The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

While the secondary market may seem sluggish, big moves are happening in the primary market.

On June 11, the modular zkVM project Nexus announced it had raised $25 million in a Series A funding round. Leading the investment were top-tier VCs Pantera and LightSpeed, with additional backing from Dragonfly Capital, Faction Ventures, and Blockchain Builders Fund.

Crypto VCs are known for their love of infrastructure projects, so it's no shock to see heavy investments in zero-knowledge proof (zk) technology.

But investing in a project led by a fresh graduate? That's a bit surprising.

In Pantera's open letter, "Why We Invested in Nexus", they explain that Nexus's biggest advantage is its team, made up of experts in cryptography and computer science.

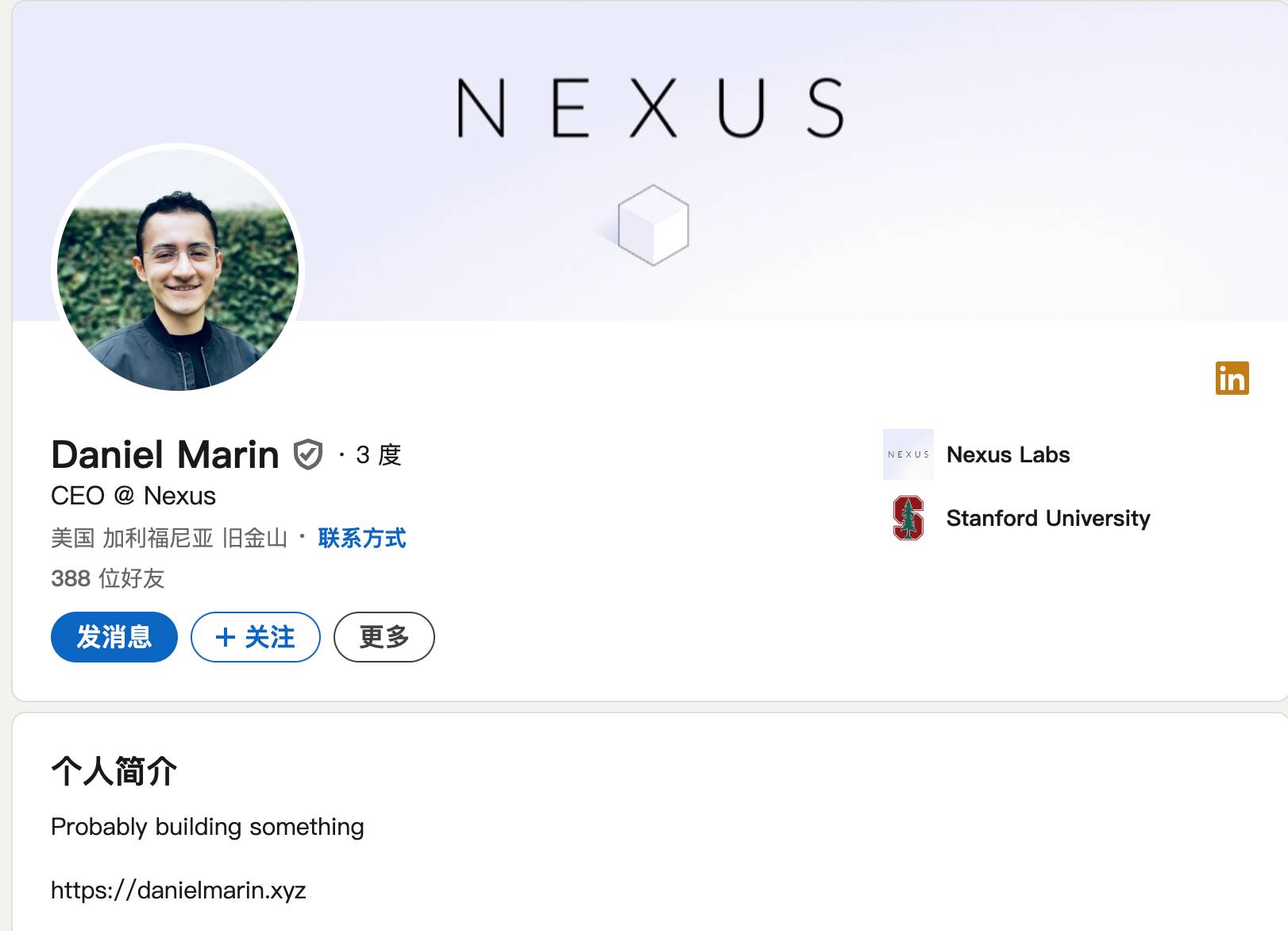

The CEO, Daniel Marin, just graduated from Stanford.

Is the Western VC world also captivated by the prestige of elite universities?

Compared to the challenging job market and the dismissive attitude toward advanced degrees in some regions, a recent grad securing $25 million in startup funding seems almost too good to be true.

So, what makes Nexus so attractive to these VCs? What special qualities does this graduate-led team have?

Before diving into the team, let's understand what the project is about.

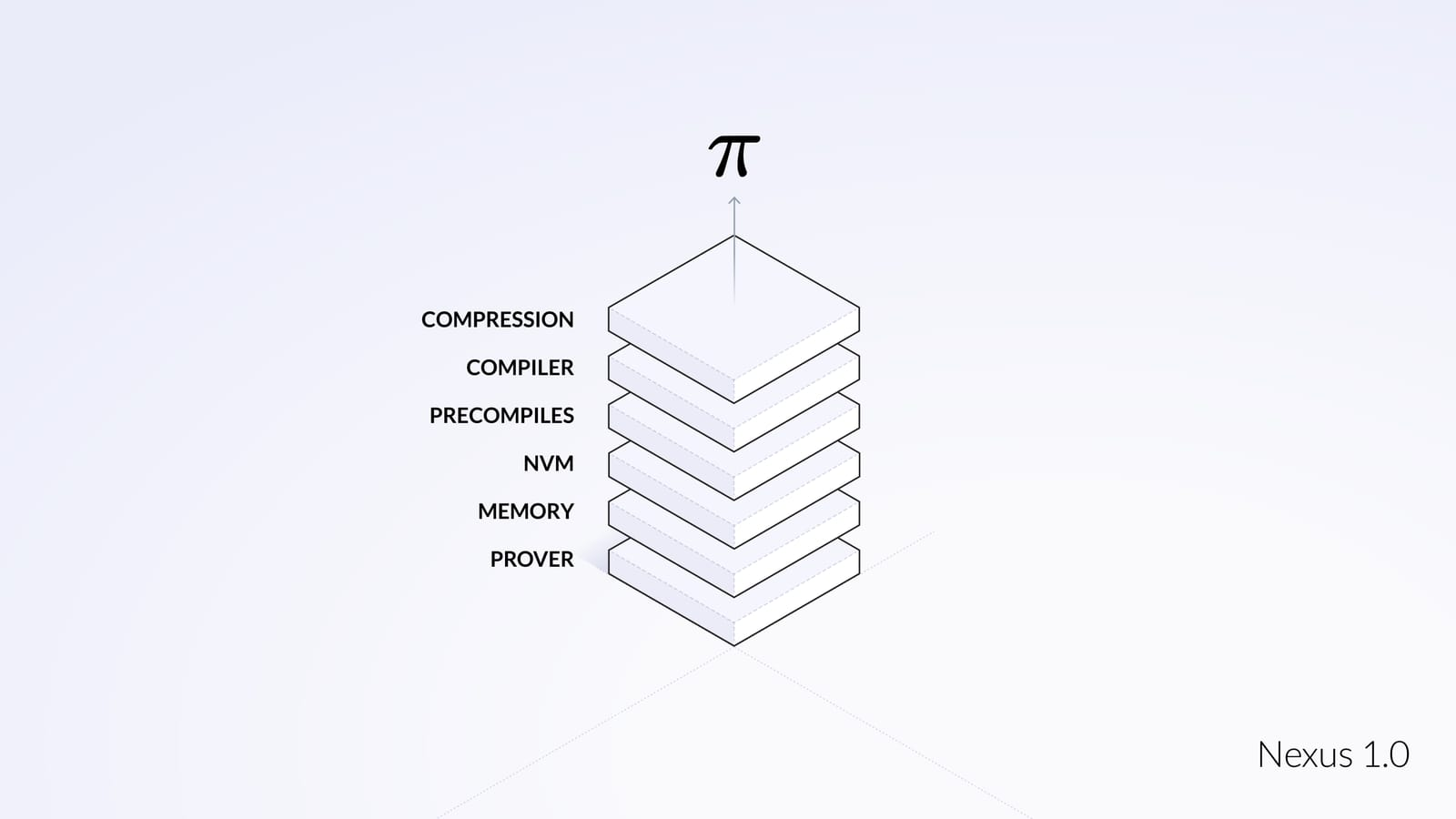

According to Nexus's official Twitter, Nexus is currently in its 1.0 phase. It's a modular, scalable, open-source zkVM written in Rust, focusing on high performance and security.

But what exactly is a zkVM?

In the blockchain and Web3 world, a virtual machine (VM) is essential. It runs smart contracts on the blockchain, managing transactions and protocols without third-party intervention, like the well-known EVM (Ethereum Virtual Machine).

Adding zk (zero-knowledge) technology brings several benefits:

Privacy Protection: On public blockchains, all data is visible. zk helps protect user privacy by keeping transaction details hidden.

Increased Efficiency: zk reduces the computational resources needed to verify transactions and execute smart contracts because verifiers only need to check the proof, not redo the entire computation.

Enhanced Security: zk ensures the authenticity and integrity of data on the blockchain without revealing the specific data content.

Nexus's zkVM delivers these three key optimizations, allowing you to prove that a transaction or operation is valid without revealing its specific details.

Moreover, Nexus's zkVM is like a versatile translator, capable of understanding and running programs written in various programming languages, like Rust, C++, and more. Developers can write smart contracts in their favorite language and run them on the zkVM.

Think of the Nexus zkVM as a Lego set, where you can modularly add special function modules to speed up specific computational tasks or extend new computational capabilities.

With privacy protection, security, efficiency, and modularity, the appeal of zkVM is clear.

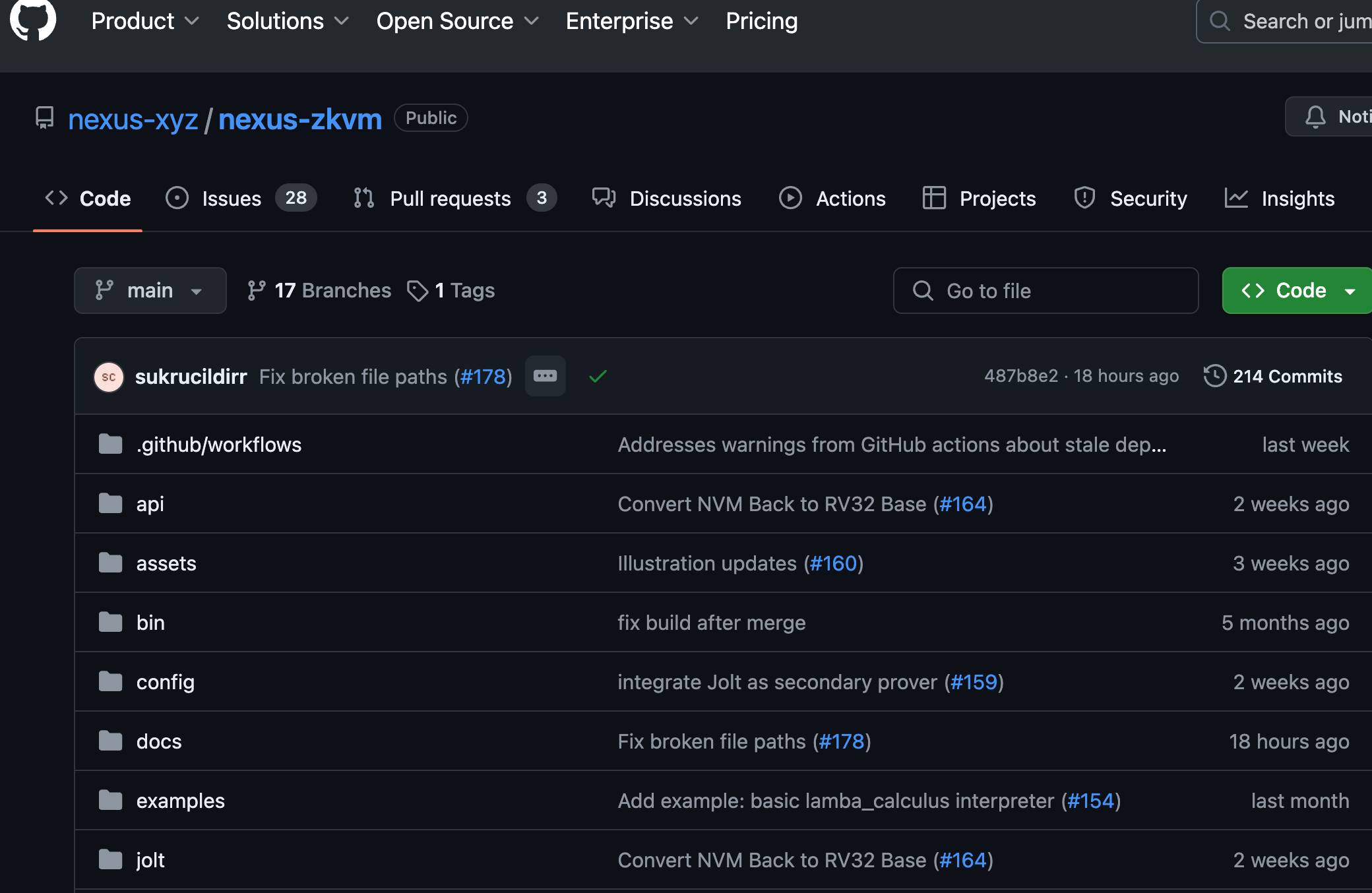

Currently, some parts of Nexus 1.0's code are open-sourced on GitHub, demonstrating the project's confidence and technical prowess.

Clearly, this is another foundational project.

With so many VMs out there, effectively incorporating zk technology requires serious technical chops.

That's why a highly skilled, specialized team is essential.

Nexus's CEO is a young newcomer.

Pantera described Daniel Marin as a "recent Stanford graduate," highlighting his fresh entry into the professional world.

However, this "newbie" clearly has the smarts and academic prowess to back up his role.

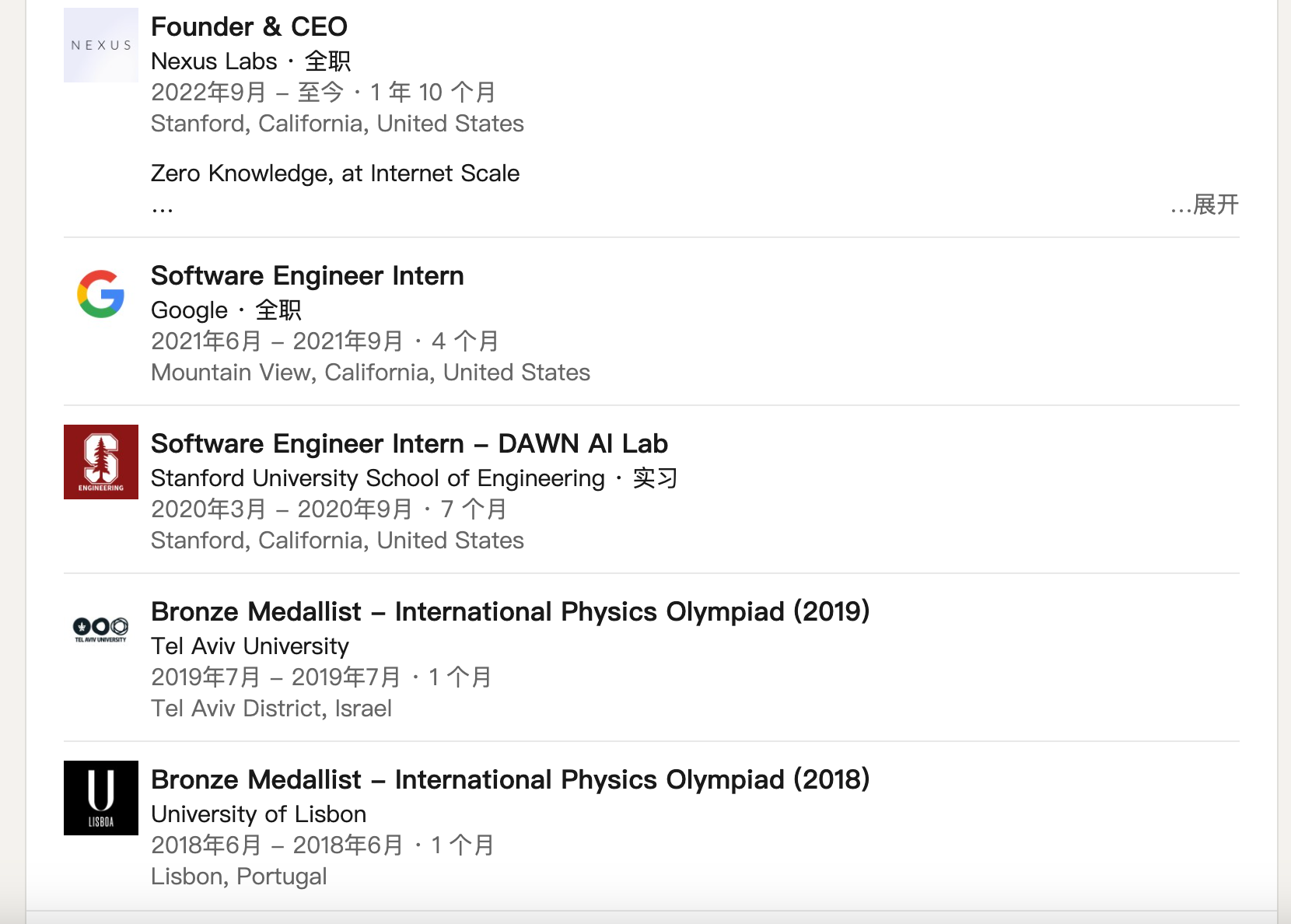

Daniel’s LinkedIn profile includes a couple of accolades that only a recent grad would list, but they are impressive:

He won bronze twice in the International Physics Olympiad.

Afterward, Daniel studied at Stanford University’s School of Software Engineering, interned at Stanford’s AI Lab and Google as a software engineer, and then went straight on to become the CEO of Nexus.

In addition to his impressive awards and roles, a look at Daniel's GitHub shows he's been consistently contributing code from 2020 to 2024. Clearly, a CEO who knows how to code makes for a great programmer.

From the available information, it's clear that this CEO is highly skilled with a strong technical background.

He’s a typical STEM prodigy, but leading a Web3 project as a CEO can be a lot for one person.

That’s why Nexus has an expert team to back him up.

After introducing Daniel, Pantera highlighted that he is advised by the renowned cryptographer Dan Boneh.

Dan is a big name in the industry, currently a computer science professor at Stanford University. His research focuses on cryptography, computer security, and distributed systems. In 2016, Boneh was elected to the National Academy of Engineering for his significant contributions to cryptography and computer security.

He has also made significant contributions to elliptic curve cryptography and other well-known blockchain technologies, and is a key figure in the development of pairing-based cryptography.

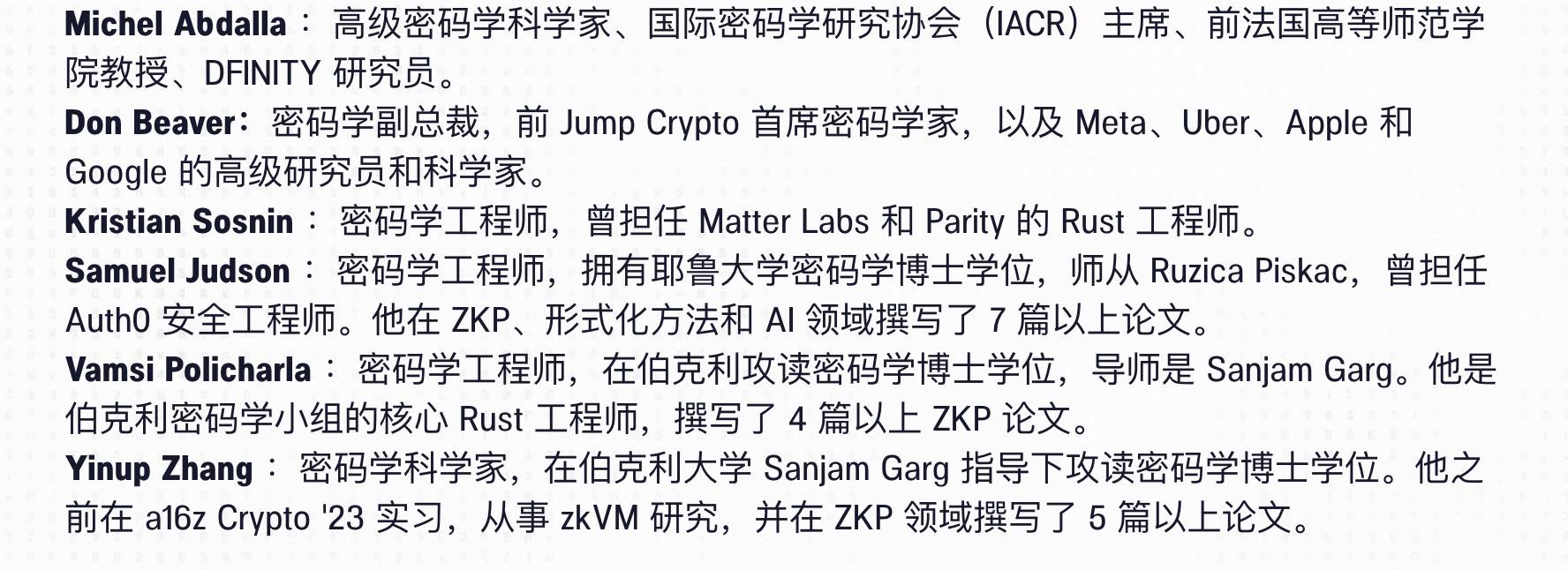

Beyond Dan Boneh, Nexus's core team is composed of highly specialized cryptographers with extensive experience in the Web3 industry. Their resumes include stints at Difinity, Jump Crypto, Matter Labs, and the a16z Crypto Startup School:

With a solid professional team, guidance from a leading cryptography expert, and a talented recent graduate at the helm, Nexus seamlessly blends academic research with industry practice to tackle zk-related Web3 projects.

When it comes to investing, it’s all about the people.

Looking at Nexus, it's clear that VCs like Pantera prefer teams with specialized expertise.

A cryptography student, a top-tier professor, and an experienced execution team—under this setup, having a recent graduate as CEO doesn’t seem so surprising. Young leaders supported by seasoned experts can create a powerful dynamic.

Regardless of structure, the team’s credentials and work demonstrate their professionalism.

For niche infrastructure projects, VCs tend to favor those with a solid academic background, trusting in the potential and experience of these cryptography specialists. This aligns with the logic of "let professionals handle the technical work".

On the other hand, there's the strategy of building resource hubs.

This approach often involves rebranding narratives and reuniting former team members, leveraging industry connections and information gaps. It’s common in fast-paced, high-hype projects that make a lot of noise but deliver little substance.

These projects focus more on asset creation and resource swapping, with less emphasis on hardcore technology.

So, is it better to invest in specialists or resource hubs? Crypto VCs are placing their bets on both strategies.

For an industry driven by wealth effects, speed and excitement capture attention. However, for the industry's long-term sustainability, a slow and steady approach is the better remedy.

Recommendation

Unpacking the MegaETH Whitepaper: The Non-Stop Infrastructure—What Makes This Vitalik-Supported, Massively Funded L1 Stand Out?

Jul 07, 2024 14:30

JOJO Exchange: DODO founder creating the future of perpdex on BASE

Jun 06, 2024 21:37

Initia

Initia: Connecting All Rollups to Build a Layer 1+ Layer 2 Multi-Chain Interconnected World

Nov 11, 2024 15:24