The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

When you think of Japan, what comes to mind first? Cherry blossoms, anime, Mount Fuji, Nintendo...?

However, when it comes to the connection between Japan and crypto, many cryptocurrency professionals have limited awareness. Despite the legal status of crypto trading and exchanges in Japan since 2017, the Japanese market has always had a weak presence, and many people have the impression that it is closed off and independent.

What is the actual state of the crypto market in Japan? Who are the key players currently involved? How can one participate in the Japanese crypto market?

With curiosity in mind, TechFlow journalist delved into Tokyo, Japan in April to engage with local crypto professionals and gather valuable insights. In this article, we aim to share this information without lengthy digressions, providing practical knowledge. Joining us as a co-author is a venture partner from Emoote, and we pay tribute to their contribution.

*This excerpt is taken from the "Web3 Truth in the Asia-Pacific Market" report by TechFlow 深潮, focusing on the Japanese market.

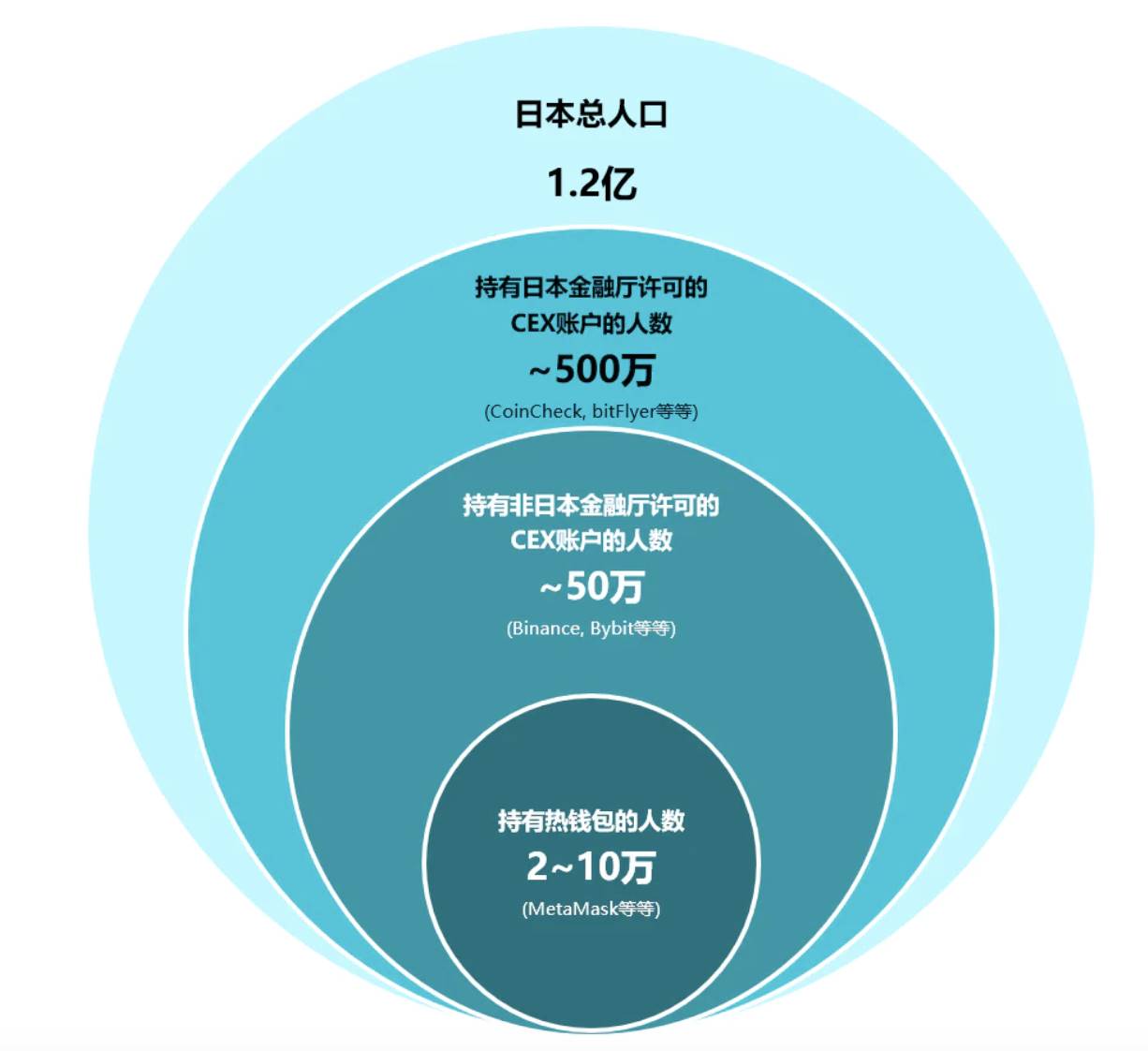

Based on discussions with friends and data from third-party organizations, Japanese cryptocurrency investors can be divided into three layers, and the lower layer is a complete subset of the upper layer. Overall, there are over 5 million local cryptocurrency users in Japan.

The Japanese market is full of peculiarities and contradictions, mainly in the following three aspects:

1. Compliant but lacking vitality

In Japan, trading in cryptocurrency assets and operating cryptocurrency exchanges can be carried out within a legal and compliant framework, mainly regulated by the Japanese Financial Services Agency and the Japan Virtual Currency Exchange Association (self-regulatory organization). The overall principle is to prioritize anti-money laundering/counter-terrorism financing regulations and then regulate trading platforms to protect user interests. For example, exchanges are required to separate customer assets from their operating funds, and at least 95% of assets held by exchanges must be stored in cold wallets, fully ensuring the safety of individual investors.

However, heavy regulation also brings many restrictions that make the Japanese cryptocurrency market lack vitality. All tokens listed on compliant exchanges in Japan require approval from the Japan Virtual Currency Exchange Association (JVCEA), which takes at least 6 months to a year.

In addition, Japan has a high tax burden. According to current rules in Japan, the tax rate for cryptocurrency-related income depends on the individual's total income, and for high-income earners, the tax rate for cryptocurrency may rise to around 50%. This has led to a phenomenon where, despite the ability to legally convert crypto assets into Japanese yen, there is still a significant demand for over-the-counter (OTC) transactions, resulting in many OTC practitioners.

2. Mismatched hotspots, strong purchasing power

The Japanese market is a relatively independent and closed market, which also means that its market hotspots may not completely match those of the global mainstream market, resulting in a certain degree of mismatch and delay. For example, when the NFT craze in China and the US passed, various types of NFT in Japan experienced a price surge.

Moreover, the Japanese market still has strong purchasing power. Two of the most direct examples are:

Cardano's initial token offering (ICO) from 2015 to 2017 mainly targeted the Asian market, with over 90% of early funding coming from Japan, which is why it is sometimes called "Japanese Ethereum," but it is still a US project at its core.

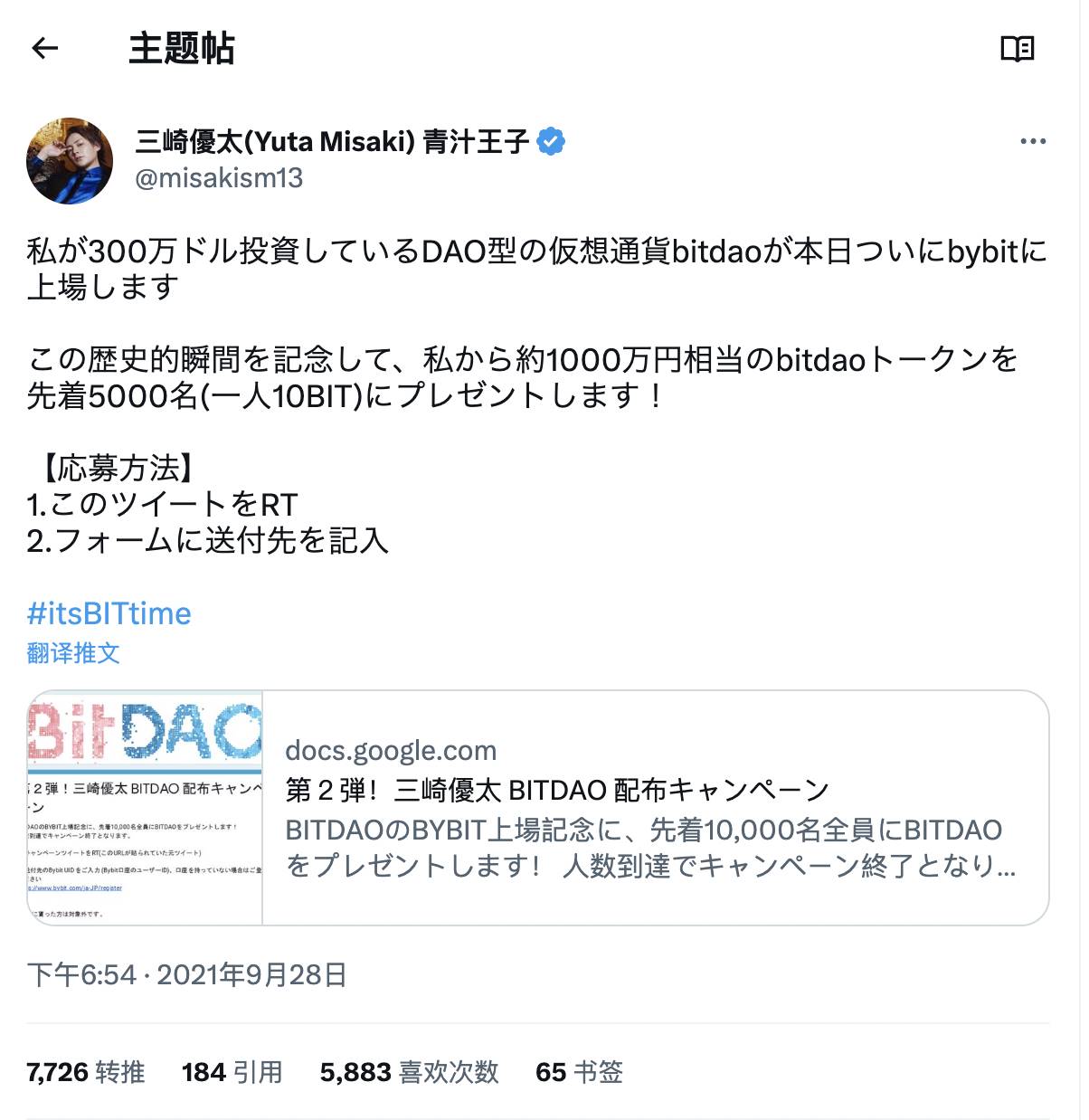

The well-known trading platform Bybit mainly relied on the Japanese market from its inception to its rise, and in the Japanese market, it could not do without the promotion of a super KOL, the "Green Juice Prince" Yuta Misaki, as well as local KOLs such as Tsubasa Yozawa and Hikaru.

Later, Bitget entered the Japanese market and provided better commission conditions, poaching KOLs from other platforms.

Compared to compliant domestic exchanges with few coins, high taxes, and no leverage, offshore exchanges with many coins, no taxes, and 100x contracts are very tempting to retail investors. Although the Japanese Financial Services Agency has issued warnings to Bybit, MEXC, Bitget, and Bitforex, completely abandoning the Japanese market or being completely compliant is not possible. Coinbase and Kraken, which are compliant, have both withdrawn from the Japanese market at the beginning of 2023, serving as a warning to others.

In the Japanese market, many practitioners have reached a politically incorrect consensus in private: if you want to make money, you can't be too compliant.

3. Transition: Japanese Ministry of Finance relaxes some regulations

Through communication with personnel from the Japanese Ministry of Finance, it was discovered that they have mixed feelings about the matter.

On the positive side, despite the bankruptcy of FTX, which dealt a heavy blow to the entire cryptocurrency industry, and the billions of dollars misappropriated by the founder SBF that have evaporated, Japan's strict regulations on cryptocurrencies have protected the country's individual investors, which they take great pride in.

Therefore, Mamoru Yanase, Deputy Director of the Strategic Development and Management Bureau (SDMB), a department under the Japanese Ministry of Finance responsible for handling cryptocurrency and financial technology issues, stated that Japanese regulatory agencies have begun urging regulators in the United States, Europe, and other regions to implement regulatory measures on cryptocurrency exchanges similar to those applied to banks and brokerages.

On the negative side, the Japanese cryptocurrency market lacks vitality, especially with Coinbase and Kraken previously withdrawing from the Japanese market. On the contrary, offshore exchanges have thrived in Japan. Consequently, they are also attempting to make some adjustments.

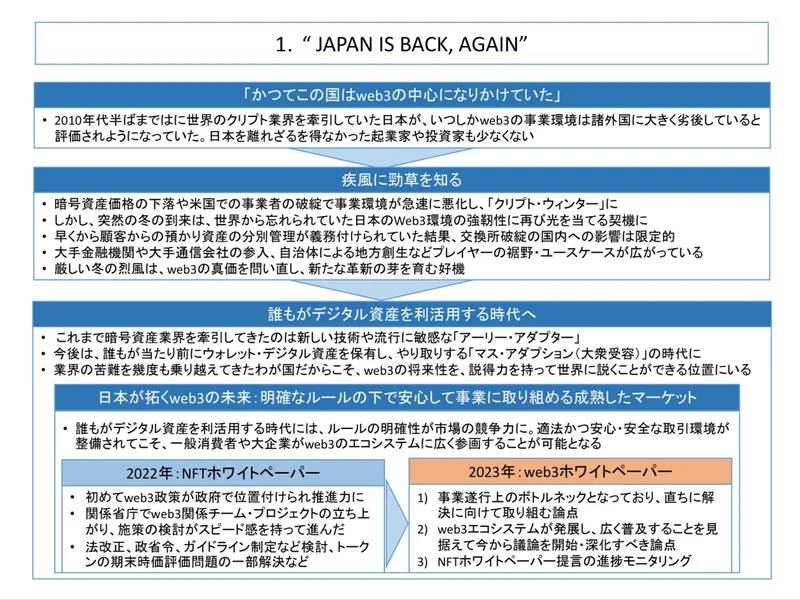

In April 2023, the Liberal Democratic Party, Japan's largest party, released the "Japan 2023 Web3 White Paper" with the slogan "JAPAN IS BACK, AGAIN." They aimed to loosen regulations in various aspects, primarily in the following areas:

Tax reform: Previously, investors were subject to high-income taxes of up to 55% due to token appreciation. After tax reform, holding tokens issued by one's own company would be exempted. Additionally, holding tokens issued by other companies would also be exempt from taxation if they were not intended for short-term trading.

Token review/issuance/circulation: The Ministry of Finance would assist in reviewing overseas token trading for listing, increasing listing efficiency, and establishing regulations for the issuance and circulation of stablecoins.

NFTs: Restrictions would be imposed on the use of NFTs for gambling, money laundering, etc., and regulations regarding the rights and returns associated with NFTs would be clarified.

Japanese 2023 Web3 Whitepaper

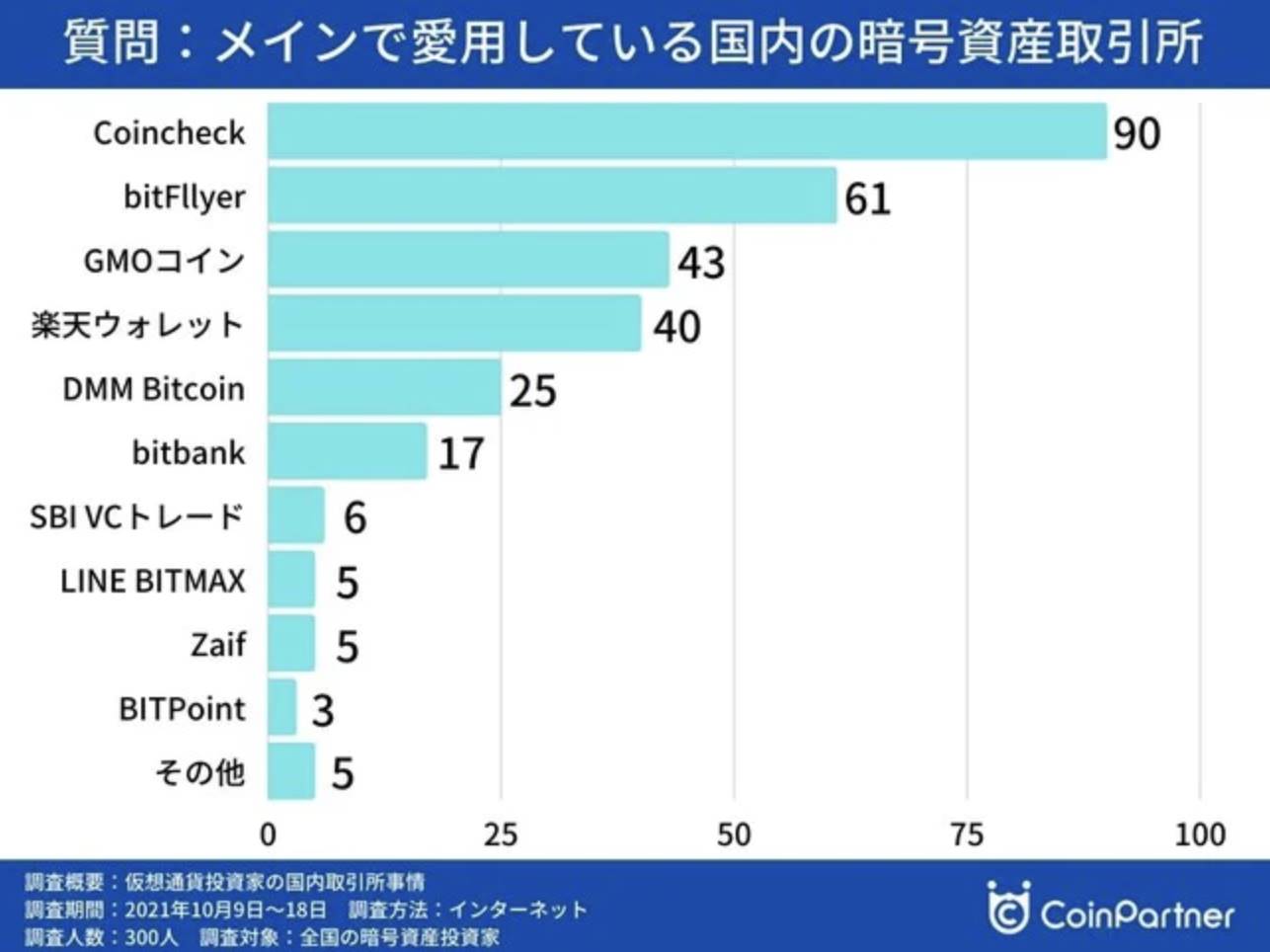

According to a survey of 300 Japanese exchange users, the most popular exchanges in Japan include Coincheck, bitFlyer, GMO Coin, Rakuten Wallet, DMM Bitcoin, and bitbank.

Regarding unlicensed exchanges in Japan, the most commonly used exchanges are Binance and Bybit, both of which have received warnings from the Financial Services Agency.

Japan has relatively few well-known native cryptocurrency projects, especially lacking self-made grassroots heroes. Most projects have deep traditional resource backgrounds. Currently, some of the more prominent projects include Astar Network, Oasys, HashPort, Jasmy, and others.

Regarding social media, Twitter remains the primary source of information and communication in Japan, followed by Instagram and Facebook. Some users also use LINE Open Chat (similar to QQ chat rooms) to collect and exchange information about virtual currencies, although this channel is not mainstream, and the largest chat room has only 5000 participants.

In Japan, there are several vertical media outlets for the general public, including CoinPost, CoinTelegraph JP, CoinDesk JP, 仮想通貨Watch、あたらしい経済 and Bitpress.

In terms of influence and traffic, the largest Japanese cryptocurrency media outlet is currently Coinpost, which is well ahead of the others. Tokyo-based cryptocurrency practitioners have reported that Coinpost has received investment from Chinese cryptocurrency capital.

Although all of the above media outlets have news services, the only one that specializes in news and is used by all Japanese companies (including non-blockchain-related companies) is PRTimes, which is well-known among Japanese office workers.

There are also some self-media outlets on Twitter that collect blockchain-related information from Japan and abroad and translate it into Japanese. Of course, many vertical media outlets also create accounts on Twitter to increase their visibility. Some of the more famous ones include dAppsMarket, CRYPTO TIMES, BlockchainGame Info, and NFT JPN. In addition, CoinGecko Japan is also not to be underestimated.

In terms of in-depth research (similar to Messari's service), HashHub Research is the leader, with an interface and layout that is similar to Messari.

In addition to the above types of media, there are numerous affiliate media (such as Kasobu), newsletters, and personal blogs that make a living through SEO. The most famous newsletters are CoffeeTimes, のぶめい、マナブ, and Ikehaya.

In terms of KOLs, we have attempted to categorize and list representative accounts for each type (not an exhaustive list), with analysis focused mainly on Twitter, where there are some KOLs that span several types.

Researcher/Academic KOLs: Traditional Japanese KOL groups consider their reputation and perform due diligence when deciding whether to promote a project. These KOLs need to maintain objectivity and neutrality, so they rarely write advertorials.

Shingen: Mainly analyzes ETH-related technologies and projects

Arata: Founder of the Japanese blockchain media CryptoTimes.

やす@暗号通貨: An all-around player whose research covers all aspects of virtual currency.

Gamefi-related KOLs: It should be emphasized that Gamefi is not a widely circulated keyword in Japan, and the term that people like to use is BCG, which stands for Blockchain Games. When conducting related searches, this should be kept in mind.

魔LUCIAN: Undoubtedly the most influential Gamefi KOL in Japan. Its influence extends far beyond Japan and it serves as the ambassador for the star GameFi project Defi Kingdom in Japan. Its successful Call rate is terrifying, enough to have a substantial impact on the market. Recently created its own community, LFG (Lucian Finders Guild).

Makai Witch: An up-and-coming star who often translates and reposts the main chain games of various chains (XANA, Sand, Star Atlas, etc.).

Onchan: Although not followed by many people, he is the Japanese community manager for many well-known projects (LOA, Defina, GameStarter, H&E, Monsta Infinite, Guildfi, RIFI, and Demole).

Defi-related KOLs

Shingen: See above

Lagoon: Mainly analyzes coin listings that are approaching their IDO and projects that may/will airdrop in the near future.

仮想戦士ロイ: An up-and-coming star who frequently interacts with LUCIAN and co-hosts Twitter Spaces, mainly focusing on the AVAX chain and analyzing Defi and gamified Defi projects.

KOLs related to the "demon world"

High-risk, high-reward coins (similar to the Chinese term "hundred-fold coins") are referred to as the "demon world" by the Japanese due to their "once you enter the deep pit, it's as deep as the sea" characteristics. Demon world coins are mainly categorized into Defi, GameFi, and CX coins according to their content.

KOLs who claim to specialize in the demon world include the following:魔LUCIAN、Makai Witch、元GA、らぐらぐぷりん ,and so on.

KOLs related to NFT:

Miin : Dedicated to discovering excellent Japanese NFT projects and collecting related information, updates the Japanese NFT ranking list every week.

ikehaya: An early investor in NFTs, holding Crypto Punk and BAYC, with over 340,000 fans.

雨弓: Head of SBI's NFT business department, a well-known Japanese internet company, often sharing information about NFT businesses of major Japanese companies.

KOL Groups

Kudasai : Japan's largest and oldest KOL group. Its Telegram community has over 18,000 participants, making it the largest virtual currency-related community in Japan. Its core members include over 20 KOLs, each responsible for different tasks such as project negotiation, research, promotion, translation/AMA, and so on. The leader is Watacchi.

ソフィクラ (Sophie Kura): The second-largest KOL group in terms of influence after Kudasai. Its Discord community has over 12,000 participants. The leader is Sophie Cherie.

Scam Dunk: Mainly shares information about demon world projects and conducts AMAs (coins with high risks and high rewards, commonly known as "hundred-fold coins" in Chinese). The leader is 仙道.

Otaku Guild: Mainly shares projects related to blockchain games and metaverse.

Giveaway/airdrop information collection KOLs:Giveaway-type KOLs are somewhat special, as some of them are not deeply involved in the virtual currency industry and accept any type of airdrop (coins, cash, vouchers, etc.), so special attention is needed. The ones mentioned here are all KOLs deeply involved in the Crypto field.

Fig : Previously, ADMEN gained fame for receiving a four-digit number of retweets from the airdrop of STEPN and liking it.

ADMEN : KOL who frequently carries out airdrops for various star projects and heavy projects. Recently, due to its high popularity, it has established its own welfare group, ADMEN DAO.

Pillars of the business world:

前泽友作 Yusaku Maezawa: The Japanese billionaire, the first private passenger for SpaceX's lunar mission, has established a personal friendship with Elon Musk and is also known as the "Japanese Musk." He owns a cryptocurrency investment fund called MZ Web3 Fund with assets worth 10 billion Japanese yen (approximately 70 million USD), and also operates MZ DAO.

国光宏尚 Kunimitsu Hironao: Founder and former president of Gumi. After leaving Gumi, he established Third Verse and Financie. Although he has left Gumi, his influence is still far-reaching, as evidenced by his co-founding of the game chain Harmony, in which Gumi recently invested.

加納裕三 Yuzo Kano: Co-founder of bitFlyer, one of Japan's largest exchanges, and representative director of the Japan Blockchain Association.

渡辺創太 Sota Watanabe: Founder of Astar Network, a Polkadot parallel chain, with the earnest expectation of many Japanese VCs that Japan will have a place in the Web3 industry.

吉田世博 Seihiro Yoshida: The CEO of HashPort, fluent in Chinese, operates Japan's first Initial Exchange Offering (IEO) token, $PLT, and the largest NFT marketplace in Japan, PLTPlace.

岡部典孝 Noritaka Okabe: CEO of JPYC, the largest Japanese yen stablecoin project, whose greatest joy in life is to take people to saunas for in-depth communication.

Yosui : The founder of the Hokusai project, which provides integrated NFT issuance solutions for Japanese businesses.

Many influencers operate their own communities, and choosing the right influencers in corresponding niche areas, such as Gamefi/Defi/investment research/airdrops, will significantly enhance the effectiveness of communication.

According to our understanding, traditional local venture capital (VC) in Japan is not particularly active, and there are very few Japanese VCs that are fully dedicated to Crypto and Web3. Moreover, most of them are only able to make equity investments.

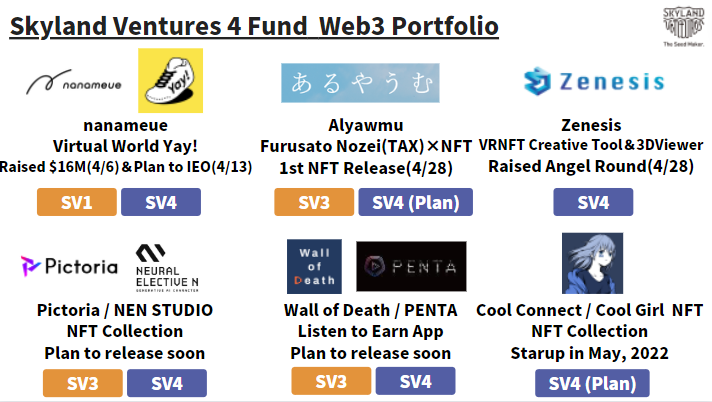

Skyland Ventures is one of the more active crypto funds in Japan and has established a seed fund focused on Web3 investments as part of its fourth fund.

On April 13th, Skyland Ventures announced the completion of fundraising for its Web3 fund, "Skyland Ventures No.4 Fund," totaling 5 billion Japanese yen (approximately 38 million USD). They also announced an investment in Takio, an Ethereum ZK-EVM solution.

Emoote is a Web3 fund established by the Japanese gaming company Akatsuki. The initial fund size is 20 million USD, and it is currently invested in a total of 24 projects, including STEPN, BreederDAO, ETHSign, Akinetwork, and others. Miss Bitcoin, a well-known Japanese KOL, serves as an advisor to Emoote.

Z Ventures, a joint venture between SoftBank and Line, has also set its sights on the Web3 field and made some strategic investments. They have invested in the NFT trading platform X2Y2, and blockchain game development platform double jump.tokyo, encrypted live-streaming platform Stacked, and others, all in the form of equity investments.

The SBI Group, a Japanese financial conglomerate, has also made significant strides in the cryptocurrency field. They are a core investor and spokesperson for Ripple in Asia and have invested in numerous local trading platforms. Among the incubators primarily operated by Japanese individuals or with Japan as their primary activity center, Fracton Ventures is the most prominent. While Fracton Ventures itself does not conduct investment operations, the team recently raised funds from various Japanese VCs and established Next Web Capital, which participated in investments in projects like EthSign.

Among other notable VCs operated by Japanese individuals or centered around Japan, Gumi Cryptos is the most well-known. Kazuki Morishita founded Gumi in 2007 and led the company to a successful IPO in 2014. It's worth mentioning that Kazuki Morishita studied at Fudan University in Shanghai for four years in 1996, but his Chinese language skills have significantly deteriorated since then. In 2021, Kazuki Morishita retired from Gumi and went all-in on blockchain and VR but still retains significant influence over Gumi.

Currently, Gumi Cryptos has invested in dozens of crypto projects such as Opensea and YGG. However, 国光宏尚(Kunimitsu Hironao) is also concerned that many of these overseas projects are unable to launch in the Japanese market or drive market development.

In the Japanese market, another notable figure is the billionaire and self-proclaimed "Japanese Musk," 前泽友作(Yusaku Maezawa). With millions of followers on Twitter, he is considered the largest KOL in Japan. He established the Web3 fund MZ Fund using his name initials, with investment amounts ranging from 1 to 5 million USD. Under MZ Fund, he owns the largest Web3 guild in Japan called Web3 Club, which has 30,000 native crypto users as members. He also operates MZ DAO, the largest "crypto education platform" in Japan, boasting a non-crypto native user base of 300,000.

Currently, MZ Fund has invested in various projects, including some with Chinese backgrounds, such as MetaOasis, Akiprotocol, SINSO, and others. Additionally, there are local VCs in Japan such as Headline Asia (and its subsidiary crypto fund Infinity Ventures Crypto), Akatsuki Crypto, i-nest Capital, and THE SEED.

The previous successful case of STEPN in Japan showcased the potential of the Japanese market. As of February 25th last year, 35% of its 21,000 active users were from Japan. Analyzing its promotional strategy, it can be observed that many top KOLs participated in Giveaway campaigns, with some even purchasing shoes at their own expense for the Giveaway. This indicates that as long as multiple top KOLs participate and the token model has good sustainability, Japan remains a market with considerable purchasing power.

However, considering the user base and the cautious tendencies of Japanese KOLs, it is advisable not to initially focus solely on Japan. But if a certain level of popularity can be gathered in Japan, it will make it easier for the project to expand into surrounding markets, especially Southeast Asia.

Furthermore, Japan as a whole is a challenging market to penetrate. Although language barriers (the well-known fact that Japanese people have psychological barriers toward English) and the cautious tendencies of Japanese KOLs make market promotion more difficult, on the flip side, if the project team remains active and committed, Japanese users are more tolerant and understanding compared to users in some other markets. This helps in creating a positive community atmosphere.

Another interesting observation is that initially, it was assumed that Japanese people would be more proud of domestic projects and have a higher level of wariness toward Chinese projects. However, according to the author's research on Japanese users, Japanese people have complex feelings toward Japanese projects, and some even consider the Chinese origin of a project as a bonus because many excellent projects come from Chinese creators (not to mention the added appeal of European and American projects).

In contrast, due to the numerous successful cases in China and the West, people who pay attention to this field for a longer period of time and have a more rational mindset consider this attribute as a bonus. However, it should be noted that the number of people fitting this user profile is limited.

Overall, in terms of localization, the author believes that it is necessary to have community managers who are native Japanese speakers and have an understanding of Japanese culture (knowing what Japanese comedy is like, being familiar with sports and political references, popular slang, and youth language, and being able to skillfully use popular catchphrases like "全米が泣いた" etc.).

Of course, if there is a good fit and rapport with a community manager, it may be worth considering bringing them into the team, as there is a significant difference between core members and external collaborators from the perspective of user mentality. This way, having a Japanese team member can provide a sense of reassurance to Japanese users, facilitate closer engagement, and at the same time, the team remains sufficiently global, giving Japanese people a sense of the project's "future prospects."

The above is the full content of the Japanese market. "Web3 Truth in the Asia-Pacific Market" is a special report produced by TechFlow that focuses on insights into the current state of the cryptocurrency market, user profiles, and industry participants across various regions in the Asia-Pacific. We will continue to publish market research for multiple regions and consult experienced local professionals to provide comprehensive and truly informative research for the Web3 community. If you have in-depth knowledge of the cryptocurrency market in your region and are interested in collaborating with TechFlow on this special report, please feel free to contact us via TechFlow's official Twitter account:https://twitter.com/TechFlowPost

Recommendation

The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Who Will Take Over From Friend.Tech? Exploring 10 Noteworthy Consumer Crypto Apps on Base

Jul 07, 2024 14:24

Chinese Crypto Market

Deep Dive into the Chinese Crypto Market: Exploring Trading Habits, MBTI Profiles, and Trending Sectors

Aug 08, 2024 16:10