The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Market trends are shifting, and several sectors are heating up again.

While the Bitcoin ecosystem often grabs the spotlight, the AI sector has been a hotbed for skyrocketing tokens this year.

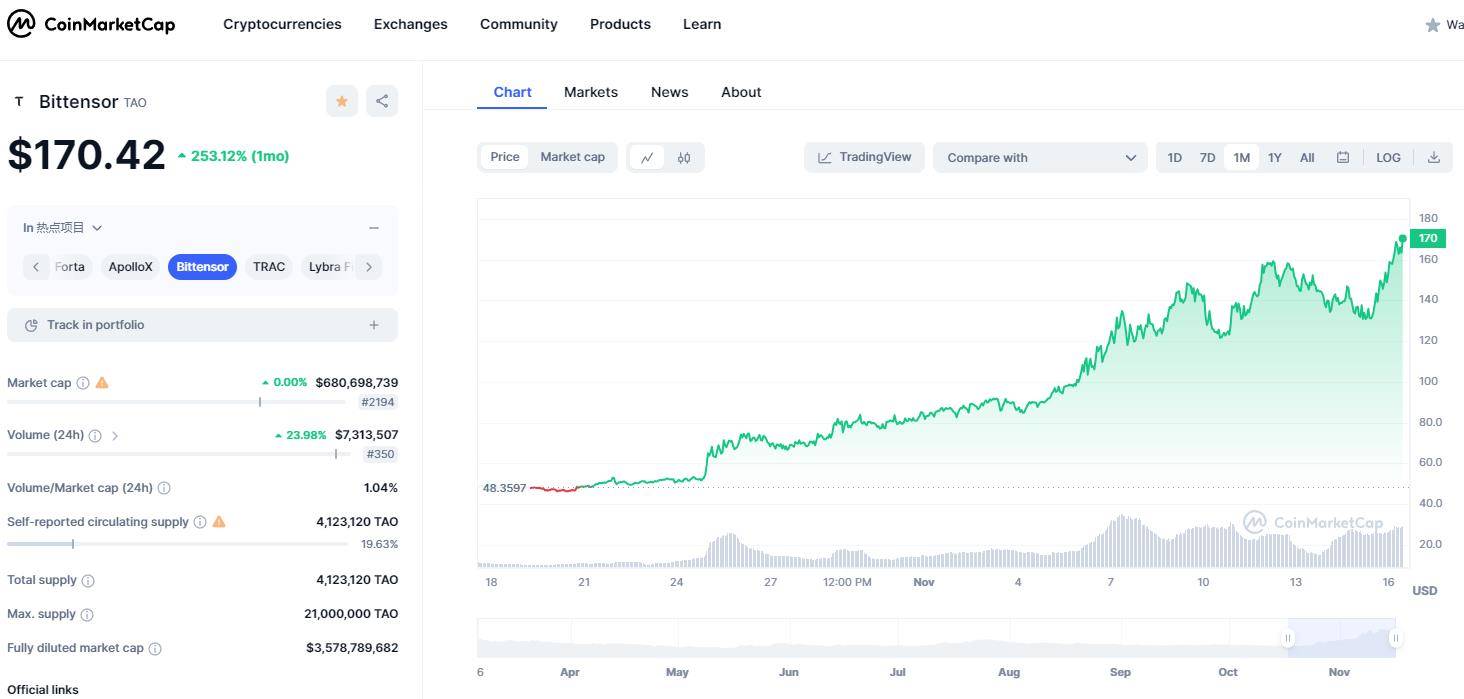

Apart from the much-hyped tokens like FET, RNDR, and OCEAN, a token called TAO has tripled in value over the past month. However, its underlying project, Bittensor, hasn't seen much in-depth analysis in the Chinese-speaking market.

Meanwhile, things are moving much faster overseas than here.

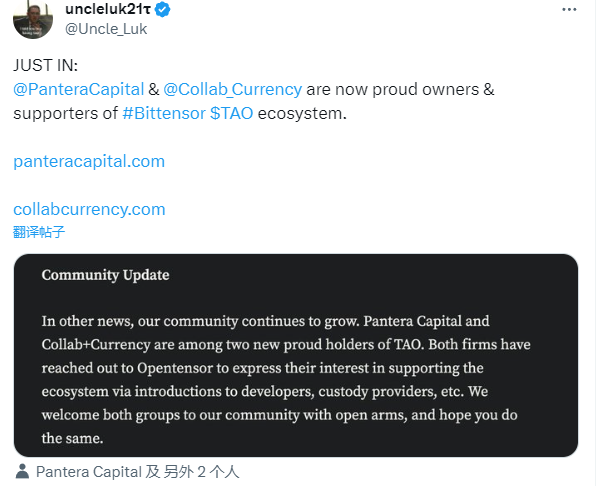

The soaring prices have caught the attention of sharp investors. On Thursday, the Bittensor project community announced that well-known crypto VCs, Pantera and Collab Currency, are now holders of the TAO token and will be offering more support for the project's ecosystem development.

VCs are great at spotting trends and even better at pushing them forward.

So, what's behind the meteoric rise of TAO? What sets its narrative, product, and tokenomics apart from other mainstream AI projects?

In this issue, we'll take an in-depth look at Bittensor, covering its background, project goals, technical makeup, and token valuation to help inform your decisions.

Every token surge has a solid investment logic and a broader industry narrative backing it. Before we dive into TAO, let's take a step back and look at the overall AI industry landscape.

AI tokens are hot, but even without Crypto, AI is already generating significant buzz.

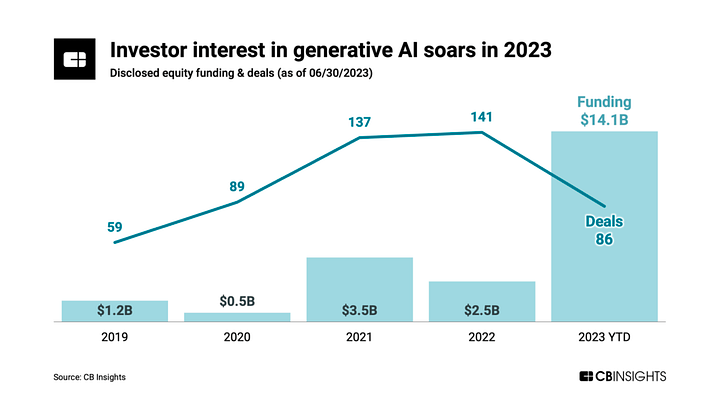

According to CB Insights, interest in generative AI has skyrocketed in 2023, with total funding for AI-related companies and projects soaring to $14 billion, up from just $2.5 billion last year.

So, whether it's TAO, RNDR, or FET, the forces driving these tokens go way beyond just ChatGPT or NVIDIA.

Industry heavyweight Arthur Hayes recently highlighted in his blog a scenario that might already be unfolding: an AI funding frenzy fueled by the bond bubble.

It's estimated that major global economies, especially the U.S., will need to roll over and issue government debt totaling around $33.58 trillion over the next three years due to fiscal deficits.

When the government issues bonds and promises to pay them back with interest, high bond yields draw in a lot of capital. This means money flows into government bonds, squeezing out other investment opportunities like private companies looking for funding or a sluggish stock market.

Arthur Hayes thinks the U.S. Federal Reserve will have to print money to buy its own debt, which would reduce the impact on the private sector. This is expected to lead to a massive increase in the supply of fiat money by 2026, potentially even more than during the COVID-19 pandemic.

So, where will all this extra money go?

"The money will flow into new tech companies that promise huge returns. Every fiat liquidity bubble features a new form of technology that attracts investors and pulls in massive capital."

In the '90s, it was the internet bubble. After the 2008 financial crisis, it was online advertising and social media. This time, it's AI.

This could be why generative AI has attracted so much investment this year. The tech behind GPT is impressive, but in the bigger picture, it's just the brightest star in a flood of capital pouring into AI. The trend of massive investment in AI is becoming clear.

With money pouring in, the next big question is: where to invest? Let’s break down the investment logic behind Crypto + AI.

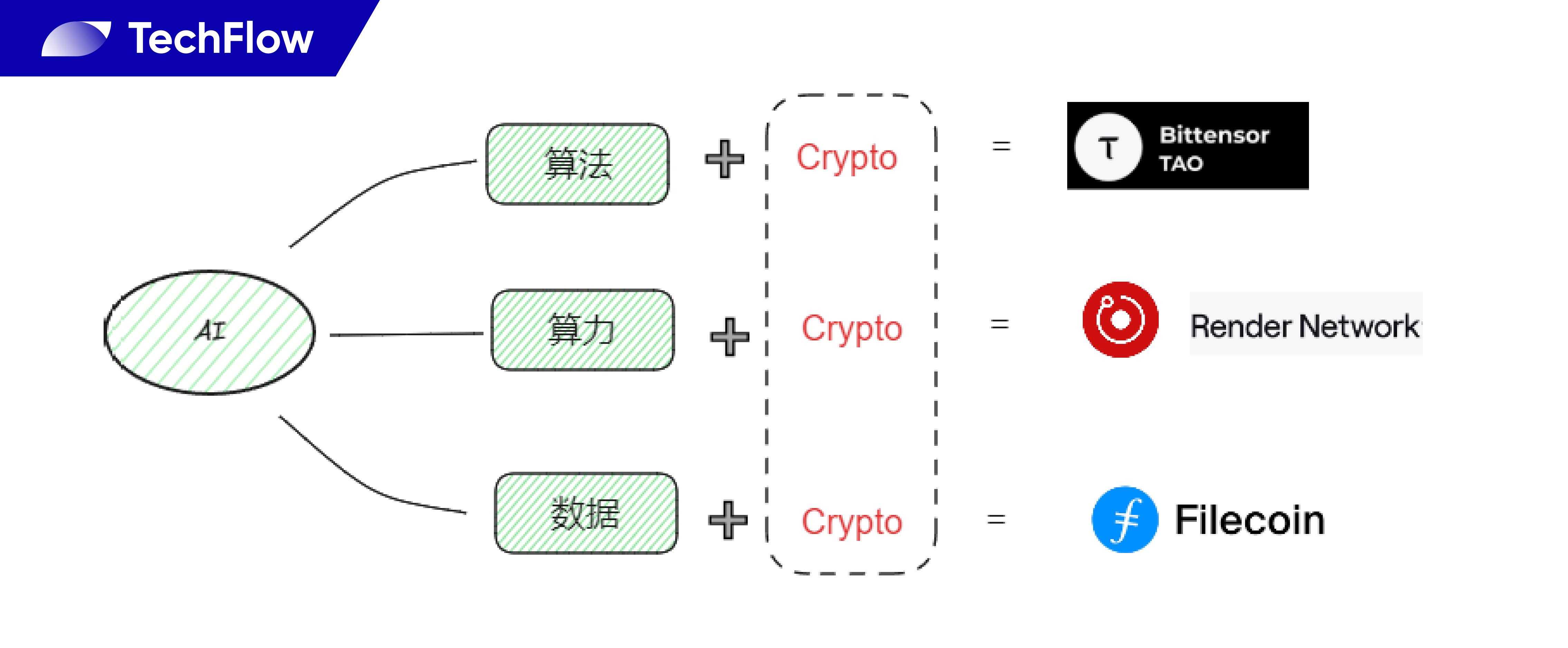

It's a well-known fact that AI thrives on three core elements: data, algorithms, and computing power. Meanwhile, cryptocurrencies and blockchain technology are more about changing how these elements are organized and incentivized, promoting their development through new coordination and reward systems.

Tokens that can enhance these three elements are poised to become hot investments.

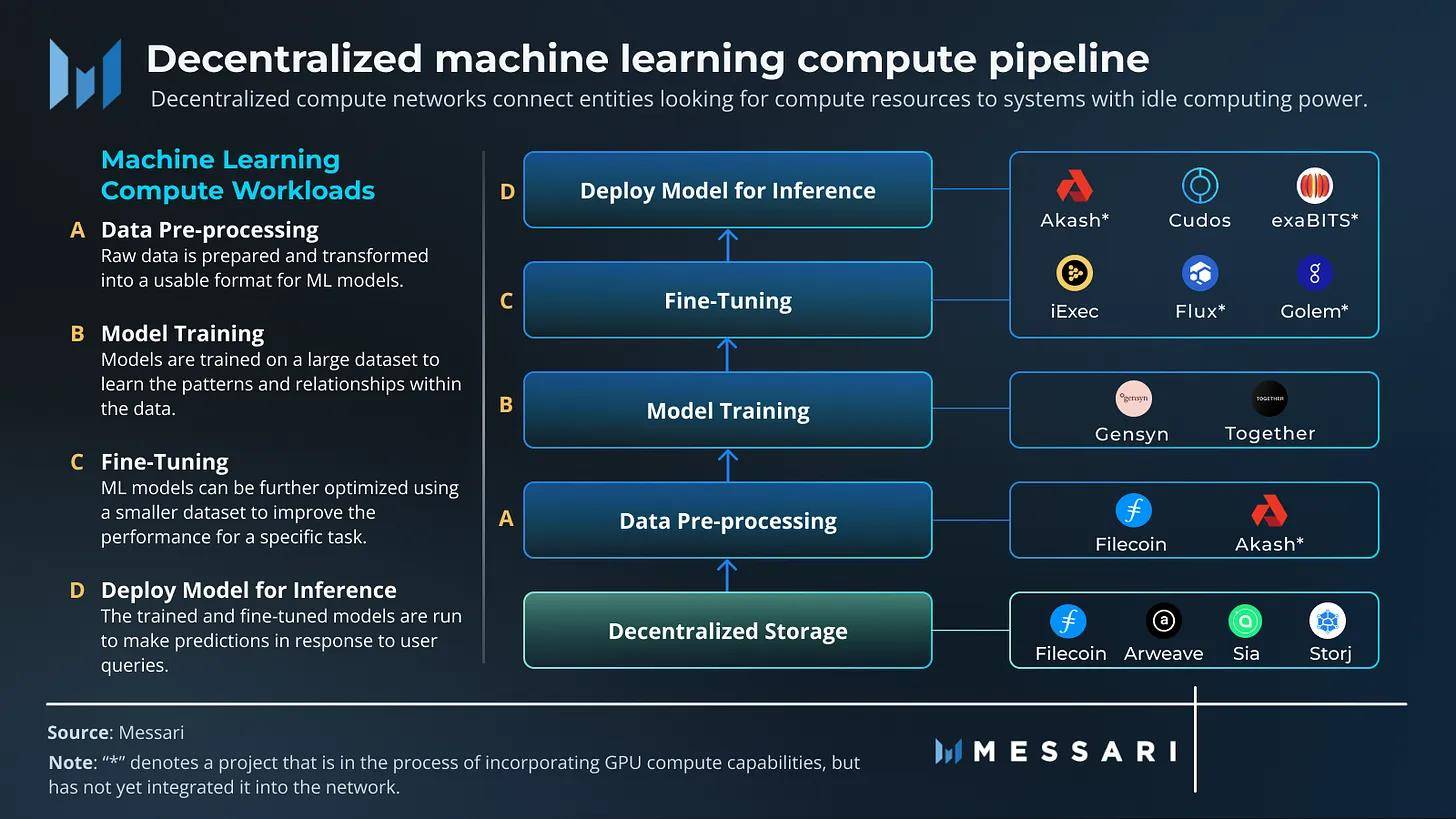

For now, let's focus on two main narratives we've seen in past projects: Crypto + Data and Crypto + Computing Power.

AI requires massive amounts of data to train models. Blockchain can incentivize data providers to contribute data or use decentralized data storage to support more democratized and decentralized data training.

In this narrative, cryptocurrencies that stand to benefit include decentralized storage solutions like Filecoin, which Arthur Hayes strongly recommends.

Building AI models requires significant computing power. While big companies and some computing resource providers have this capability, there's still potential in the long-tail market. Distributed computing resources, like personal GPUs and devices, can contribute power in exchange for cryptocurrency rewards.

In this narrative, cryptocurrencies like RNDR and other projects that reward computing power contributions come out on top.

Algorithms are a different story.

Unlike data and computing power, which are resource-intensive, algorithms are technology-intensive. They're the secret sauce that AI companies keep refining. It's tough to "create" a better algorithm from scratch using cryptocurrency incentives; the logic of contribution, coordination, and rewards doesn't really apply here.

(Note: An AI model is the outcome of algorithm training. Strictly speaking, algorithms and models follow one another, but I'll use them interchangeably for simplicity.)

However, you can incentivize the "selection" of better algorithms from existing ones, preventing everyone from using the same solution. Just like how oracle projects use incentives to encourage competition and choose better data sources, blockchain can drive competition to find superior algorithms.

There's no clear leader in this niche yet, but Bittensor is a notable example. It doesn't directly provide data or computing power. Instead, it uses a blockchain network and incentive mechanisms to manage and select different algorithms, creating a competitive, knowledge-sharing marketplace for algorithms in the AI field.

Sounds complicated? Let’s simplify it.

In a nutshell, Bittensor can be summed up with one line: "We don't create algorithms; we just deliver the best ones."

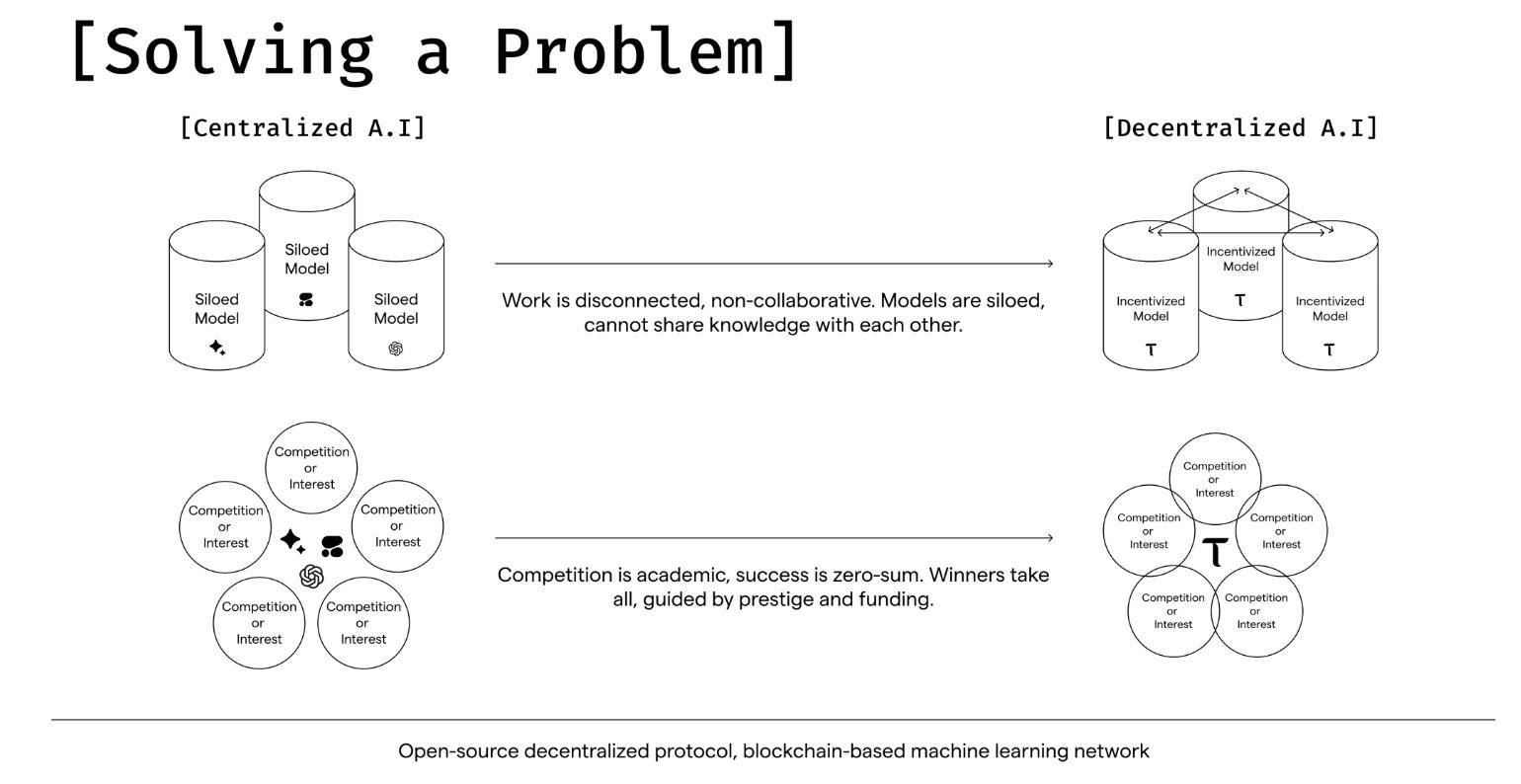

Why deliver algorithms? A glance at the current AI landscape highlights the problem.

In the AI industry, each player’s algorithms and models operate in isolation. Due to commercial competition, companies don’t let their algorithms learn from each other. This means that in the AI supply chain, competition is zero-sum: if one company's AI wins the market, the others lose out.

For the winner, this works just fine.

But Bittensor believes this isolation hinders overall AI progress and innovation. Isolated models and winner-takes-all AI services mean that developing a new model often requires starting from scratch.

Imagine Model A excels at Spanish, and Model B is great at coding. If a user needs an AI to explain code with Spanish comments, combining both algorithms would yield the best results. But in the current environment, this isn't possible.

Moreover, because third-party apps need permission from AI model owners to integrate, functionality is limited, which means limited value. The collective power of the AI field isn't being fully realized.

Bittensor's big goal is to enable different AI algorithms and models to collaborate, learn from each other, and combine to create more powerful models, better serving developers and users.

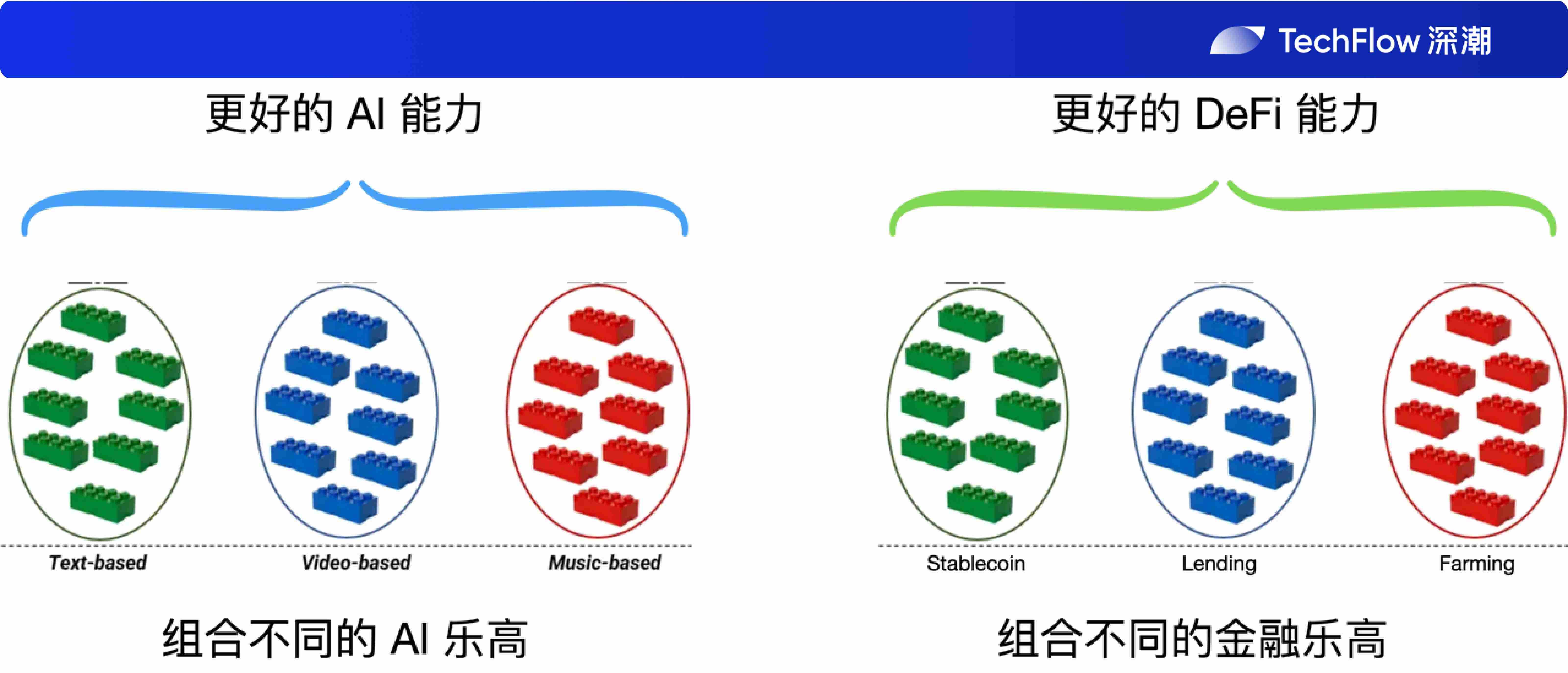

This idea is reminiscent of DeFi Summer a few years ago—financial Legos.

Stablecoins, lending protocols, and liquidity mining components were all open-source and permissionless. Users could mix and match them like Lego bricks to create new products and services.

Similarly, AI models that excel in image processing, text processing, or audio processing can be combined to handle different tasks, creating an "AI Lego" system.

For Bittensor, this means the project itself won't perform computations or provide data for on-chain machine learning. Instead, it coordinates off-chain AI models to work together.

In theory, by piecing together AI Lego blocks, Bittensor can expand its AI capabilities faster and more efficiently than isolated models.

However, whether AI model providers will buy into this approach, how it will develop commercially, and if it can be effectively implemented in practice remain to be seen.

Making different AIs work together is a big goal, but how can it be achieved?

Bittensor's solution is to build a blockchain network that coordinates through mining incentives.

Bittensor uses Polkadot's parachain design at its core, creating a dedicated chain for AI model collaboration, powered by its own token, $TAO, for incentives.

To understand how this chain works, let's break it down into three key questions:

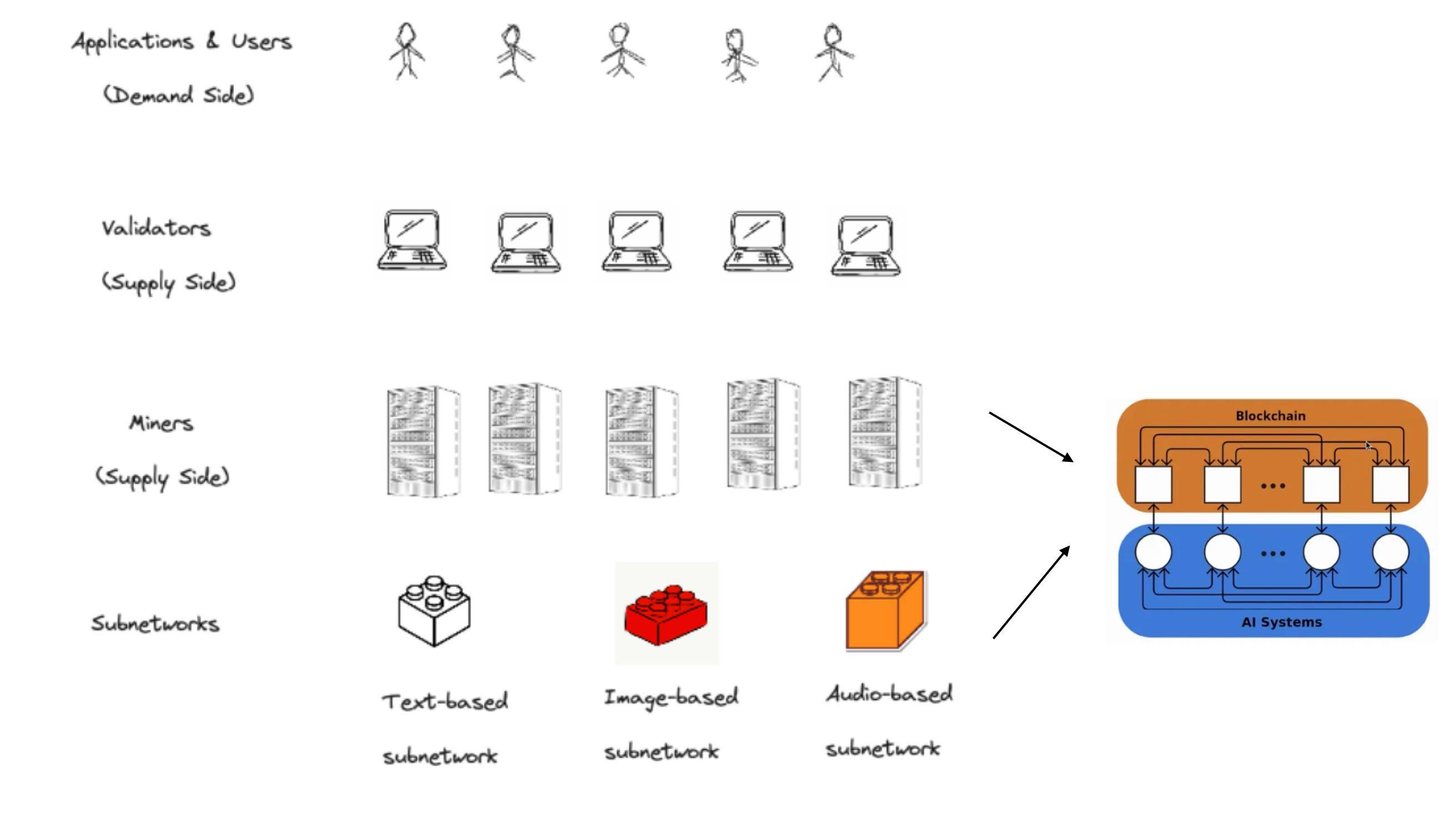

Who are the participants on this chain?

What roles do these participants play, and how do they interact?

Which behaviors are incentivized by the tokens?

Miners: These are the providers of various AI algorithms and models from around the world. They host AI models and offer them to the Bittensor network. Different types of models form different subnets, such as those specialized in images or sounds.

Validators: These are the evaluators within the Bittensor network. They assess the quality and effectiveness of AI models, ranking them based on performance for specific tasks, helping users find the best solutions.

(Note: Currently, the validators seem to be affiliated with the project itself, which may not be fully decentralized. However, as the network grows, other organizations might join as validators.)

Nominators: These participants delegate their tokens to specific validators to show support. They can switch validators for delegation, similar to staking tokens in DeFi platforms like Lido to earn rewards.

Users: The end-users of the AI models provided by Bittensor. They can be individuals or developers looking to integrate AI models into their applications.

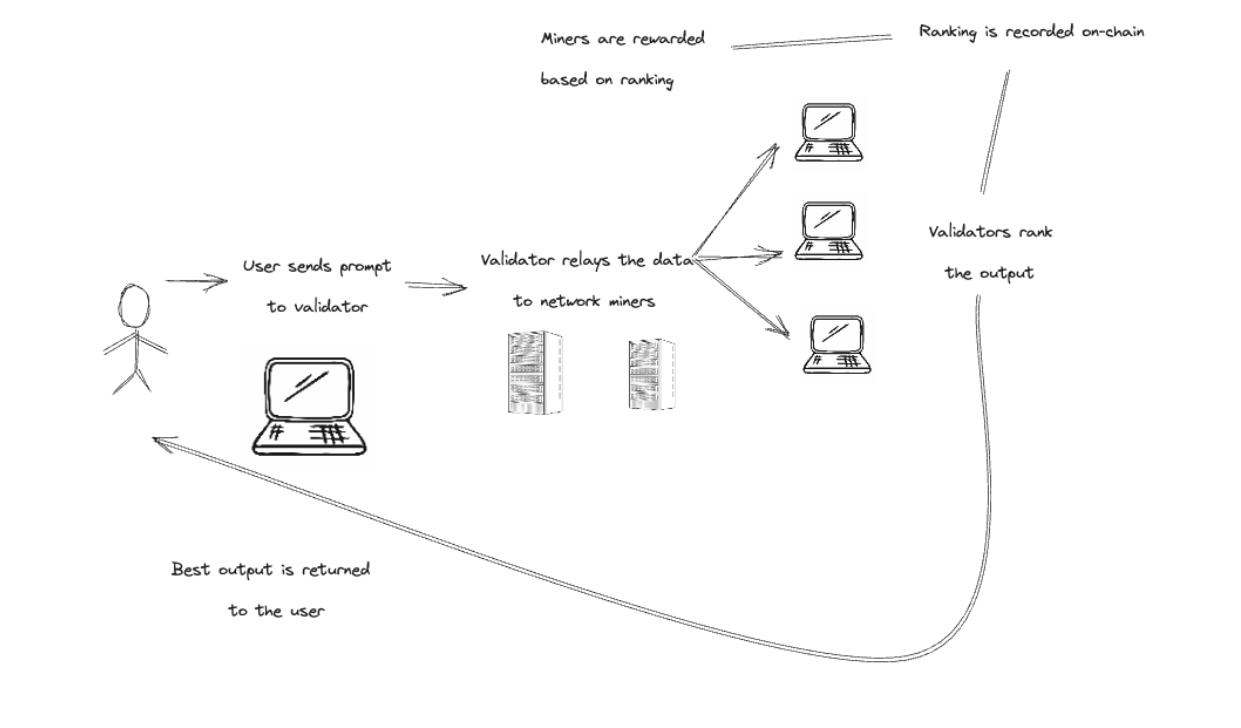

Users need better AI models. Validators select the best models for different uses. Miners provide their AI models, and Nominators support different validators.

In simple terms, it’s an open AI supply chain: people provide various models, others evaluate them, and users get the best results from these models.

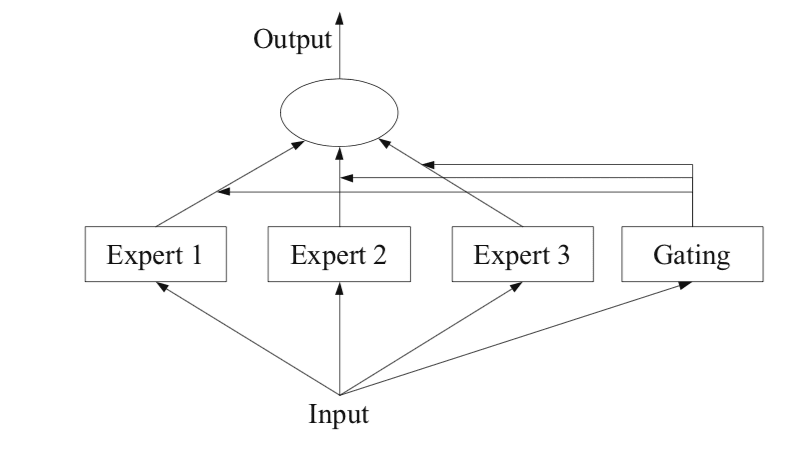

The image above simplifies the process: users submit their requests, validators route these requests to miners in the Bittensor network, miners provide answers, and validators evaluate the quality before sending the final result back to users.

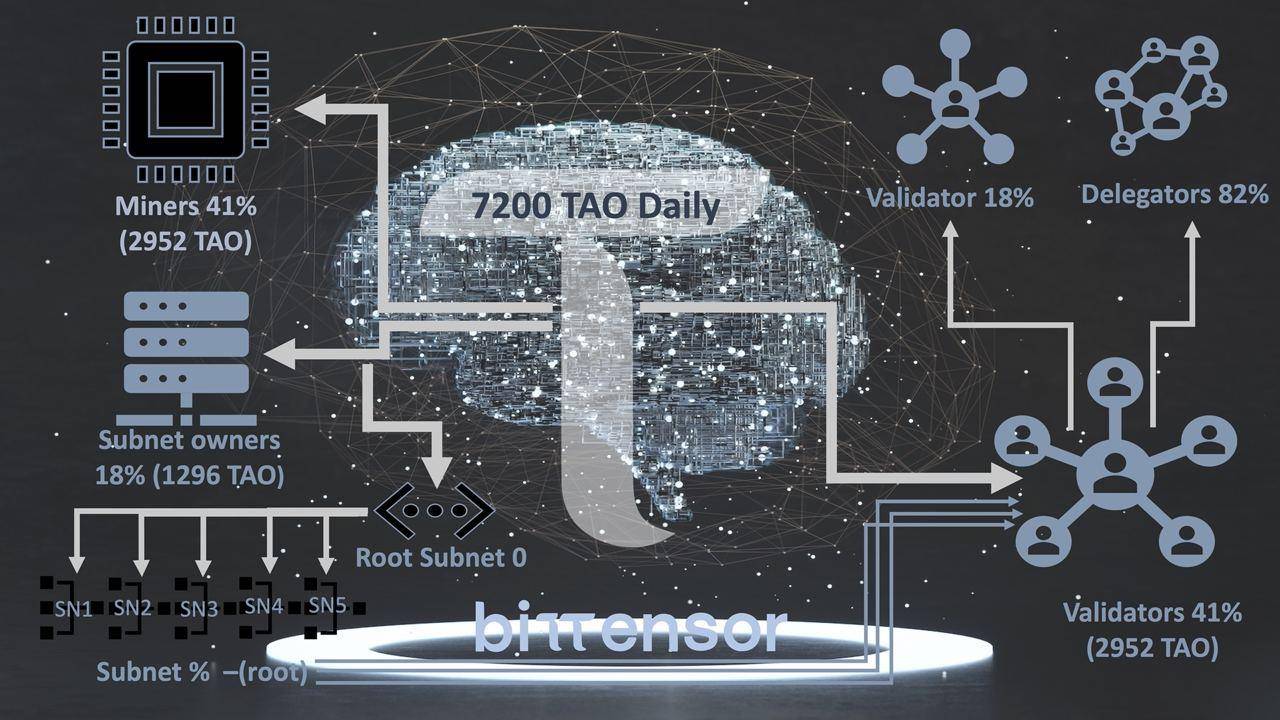

For Validators: They earn more rewards for accurately and consistently evaluating and selecting AI models. Becoming a validator requires staking a certain amount of TAO tokens.

For Miners: They provide their AI models in response to user needs and earn TAO tokens based on their contributions.

For Nominators: They delegate their TAO tokens to validators and earn rewards, similar to liquidity staking.

For Users: They pay TAO tokens to initiate tasks, essentially acting as consumers.

Ideally, the different AI models in this network will collaborate, with various models excelling in different tasks. Since these tasks are trackable on the blockchain and visible to network nodes, models can learn from each other and adjust based on the specific tasks.

Think of Bittensor as an AI "oracle". Just like oracles in DeFi feed the best prices to applications, Bittensor feeds the best AI models to users who need them.

Becoming a validator or miner in this network involves technical coding and development interfaces, which we won’t dive into here. If you’re interested, you can visit the official documentation for more details.

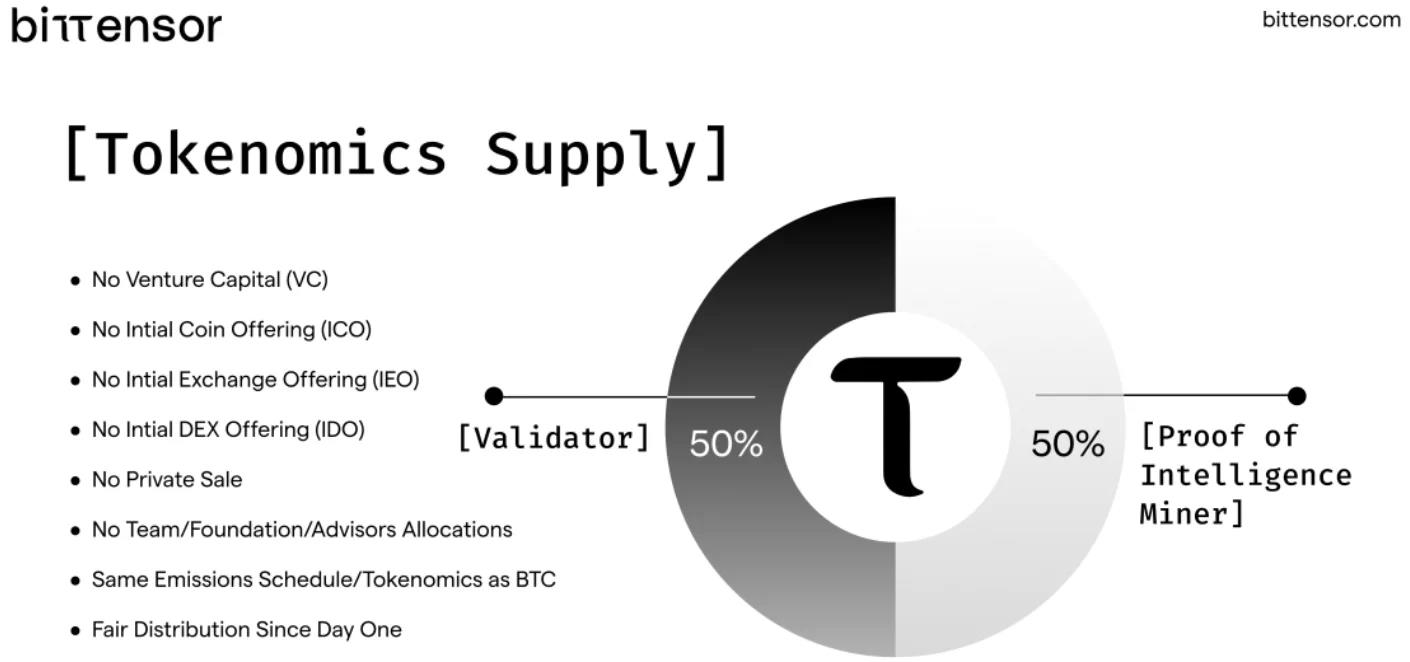

According to the official documentation, Bittensor had a "fair launch" in 2021 with no pre-mined tokens.

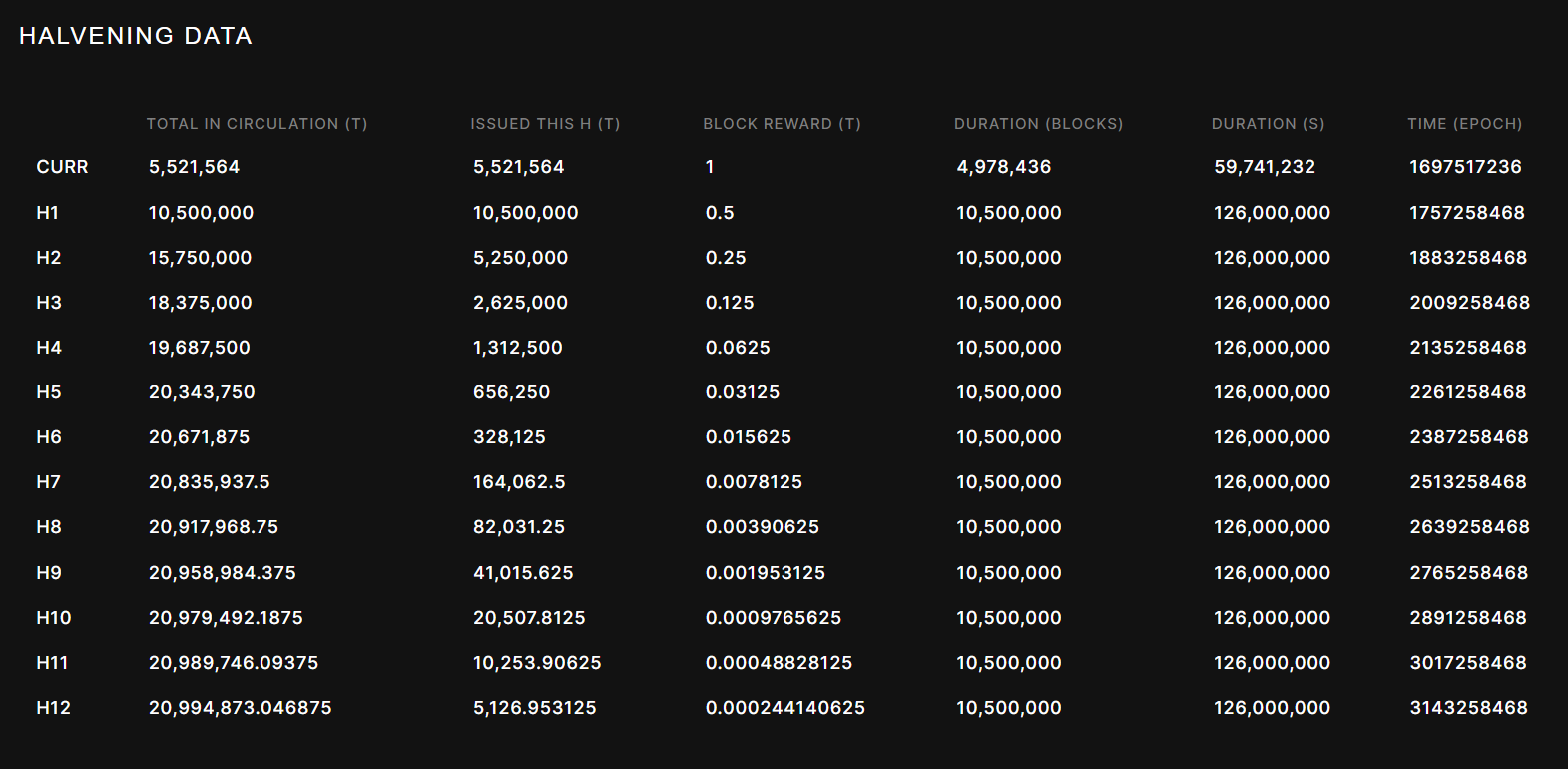

The token, called TAO, has a total supply of 21,000,000, a nod to BTC, and follows a four-year halving cycle. Every 10.5 million blocks, the block reward is halved. There will be 64 halving events in total, with the next one happening in August 2025.

It's pretty wild to think about, but with this halving schedule, it will take 256 years for all the tokens to be fully mined.

Right now, a TAO token is issued to the network every 12 seconds. This means around 7,200 TAO are produced daily, with miners and validators each getting half.

The fair launch of TAO means there were no VC rounds, private sales, ICOs, or foundation reserves—none: none of the usual tactics. It's purely a mined coin.

Each time a reward is mined, TAO is split between validators and miners.

However, on Bittensor's website, you'll notice big names like DCG, GSR, Polychain, and Firstmask as investors and market makers.

A plausible assumption is that since many validators in the network are currently tied to Bittensor's own entities, the mined tokens might first go to them and then be distributed to market makers to ensure liquidity.

Plus, these major institutions can also join as validator nodes or even miners to participate in TAO mining themselves.

As we mentioned at the beginning, crypto VCs like Pantera have recently become TAO holders. So, while Bittensor had a fair launch, it doesn't mean VCs are entirely absent.

In this new market cycle, the "VC sells to the public" token model is losing its appeal. TAO's "fair launch first, attract capital later" approach aims to make the process as fair as possible.

TAO's market performance has been impressive, with its price increasing more than fivefold from its lowest point this year.

However, other AI projects have also seen strong gains. For instance, RNDR has experienced a similar fivefold increase since the start of the year.

So, analyzing token value based solely on absolute price increases isn't very useful.

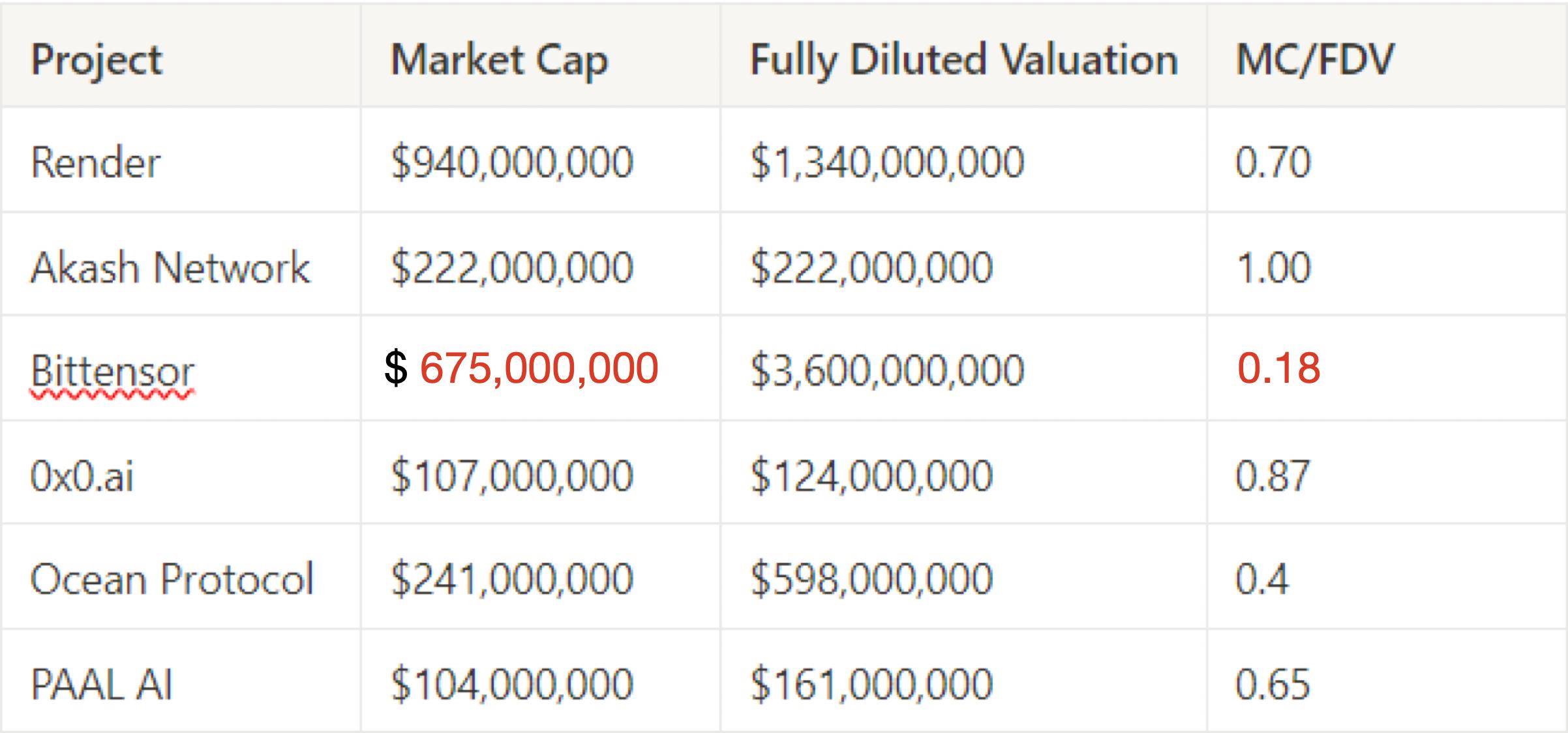

Compared to other popular AI projects, TAO's market cap is currently second only to RNDR. However, because of the long-term release mechanism with the four-year halving cycle, the ratio of market cap to fully diluted value is the lowest among these projects. This means TAO's current circulating supply is relatively low, but its individual token price is quite high.

Low circulation can sometimes mean a smaller market cap, making it easier for the price to rise. At the current price of $160, if all 7,200 TAO mined daily were sold, the market would face about $1.15 million in selling pressure. Given the current market interest and trading volume, with TAO's daily trading volume at $5 million, this selling pressure shouldn't be an issue.

To properly value TAO, it's important to compare it with similar projects, rather than looking at it in isolation.

As mentioned earlier, Bittensor focuses on crypto + algorithms/models, so it's not directly comparable to projects like RNDR that provide basic computing power.

According to Nansen's AI research report, Bittensor falls into the "Model Training" category, with competitors like Gensyn and Together. Notably, Gensyn is backed by a16z.

However, since neither of these projects has a publicly available token, directly comparing TAO's market cap with theirs isn't possible.

David Attermann, co-founder of Omnichain Capital, suggested a more aggressive comparison in his blog post from May: directly comparing Bittensor with OpenAI.

Interestingly, David made it clear that he didn't hold any TAO at the time, aiming to keep his analysis unbiased.

Both Bittensor and OpenAI focus on model training and user applications—one is a closed-source company, while the other coordinates global AI models. Despite their different approaches, both aim to enhance AI user experience.

Given that OpenAI previously received a $29 billion valuation from Microsoft and TAO's fully diluted valuation (FDV) is currently around $3.6 billion, there's an argument that TAO could have up to an 8x growth potential.

I don't entirely agree with this comparison. The fundamentals, growth pace, and market focus of Web3 and Web2 projects are quite different. The 8x potential based solely on valuation might be optimistic. It's more important to consider TAO's own strengths and the current market interest.

In summary, TAO/Bittensor presents a unique story in the AI-themed crypto space. Unlike others, it doesn’t engage in the production side, including computing resources and data. Instead, it focuses on coordinating production relationships to facilitate collaboration, competition, and optimization among AI models.

This narrative is compelling, but integrating AI models, the centralization of validation nodes, and evaluating model quality are challenges that can’t be solved with just a whitepaper. While AI itself is straightforward, the commercial dynamics are complex. Convincing more participants to join the network for token rewards and persuading tech companies to collaborate with other AI models remains tricky.

Aside from the fundamentals, TAO’s impressive price increase shows strong market interest in the AI sector. Given that Bittensor has no similarly scaled competitors in its niche, TAO could see more benefits as the AI sector continues to boom. However, without proper valuation benchmarks, the long-term hold potential is still uncertain.

Staying updated on project news and monitoring sudden changes in trading volume might be the most practical approach.

Recommendation

Exploring Kontos: Simplicity Redefined, a Single Gateway to Seamless Blockchain Integration

Jul 07, 2024 14:32

From Graduate to CEO: Nexus Secures $25 Million Led by Pantera - Whats the Story?

Jun 06, 2024 19:01

Understanding the Allora Whitepaper: A Self-Improving Decentralized AI Network

Jul 07, 2024 14:25