The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Produced by:TechFlow 深潮

Author:0xmin & Zolo & Min L

Do you understand the real Chinese cryptocurrency market?

As "Chinese Coin" and Hong Kong narratives take the spotlight, the Chinese market has once again garnered widespread attention. Institutions and projects that were hesitant about expanding into the Chinese market have witnessed its undeniable power through the pump in Hong Kong concepts.

In contrast to scattered analyses and second-hand information, we have engaged in direct communication with multiple friends and, based on TechFlow's long-term cultivation and insights into the Chinese market, we present a comprehensive and informative report on the market environment, user profiles, VCs, and Marketing strategies, uncovering unknown insider information.

Whether you are an institution, a project team, or an individual, we hope this report will help you quickly establish an understanding of the Chinese cryptocurrency market and assist you in successful ecosystem expansion.

Big shout out to our co-author, Min L, Director of Market Strategy at a top 10 global exchange, with ten years of global market experience. Co-founder of FAB DAO.

*This excerpt is taken from the "Web3 Truth in the Asia-Pacific Market" report by TechFlow 深潮, focusing on the Chinese market.

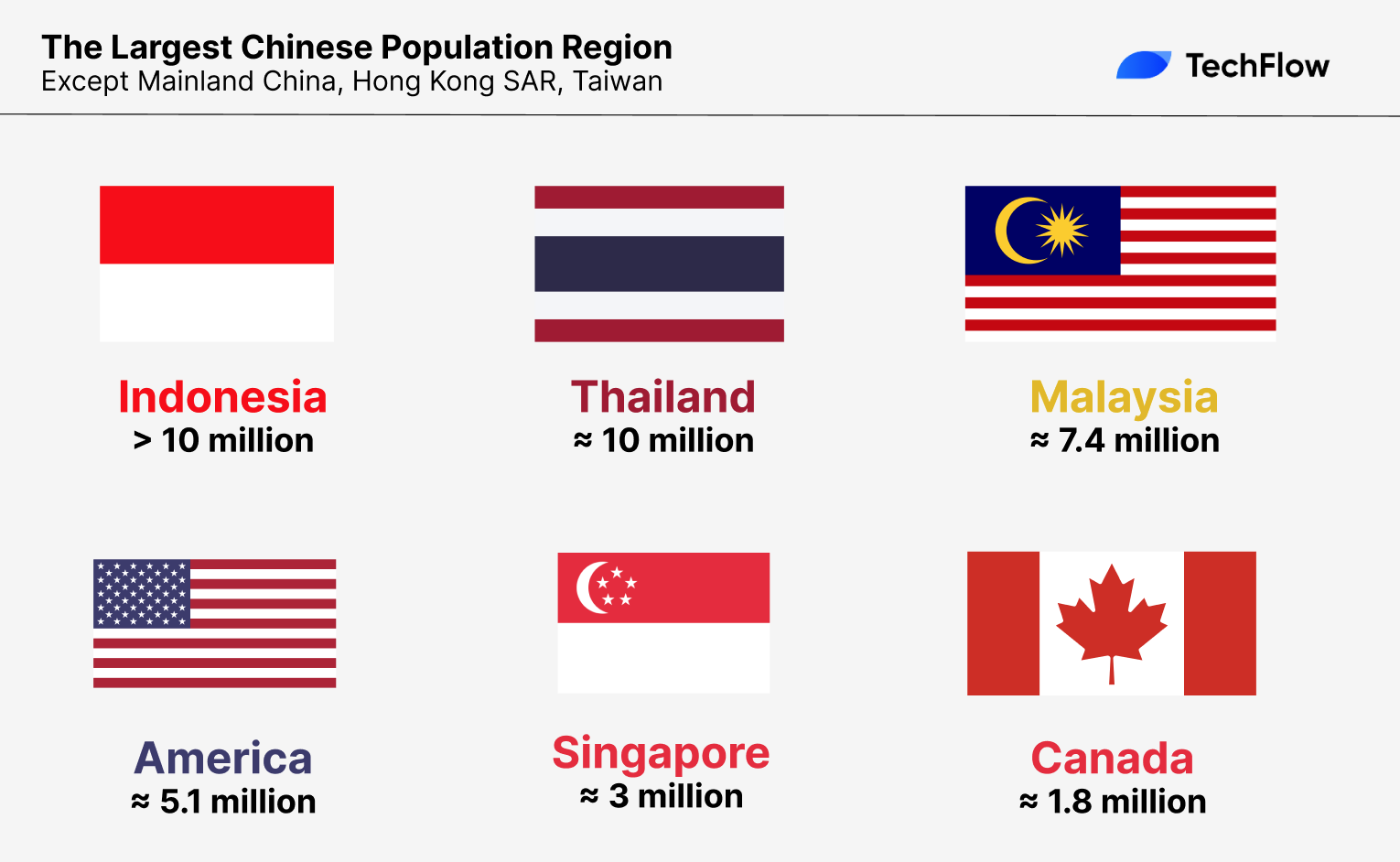

The Chinese-speaking market is the largest in the Asia-Pacific region, encompassing Mainland China, Hong Kong SAR, Taiwan, Singapore, Thailand, Malaysia, and many other places where there is a significant Chinese population. According to a survey report by Jintou, apart from China, the six countries with the most Chinese people are:

Indonesia, with over 10 million Chinese

Thailand, with around 10 million Chinese

Malaysia, with 7.4 million Chinese

the United States, with 5.08 million Chinese

Singapore, with 2.98 million Chinese

Canada, with 1.77 million Chinese

Different crypto policies in different regions have resulted in different user profiles for the crypto market.

In September 2017, the People's Bank of China, together with other regulatory authorities, announced a ban on ICOs and the closure of cryptocurrency exchanges. Then, in May 2021, relevant regulatory authorities issued another notice to crack down on Bitcoin mining and trading activities. Since then, whether it's exchanges, project parties, miners, or users, they have all started to go overseas.

However, Chinese-speaking users have only migrated and have not disappeared completely.

According to Triple A, as of 2023, the global crypto ownership rate is estimated to be an average of 4.2% (including off-chain users).

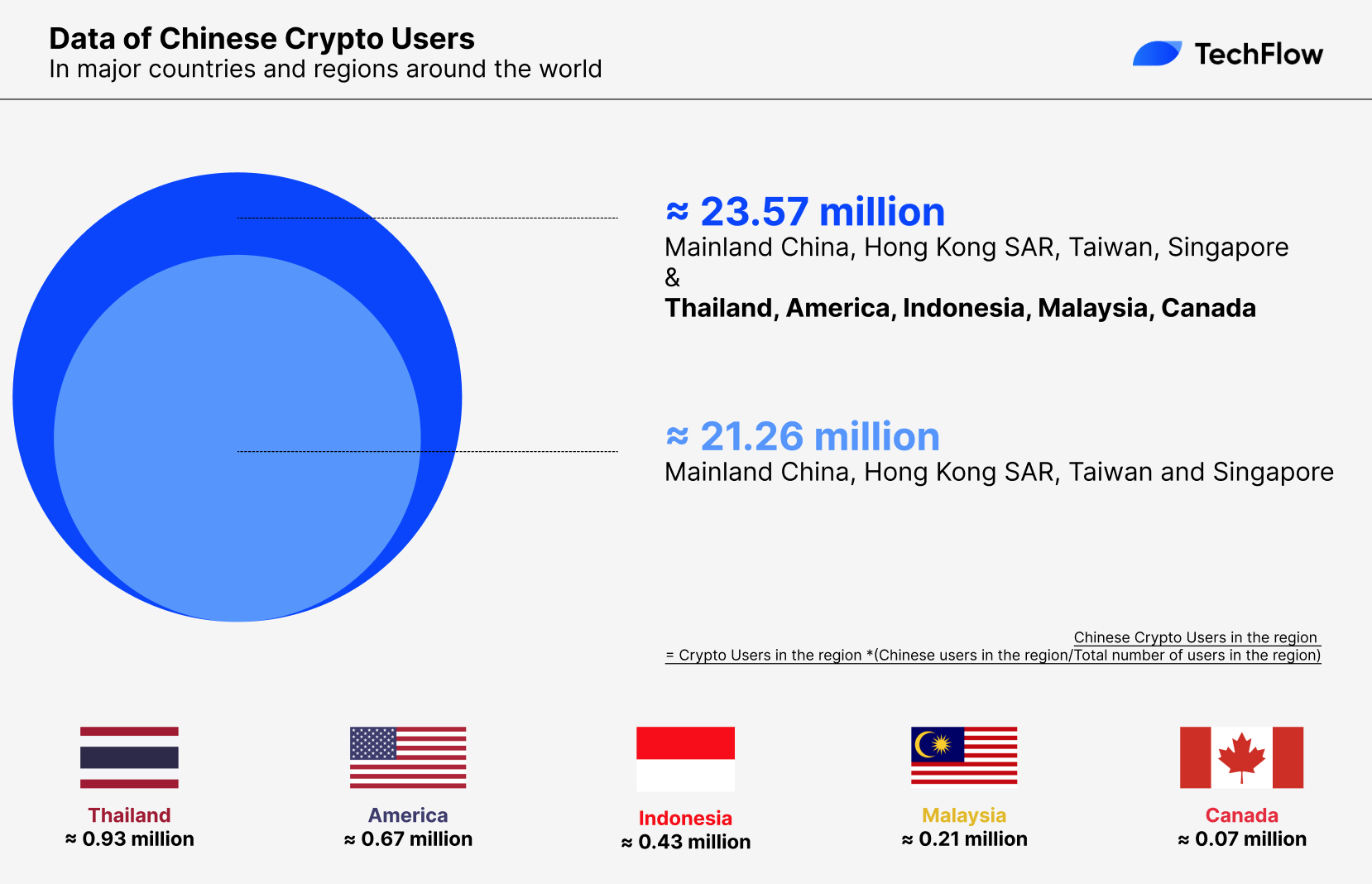

Among them, if only considering regions where Chinese is the main language: mainland China has 19.9 million users, Hong Kong SAR has 0.18 million, Singapore has 0.64 million, and Taiwan has 0.54 million. The number of cryptocurrency users in these regions totals 21.26 million.

If this data includes the proportion of Chinese in Indonesia, Thailand, Malaysia, the United States, and Canada, the number of users that Chinese-language content can reach is at least 23.57 million (the calculation formula is: Number of cryptocurrency users in that region * (Number of Chinese speakers in that region/Total population of that region)).

What we have always emphasized is the concept of the Chinese market, rather than just the Chinese mainland market. Apart from mainland China, there are still significant numbers of Chinese people in regions such as Hong Kong SAR, Taiwan, Singapore, Malaysia, North America, and Europe, and this demographic possesses strong purchasing power.

For any ambitious entrepreneur, it is acceptable to acknowledge that due to policies or other reasons, they may not focus on the Chinese mainland market. However, it is crucial not to overlook the Chinese diaspora market.

Hong Kong serves as a gateway connecting the global Chinese market. At the same time, Taiwan is also a place we need to pay great attention to. In fact, many projects seeking to enter the Chinese market often consider Taiwan as a testing ground.

Taiwan has benefited from decades of infrastructure development and stable economic growth. The presence of numerous small and medium-sized enterprises has led to a socio-economic structure that has achieved a relatively equal and comfortable standard of living since the 1960s. Most Taiwanese people born in the 1980s onwards have not experienced extreme poverty or a lack of food. Compared to the significant wealth gap in mainland China, and the social class rigidity in Japan, South Korea, and Hong Kong, the average salary of Taiwanese individuals can at least meet basic needs. Therefore, Taiwanese users tend to focus on "continuously accumulating assets" rather than seeking instant wealth.

As a result, long-term investment projects (such as lending, regular investment management, and DeFi strategies) and easily comprehensible trading products (such as grid trading and social trading) are more favored by Taiwanese users because they provide a stable means of asset accumulation.

On November 14, 2022, the FTX incident erupted, leading to the collapse of the world's second-largest exchange. Official reports confirmed that Taiwan was the fifth most affected region, indirectly highlighting the significance and activity of Taiwanese users in the crypto trading market. Despite Taiwan's economic growth not being exceptionally high in recent years, its stable economy and social environment have provided Taiwanese users with the confidence to seek new wealth opportunities.

The Taiwanese market has long been in a gray area, with regulators failing to implement effective policies over the years. Following the FTX incident, several cryptocurrency asset management companies in Taiwan were implicated. However, the government could only detain individuals without the power to impose sentences, revealing the limitations of regulatory laws. Consequently, the Taiwanese market has become a highly contested battlefield for many traders eager to explore its potential.

This brings us to the issue of cryptocurrency policies once again. We will primarily share the policy situations in mainland China, Hong Kong SAR, Taiwan, and Singapore.

Mainland China: Cryptocurrency-related activities are prohibited for exchanges/institutions, and retail investors/companies are responsible for any financial losses resulting from their participation in such activities.

In fact, large-scale cryptocurrency activities are rare in Mainland China, and more discussions are related to the Metaverse, NFT, or technology. Retail users can participate in cryptocurrency projects through other channels, but their financial losses resulting from participating in cryptocurrency activities are not protected by law. Source: http://www.gov.cn/xinwen/2021-09/25/content_5639201.htm

Hong Kong SAR: Cryptocurrency businesses can operate legally if they meet regulatory requirements, and regulations for cryptocurrency businesses targeting retail investors are being developed.

Currently, as long as they meet Hong Kong's regulatory requirements, cryptocurrency-related businesses can be established in Hong Kong. As for exchanges, only OSL Digital Securities and HashKey Group have obtained virtual asset trading platform licenses from the Hong Kong Securities and Futures Commission at this moment. According to insiders, Hong Kong is also developing cryptocurrency policies targeting retail investors. Source: https://gia.info.gov.hk/general/202210/31/P2022103000455_404825_1_1667173459238.pdf

Taiwan: At present, Taiwan regards cryptocurrency as a "commodity," and there is no direct law to prosecute cryptocurrency-related activities, so institutions or users can participate in cryptocurrency-related activities.

Taiwan's policies are relatively relaxed, and they are still observing international policies on cryptocurrency. Due to this relaxed policy, Taiwan's cryptocurrency community has also developed rapidly. In the previous FTX crash incident, Taiwanese users accounted for 3%, ranking seventh in the world.

Singapore: Singapore also regards cryptocurrency as a "commodity," and various institutions can legally conduct cryptocurrency businesses for the B-end as long as they comply with legal requirements.

We need to note that the Singapore regulator has never issued a cryptocurrency exchange license. The 11 cryptocurrency licenses issued previously were only used in the payment field. Singapore's Deputy Prime Minister and Finance Minister, as well as the "next Prime Minister," Heng Swee Keat, publicly stated at the end of 2022 that digital assets are an important driving force for changing the financial market, cross-border payments, settlement, and capital markets. However, Singapore's consistent stance is to take a tough stance on cryptocurrency speculation and trading, especially for retail investors.

Overall, except for mainland China, other major Chinese-speaking regions are able to legally develop their cryptocurrency businesses. However, there are still relatively strict requirements for serving retail investors. Nevertheless, the Securities and Futures Commission of Hong Kong has recently announced that starting from June 1st, they will implement regulatory provisions for virtual assets, allowing qualified retail investors to trade cryptocurrency assets.

We conducted surveys of over 1000 users across multiple Mandarin-speaking communities and obtained the following analysis.

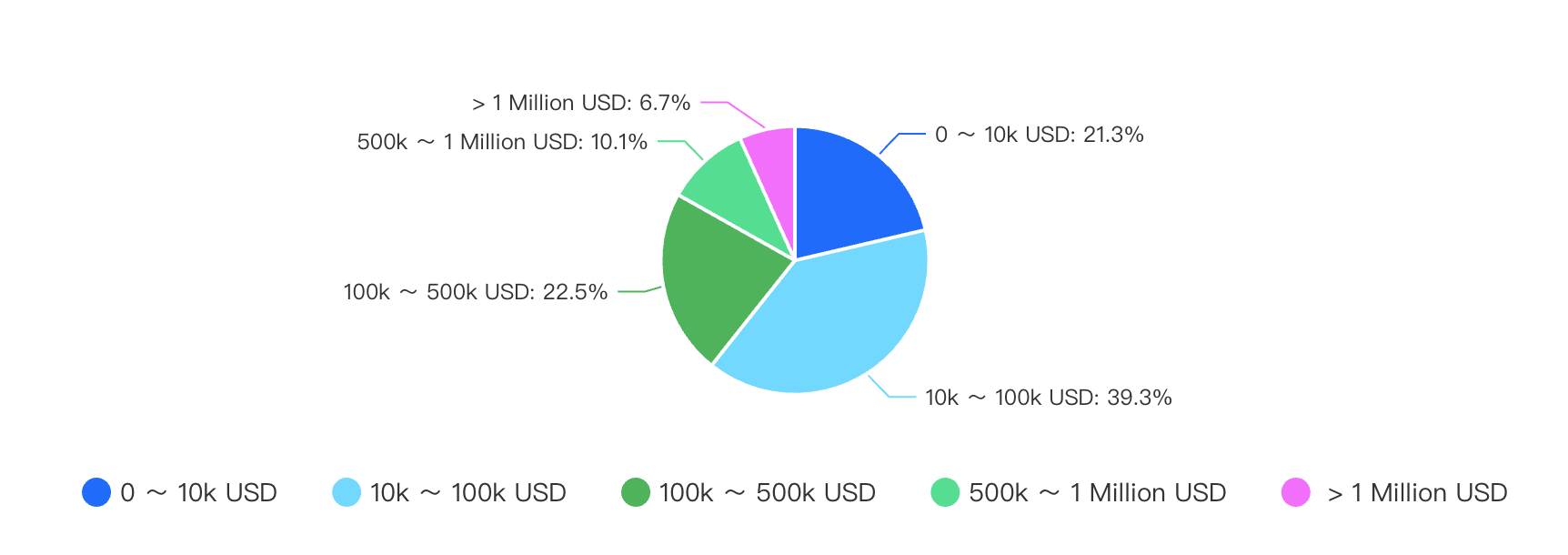

1-Overall, Chinese-speaking users have the highest investment proportion in the cryptocurrency market within the range of 10,000 to 100,000 USD, accounting for 39.3%, followed by 100,000 to 500,000 USD, which accounts for 22.5%.

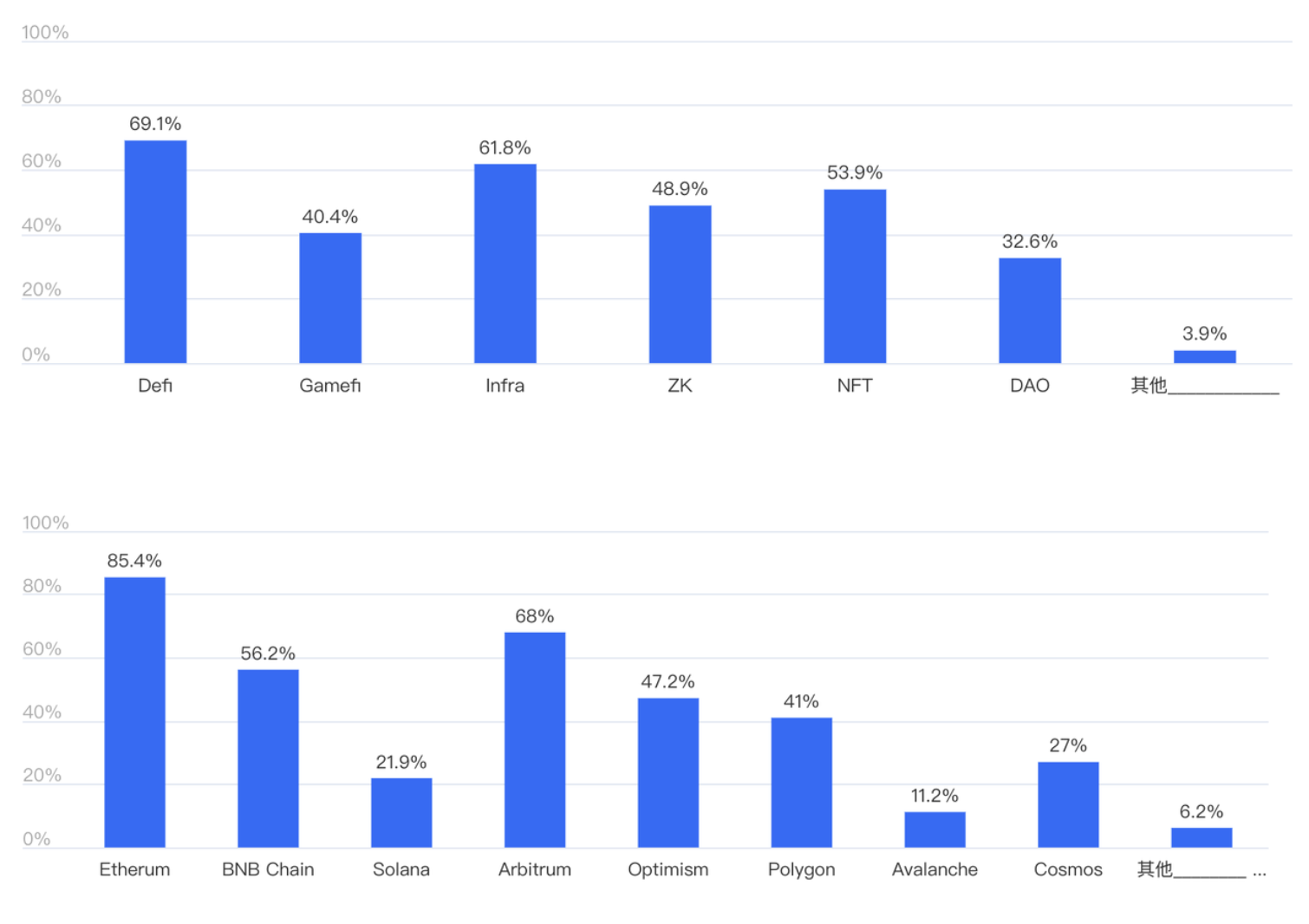

2-In terms of the specific areas of interest for Chinese-speaking users, Defi, infrastructure, and NFT are the top three. Regarding Layer1, Ethereum, Arbitrum, and BNB Chain are the top three in terms of attention.

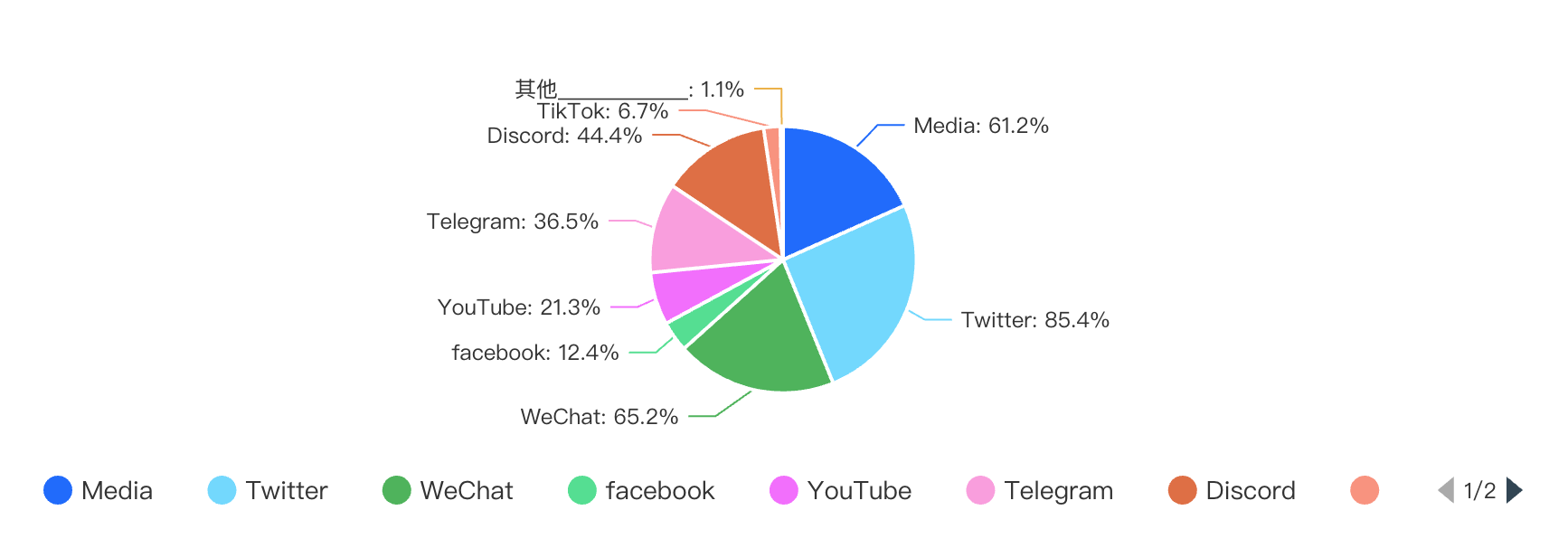

3-Chinese-speaking users' online habits are becoming increasingly internationalized. Twitter is the primary source of information, accounting for 85.4%, followed by WeChat at 65.2%, and media channels at 61.2%. Most Chinese-speaking media outlets also operate their own Twitter accounts.

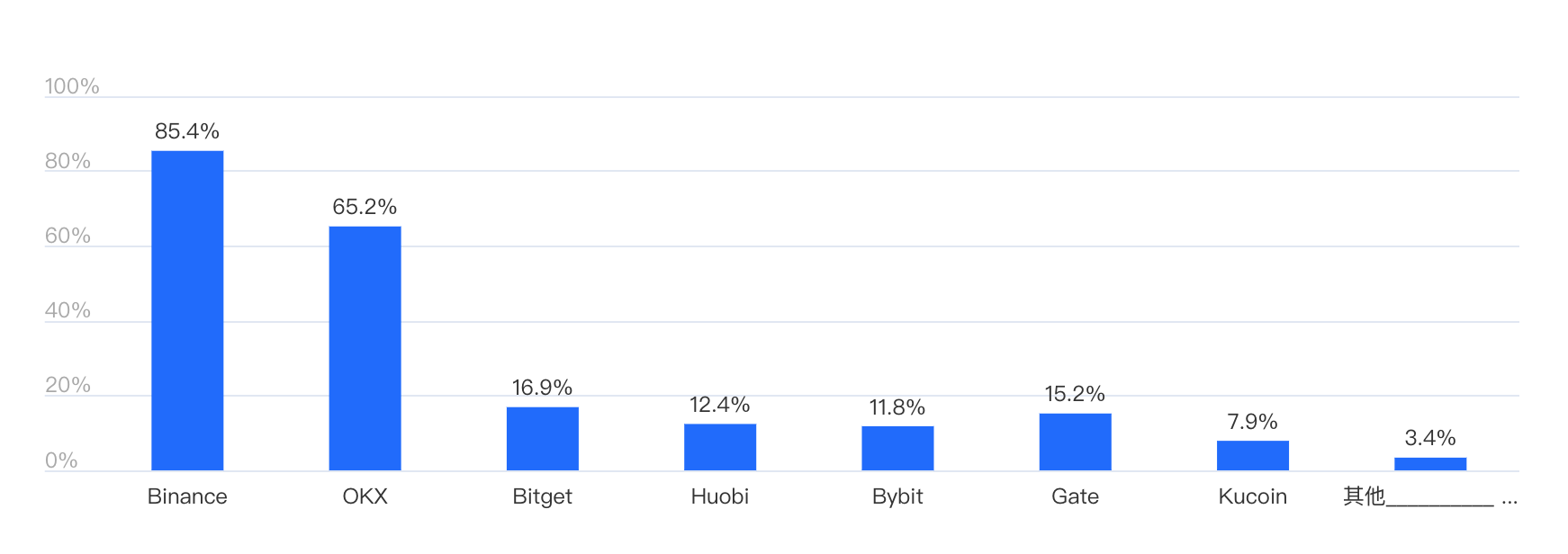

4-As for exchanges, Binance and OKX currently dominate the Mandarin-speaking market. Bitget, Gate, Huobi, and others followed in second place. Notably, Binance, OKX, Bitget, Huobi, Kucoin, Gate, Bybit, MEXC, and other top exchanges were all founded by Chinese people.

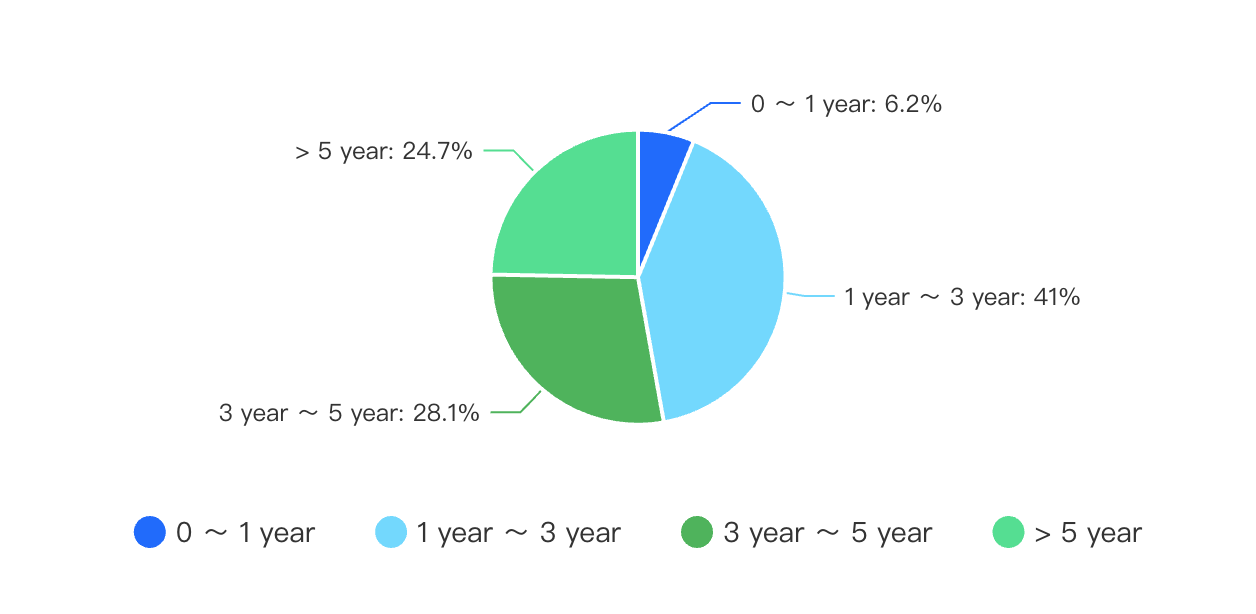

5-The cryptocurrency market is relatively new, and 1-3 year users are the largest group, accounting for 41% of Chinese-speaking users. The next largest group is the 3-5 year users, accounting for 28.1%.

Overall, Chinese-speaking users show enthusiasm for the cryptocurrency market, as reflected in their investment amounts, despite their relatively early stage of understanding. Due to certain policy reasons, users increasingly rely on international channels as an irreversible trend in their information consumption habits, especially when it comes to platforms like Twitter. However, for effective localization efforts, Media and WeChat remain important operational platforms.

Additionally, user habits in the Taiwan and Hong Kong SAR markets also exhibit local uniqueness. In terms of exchanges, besides commonly used offshore exchanges like Binance and OKX, the top three local exchanges in Taiwan are MAICOIN, ACE, and Bitopro, with BingX also having a substantial user base. In Hong Kong, the main local exchanges are HKD and Kikitrade.

In Taiwan, the primary social media platforms used are LINE, Instagram, and Facebook, while in Hong Kong SAR, WhatsApp, Facebook, and Instagram are more commonly used. Regardless of whether it is mainland China, Hong Kong, or other regions, Chinese cryptocurrency investors frequently use Twitter and Telegram to access and communicate industry-related information.

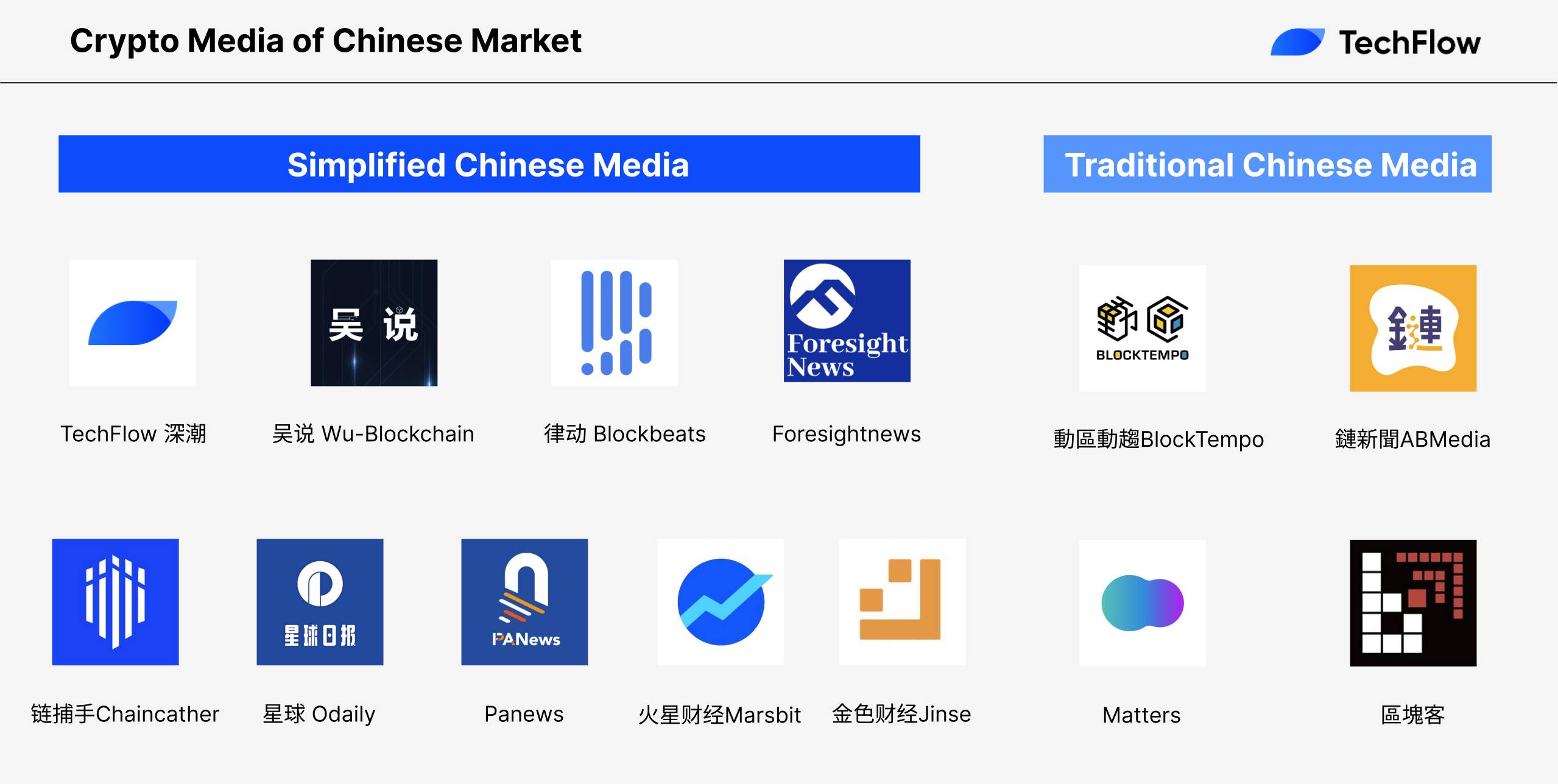

Media is one of the main channels for users to obtain information, and content is also the first stop for most people to enter the Web3 world. An article, a podcast, or a video could potentially spark interest in the cryptocurrency market for a traditional Web2 user.

Or, good content could also bring good exposure and long-term content accumulation for a project. It is estimated that there are over 100 Chinese-language cryptocurrency media outlets, and selecting a media outlet with high traffic, a positive brand, and unique features can truly bring dissemination effects to your project. Based on research, we have compiled a list of some mainstream media outlets in the Chinese markets for reference.

In general, Chinese crypto media are exploring their own characteristics and direction.

Wu-Blockchain maintains classical journalism and often reports exclusive news; ChainCatcher collaborates with its investment fund Cather VC to produce project research; Foresight News continuously explores activities and tools; Panews has a more global marketing layout; Blockbeats and Odaily are at the forefront of quick news updates and have extensive user and traffic accumulation; TechFlow is dedicated to producing original in-depth articles, deep research, and analysis, as well as expressing subjective emotions and perspectives...

In the Traditional Chinese market, Blocktempo and ChainNews are influential crypto media platforms in Taiwan in terms of traffic and influence, while Matters has a stronger community aspect.

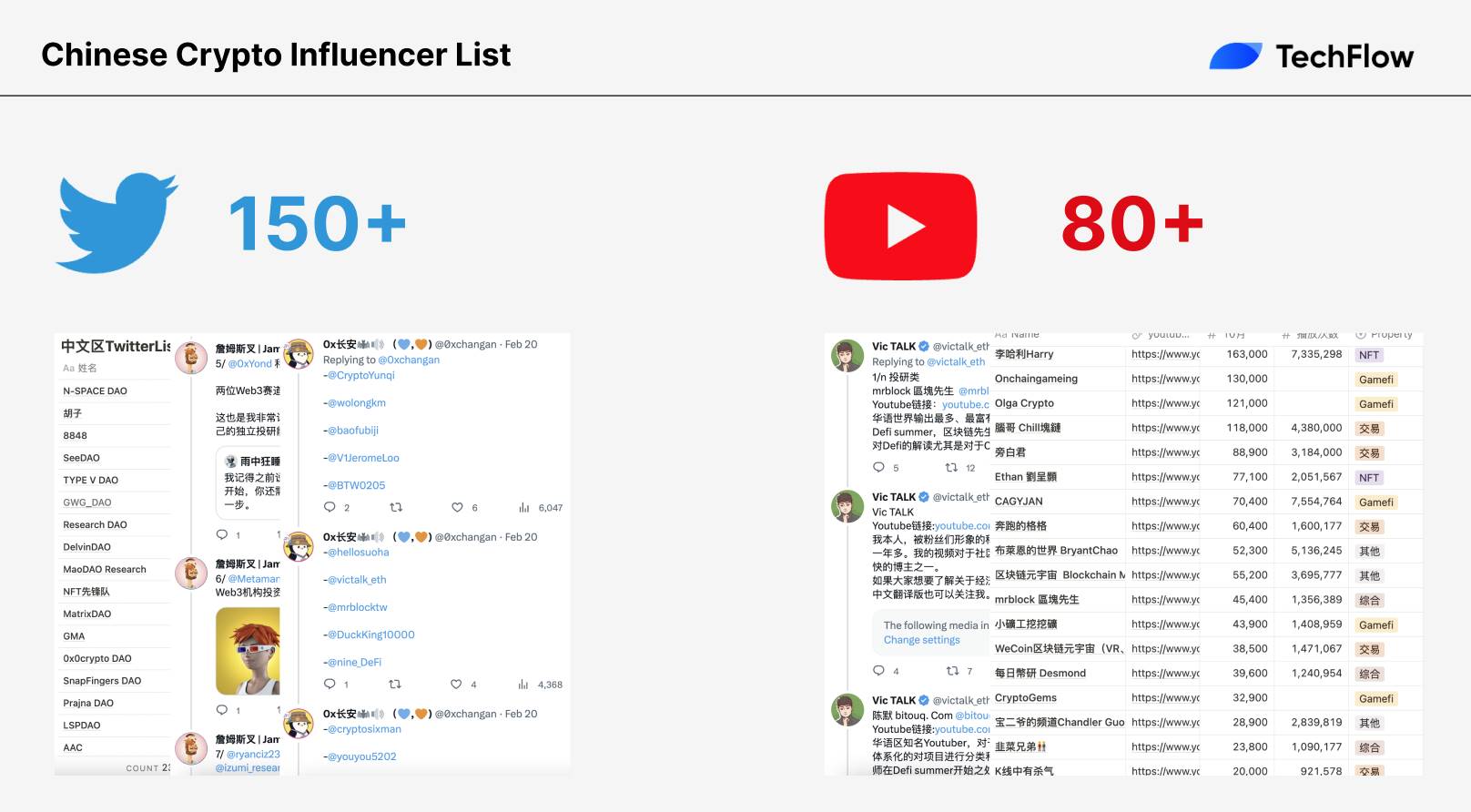

In terms of communities and Influencers, WeChat, Weibo, and Bilibili were important information sources for Chinese-speaking users. However, due to policies, Chinese users' main sources of information have gradually shifted to international channels such as Twitter and YouTube. Many communities and Influencers that were previously on WeChat, Weibo, and other channels have also gradually migrated to international channels. Therefore, we mainly list Chinese-speaking Influencers and communities on Twitter and YouTube.

Due to the subjective nature of the selection rules and perspectives for Influencers, we have compiled the content of several third-party individuals as objectively and comprehensively as possible in the hope that it will be helpful to you.

Chinese Twitter Influencers 150+

Chinese Twitter List Collection

List of high-quality bloggers with relatively small fan bases

Chinese Youtube Influencers 80+

List of Chinese-speaking YouTubers

Chinese-speaking YouTubers Recommendation

In the Taiwanese market, there are also numerous localized Influencers/communities. Some well-known ones include Mr. Block, who is known for blockchain-related content but has also faced controversies. There's Woody, a trader, and Benson, who ceased updating community activities after the FTX incident. Chill塊鏈, Alvin from Daily Coin Research are more inclined towards Degen/trading topics. The 2140 Cryptocurrency Community and 杜哥777 Channel are also focused on trading. In terms of a more comprehensive approach, there are individuals like 許明恩/區塊勢, Terence, and the popular Hong Kong-based Buji DAO represented by Little Raccoon.

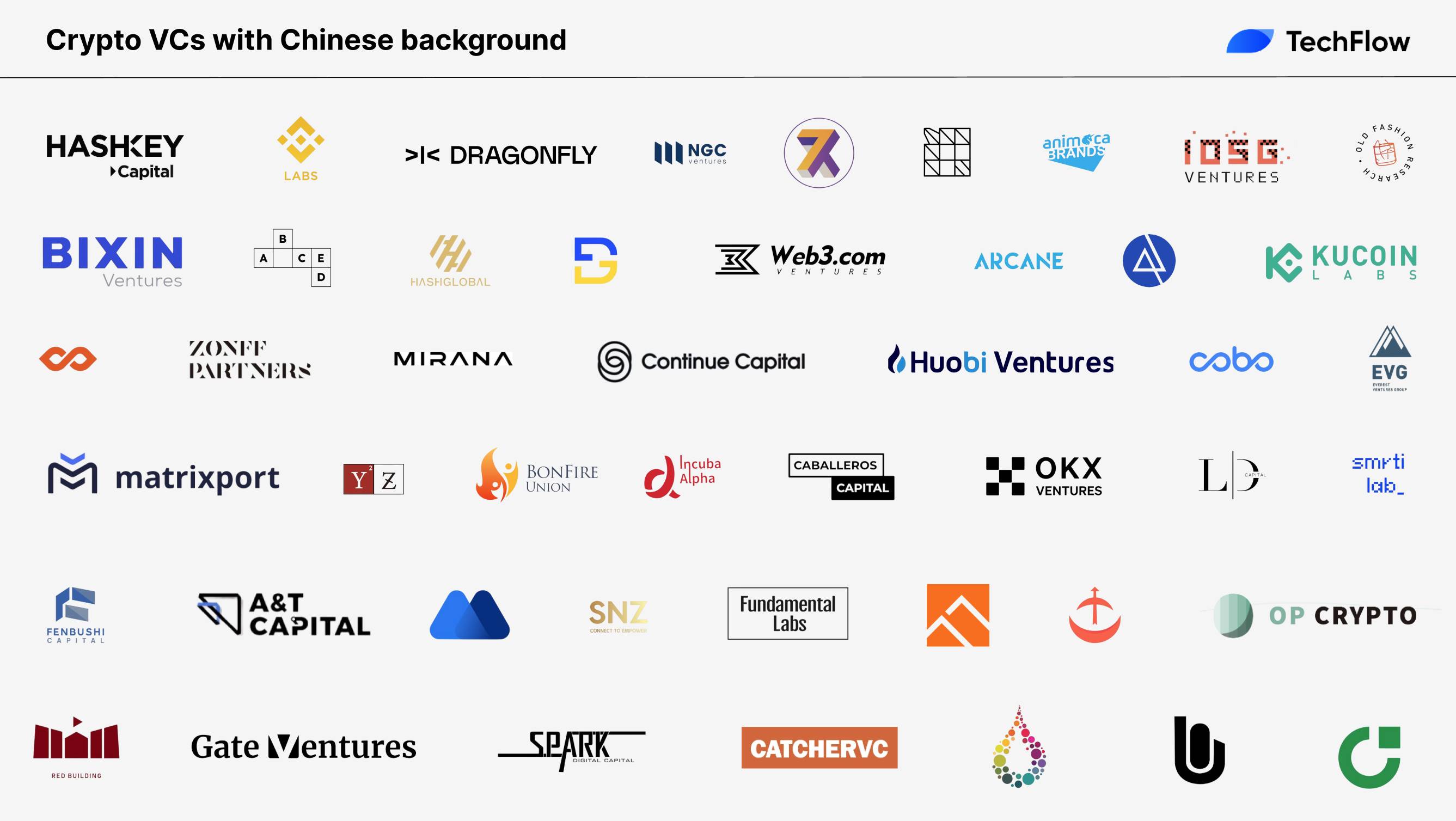

In the Asian-Pacific cryptocurrency VC scene, Chinese background VC dominates both in terms of quantity and overall strength. However, similar to the previous "Made in China" phenomenon, Chinese-background VC firms face the challenge of being numerous but lacking in individual strength, resulting in a lack of influence.

Many VC firms are often criticized for their lack of investment methodology and their preference for co-investment while relying on the backing of certain Western major funds. As a result, they tend to cast a wide net during bull markets due to FOMO but refrain from making investments during bear markets. Ultimately, they find it difficult to outperform ETH in terms of overall net asset growth over a cycle.

Starting in the second half of 2022, a trend has emerged where many Chinese background crypto VC firms are reducing their investments in primary projects. Instead, they are shifting towards secondary investments, raising funds for the secondary market. Additionally, VC firms are increasingly involved in project incubation, with various accelerators, incubators, and Demo Days emerging. The focus has shifted from the internal competition of primary investments during bull markets to incubation-driven competition.

This article will provide an overview of various active or previously active crypto funds with a Chinese background.

HashKey Capital

HashKey Capital, a subsidiary of HashKey Group, is an Asian asset management firm that specializes in investing in blockchain technology and digital assets. They are also early investors in Ethereum. Currently, HashKey Capital is the most active Web3 investment institution in the Asian region, with over 200 investments spanning 17 countries and regions.

HashKey Capital benefits from strong Asian resources and has relatively strong fundraising capabilities. It is one of the two Chinese-background crypto VC firms that have received support from Temasek, the investment fund of the Singapore government.

HashKey has a long-term presence in Hong Kong, gradually transitioning from Cyberport to the Central district. HashKey Group has obtained a virtual asset trading platform license issued by the Hong Kong Securities and Futures Commission, showcasing its commitment to operating in the region.

Portfolio: Animoca Brands,Cosmos,Polkadot,dydx,IoTeX,Alchemy,Celestia,1inch Network,Mask Network,Evomos,Terra,Harmony,Alliance,Mina,Galxe,Stacks,iZUMi Finance,Cobo,RSS3,Moonbeam,Radicle,Multichain,Pendle,Coinlist,DeBank,Decrypt,The Block,Foresight News,Secret network...

Website:https://capital.hashkey.com/en/

Twitter:https://twitter.com/HashKey_Capital

Fenbushi

Fenbushi Capital was established in late 2015 as the first venture capital firm in China focused on investing in blockchain-related enterprises. They were also early investors in Ethereum, and Vitalik Buterin, the founder of Ethereum, served as an advisor to Fenbushi Capital.

Fenbushi Capital has participated in numerous investments in critical infrastructure and applications within the Ethereum ecosystem, including projects like Kyber Network, MakerDAO, and Arbitrum. In December 2022, Amber Group announced the completion of a $300 million Series C financing round, with Fenbushi Capital US leading the investment. Currently, Fenbushi Capital holds significant influence on Amber Group, and the two collaborate to launch and operate a Gamma Fund.

Portfolio:Amber Group,Messari,Offchain Labs,Fuel,Circle,Mina,The Graph,1inch Network,Stacks,Balancer,Moonbeam,iZUMi Finance,Oasys,Astar Network,Forkast,Coinlist,ChainFeeds,Consensys,DeBank,DFINITY,Flow,NYM,Biconomy,Radicle,WOO Network,MathWallet,BlockSec,...

Website:https://fenbushi.vc/index_cn.html

Twitter:https://twitter.com/fenbushi

SNZ Holding

SNZ Holding is a crypto fund comprised of a group of engineers, blockchain advocates, and entrepreneurs. They share a common belief in blockchain technology, envisioning it as a means to restore the original spirit of the internet and build a better future through aspects such as privacy protection, information verification, distributed supercomputing, and digitized assets. Additionally, SNZ Holding provides professional Proof of Stake (PoS) mining pool services.

Portfolio:Animoca Brands,Arbitrum,Avalanche,Stacks,Mina,Manta Network,Mask Network,Solv Protocol,Astar Network,NFTScan...

Website:https://snzholding.com/

Twitter:https://twitter.com/snzholding

Animoca Brands

Animoca Brands is a Web3 gaming software company and venture capital firm founded by Yat Siu in 2014. On the one hand, Animoca Brands continuously expands its portfolio through acquisitions and owns several subsidiary companies, including The Sandbox, Blowfish Studios, Quidd, GAMEE, and more. Additionally, Animoca Brands has made numerous primary project investments in 2021 and 2022, with a total investment in over 400 projects.

Today, Animoca Brands has become a unicorn company and a shining star in Cyberport. However, it is surprising that Yat Siu is not fluent in Cantonese.

Portfolio:Ledger,Yuga Labs,Opensea,Kraken,LayerZero,Yield Guild Games,Axie Infinity,Consensys,Immutable,Polygon,WAX,CyberConnect,Mask Network,MOBOX,The Sandbox,Flow,Harmony,Hishstreet,Forkast...

Website:https://www.animocabrands.com/

Twitter:https://twitter.com/animocabrands

Seven X

SevenX Ventures was founded in 2020 and has quickly emerged as a rising star in the Asian region's crypto investment scene. The three founding partners and their team are seasoned with over five years of experience in the industry.

In terms of investment style, SevenX Ventures advocates for "immersive investment." Beyond providing financial support, they empower the projects they invest in through comprehensive assistance in fundraising planning, product design, economic modeling, marketing, and more. Their website proudly states their motto, "Empowering Startups in Crypto & Web3."

Portfolio:Near Protocol,Oasis Foundation,Arweave,Cyberconnct,RSS3,Bitget Wallet,DeBank,BitKeep,DAO Maker,Yield Guild Games,Mask Network,ChainFeeds,SubDAO,WOO Network,SubQuery,DODO,Footprint Analytics...

Website:https://7xvc.com/

Twitter:https://twitter.com/SevenXVentures

A&T Capital

A&T Capital was established in 2021 as an early to-growth-stage venture fund focused on disruptive emerging technologies. It has received funding support from Ant Group, one of China's top financial technology companies. The first fund raised $100 million, and due to its financial strength, A&T Capital has participated in investments in numerous well-known projects, including ConsenSys, Sui, Celestia, and more.

Following a scandal involving a former founding partner, A&T Capital entered a phase of comprehensive low-profile operations. This included deleting content on Twitter, shutting down public accounts, and clearing the website's content. However, it must be acknowledged that A&T Capital's portfolio is quite strong, despite the fact that some investments may have high valuations. Additionally, A&T Capital has recruited a group of talented individuals and has produced valuable content. One person's actions should not overshadow the team's previous efforts.

Portfolio:Amber Group,Sui,Celestia,Consensys,Cobo,Scroll,Orbiter Finance,Gnosis safe,Debank,Bitkeep,BlockSec,ChainFeeds,Footprint Analytics...

Website:https://a-tcapital.com/

Twitter:https://twitter.com/AT_Capital2021

Foresight Ventures

Foresight Ventures was established in 2021 with funding support from the exchange Bitget. The total assets under management of its various funds have exceeded $400 million. Foresight Ventures aims to provide comprehensive support to projects through the "power of the ecosystem." Its ecosystem primarily includes the exchange Bitget, the wallet Bitkeep, the Chinese crypto media Foresight News, and the incubator Foresight X.

Thanks to the synergy between Foresight Ventures and Foresight News in terms of branding and events, the overall Foresight brand has experienced rapid growth. The effective combination of their ecosystem components has positioned Foresight as a rising star among Asian crypto VC firms.

Portfolio:SPACE ID,Bitkeep,Foresight News,Shardeum,RSS3,Polyhedra,Xterio,Zebec...

Website:https://www.foresightventures.com/

Twitter:https://twitter.com/ForesightVen

Dragonfly

Dragonfly was founded in 2018 with the participation of Feng Bo, the founder of Ceyuan Ventures, and Haseeb Qureshi, a professional poker player, as the managing partner. It has the strongest fundraising capabilities in the Chinese-speaking world and has received long-term support from Sequoia China, as well as from the family offices of founders and executives of large internet technology companies. It has also received investment from Singapore government fund Temasek.

Dragonfly Capital primarily focuses on three investment directions: investing in new types of crypto asset management funds as the parent fund, investing in protocols and applications that have the potential to become the foundation of a decentralized economy, and supporting technology startups that can bridge the decentralized and centralized worlds.

Dragonfly aims to be a bridge connecting the cryptocurrency industries of the East and the West, facilitating Asian projects and investors in accessing Western-developed technologies and helping Western blockchain projects enter the Asian cryptocurrency market. As their slogan on the Dragonfly website states, they strive to be "Global from Day One."

Dragonfly has faced controversies due to its portfolio companies, such as Babel Finance's involvement in crypto and Amber's situation. Overall, Dragonfly is considered one of the most successful funds for practicing the "Chinese LP + Overseas GP" model, and it has truly established its brand among the top-tier global crypto VC firms.

Portfolio:zkSync,Animoca Brands,Lido,Avalanche,BitDAO,MakerDAO,Amber Group,Aptos,Babel Finance,Near protocol,Mina,Consensys,Polygon,Dune Analytics,dYdX,Celo,Cosmos,Flashbots,Bybit,OneKey,RSS3,1inch Network,Hashflow,SHRAPNEL,Debank,Element,Bitget Wallet,Ribbon Finance,UMA,Axelar...

Website:https://www.dragonfly.xyz/

Twitter:https://twitter.com/dragonfly_xyz

Old Fashion Research(OFR)

Old Fashion is a cocktail and also a multi-strategy blockchain investment fund. The team members, including former executives and investment professionals from Binance, founded the fund in July 2021. The founding partners consist of Ling Zhang, former VP of Strategic Investments and M&A at Binance, Wayne Fu, former Head of Corporate Development, and Xin Jiang, former Investment Director and Head of Launchpad at Binance Labs.

In addition to investments, OFR also engages in incubating numerous crypto projects and has established a presence in the South American and African markets.

In February 2023, an investor consortium led by Old Fashion Research (OFR) acquired the anime NFT series, 0N1 Force.

Portfolio:Nansen,Mexc Global,Pudgy Penguins,WOO Network,ZetaChain,Boba Network,Rebase,Genopets,Blocto…

Website:https://www.ofr.asia/

Twitter:https://twitter.com/ofrfund

NGC Ventures

NGC, short for NEO Global Capital, was established in late 2017. It had close ties with NEO in the early stages but later became more independent. NGC has a deep understanding of the cryptocurrency investment and financing cycle. The team members are relative "Degen" (degenerative), and they actively participate in the in-depth incubation and development of projects. NGC is considered a relatively crypto-native investment fund.

Portfolio:Avalanche,BitDAO,Solana,Polkadot,Render,Kucoin,Babel Finance,Highstreet,ConsenSys,NYM,MultiverseX,Algorand,Oasys,Ankr,Oasis Network,Zilliqa,Ontology...

Website:https://ngc.fund/

Twitter:https://twitter.com/ngc_ventures

OP Crypto

OP Crypto is an emerging crypto fund founded by former Huobi executive David Gan. Its website emphasizes its role as a digital asset VC with local connections in both Eastern and Western markets. Its LP (Limited Partners) primarily includes Huobi, Bybit, Animoca, DCG, Republic, and others. OP Crypto is a prominent early investor in Scroll, a well-known Ethereum Layer2 scaling project.

Portfolio:Scroll,Particle Network,Merit Circle,nftperp,Aurory,Ethos,Connext,Astra Protocol,,Stardust…

Website:https://www.opcrypto.vc/

Twitter:https://twitter.com/OPCryptoVC

Bixin Ventures

Bixin Ventures is affiliated with Bixin Group, one of the largest crypto wallets in Asia with over one million registered users. Its founding members were early adopters and promoters of Bitcoin and its ecosystem. Bixin Ventures has its own technological expertise and professional insights into the MOVE language and has invested in projects such as Aptos and Sui.

Portfolio:Arweave,LayerZero,Aptos,Sui,Sei Network,EigenLayer,Mina,Algorand,iZUMi Finance,Pendle,Bitget Wallet,SHRAPNEL,Ondo Finance,nftperp,Ethos...

Website:https://bixinvc.com/

Twitter:https://twitter.com/bixinventures?lang=en

ABCDE Capital

ABCDE was founded in 2022 as a Web3 fund by Du Jun, co-founder of Huobi, and BMAN, founder of Metropolis Capital. It has a fund size of 400 million dollars. In terms of investment style, ABCDE prefers to lead investments in projects, with approximately 80% of its investment projects being led by ABCDE.

Portfolio:PolyHedra,Debox,0xScope,NFEX,Cysic,Elven,MetaTrust,cointime,Particle Network,CoinCatch

Website:https://www.abcde.com/

Twitter:https://twitter.com/ABCDECapital

Hash Global

Hash Global, established in 2019, is a Web 3 venture capital firm that focuses on global Chinese teams and projects. It specializes in investing in two areas: 1) global Chinese founder teams and 2) early-stage blockchain projects that facilitate the integration of Web 2 and Web 3.

Currently, Hash Global has invested in over 50 projects across seven different tracks, with assets under management exceeding 300 million US dollars. The company has extensive collaborations and connections with Liang Xinjun, one of the founders of the well-known Chinese conglomerate Fosun Group.

Portfolio:Mask Network,DeBank,RSS3,rct AI,PlatON,NFTGo,Space and Time,SeeDAO,ChainFeeds,0xScope,DAOSquare,TokenScript...

Website:https://www.hashglobal.io/

Twitter:https://twitter.com/HashGlobal

RedlineDAO

Redline DAO is a cryptocurrency investment DAO based in Asia that offers comprehensive one-stop services to early-stage teams. These services include incubation, investment and financing, operations, marketing, media promotion, exchange relationships, and liquidity management.

The original Redline Capital was a blockchain fund that focused on early-stage projects in industries such as blockchain. It invested in over a hundred blockchain projects and had a background in market making and quantitative trading.

Portfolio:Conflux,Mask Network,Fantom,Celer Network,Mina,DODO、Algorand,Filecoin,Dfinity,iOST,Aura Network,Boba Network,WOO Network...

Website:https://redlinedao.com/

Twitter:https://twitter.com/RedlineDAO

Web3.com Ventures

Web3.com Ventures is the family office of Quantum Chain's founder. It not only participates in the investment of numerous top-tier projects but also serves as a limited partner (LP) for HashKey Capital and Animoca.

Portfolio:rct AI,MetaOasis,Cysic,Era7,Delphinus Lab,Relation,Prodia,Amethyst,Cassava Network...

Website:ventures.web3.com

Twitter:https://twitter.com/Web3com_VC

Arcane Group

Arcane Group, headquartered in Singapore, is a global multi-stage venture capital firm. It invests in the next generation of entrepreneurs in the Web3 era and also operates as a family office with assets under management reaching $500 million.

Arcane is dedicated to finding trailblazers who harness the power of blockchain technology to fundamentally transform existing systems and structures, creating solutions that make industries better.

Portfolio:Animoca Brands,Discord,Yuga Labs,Consensys,Foresight Ventures,Particle Network,Polyhedra Network,NEST,Gameta,Outland...

Website:https://www.arcanegroup.io/

Twitter:https://twitter.com/ArcaneGrp

Infinity Ventures Crypto (IVC)

Infinity Ventures Crypto is a cryptocurrency fund with a strong presence in Japan, Taiwan, and mainland China. It originated from Headline Asia (formerly known as Infinity Ventures) and maintains close ties with it. In February 2022, IVC announced a successful fundraising of $70 million, with participation from Circle, Digital Currency Group, and Animoca Brands as investors in the fund.

Portfolio:Yield Guild Games,Thala,Oasys,Scroll,Delysium,Zebec Protocol,RSS3,HighStreet,Xterio,OP Games,Web3Go...

Website:https://www.ivcrypto.io/

Twitter:https://twitter.com/ivcryptofund

IOSG

IOSG is a research-driven cryptocurrency venture capital firm that focuses on investing in projects based on four key principles:

Ambitious and resilient teams and founders.

Projects that are innovative and add value to the entire Web3.0 ecosystem.

Excellent operational and delivery capabilities.

Focus on building a strong community with a large user base.

IOSG places emphasis on brand building and regularly publishes in-depth research reports. They also organize events like IOSG Old Friends Reunion to connect investors and entrepreneurs from both the East and the West.

Portfolio:zkSync,Consensys,IoTeX,Arbitrum,Avalanche,Polkadot,NEAR Protocol,MakerDAO,EigenLayer,Stacks,Cosmos,Celer Network,Vechain,Filecoin,Synthetix,Conflux,Starkware、Celestia,Mina,Gnosis Safe,Mask Network,1inch Network,Scroll,Treasure Dao,Illuvium,0x,OneKey,UMA,Bigtime,Astar Network,Galxe,Decrypt,CyberConnect,Liquity,iZUMi Finance,Aavegotchi,Centrifuge,Moonbeam,DODO,Oasis Network,Ocean Network,Ontology,Footprint Analytics,Aztec Network…

Website:https://t.co/TLEEkn2hpP

Twitter:https://twitter.com/IOSGVC

DFG

Digital Finance Group (DFG) was originally established in 2015 and currently manages assets worth over $1 billion. It is a self-funded investment firm.

Currently, DFG manages three strategic funds: a venture equity fund, a Polkadot ecosystem fund, and a cryptocurrency fund.

In 2021, DFG sold its subsidiary company, LedgerX, to FTX. In terms of investment style, DFG tends to have significant holdings in specific crypto assets at both primary and secondary levels. They were early supporters of ETC (Ethereum Classic) and have become major holders and supporters of Polkadot. DFG also has a sister fund called Jsquare, which focuses on research and technology-driven investments, and manages assets worth over $150 million using its own funds.

Portfolio:Ledger,Circle,CoinList,Ava Labs,Solana,Amber Group,Big Time,Render,Dao Maker,Metis,Shradeum,Astar Network,OP Fames ……

Website:https://t.co/qlFpx9l0Gj

Twitter:https://twitter.com/DFG_OfficiaI

LD CAPITAL

LD Capital was founded in 2016 and relies on its own funds. It has invested in over 300 companies, covering primary and secondary investments, FOF (Fund of Funds), and more. With assets under management reaching $1 billion, LD Capital emphasizes providing multidimensional post-investment services to its portfolio companies. These services include talent recruitment, Tokenomics design, ecosystem collaboration, technology development, community and media relations, and fundraising. LD Capital is willing to be the first investor in a project and provide founders with confidence and support during the most challenging times.

In Asia, LD Capital is regarded as a representative of extensive investments. However, according to the founder's disclosure, LD Capital will be more selective in the future, focusing on high-quality projects and providing dedicated post-investment services to accompany their growth.

Entering 2023, LD Capital has begun to focus on secondary market investments.

Portfolio: Flow,Mina,Assembly,CoinList,Certik,Near Protocol,Illuvium,Big Time,Render Network,Ankr,Celer Network,MEXC,NYM,Flare Network,Algorand,StarryNift,DAO Maker,Boba Network,SubDAO,DAOSquare,Star Atlas,Alien Worlds…

Website:https://ldcap.com/

Twitter:https://twitter.com/ld_capital

Fundamental Labs

Fundamental Labs was founded in 2016 and emphasize fundamental analysis and investment. It focuses on on-chain metrics, financial indicators, team technical backgrounds, community health, and other dimensions. The investment amount per deal ranges from $500,000 to $50 million, providing comprehensive coverage throughout the various stages of project development.

In addition to its investment business, Fundamental Labs' parent company, CTH, also owns IDEG, a digital asset management company, and Atlas, a WEB3 infrastructure solution provider. Fundamental Labs has a close relationship with the Hong Kong-based Belle Group.

Portfolio:Avalanche,Coinbase,Cannan,Polkadot,Conflux,Kyber Network,Stacks,Filecoin,Decentraland,RSS3,Mask Network,SingularityNET,Loopring,Golem,Vechain,Binance.US,Blockstack,NEAR Protocol,Certik…

Website:https://www.cth.group/what_we_do/fundamental_labs/

Twitter:https://twitter.com/fundamentallabs

Folius Ventures

Folius Ventures was founded in 2020 by Jason @MapleLeafCap, a renowned Web3 influencer (Influencer) on Twitter. Jason, who has a background working on Wall Street, is well-versed in the capital game rules of both the East and the West. With a global perspective and a deep understanding of Eastern entrepreneurs, Folius Ventures serves as a bridge connecting the Western and Eastern worlds.

The motto of Folius Ventures is "We love APAC founders," reflecting their commitment to supporting Asia-Pacific and Chinese entrepreneurs. Folius Ventures provides project support in the following areas:

In-depth research to help projects gain more exposure and recognition.

Business support, such as token model design, IR (Investor Relations), development, and business growth.

Endorsement of project brands and introduction of core investors in current and subsequent rounds.

Several entrepreneurs have expressed that Jason's strengths lie in his expertise in "non-consensus" investments, particularly in the secondary market. Additionally, he has a preference for investing in mature entrepreneurs who have already been validated.

Portfolio:NEAR Protocol,STEPN,Nansen,ConsenSys,Scroll,Galxe,Debank,Onekey,Ethsign,Jambo,Cyberconnect,Solv Protocol…

Website:https://t.co/XALsw351GE

Twitter:https://twitter.com/FoliusVentures

EVG

EVG is a crypto fund established in Hong Kong, China, with the support of top family offices in Hong Kong and South Korea. EVG is a strategic partner of Animoca and both entities have cross-shareholdings, actively participating in the incubation and investment of multiple projects in the GameFi/NFT field.

EVG has two distinctive features. Firstly, leveraging its extensive and robust global resource network, it provides financing services (FA) to numerous projects and institutions. Secondly, in addition to financial investments, EVG excels in deep project incubation. It has successfully incubated projects such as Kikitrade, Aspen Digital, and Vibra, among others.

Portfolio:Animoca,Dapper Labs,Kraken,Sandbox,Flow,Blockto,HighStreet,Crema Finance,OP Games,iZUMi Finance,rct AI,…

Website:https://www.evg.co/

Twitter:https://mobile.twitter.com/evg_ventures

Cobo Ventures

Cobo Ventures is the investment division of the digital asset service platform Cobo. Cobo provides a range of services, including custody, DeFi funds, and Cobo SaaS, and has accumulated over 300 institutional clients worldwide, with over $3 billion in assets under custody. Cobo is dedicated to building infrastructure for various DeFi sectors.

Cobo Ventures primarily focuses on investing in the DeFi space, including DeFi infrastructure, applications, smart contracts, and cross-chain solutions. However, it is also exploring opportunities in the metaverse and GameFi fields.

The motto of Cobo Ventures is "We're Wise Money," leveraging Cobo's technological, financial, and resource network advantages to better assist DeFi project teams in their development.

Portfolio:iZUMi Finance,Safeheron,Orbiter,Gammax,Flashwire,Li.Finance,EdgeSwap,Orderly Network,TwitterScan…

Website:https://www.cobo.com/ventures

Twitter:https://twitter.com/Cobo_Global

Continue Capital

Continue Capital was established in 2016, and both co-founders are early evangelists in the Ethereum community. Co-founder Pima has led investments in over 40 projects, including Cosmos, Qtum, Tezos, Polkadot, Iost, Zilliqa, and Quarkchain. He is also one of the largest individual investors in OmiseGo, Zilliqa, and Polkadot in China, and contributed to the Chinese naming of $ATOM. The other co-founder, Xiahong Lin, is based in Silicon Valley and has a background as a former mobile development engineer at Twitter. He has also founded a blockchain company.

Continue Capital focuses on boutique investments and only invests in projects they understand and have thoroughly researched. However, they have been relatively inactive in terms of making investments at present.

Portfolio:Polkadot, Hedera,NEAR Protocolr,Cosmos,Celer Network,Filecoin,RSS3,IOST,Balancer,Qtum,Tezos,Zilliqa,Harmony,Coinlist,Algorand,Octopus Protocol...

Website:https://continue.capital/

Twitter:https://twitter.com/ContinueFund

Incuba Alpha

Incuba Alpha is a crypto fund originating from Japan, focusing on early-stage entrepreneurs in the decentralized finance (Defi), DAO, and Web3 sectors. Incuba sees itself as a strategic partner for startup companies, providing support in token economics and governance mechanism design, marketing positioning, and community building (especially in Japan).

Portfolio:Near、Mask、Ethsign、iZUMi Finance、Aki protocol、RSS3、SignalPlus……

Website:https://www.incuba.capital/

Twitter:https://twitter.com/Incuba_Alpha

Caballeros Capital

Caballeros Capital is an early-stage venture capital firm that focuses on Web 3 protocols, projects, and founders. It strategically positions itself in the Chinese and Southeast Asian markets, critically contemplating how to empower founding teams and actively supporting native crypto projects. Caballeros Capital possesses a robust ability to identify early-stage alphas and has gained recognition for its portfolio.

Portfolio:Polkadot,Sentiment,Ren,Polynomia,Radicle,OP Games,Ocean,ZKX,nftperp,Eclipse...

Website:https://caballeroscapital.com/#/home

Twitter:https://twitter.com/CaballerosCap

Smrti Lab

Smrti Lab is an open-ended evergreen hedge fund that manages assets worth 140 million USD. The fund focuses on long-term investments in emerging cryptocurrencies in both the public and primary markets. Smrti Lab's investment style primarily revolves around BTC/ETH long strategies, early-stage investments, and hedge funds. It predominantly invests in emerging crypto infrastructure with a focus on liquidity tokens.

Portfolio:Galxe,CyberConnect,Ancient8,Dfinity,Flashbots,Mobilecoin,Celestia,ZetaChain,BreederDAO,Blast Royale,Ancient 8,P12,Delysium,MirrorWorld…

Website:https://t.co/hsaB6ZfWSu

Twitter:https://twitter.com/smrti_lab

Binance Labs

Binance Labs is the venture capital and incubation arm of Binance, led by He Yi, the co-founder of Binance. It has a fund size of approximately 7.5 billion USD. Despite several significant changes in its core team over the past three years, Binance Labs has invested in over 200 projects in more than 25 countries, covering nearly all Web3-related sectors. In terms of investment style, Binance Labs prefers to be deeply involved in early-stage projects and possesses extremely strong bargaining power.

Portfolio:zkSync,LayerZero,SPACE ID,Symbiosis Finance,Sui,Celestia,Aptos,Injective,Certik,Axie Infinity,STEPN,NYM,Axelar,Polygon,Dune Analytics,Astar Network,Multichain,1inch Network,Mythical Games,Biconomy,Chiliz,Celer Network,Mask Network,PolyHedra,Hooked Protocol,Ankr,Hashflow,PancakeSwap,StarryNift,Wombat Exchange,Terra,The Sandbox,Moonbeam,Kava,Harmony,Oasis Network...

Website:https://labs.binance.com/

Twitter:https://twitter.com/BinanceLabs

Huobi Ventures

Huobi Ventures is the global investment division of Huobi, utilizing capital operations to empower Huobi's global expansion and facilitate the mutual growth and benefits of partnerships worldwide. During the previous bullish market cycle, Huobi Ventures achieved significant returns through investments and exits in Terra and Matic. Subsequently, it has continued to participate in investments in Matter Labs and Offchain Labs, accumulating tickets for the next market cycle.

Portfolio:zkSync,Animoca Brands,Arbitrum,Conflux,Optimism,NYM,Immutable X,Biconomy,Circle,Stacks,Celer Network,RSS,IOST,Oasis Network,Pyth network,ren,Oasys,Highstreet,Terra...

Website:https://www.huobi.com/en-us/huobiventures

Twitter:https://twitter.com/HuobiVentures

OKX Ventures

OKX Ventures is the investment division of OKX, with an initial fund of $100 million. It focuses on investing in areas such as blockchain infrastructure, Layer2, DeFi, NFTs, and the Metaverse.

OKX Ventures aims to provide extensive post-investment services to the projects it invests in. Whether it is in China, Silicon Valley, Japan, South Korea, or Southeast Asia, OKX Ventures has established a network of resources with local media and Influencers to assist entrepreneurs from various perspectives. Furthermore, projects in which OKX Ventures deeply participates and invests will be recommended to OKX, offering opportunities to access numerous OKX products, services, promotional resources, user base, and brand endorsements.

Portfolio: Matter Labs,offchain Labs,Sei Network,Metis,LayerZero,Scroll,ssv.network,Big Time,RACA,octopus Network,Rage Trade...

Website:https://www.okx.com/en-in/ventures

Twitter:https://twitter.com/okx_ventures

Mirana Ventures

Mirana was established in 2021 as the investment division of Bybit, with a focus on supporting the transition of companies, protocols, networks, and DAOs toward a more decentralized society. It primarily invests in crypto companies that have strategic relevance to Bybit and BitDAO, with investment sizes ranging from $200,000 to $20 million.

Portfolio:Matter Labs,Animoca Brands,Galxe,Oasys,Scroll,Ancient8,EthSign,iZUMi Finance,BlockSec,UMA,Mirror World,Tsunami Finance,Orbiter Finance,EPIC LEAGUE...

Website:https://mirana.xyz/

Twitter:https://twitter.com/mirana

KuCoin Labs

KuCoin Labs is the investment and incubation division under KuCoin, which focuses on diversified investments in early-stage projects while providing continuous support for the growth of these projects. Additionally, within KuCoin, there is also KuCoin Ventures, which is responsible for investment.

Portfolio:Symbiosis Finance,Pyth network,LiveArtX,Solcial,DAOAquare,Coinweb,Aura Network,Lifeform...

Website:https://www.kucoin.com/land/kucoinlabs

Twitter:https://twitter.com/KCLabsOfficial

Gate Ventures

Gate Ventures is the venture capital division of the cryptocurrency exchange Gate.io, specializing in investments in decentralized infrastructure, ecosystems, and applications.

Portfolio:Oasys,StarryNift,Aspecta,WOO Network,LiveArtX,Dora Factory...

Website:https://gate-ventures.com/

M-Ventures

M-Ventures is a comprehensive fund under the MEXC Group, dedicated to empowering innovation in the cryptocurrency field through strategic investments, mergers and acquisitions (M&A), fund of funds (FOF), project incubation, and other methods. It has already invested in hundreds of projects.

Portfolio:izumi Finance,Aura Network,KYVE,WOO Network,prePO,Orderly Protocol,TwitterScan..

Website:https://m-ventures.io/ Twitter:https://twitter.com/MVenturesLabs

Bonfire Union Ventures (Mask Network )

Bonfire Union Ventures is the investment division of Mask Network, dedicated to investing in the revival of open networks. It has made extensive investments in various decentralized social products and protocols.

Suji, the founder of Mask Network, holds significant personal influence in the Asian crypto world. Tianran Zhang, the head of investments at Bonfire Union Ventures, operates the highest-quality crypto community in the Chinese crypto world, bringing together entrepreneurs, crypto VC investors, and USD fund investors. It serves as a large resource hub.

Portfolio:Oasys,0xScope,Shield protocol,Rct AI、Galxe,Ethsign,Cyberconnect,RSS3,NFTGo,Showme,Orbiter Fiance…

Website:https://t.co/LwzUxo2xOY

Twitter:https://twitter.com/BonfireUnion

Y2Z ventures

y2z Ventures (formerly known as MetaVerse Capital) was established in 2021 as a long-term venture capital fund focused on Metaverse and Web3. Its brand positioning is "From yesterday to Gen Z," dedicated to supporting young individuals and startups who aspire to build metaverse infrastructure, create metaverse content, and spread Eastern culture.

y2z Ventures has provided assistance to numerous early-stage Web3 entrepreneurs during challenging times, earning recognition and respect within the Chinese community, particularly among young entrepreneurs.

Portfolio:RSS3,Mask Network,Delysium,Blocto,Matrix world,degame,Cedar,Orbitor Finance,PANONY,ChainFeeds,SeeDAO,NFTScan,Ethsign,rct AI,Mexo...

Website:https://t.co/4xLaVIMhwA

Twitter:https://twitter.com/y2z_Ventures

Zonff Partners

Zonff Partners, founded in 2016, is a venture capital that invests in technology companies from seed to late stages. In addition to the cryptocurrency field, its investment interests also cover cutting-edge technologies, biotech/healthcare, and consumer sectors.

One of Zonff Partners' primary focuses is on early-stage startups that create value for the decentralized economy. It has completed diverse asset allocations across blockchain ecosystems, including quantitative hedge funds, computing power funds, and NFT art funds (such as VulcanDAO).

Portfolio:IoTeX,Polkadot,Conflux,Certik,Algorand,Celer Network,IOST,Mask Network,Delysium,Solv Protocol,DODO,Zilliqa,Orbitor Finance,Crema Finance...

Website:http://www.zonff.partners/

Twitter:https://twitter.com/ZonffPartners

CatcherVC

CatcherVC is a cryptocurrency investment fund initiated by the core team of ChainCatcher, a Chinese-language crypto media platform. It seeks to explore innovative projects in the blockchain world through a research-driven approach and share its resources and insights with all stakeholders to provide genuine and lasting value.

Portfolio:Scroll,Metis,Orbitor Finance,Dmail,Alex,Blocto,GuildFi,Solv Protocol,PlatON,Bloktopia...

Website:https://www.catchervc.com/

Twitter:https://twitter.com/CatcherVC

Waterdrip Capital

Waterdrip Capital takes its name from the powerful weapon "Waterdrip" in the famous science fiction novel "SanTi." It was founded in 2017 by OGs in the Chinese crypto industry, and its co-founder, JuXie, is the individual responsible for the Chinese naming of Ethereum. Waterdrip Capital aims to make targeted investments in the most promising blockchain startups and empower them with diverse resources.

Portfolio:Scroll,Metis,Blocto,Desmo,Moonbeam,Footprint Analytics,Dora Factory,SubDAO...

Website:http://waterdrip.io/

Twitter:https://twitter.com/waterdripfund

ArkStream Capital

ArkStream is a crypto-native fund dedicated to accelerating Web3.0 unicorns. It has provided early support to numerous prominent projects such as AAVE, Polkadot, FLOW, and more. Its predecessor was a crypto marketing agency called BlockArk, which brought many projects into the Chinese-speaking region.

Portfolio:Secret Network,REALY,Particle Network,Blocto,Anima,Ankr,Oasis Nework,DAOSquare...

Website:https://arkstream.capital/

Twitter:https://twitter.com/ark_stream

Red Building Capital

Red Building Capital is the first venture capital firm in Taiwan specializing in integrating blockchain technology and digital technology. It operates as a Venture Studio, providing empowering venture capital by not only investing capital but also actively assisting the growth of startups in their business. It has an overall incubation-style approach. Red Building Capital takes its name from Taipei Municipal Jianguo High School, symbolizing the Red Building.

Portfolio:Klaytn,InsurAce,Dappio,Blocto,YIN,Reef Finance,Parsiq,Kyoko...

Website:https://www.rbcap.io/

Twitter:https://twitter.com/RedBuildingCap

Matrixport Ventures

Matrixport Ventures is the risk investment division of Matrixport, the largest cryptocurrency financial services platform in Asia. The co-founders of Matrixport include Wu Jihan, former CEO of Bitmain, and Ge Yuesheng, former director of Bitmain.

Portfolio:LayerZero,Galxe,Bitget Wallet,Orbitor Finance,GammaX,Ethos,MarsBit News,Ethsign,Sentiment...

Website:https://www.matrixport.ventures/

Youbi Capital

Youbi Capital was co-founded by seasoned Wall Street investment experts, Bitcoin mining pool owners, and cryptocurrency investors.

Portfolio:Avalanche,Yeild Guild Games,Octopus Network,Algorand,NFTGo,iZUMi Finance,Pendle,RSS3,Mask Network,Debank,platON,Footprint Analytics,DAOSquare...

Website:https://www.youbicapital.com/

Twitter:https://twitter.com/youbicapital

Spark Digital Capital

Spark Digital Capital was established in 2018 as a research-focused cryptocurrency fund, investing in the future of blockchain and technology.

Portfolio:Certik,STEPN,The Graph,1inch Network,Octopus Network,MultiversX,Celer Nework,Hashflow,Dmail...

Website:https://sparkdigitalcapital.com/

Twitter:https://twitter.com/capital_spark

C² Ventures

C² Ventures is an early-stage Web3 investment company, with Ciara Sun, a former executive at Huobi, as its founding partner.

Portfolio:Galxe,CyberConnect,Ancient8,AlienSwap,Blast Royale,Orderly,Pocket Protocol,Ramper,Tanssi Network...

Website:https://www.csquared.vc/

Twitter:https://twitter.com/CsquaredVC

In addition to the aforementioned cryptocurrency VC, the Chinese market also has numerous high-net-worth angel investors with significant influence. For example, Liang Xinjun, the co-founder of Fosun Group, frequently appears in financing news of various projects and has invested in 0xScope, Smart Token Labs, and others. Liu Feng, the former editor-in-chief of ChainNews, has his fund called BODL, which has invested in Smart Token Labs, Keystone, and more. Wang Yiming, the founder of JDI Global, has established Wang Ventures. Dovey Wan, the former managing director of DHVC, is an angel investor in many star projects such as GMX. Blake, a former partner at LD Capital, actively participates in early-stage investments as an angel investor. DaiDai, the founder of Dodo, has also launched Puzzle Ventures and invested in projects like Aurora and GoPlus.

In view of various constraints such as policy frameworks, LPs, fund size (too large to make efficient investments), and decision-making mechanisms, many traditional USD funds tend to exhibit opportunistic tendencies in Web3 investments. The failure of several high-profile unicorns in the crypto world, coupled with concerns among traditional investment institutions, has led many investors who once wanted to go "all in" on crypto to shift their focus to AI.

However, we still see many traditional USD funds actively participating in the primary market of cryptocurrencies, and some have even become key investors in highly valued projects.

Currently, active or seemingly active traditional funds in the crypto primary market include Sequoia Capital China, XVC, Sky9 Capital, BAI Capital, BlueRun Ventures, Atlas Capital, Sequoia China, IDG Capital, Matrix Partners China, SIG, GGV Capital, ZhenFund, Tencent Investment, and other investment departments of internet companies. In addition to direct investments in projects, many traditional USD funds also act as limited partners (LPs) in numerous Crypto Funds.

During a bear market in the crypto industry, Crypto Funds tend to be more cautious in their investments and may not be able to invest large amounts in highly valued projects. As a result, traditional USD funds with large fund sizes become the only fundraising options for many high-valued projects. For example, in the Layer2 scaling projects Scroll and Taiko's latest funding rounds, the core investors were traditional institutions, with individual investments totaling millions or even tens of millions of dollars.

In terms of portfolio performance, one of the best-performing traditional USD funds is IDG Capital. They participated in the seed round investment of Coinbase in 2012, invested in Ripple in 2013, Circle in 2015, Bitmain in 2017, KuCoin and imToken in 2018, and Matrixport in 2019. Currently, they have more joint investments with Circle and KuCoin.

As the crypto primary market continues to experience a downturn and attention and capital shift toward AI, let's appreciate those traditional USD fund investors who are still actively exploring and investing in Web3 projects.

Based on our actual communication experience, in the past two years, due to market policies, many overseas projects have deliberately avoided the Chinese market. Even projects that have the intention to expand into the Chinese market, would approach it with caution or try to avoid official participation. However, starting this year, the attitudes of many project teams towards the Chinese market have undergone significant changes.

Even from a policy perspective, if they choose not to target the mainland China market, the Chinese market outside the mainland, such as Hong Kong SAR, Taiwan, Singapore, Malaysia, North America, Europe, and other regions, still represents a strong purchasing power. It also benefits from the engineering dividend of the Chinese community and has a large number of developers, making it a target that many Layer1 ecosystems must attract.

A direct example is that the considerations of project teams towards the Chinese market have changed from "whether or not to target the Chinese market" to "how to do well in the Chinese market." As the main group in the Asia-Pacific market, the Chinese market has a large user base and rich projects and communities. It is crucial to collaborate with reputable partners. Therefore, if you want to succeed in localization, it is particularly important to recruit team members who are familiar with the local market and culture.

In terms of focus, Chinese users have similar interests to the international market. However, in general perception, Chinese generally do not prefer projects with purely Chinese teams due to the prevalence of rug projects (similar phenomena can also be found in some overseas communities) and the lack of top-tier star projects that bring wealth effects. However, recently, with the rise of the "Chinese narrative" and the outstanding performance of some Chinese projects, this perception has started to change.

In general, Chinese users tend to pay more attention to a project based on the following characteristics:

Potential airdrops: When describing your marketing activities, you can mention potential airdrops in your messaging or incorporate them into certain aspects of your project. This will attract more users or influencers who are willing to share your project.

Non-pure Chinese project: Highlight the international background and past success stories of your project. Emphasize the global nature of your project to appeal to Chinese users.

Endorsement from major institutions: Partnerships with reputable VCs and high-quality project teams, Marketing makers, and other entities can boost the credibility of your project. If you have received significant funding, it is advisable to showcase it as it can attract more participation.

Operational capabilities: Chinese users are interested in the project's operational capabilities, such as market manipulation and the identities of key players. While these concerns may seem grounded, they reflect the users' emphasis on the practical aspects of a project in addition to its fundamentals.

However, recently, some projects endorsed by major institutions have experienced theft or questionable operations, leading to a slight decline in the brand effect of these institutions. Additionally, influencers (Influencers) play an important role in the Chinese market. Many Chinese Influencers have shifted their focus to Twitter due to its influence, while channels like Weibo and WeChat have become more sensitive. When marketing on Twitter, consider the following:

Quality of followers is more important than quantity: Twitter is a channel where content can easily be spread. As a brand, provide high-quality content to influential Influencers who specialize in your brand's field. Focus on quality coverage among the followers before achieving brand exposure.

Allow room for Influencers to showcase their creativity: Avoid providing Influencers with identical content. Some projects have extensively used Influencers to spread nearly identical content, resulting in user backlash. In traditional PR strategies, there is a term called "disassembling drafts," which means presenting the same content from different angles. This strategy can also be applied to Twitter. Additionally, keep in mind that high-quality Influencers have their own styles and value their reputation. Brands should provide customized and distinctive content tailored to important Influencers.

Use Twitter as part of an integrated strategy, not the sole channel: Due to Twitter's social attributes, its primary value lies in content dissemination and interpretation. Brands should first establish substantial content and then utilize Twitter for secondary dissemination. Pay attention to timing and the pace of communication.

These are just some examples, and the actual execution should be tailored to the specific characteristics of your project. For brands entering the Chinese market, leveraging media coverage and participating in relevant events can also help attract attention.

You can consider collaborating with projects that have a Chinese background for joint activities. This will help you understand the Chinese community atmosphere, and connect with and select the first batch of Chinese users. Afterward, you can expand your presence through news channels and increase your influence. Once you have the initial wave of Chinese users, engage in more communication with them and listen to their feedback and suggestions about the project itself.

Later, it is advisable to provide more in-depth and comprehensive introductions and coverage to form a well-rounded Chinese content base. When a new user wants to learn about your project, having an officially recognized and comprehensive content presentation will facilitate faster and better onboarding of new users. The content should be comprehensive and popular rather than fragmented. In fact, much of the Chinese content comes from overseas translations, often leading to inaccuracies or incomplete information.

The specific methods to use depend on your specific communication plan and content. Regardless of the channel used, the content needs to be adapted to the local language and culture to better capture users' interest, such as incorporating local language or memes to enhance the spread.

For the Taiwanese market, we have invited a local user who has over ten years of market experience and works in exchange to share the situation of the local market. The key points include:

Stable growth is preferred by most stable users over speculative gains, e.g., lending, and dollar-cost averaging.

Building trust with users requires effort and local brand representatives lead the community.

Taiwanese people enjoy gambling, but they tend to be conservative and aim for big wins with small bets, e.g., IEO, and Launchpad.

Managing the community in Taiwan emphasizes consistent high-quality content, e.g., TechFlow.

In the Taiwanese market, Influencers have a high level of trust. Therefore, when launching a Web3 project, leveraging the power of Influencers can enhance user trust. For example, when FTX entered the Taiwanese market, they introduced community partners who were real people, dining with users, hosting gatherings, conducting live streams, and engaging in actual trading operations on-site. They shared their successful or failed experiences, demonstrating real market resilience and strengthening user trust.

Tips for collaborating with Influencers:

Efficient collaboration: Ensure that the promotional materials and visuals created for the Influencer align with their style, as this will enhance collaboration efficiency. It is recommended to use ChatGPT, as it may be even smarter in this aspect than human brains.

Collaboration quality: Ask the Influencer directly for areas of improvement and provide regular feedback on progress to enhance the quality of collaboration.

Relationship maintenance: When giving gifts, show thoughtfulness by selecting presents suitable for important individuals in the Influencer's life. This will make them feel special. If the gift for the influencers themselves is a trendy product that everyone has, it can be acknowledged by the influencer in their posts as a token of gratitude for the gift.

Even if Taiwanese users haven't fully entered the market, they have heard about cryptocurrencies such as Bitcoin, Ethereum, Tether, and even more directly, NFTs and the metaverse. To address users' concerns, avoid discussing underlying technical issues with them and instead make comparisons using things they are familiar with. For example, the annual interest rate for USD savings accounts in Taiwanese banks is around 1%, while the USDT earns APR on exchanges is over 3%. If money is deposited in a bank, it could be lost if the bank goes bankrupt. However, by using a blockchain's decentralized ledger, everyone records how much money they have, making your assets more secure.

According to Meta's 2023 data, the social media usage rate among Taiwanese individuals aged 18 and above has reached 95.4%, with an average daily time spent on social media of 2 hours and 6 minutes. The channel characteristics of Taiwanese users are particularly prominent, and effectively managing communities is crucial, although it requires time to build trust. The only advice for community management in the Taiwanese market is to "be an audience loyal to your own community." Taiwanese users are not particularly proactive in sharing news, so using engagement rate as a KPI may lead to disappointment (though it may be even more disappointing in Europe, hahaha). However, if the content released by the project is something that even you, as an audience, would eagerly anticipate and want to see, you won't have to worry about conversion rates.

The market is ever-changing, and being prepared for a product doesn't guarantee that the market is ready to embrace it. Hopefully, this content will help you better understand the Chinese market and formulate suitable market strategies.

The above is the full content of the Japanese market. "Web3 Truth in the Asia-Pacific Market" is a special report produced by TechFlow that focuses on insights into the current state of the cryptocurrency market, user profiles, and industry participants across various regions in the Asia-Pacific. We will continue to publish market research for multiple regions and consult experienced local professionals to provide comprehensive and truly informative research for the Web3 community.

If you have in-depth knowledge of the cryptocurrency market in your region and are interested in collaborating with TechFlow on this special report, please feel free to contact us via TechFlow's official Twitter account:https://twitter.com/TechFlow_Intern

Recommendation

Russia,Bitcoin

From Rubles to Bitcoins: Russias Pivot to Crypto in the Face of Sanctions

Oct 10, 2024 15:33

Understanding Solana Blink: One-Click On-Chain Operations Integrated with Social Media – Is Socialization the Endgame?

Jul 07, 2024 14:06

Exploring the Real Japanese Crypto Market: Coexistence of Isolation and Contradiction, Where are the Opportunities?

Jun 06, 2024 18:47