The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

The crypto market is never short on new concepts.

However, most new concepts are just minor innovations in old ideas. These small tweaks often spark new trends and hype.

Nothing illustrates this better than the methods of asset issuance.

From the ICO boom in 2017 to the later IEOs, and now the popular IDOs or LBPs (Liquidity Bootstrapping Pools). Each new wave of asset issuance brings a slew of new projects and fresh opportunities for degens to profit.

The format changes, but the core idea remains the same.

As we move into 2024 and AI becomes the "new darling" of crypto narratives, issuing assets around AI presents a new frontier for innovation.

For example, the recent emergence of the IMO or Initial Model Offering.

On March 2nd, an AI project called Ora Protocol introduced the concept of IMO on its social media, garnering significant attention.

The idea is simple: if everything can be tokenized, then AI models can be too, making them assets that can be issued and traded.

But putting the IMO concept into practice is not so straightforward.

For ICOs and their variations, the core process involves creating a token, defining its quantity, release conditions, purpose, and functionality, and then allowing it to develop a market price.

These tokens usually don't correspond to any real-world assets and can be created out of thin air, that is "minting a coin."

But IMO is different.

The key to IMO lies in the monetization of AI models.

Many open-source AI models struggle with monetizing their contributions, leading to a lack of motivation for contributors and organizations because they don't make money. This is why the AI industry today is mostly dominated by closed-source, profit-driven companies. For open-source AI models to thrive, they need more funding and public support.

The purpose of IMO is to provide a new way of issuing assets to help open-source AI models raise funds for their development.

Similar to previous IXO (Initial Exchange Offerings) methods, you invest in a token asset you believe in. The token’s market performance can bring you returns, and you might also share in the income generated by the protocol the token represents.

In the IMO scenario, if you believe in a particular AI model, you can invest in its corresponding token. The AI model provider raises funds for development, and as the model generates economic returns through its use, you might share in those profits.

To tokenize AI models and share their revenue, several key issues need to be addressed:

How to ensure that an AI model is legitimate and corresponds to the token you hold?

How to ensure that the revenue generated by the AI model's use is shared with token holders?

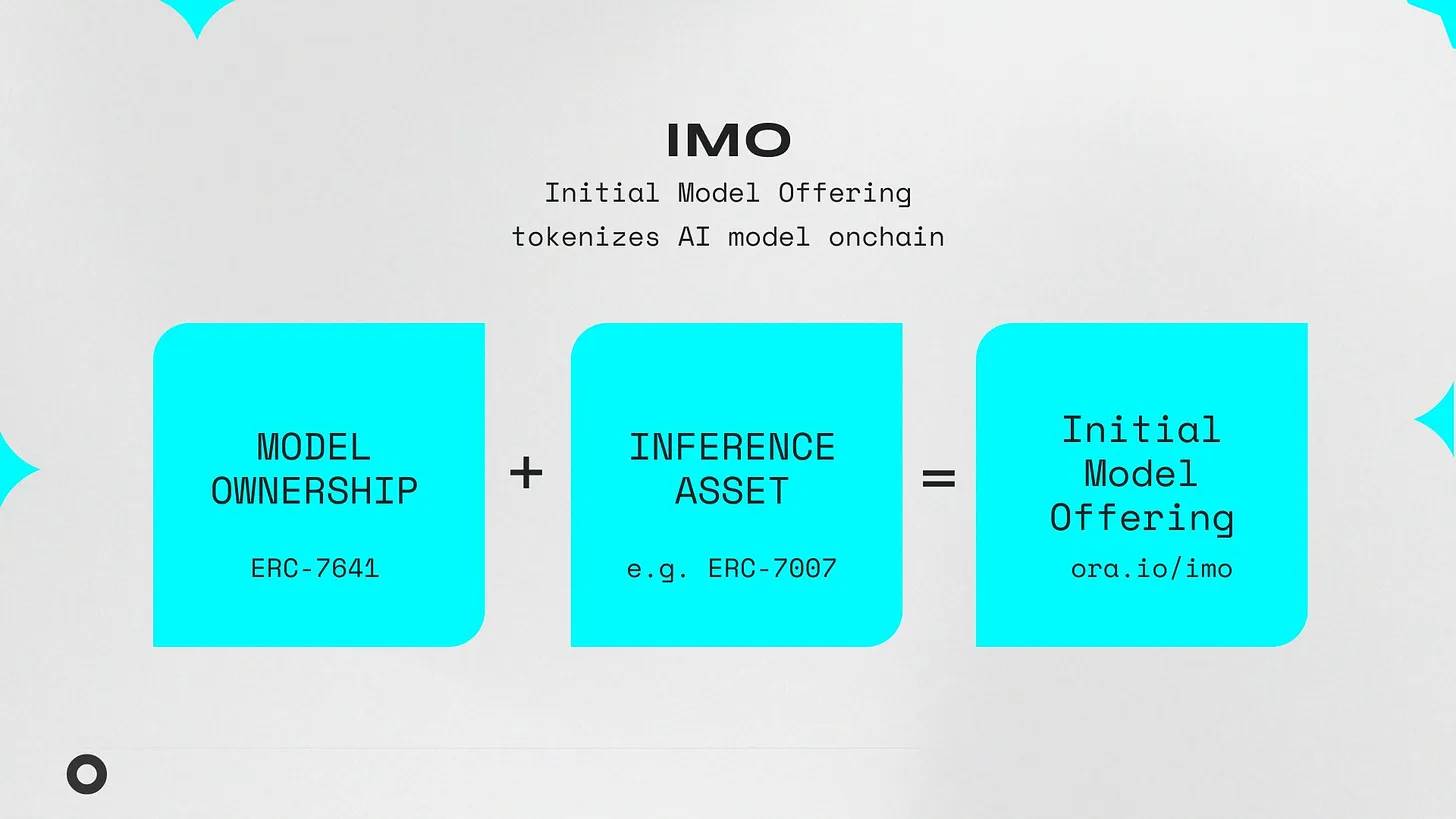

Ora Protocol tackles these issues using two different ERC standards, ERC-7641 and ERC-7007, combined with oracles and Zero-Knowledge (ZK) technology.

How do you guarantee that an AI model is real and not just a concept for a cash grab?

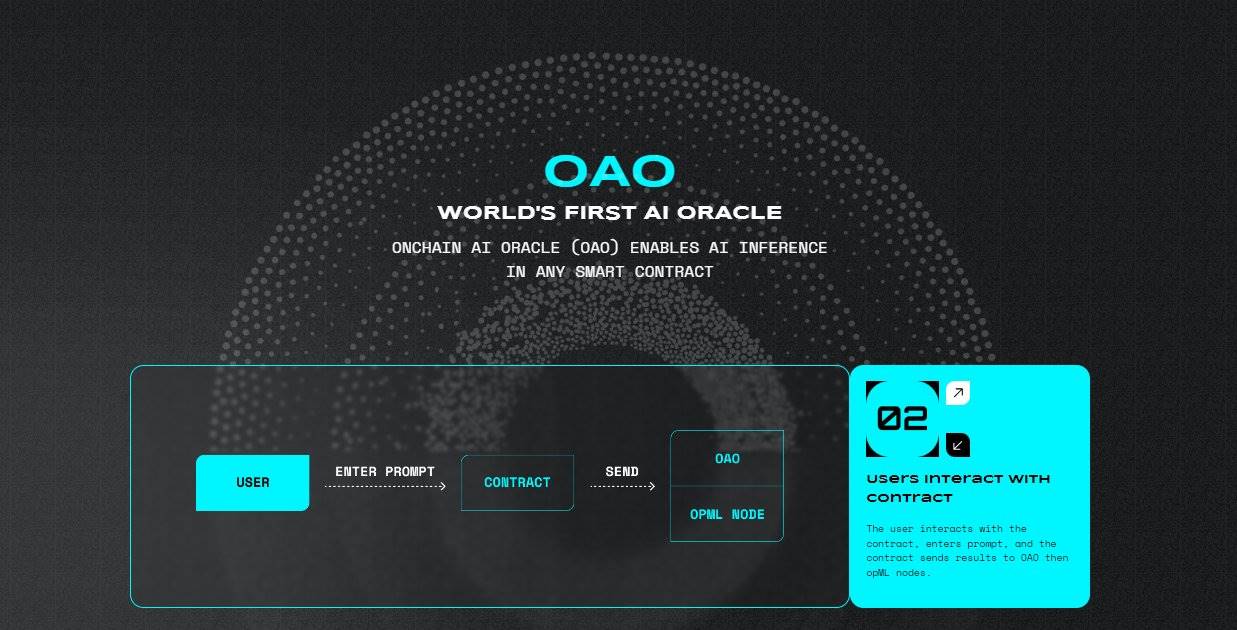

First, it's important to understand that Ora Protocol specializes in AI oracles, with its core product being the Onchain AI Oracle (OAO).

This oracle's function is to validate and execute AI models on the blockchain, ensuring that the deployment and operation of the AI models occur entirely on-chain. This process guarantees transparency and verifiability in the execution of AI models.

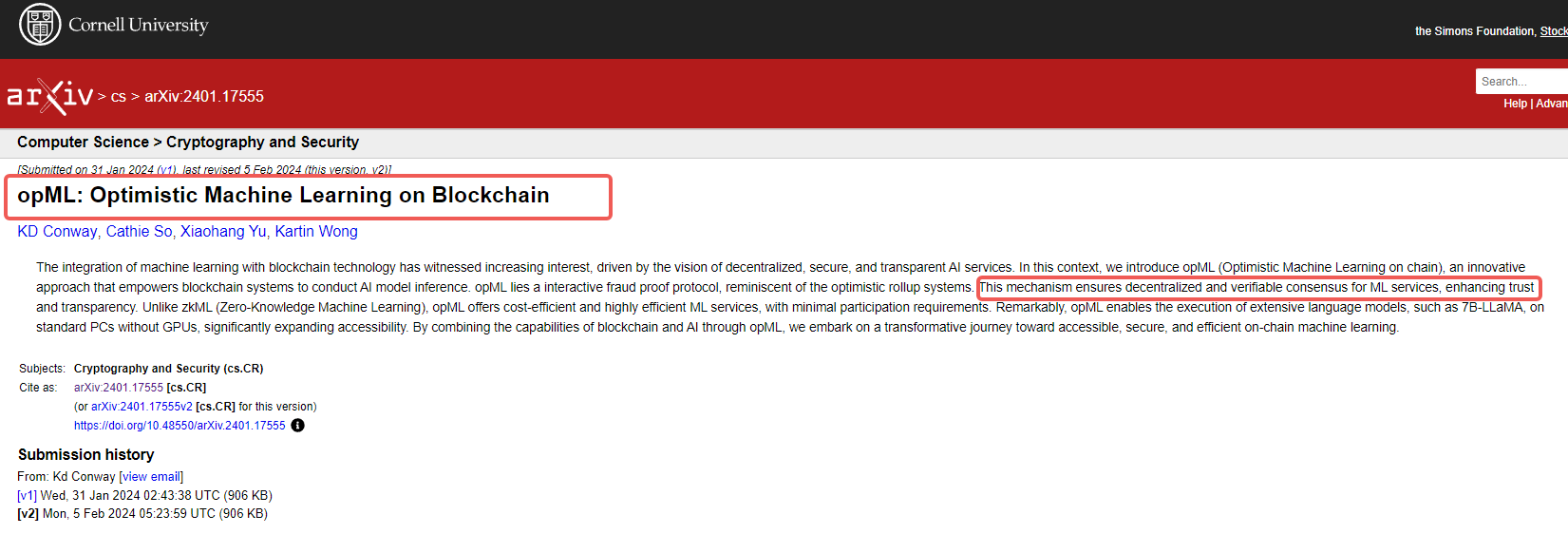

However, since AI models are often a core competitive advantage, revealing them completely would eliminate their commercial edge. Therefore, Ora Protocol also uses another technology called opML (Optimistic Machine Learning).

In simple terms, opML uses zero-knowledge proofs or other cryptographic methods to prove that the model's results are correct without disclosing the model's details. This ensures the model's authenticity and effectiveness while protecting its privacy and proprietary information.

The specific implementation of opML is backed by published papers, and while we can't evaluate the technical details, it's essential to understand the impact of the technology.

With AI oracles and zero-knowledge proofs, we've addressed the question of "how to prove an AI model truly exists."

The next challenge is ensuring that the token representing the AI model is genuinely yours and that you can share in its revenue.

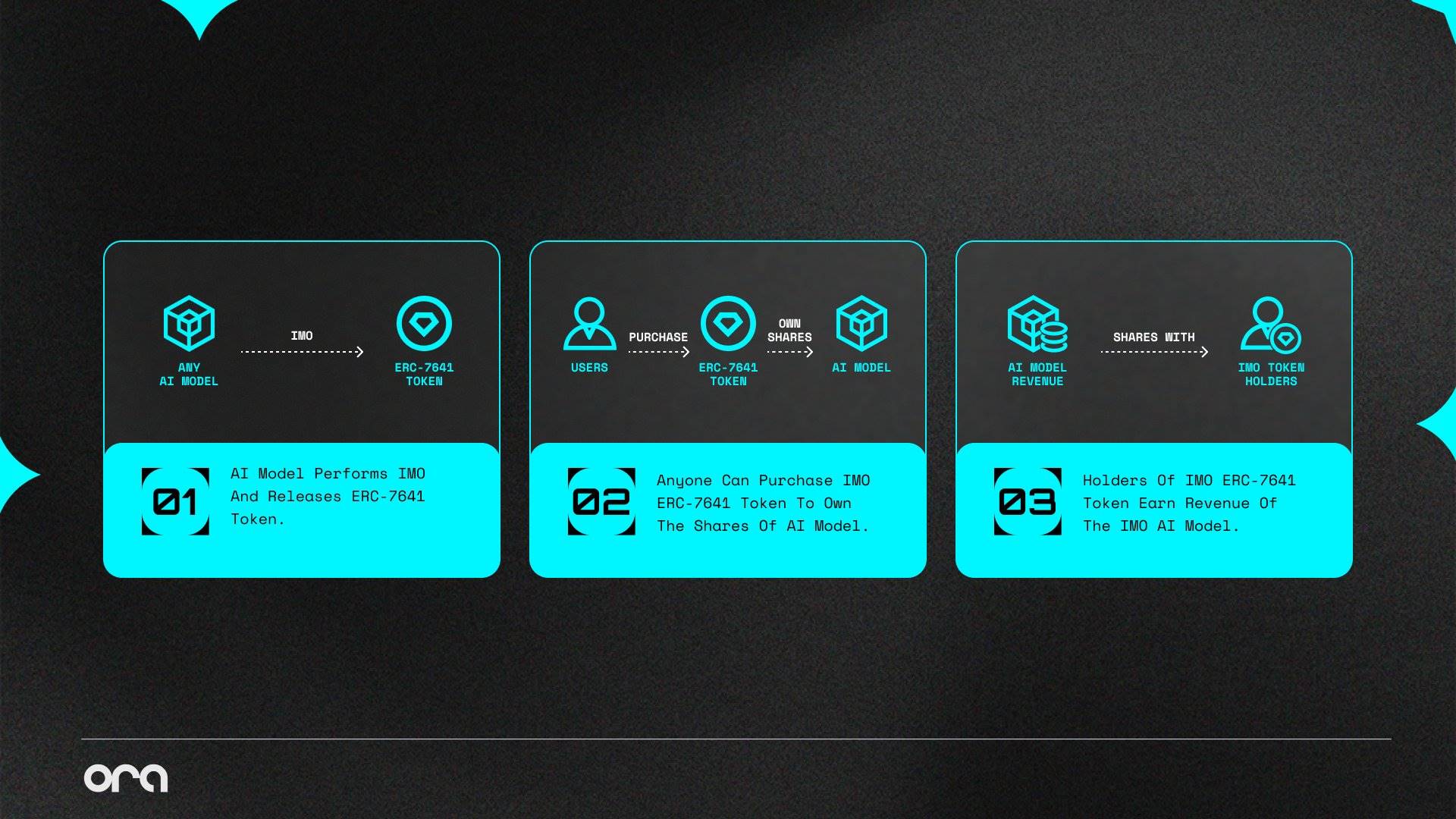

Tokenizing an AI model is key to IMO. Ora Protocol introduces a token standard called ERC-7641, which is compatible with ERC-20.

If an AI model developer thinks their model is valuable and wants to conduct an IMO in the crypto market, here's how they might go about it:

Link the AI model to an ERC-7641 asset, specifying the total number of tokens in the smart contract.

Investors in the crypto market buy these tokens, with the number of tokens they purchase representing their ownership share in the AI model, similar to shareholders.

Once the AI model runs on the blockchain, any revenue it generates, such as usage fees when the model is called or royalties from AI-generated NFT sales, can be distributed according to predefined rules in the ERC-7641 contract. Token holders automatically receive their share of the revenue based on the number of tokens they own.

Through this mechanism, ERC-7641 tokens become a bridge between AI models and their economic value, allowing contributors and investors in open-source AI models to share in the model's long-term benefits.

The ERC-7641 token, also known as the Intrinsic RevShare Token, is designed to distribute the revenue generated by AI models.

This token standard allows AI model developers to raise funds by linking their models to a token and conducting an IMO. Buyers purchase these tokens and, according to the smart contract rules, share in the subsequent revenue from the AI model’s use and generated content.

However, there's a crucial challenge:

How do you know that the AI-generated content, like NFTs, images, videos, etc., truly comes from the AI model that conducted the IMO and isn't fake?

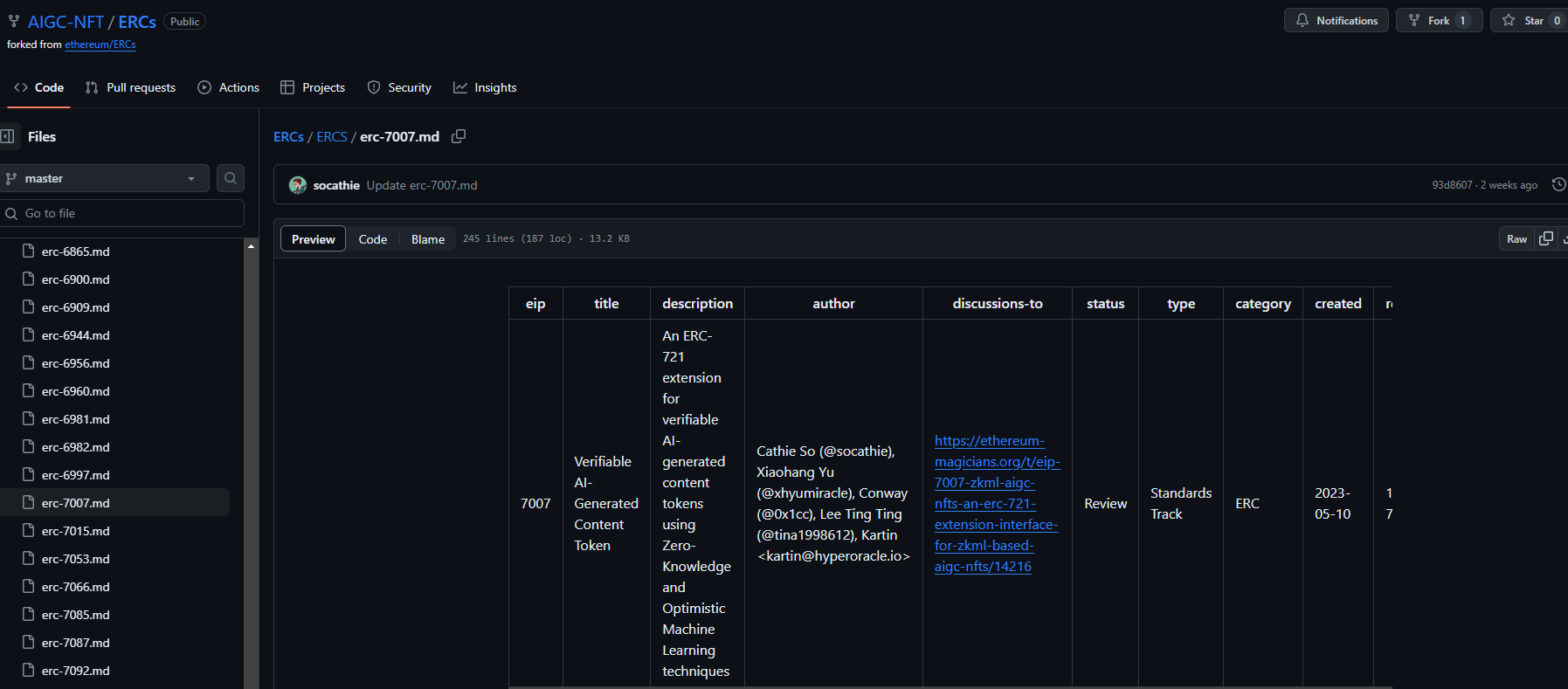

Ora Protocol addresses this by marking AI-generated content and using ERC-7007 to ensure authenticity.

ERC-7007 is a token standard designed to ensure the authenticity and traceability of AI-generated content.

It works by recording metadata of AI-generated content on the blockchain, such as the AI model used, generation time, and conditions. Smart contracts then automatically verify this information. Developers can use zkML or opML to verify that specific NFT data indeed comes from a particular machine learning model and specific inputs.

This increases the transparency of AI-generated content (AIGC) and ensures that once the data is recorded on the blockchain, it cannot be altered or forged. Therefore, in the ORA protocol, ERC-7007 is also known as the Verifiable AI-Generated Content Token.

The ERC-7641 standard is now open source and accessible. Click here to view it.

With this, we can fully grasp the logic of IMO:

Tokenize AI Models: Bind AI models to revenue-sharing tokens and conduct an IMO.

Investor Revenue Share: Investors buy these tokens and earn a share of the revenue from the AI model's use and generated content based on their token holdings.

Verify Content Authenticity: Use a token protocol that verifies the authenticity of AI-generated content to ensure it truly comes from the specified model and share the revenue accordingly.

From ICOs to IMOs, the tokenization of AI models is set to be a hot trend this year, tightly linking crypto and AI.

However, Ora Protocol's IMO approach isn't without flaws.

Off-Chain Use: Even if IMO successfully tokenizes AI models and shares revenue on-chain, it struggles with revenue sharing for off-chain uses. Tracking and distributing revenue from non-blockchain applications of AI models is a complex challenge.

Market Demand Uncertainty: While on-chain AI-generated content (like NFTs) introduces new possibilities for the creative industry, market demand for these works remains highly uncertain. The market value and liquidity of AIGC, and how much people are willing to pay for these works, are unknown factors, making stable revenue sharing from AI models uncertain.

Practical Revenue Sharing: In theory, revenue sharing through ERC-7641 tokens is attractive. However, the effectiveness and feasibility of this mechanism need market validation. Given the high volatility of blockchain projects and tokens, the actual returns for token holders can vary significantly.

In the crypto world, innovative asset issuance methods abound, but the utility and adoption of the assets themselves remain uncertain.

Despite its imperfections, IMO offers an innovative framework that allows open-source AI models to secure funding and share value through tokenization.

This framework aligns with current trends and provides a positive narrative.

In an imperfect asset game, riding the wave of AI hype often leads to success.

Recommendation

Meme,Murad

Will Meme Coins Reach a Trillion-Dollar Market Cap? Meet Murad, The New Meme King in Crypto

Oct 10, 2024 15:41

Russia,Bitcoin

From Rubles to Bitcoins: Russias Pivot to Crypto in the Face of Sanctions

Oct 10, 2024 15:33

Liquid Restaking Token (LRT) Narrative Reignited: Seeking High-Potential Project Opportunities in the Endless Liquidity Loop

Jun 06, 2024 21:50