The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Memes, valueless or valuable? This question is a perennial hot topic.

Love them or hate them. Everyone's a fan when meme coins skyrocket.

In the world of crypto, where anything can turn into a meme, any joke or event can potentially spin into a wealth creation machine, drawing in throngs of dreamers willing to stake it all on a small meme.

Here’s a little-known fact:

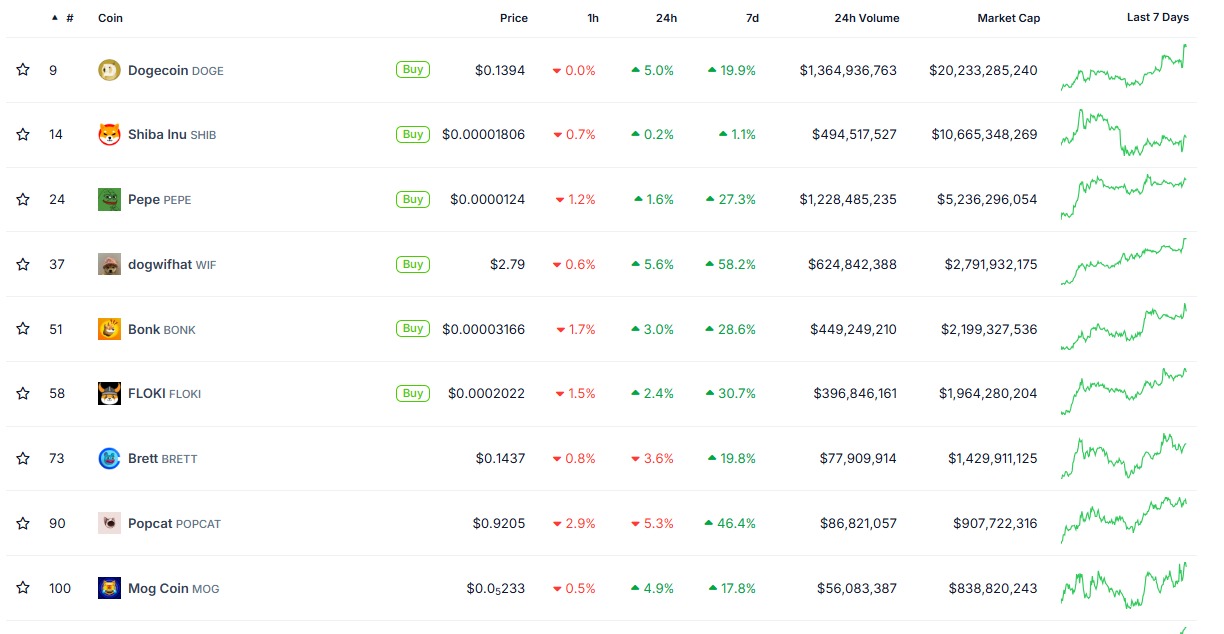

Among the top 100 cryptocurrencies by market cap, there are now 9 meme coins.

From Dogecoin to Shiba Inu, from Frog to Nyan Cat—these animal and character coins are making their way to the center stage of the crypto universe.

In the recent market rally, if you look at the top 500 by market cap and their performance, you'll notice that meme coins are among those with the sharpest increases.

Originating from grassroots movements, these coins are strong in market surges and skilled in spreading buzz, yet they're tangled with risks.

Meme coins blend enchanting and dangerous traits, resembling the legendary 108 heroes of Mount Liang—once seated, they're heroes, regardless of whether they were humble craftsmen or notorious outlaws before. In a world ruled by outcomes, the backstory often matters less.

More important than debating "which coins hold true value" is the ability to adapt to change.

In this crypto cycle, the "barbell strategy" is gaining traction.

This approach involves balancing your portfolio with stable, high-value tokens like Bitcoin, Ethereum, and potentially Solana on one end, and various volatile meme coins on the other.

This strategy secures a safety net on one end while gambling for high returns on the other, combining long-term holds with rapid trading moves.

Regarding the VC coins and so-called value coins in the middle of the barbell, investors are reducing their holdings or even phasing them out entirely.

This pragmatic shift reflects a response to current market dynamics, influenced by a materialist philosophy suggesting that material conditions shape consciousness.

The barbell strategy garners increasing consensus on the significance of both ends.

Infrastructure, applications, and narratives all carry value, but none as much as attention.

The left side of the barbell symbolizes long-lasting attention, while the right captures ephemeral attention. Cryptocurrency investing is essentially about investing in attention; capturing its pulse provides liquidity and sets the stage for potential price spikes or drops.

Consider this perspective, and it becomes clear that astute institutional investors think similarly.

Since last December, the Stratos hedge fund, backed by a16z, has been managing a liquidity fund invested in WIF tokens. Initially priced at $0.01, Stratos has secured a 300-fold return on this investment.

Interestingly, top VC firm Pantera has openly admitted to holding meme coins. Partner Paul Veradittakit wrote an article describing memes as "Trojan horses disguised as toys," suggesting that memes have the potential to attract more people to cryptocurrency.

While you might be concerned about VC coins with high FDV and low liquidity being used for price manipulation, the VCs themselves are also engaging with memes on one side of the barbell strategy.

In the crypto world, attention is as valuable as any asset, a fact that all participants must recognize.

Memes are born from grassroots efforts and are adept at spreading widely. Project developers have taken note of these traits.

Consequently, you'll see more and more projects embracing memes from their inception to operation, attempting to use relatable expressions to connect with the crypto community more effectively.

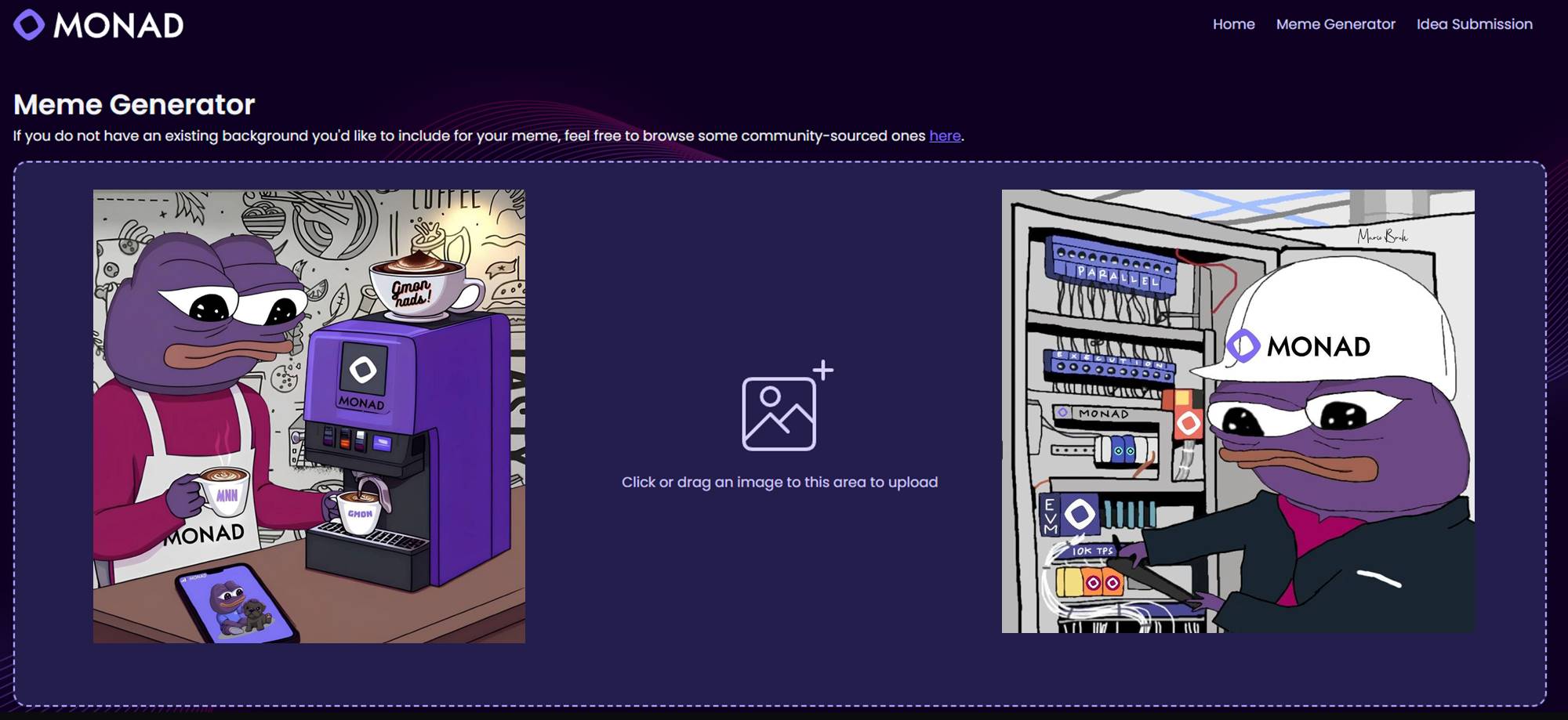

For example, the eagerly anticipated project Monad, which leverages narratives around parallel EVMs, even features a "Meme Generator" on its official website to enable the community to create memes centered on Monad.

Moreover, promotional posts and articles about Monad often include an image of a sad frog, aligning with Monad's purple logo, which has become synonymous with the project.

Similarly, Berachain, which could be the meme-iest of Layer 1s, positioned itself as a lovable bear right from the start. Naturally, the nickname "Bearchain" caught on.

In its more detailed product designs, you can see how bear and honey themes play into its tokenomics and liquidity models.

This reflects the current crypto market environment where attention is scarce and memes have value in making projects more memorable and shareable.

When you look at how crypto projects market for attention, you'll notice that not much has really changed:

Earlier crypto projects loved to tout their technical prowess with terms like "million TPS," "directed acyclic graphs," "high concurrency," and "EVM compatibility." Investors and newcomers, though baffled, felt these were impressive because of their complexity.

As the crypto market has evolved, participants have begun to experience "jargon fatigue," where too many technical terms lose their novelty.

Instead, easily shareable memes like Pepe the Frog have become more appealing.

Whether it’s a marketing strategy or a trading tactic, embracing memes has become an irreversible trend.

Don’t get bogged down in discussions about whether memes have intrinsic value, wasting precious time on metaphysical navel-gazing.

Question memes, understand them, and then decide to either embrace them or steer clear—it’s really that simple.

Recommendation

Exploring Kontos: Simplicity Redefined, a Single Gateway to Seamless Blockchain Integration

Jul 07, 2024 14:32

Unpacking the MegaETH Whitepaper: The Non-Stop Infrastructure—What Makes This Vitalik-Supported, Massively Funded L1 Stand Out?

Jul 07, 2024 14:30

ZK on Solana? Exploring Light Protocols Introduction of ZK Compression

Jul 07, 2024 14:28