifies that Bob plans to transfer 100 DAI from the Gnosis chain to the Polygon chain. Recognizing the potential offsetting nature of these two transactions, Everclear employs net settlement.

Ultimately, Alice's 100 DAI gets locked on the Polygon chain, while Bob's 100 DAI becomes locked on the Gnosis chain. Subsequently, the system releases an equivalent amount of DAI to each party on their respective chains. This strategic maneuver minimizes the need for actual fund transfers, enhancing efficiency and reducing costs for both Alice and Bob.

Now that we've grasped the core principles of Everclear, let's delve into its placement within the broader chain abstraction ecosystem.

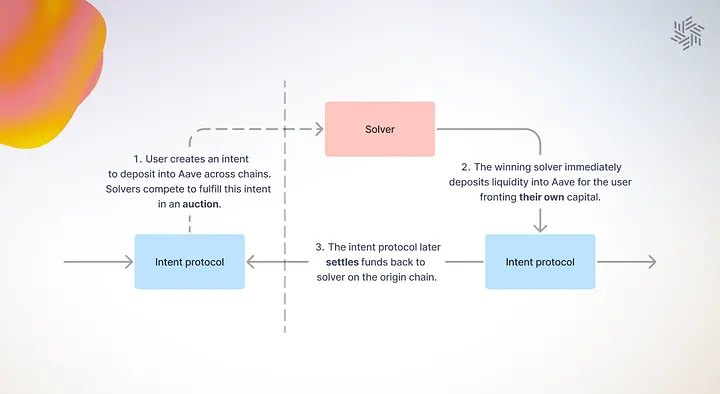

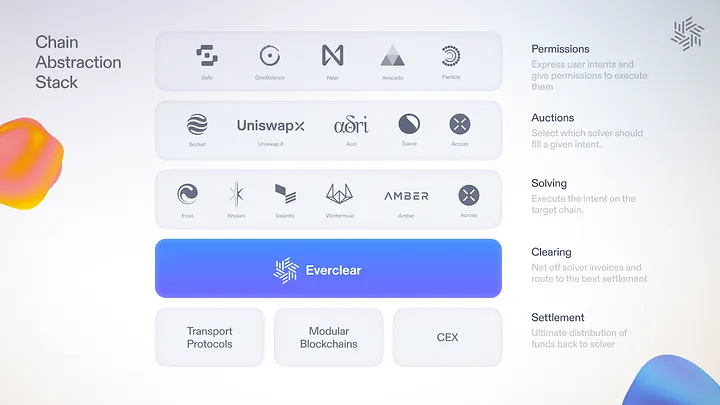

In the era of modularity, where permission layers, auctions, and solvers each contribute to addressing cross-chain intents, Everclear distinguishes itself as a clearing layer. Positioned beneath these layers, Everclear facilitates seamless liquidity for intent protocols and the solvers constructed atop them.

This operational paradigm bears resemblance to VISA's role, which furnishes settlement and clearing services for transactions among merchants and institutions.

The project highlights its niche advantages in its official blog:

Leveraging net settlement, Everclear slashes settlement costs and complexity by up to 10 times.

By supporting Programmable Settlement, it enables seamless connection and coordination among messaging protocols, token standards, canonical bridges, and other mechanisms crucial for user settlements.

Everclear furnishes permissionless liquidity for nascent chains, laying the groundwork for supporting intent-based bridges and chain abstraction applications from inception.

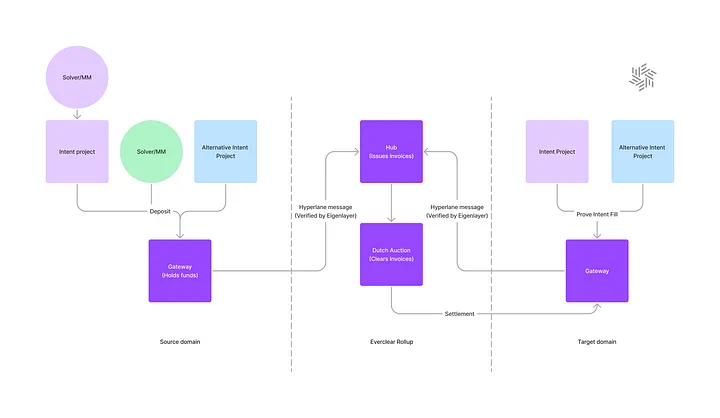

Moreover, Everclear adopts a Rollup design, employing Arbitrum Orbit rollup technology and collaborating with EigenDA and Gelato RaaS. Acting as a shared "computer," Everclear offers efficient clearing and settlement services tailored for the protocols and solver ecosystems built atop it.

Users, including intent protocols, solvers, centralized exchanges (CEXs), market makers, and more, engage with Everclear by depositing funds into gateway contracts deployed on each supported chain. Everclear Rollup, in turn, employs Hyperlane alongside its underlying Autonomous Validation System (AVS) to efficiently batch-read the state of each gateway.

Presently, the Everclear testnet is operational and poised to integrate seamlessly with solvers, market makers, and intent protocols.

In terms of branding, Everclear is set to supersede Connext as the new brand entity, while NEXT will persist as the native token of Everclear. The mainnet launch is slated for early Q3.

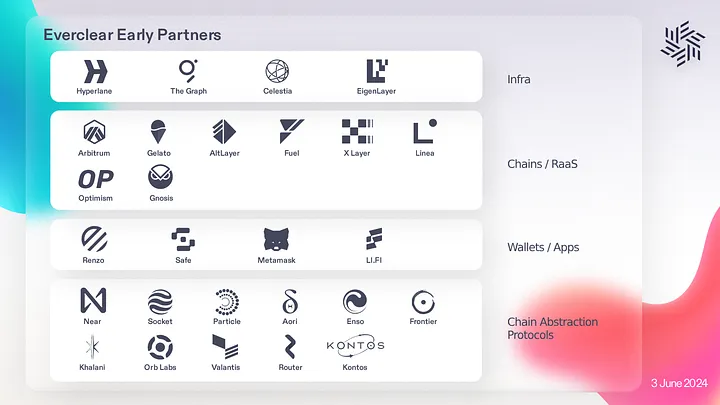

Functioning as a settlement layer that fosters multi-party collaboration, Everclear has already forged numerous partnerships, as depicted in the image below:

In essence, Everclear not only enhances cross-chain liquidity at a technical level but also assumes a pivotal role within the ecosystem.

Promoting collaborative efforts among stakeholders is undeniably the optimal strategy in today's crypto market, where participants seek dependable tools and mutual reinforcement.

With the imminent mainnet launch and continued technological advancements, Everclear is poised to emerge as the go-to solution for cross-chain settlement, introducing novel functionalities in DeFi, payments, and lending arenas.

Nonetheless, prevailing liquidity may not be ample, as much attention is currently directed towards meme-based projects. The true potential for initiatives like Everclear will be fully realized when cross-chain demand experiences a substantial surge.

Recommendation

Initia

Initia: Connecting All Rollups to Build a Layer 1+ Layer 2 Multi-Chain Interconnected World

Nov 11, 2024 15:24

CARV

New Rules of Data Value Distribution: How CARV is Powering Millions of Users?

Nov 11, 2024 15:49

BTCFi

Comparing Bitcoins Top 4 Scaling Solutions: Which Will Unleash BTCFis Trillion-Dollar Potential?

Nov 11, 2024 15:15