The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

Soju mixed with beer turns into "honey water," people sway to the DJ's beats on the dance floor, Korean beef sizzles on the grill approaching medium-rare, and over 300 side events are buzzing at the Korea Blockchain Week.

Yet beneath the noisy mix of music and alcohol lies deep anxiety.

Project teams are anxious over insufficient market liquidity, a lack of compelling new narratives, and retail investors not buying in. Top-tier exchange listings are becoming increasingly stringent, and investors continuously press with questions like "WHEN LISTING?"

VCs are equally concerned, with many of their investments languishing in a "half-dead" state. Projects that have issued tokens remain in lock-up periods, their market values steadily declining. Short fund lifecycles are making fundraising increasingly challenging.

Entrepreneurs feel the chill of a frigid primary market. Many VCs window-shop but don't invest, even after months of discussions. New financing rounds remain elusive. Even when VCs show interest, they often wait for a strong lead investor before committing.

Media and community outlets, positioned in the middle to lower tiers of the industry's food chain, rely on the surplus from the top to survive.

Exchanges are feeling the squeeze as well, with shrinking trading volumes and intensifying competition. They console themselves with the thought that they're still better off than the project teams.

The cure for these woes? Only a bull market.

Everyone is anticipating a massive altcoin bull run, with many projects pinning their hopes on Q4 for token issuance and listing.

However, "waiting for the bull market" is akin to waiting to die, prompting many to set their sights on the Korean market to secure liquidity exits.

Whether project teams or VCs, most come to Korea with the same mission: get listed on Korean exchanges and engage Korean KOLs and communities for promotion.

At various events, the most frequently heard queries are, "Do you know anyone at Upbit and Bithumb, could you introduce me?" or people curiously asking, "How did XXXX and XXXXXX manage to get listed on Upbit?"

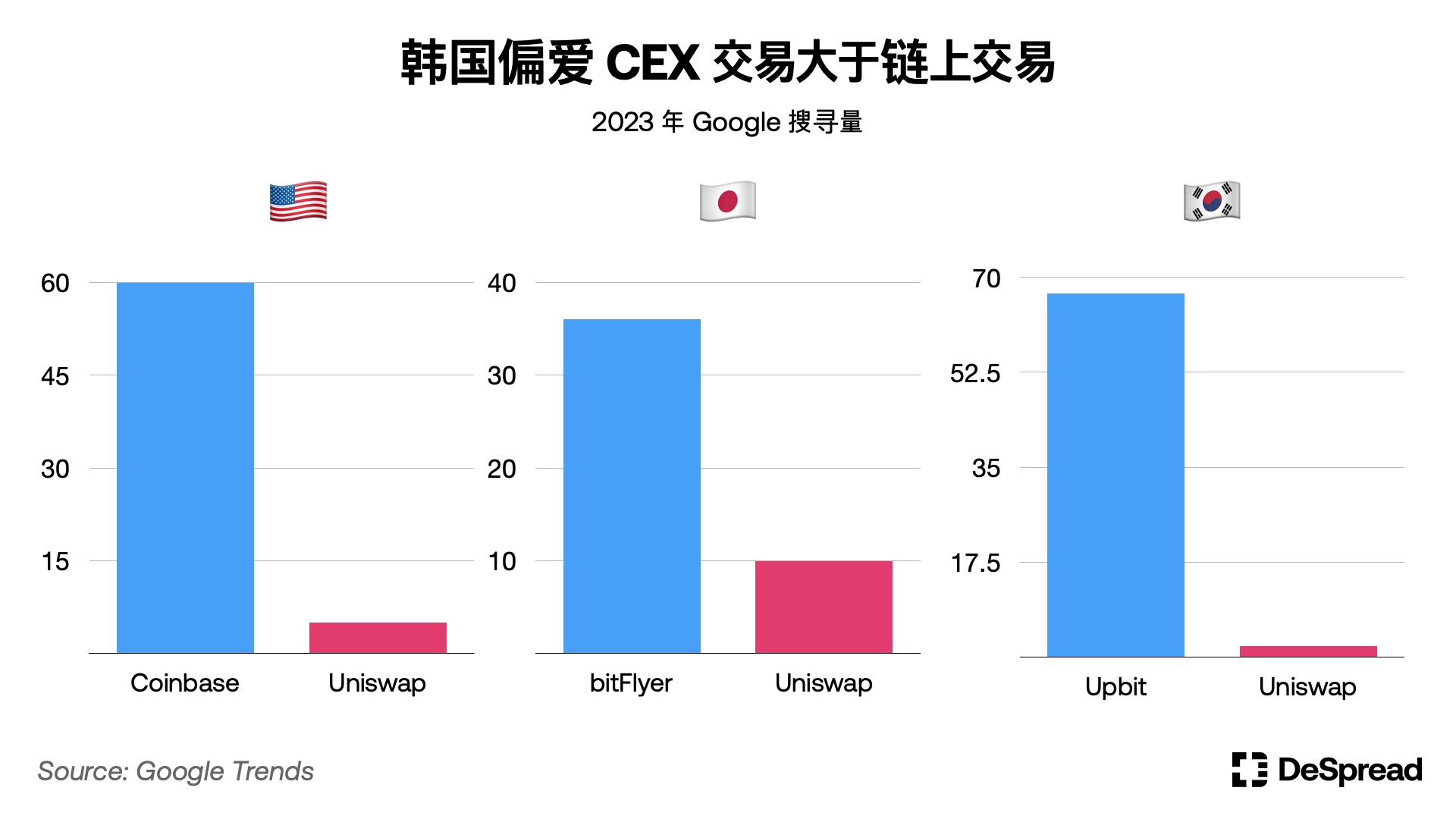

It's increasingly recognized that Korean exchanges, especially Upbit, are prime global venues for altcoin trading (serving as crucial liquidity exit points), and Korean investors prefer trading on centralized exchanges rather than engaging in on-chain transactions.

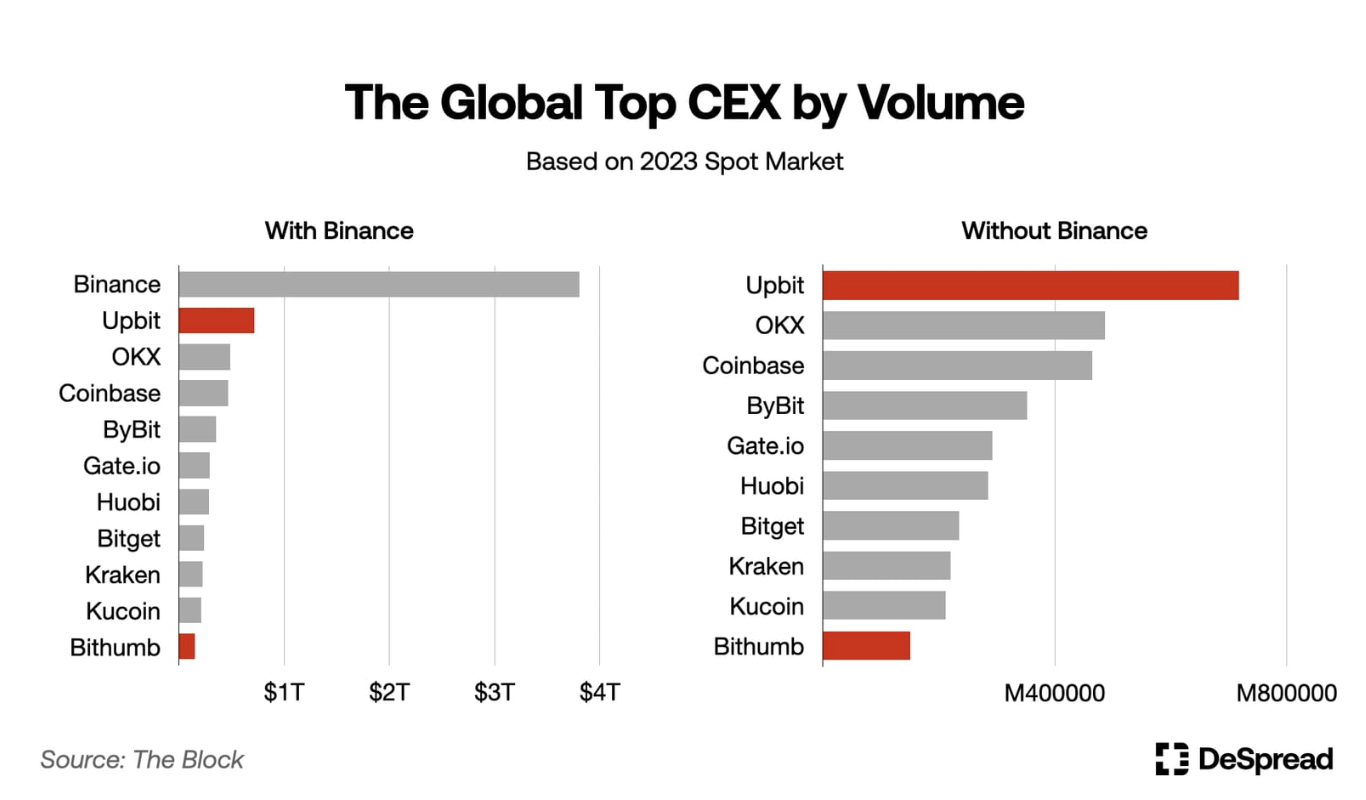

South Korea is home to four major cryptocurrency exchanges: Upbit, Bithumb, Coinone, and Korbit. Upbit is the clear leader, capturing 70%-80% of the market share and ranking as the second largest global cryptocurrency spot market in 2023, just behind Binance.

Bithumb has consistently held the second spot in the market, commanding 15%-20% of the total trading volume across the four major exchanges, while Coinone's market share ranges between 3% and 5%, and Korbit holds less than 1%.

Thus, securing a listing on Upbit is a coveted goal for many project teams.

However, getting listed on Upbit is no easy task. Korean exchanges don't prioritize initial coin offerings, and Upbit's listing standards involve rigorous requirements for both token liquidity and prior exchange listings:

Market Demand:

Evaluate the proposed digital asset's trading liquidity and commercial viability.

Review its known market cap, asset concentration, number of wallets, or trading volumes on other exchanges.

Listing Status:

Check the current listing status of the proposed digital asset, including its presence on other exchanges.

Assess the reputation, jurisdiction, and AML/CFT practices of these exchanges.

It's widely known that to get listed on Upbit, projects often first need to secure listings on major platforms like Binance/OKX, or at least Bybit.

The relatively insular Korean crypto market has given rise to numerous intermediaries or brokers who capitalize on informational asymmetries. Some support overseas projects with Go-To-Market strategies in Korea, like SEI and SAGA, executed by individuals rather than institutions. Others focus on KOL recommendations and management, or guide projects on how to get listed on Korean exchanges.

With a mix of intermediaries, the quality varies significantly. A member of a local Korean institution told TechFlow that Upbit’s listing process is highly structured, and anyone claiming they can guarantee a listing on Upbit is likely engaging in fraudulent practices.

Achieving liquidity exit requires not only exchange listings but also buying from retail investors. Consequently, engaging Korean communities and KOLs for promotional activities has become essential.

A local Korean marketing consultancy noted that their business volume this year has multiplied compared to last year.

Contrary to previous beliefs that Korean crypto investors primarily congregated on the local messaging app Kakao, the current reality is that most crypto investors, especially younger ones, are now actively engaging on Telegram.

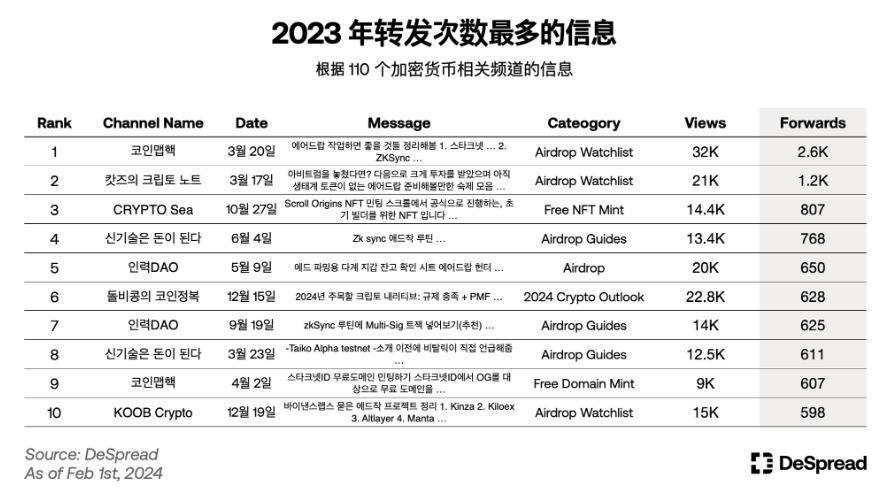

In 2023, among the top 110 Korean crypto market Telegram channels, statistics highlighted the ten most reshared channels.

The most reshared channel on Telegram in Korea is "코인같이투자 (WeCryptoTogether)," which saw 168,765 reshares, roughly 34% more than the second-most reshared channel, "취미생활방 (EnjoyMyHobby)," which had 125,919 reshares.

The channels rounding out the third to tenth spots are @kkeongsmemo, @emperorcoin, @centurywhale, @mujammin123, @masrshallog, @airdropAScenter, @seaotterbtc, and @kookookoob.

What topics grab Korean investors' attention?

An examination of viewing and resharing data from these 110 Telegram channels reveals what's trending.

A review of 2023 shows that the most viewed information in the Korean cryptocurrency community revolves around three main themes:

Legal and Regulatory Issues: Content related to the legal and regulatory landscape of Korea’s cryptocurrency sector, particularly issues like privacy breaches, money laundering, and financial crimes, consistently garners the highest views.

New Investment Opportunities: Details about new token sales, like the Sui token, rank highly, showing that Korean investors are keenly interested in new projects and potential profit opportunities.

Macroeconomic Indicators: Information related to macroeconomic indicators, such as the Consumer Price Index (CPI), is also highly viewed. The performance of Bitcoin this year, for instance, has been heavily influenced by macroeconomic data.

Additionally, the most reshared messages in Korea's crypto community in 2023 all revolve around one topic: taking advantage of airdrops.

The most reshared message was a "Airdrop Workflow Summary" posted on March 20 in the "Coinmap Hack" channel. It provided detailed instructions on how to participate in airdrops from major projects like Starknet, zkSync, and LayerZero, and was reshared over 2,600 times, topping the charts.

Most of the other top-ten messages also focused on airdrops, explaining how to access free tokens and NFTs from projects like zkSync and Starknet.

Clearly, the enthusiasm for airdrops transcends national and cultural boundaries, becoming a universally recognized and practiced aspect of cryptocurrency investment.

As more projects make their way into the Korean market, Korean KOLs and community leaders are becoming more selective about the projects they endorse. Local community leaders in Korea prefer to collaborate with projects backed by well-known investment institutions, especially those with backing from Binance Labs.

Another intriguing insight, though challenging to fully verify, suggests that Korean investors currently exhibit a preference against local Korean founders and investment institutions. This sentiment, if true, bears similarities to trends observed in the Chinese market.

Upon leaving Seoul, I inquired a few VCs and project professionals about their experiences. Most reported that their trip was "not very fruitful, more for fun and cosmetic treatments," with some even feeling guilty for squandering company resources.

These responses perhaps reflect the current state of the Korean market: while it appears promising on the surface, successfully achieving liquidity exits in Korea remains a formidable challenge.

Recommendation

Exploring the Real Japanese Crypto Market: Coexistence of Isolation and Contradiction, Where are the Opportunities?

Jun 06, 2024 18:47

Comprehensive Guide to the Crypto AI Landscape: Overview of AI Business Categories and Notable Crypto Projects

Jun 06, 2024 19:01

Russia,Bitcoin

From Rubles to Bitcoins: Russias Pivot to Crypto in the Face of Sanctions

Oct 10, 2024 15:33