The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

TechFlow: Sunny

Wormhole Foundation: Dan Reecer, COO

"Our history is deeply rooted in the crypto-native, hackathon culture, and we maintain this ethos by prioritizing decentralization, security, and open-source principles."

--- Dan Reecer, COO of Wormhole Foundation

Last year, Uniswap released a significant cross-chain bridge assessment report, where Wormhole and Axeler Network stood out among the top six cross-chain bridges in the entire network, becoming trusted foundational infrastructure for governance. Other cross-chain infrastructure providers, such as LayerZero, Celer, Debridge, and Multichain, are all leading players in the industry.

Why have Wormhole and Axeler become decentralized cross-chain experts recognized by Uniswap?

Difference between Wormhole and Axelar?

How does Uniswap's governance information bridge across various blockchain networks?

Is LayerZero a Web2 company?

TechFlow invited Dan Reecer, the Chief Operating Officer of Wormhole Foundation, to answer these questions for us. More intriguingly, unlike other Web3 projects, Wormhole is a "headless organization" without a founder leading. In such an organization:

What is the organizational distribution of Wormhole? Is it similar to the Web3 trio: DAO, Foundation, and engineer-driven Labs?

Under such an organizational structure, how does Dan formulate operational strategies and turn Wormhole into the successful project it is today?

With rich operational and marketing experience in the traditional pharmaceutical industry, how does Dan perceive the differences between centralized and decentralized organizations in terms of operational direction and tool usage?

Why did Wormhole specifically set up a gateway for the Cosmos ecosystem? What are Dan's insights into the Polkadot and Cosmos ecosystems?

At the same time, we appreciate the questions from the Wormhole Chinese community, addressing some of the current user experience issues Wormhole is facing:

Progress of Wormhole's ZK engineering team.

Low liquidity issues when transferring to L2 using Wormhole and how to address them.

Factors determining the speed of cross-chain transactions using Wormhole.

Below is the complete conversation with Dan, hoping to resolve some of your confusion.

TechFlow: Today marks my first interview with a deep infrastructure project like Wormhole. I've taken advice from others to keep the questions specific. For my initial inquiry, could you provide a brief history of the Wormhole Foundation?

Dan Reecer:

The Wormhole project has an intriguing origin, emerging from a hackathon roughly three years ago. Initially conceptualized during a Solana hackathon, our primary objective was to bridge the gap between Solana and Ethereum.

Originating as a small team during the hackathon, the project garnered significant recognition and attention, evolving into a substantial undertaking. Jump Crypto played a pivotal role, essentially absorbing Wormhole into its framework and incubating the project.

Over time, Wormhole expanded its scope to encompass approximately 30 different blockchains. Presently, the individuals originally associated with Jump Crypto and Wormhole have transitioned, with the project now solely managed by teams of individuals external to the Jump team. In recent years, multiple entities have emerged to contribute to Wormhole's development.

The Wormhole Foundation, established in the Cayman Islands, boasts around 15 employees and provides grants to various organizations supporting Wormhole.

xLabs, operating from Argentina, manages relayer infrastructure and acts as one of the network's guardians and validators.

Wormhole Labs, the third core contributing organization, drives many engineering, product, and business development initiatives.

Furthermore, we have recently funded two Zero-Knowledge (ZK) engineering teams, although the details of these partnerships are yet to be officially announced. These teams focus on developing Wormhole ZK, encompassing light clients and bridges. Additionally, various teams, including a security team, community teams, and a team within the Cosmos ecosystem, have contributed to the project.

Our history is deeply rooted in the crypto-native, hackathon culture, and we maintain this ethos by prioritizing decentralization, security, and open-source principles.

This commitment to decentralization and open source sets us apart from some competitors who opt for centralized and closed-source approaches.

Despite the challenges, we firmly believe that, as a foundational infrastructure layer, proper decentralization and openness are essential for ensuring security and scalability as we continue to grow.

TechFlow: Can you share more about the organizational setup (i.e. usually split into DAO, Foundation, Labs) of Wormhole?

Dan Reecer:

The DAO hasn't been activated yet. We plan to implement both a DAO and an on-chain treasury. This project is distinctive because, in the traditional sense, we lack conventional founders. Although someone named Hendrick was involved early on, he's no longer part of the project. It's now a founderless initiative. Approximately 12 individuals, spread across leadership teams in various teams, collaborate extensively, leading efforts in product development, engineering, and business development. The entity setup is notably decentralized.

TechFlow: I'm intrigued by the operational strategies driving Wormhole, considering the competition and its leadership position in a field with numerous messaging protocols and ongoing hackathons.

Given your background in corporate management and evident expertise in Web2 marketing strategies and operations, how do you approach operations in a decentralized, headless organization like Wormhole?

Could you share insights into your personal approach and highlight the differences between Web2 and Web3 operations?

Dan Reecer:

It's an excellent question, and the current working dynamics are quite distinct. As mentioned earlier, we collaborate with approximately five or six teams on a regular basis, fostering a dynamic environment unlike a traditional structure with a set hierarchy of managers assigning tasks. The coordination is akin to working groups, where individuals, often from different teams, come together for specific projects or launches. This involves active engagement through calls, Slack channels, and similar platforms.

Another noteworthy aspect, less prevalent in the crypto space compared to traditional companies, is the importance of goal setting. In my experience with companies like Eli Lilly, a strong emphasis is placed on defining company goals annually and quarterly, as well as individual goals. Drawing from my corporate background, which has provided insights into well-established companies operating for over 200 years, integrating such practices into a decentralized ecosystem poses challenges.

However, aligning everyone with the same quarterly objectives, utilizing systems like OKRs (Objectives and Key Results), is both challenging and rewarding.

Corporate experience has proven valuable in implementing coordination strategies. It involves working with leaders from different teams to define strategies, establish goals, motivate team members, and celebrate achievements.

This contrasts sharply with the specific hierarchy found in corporations, emphasizing individual coordination and a decentralized structure as the primary differences.

TechFlow: I understand the challenge of simultaneously handling user event operations, tracking the evolving tech stack, and staying abreast of market trends, especially in the rapidly evolving crypto space. Considering the recent developments like BTC ETF and crypto regulations, how do you manage to balance these operational aspects within Wormhole Foundation?

Dan Reecer:

Yes, you're referring to the use of various project management tools, such as Notion and Slack, among others, for our internal company tech stack.

Over time, I've discovered the most effective tools for communication, with Slack standing out as the clear choice. Despite not being decentralized, its efficiency surpasses that of decentralized alternatives. While some teams, like Polkadot, prioritize decentralization and opt for decentralized tools, this approach can be less efficient, especially in terms of mobile functionality. Given its superior performance, we rely on Slack for our communication needs.

Ensuring everyone is on the same page is crucial. For tracking product documentation and strategic documents, we use Notion, organizing information in a way that's easily accessible and traceable.

Project management is another key aspect, and we use ClickUp for this purpose.

Centralizing everyone in the same project management tool and consistently utilizing it is vital for keeping projects on track. To facilitate this, we have a dedicated project manager who oversees all projects, conducts weekly check-ins on project status, and ensures that launches and other milestones stay on schedule.

This approach forms the foundation of our operational strategy.

TechFlow: Wormhole encompasses various product lines, including messaging and Gateway, along with its own chain for treasury purposes. Could you provide a brief introduction to each and explain their functionalities?

Dan Reecer:

The primary product integral to our ecosystem is Wormhole Messaging, often classified in the industry as a bridge, but it is rather a messaging protocol on which bridges like AllBridge, Mayan, and Portal can be built.

However, it's essential to note that Wormhole functions as a messaging protocol. Currently, there are approximately 10 bridges established on the Wormhole protocol. Beneath this lies a messaging layer, enabling the transmission of various data forms between blockchains. While this data can pertain to token-related information, it can also encompass non-token data.

An illustration of non-token bridging is evident in Uniswap's governance. Utilizing Wormhole across five instances, Uniswap employs the protocol to broadcast governance decisions cross-chain. With Ethereum as their home chain, they deploy roughly 15 to 20 units on other chains. When a governance decision is made on Ethereum, Wormhole messaging facilitates the dissemination of this decision to all connected chains.

Another case involves Pyth, the second-largest Oracle after Chainlink. Pyth's entire Oracle network relies on Wormhole messaging, disseminating price feeds from their Solana Fork base to approximately 40 different chains.

At a higher level, Wormhole messaging serves as the foundational platform for diverse applications.

Digging deeper into the technology, messages undergo a verification process through the Guardian Network—a consortium of 19 validators verifying the truth and quality of each message.

Once verified, 13 out of the 19 validators must agree on its validity before the message is relayed to the destination chain. This offers a more technical insight into the workings of Wormhole messaging, positioning it as the fundamental infrastructure upon which various applications are built.

You mentioned Wormhole Gateway, a blockchain we developed for dual purposes.

Firstly, it enhances security features across the broader Wormhole Network.

Secondly, its primary function is serving as a gateway to and from the Cosmos ecosystem.

Integrating new blockchains into Wormhole proves challenging due to the need for one of the 19 Guardians to run a full blockchain node each night.

Wormhole Gateway resolves this by allowing any new Cosmos chain to connect seamlessly to the Wormhole Network via an IBC connection, particularly scaling well within the Cosmos ecosystem.

Wormhole Gateway functions as a component within the broader Wormhole Network, distinct from what powers the entire Wormhole.

Another notable distinction lies in comparison with Axelar Network, where their entire bridging network is built on their Cosmos-based chain.

Moving on to Wormhole Connect, it is dubbed an in-app widget addressing the historical challenge faced by applications like AAVE. Traditionally, users bridging funds were redirected to external bridges, resulting in user drop-off and reduced returns. To overcome this, Wormhole enables developers to embed a bridge within their application using just three lines of code. Users can seamlessly bridge funds within the app, eliminating the need to leave.

Lastly, Wormhole Queries recently launched about three weeks ago. This innovative product functions akin to an oracle but for onchain data. While Chainlink and Pyth serve as oracles for bringing off-chain data onto the blockchain, Wormhole Queries introduces a new primitive for DeFi. It allows other blockchains to query data from different blockchains, efficiently and cost-effectively. This product has garnered significant demand, with over a hundred applications expressing interest within the first few weeks.

TechFlow: I assume you need to engage with various networks, such as Ethereum, Cosmos, Solana, and Polkadot. Having previously worked in the Polkadot ecosystem and now seeing Wormhole's connections with Cosmos, what insights can you share about the differences between Cosmos and Polkadot? From my knowledge, there is a bullish sentiment towards Cosmos in 2024 predictions. Could you shed light on the reasons for this, or, more relevantly, explain why Wormhole is specifically building the Gateway for Cosmos?

Dan Reecer:

Yes, we developed Wormhole Gateway for Cosmos due to the vibrant activity in the Cosmos ecosystem. Noteworthy teams like Osmosis and others have recently launched, showcasing significant developments such as the team working on the WBTC chain. Launching Wormhole Gateway allowed us to seamlessly scale within this ecosystem without incurring additional infrastructure costs when adding new chains—a concept similar to a router chain.

A similar concept was implemented in the Polkadot ecosystem, where Moonbeam and the Acala team independently built routers facilitating the movement of messages in and out of their chains, connecting with any other chain in the Polkadot ecosystem. This approach benefited both parties, increasing network traffic for them and aiding our scalability in the Polkadot ecosystem.

Reflecting on my experience in the Polkadot ecosystem for about four years, there were several shortcomings in business development and marketing. The emphasis on engineering overshadowed the need for effective marketing and sales efforts.

Cosmos, on the other hand, is making strides in these areas, having been launched for a longer period and undergone leadership changes, resulting in recent growth.

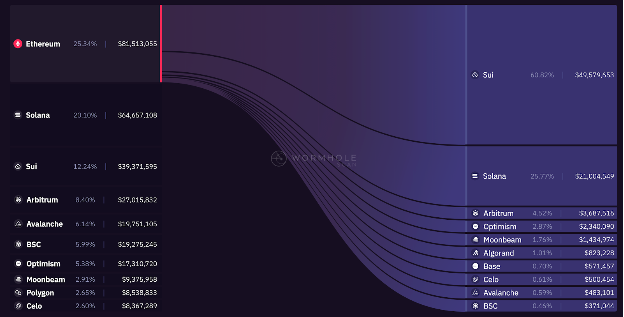

Being a part of the Wormhole team, I find it advantageous to be in a central and neutral position, enabling us to observe and engage across various ecosystems. Currently, Solana and Ethereum are the most active, with Ethereum as an L2 solution, followed by Cosmos as the third most active. The ecosystem's recent growth is evident on Wormhole Scan, offering insightful visualizations of token flows between networks.

Wormhole Scan's Snapshot of Cross Chain Volume

Wormhole's unique position allows us to witness trends firsthand. Notably, Ethereum transfers are primarily heading to Solana and Sui. Starting on Solana, our initial goal was to connect Solana and Ethereum, and this foundation has contributed significantly to our growth in the industry's most active ecosystems.

TechFlow: In terms of bridge competitors in the industry, I recall from your podcast with Crypto Coin Show that you briefly mentioned LayerZero, highlighting their centralization akin to a Web2 company rather than a Web3 company. Can you elaborate on the reasons behind this observation

Dan Reecer:

One notable piece of data to examine is the Uniswap Bridge Assessment Report. Recognizing the complexity of their community voting on bridge selection, the Uniswap Foundation commissioned a group of unbiased, third-party researchers with deep technical expertise.

Over several months, they conducted a study on six different cross-chain protocols, including Wormhole, Axeler Network, LayerZero, and others. The report focused primarily on decentralization and security, with Wormhole emerging as the top-rated protocol, thanks to its decentralization achieved through the operation of 19 Guardians and open-source code.

Axeler Network, another protocol, was also approved for use by Uniswap, showcasing its open-source nature and decentralization.

However, the other four bridges were denied the opportunity to collaborate with Uniswap governance unless substantial changes were made.

One crucial reason for the denial of LayerZero was its operational structure: it is controlled by a centralized two-of-two multisig, posing risks such as potential censorship of transactions and fund theft.

In contrast, both Wormhole and Axeler Network prioritize decentralization and open-source principles. The report also highlighted a significant drawback of LayerZero - its closed-source code, akin to major corporations like Twitter, Google, and Apple.

In an industry where decentralization and open source are paramount, relying on a closed-source approach raises concerns about transparency and security.

This led the Uniswap Bridge Assessment Committee to express reservations about LayerZero, considering it a risky choice for users due to its lack of transparency and decentralized operation.

TechFlow:Based on current information, Wormhole is set to integrate ZK technology in 2024 to achieve fully trustless transmission between major networks. What's the progress on this front thus far?

Dan Reecer:

We are on the verge of rolling out these announcements very soon, and I'm currently working on that today. A couple of engineering teams have been granted funds to focus on Zero-Knowledge (ZK).

We are set to reveal a major hardware partner who will collaborate with us to enhance the hardware supporting our ZK technology. Additionally, we are progressing on an initiative where ZK Bridges will utilize light clients. We are nearing the completion of our Ethereum light client and will subsequently announce light clients for various other chains.

This development will enable the launch of several fully trustless corridors between chains.

We are actively working on light clients for Aptos, Sui, and several others, aiming for a challenging but significant industry impact. These are the initiatives currently in progress, and within the next two weeks, there will be a substantial release of new information concerning ZK.

TechFlow: The lack of liquidity for Wormhole assets on different Layer 2 solutions results in suboptimal user experiences. How does Wormhole intend to tackle this problem, and will the liquidity layer enhance the situation?

Dan Reecer:

That's an excellent question, and my response was actually going to highlight the liquidity layer. We are currently in the process of building this product and working towards a swift release.

Historically, the Wormhole bridge facilitated bridging using wrapped assets. The new liquidity layer is designed to provide users with a native-to-native transfer experience. We recently introduced this technology, which we will formally announce this Wednesday. It enables native Ether transfers and native Wrapped Ether transfers between six of the top Ethereum mainnet and Layer 2 chains, including Optimism and Arbitrum.

This development marks a significant improvement in user experience for anyone transferring assets between these chains. Looking ahead, our goal is to extend the liquidity layer to include essentially any asset with native liquidity on both sides. We aim to minimize reliance on token wrapping where possible.

Although certain assets like Ethereum and Solana have immutable contracts that prevent burning, we plan to introduce products that involve burning and minting. For assets like WBTC or USDC, burning and minting can be utilized. However, for Ethereum, wrapping will always be necessary to move it to another chain. Despite this, our overarching strategy is to prioritize native transfers and incorporate burning and minting transfers whenever feasible.

TechFlow: In your discussion on transactions and cross-chain regions, what factors influence the timing or duration of such transactions?

Dan Reecer:

Transaction speed is contingent on the finality of the originating chain. For instance, Polygon, a Layer 2 solution, may experience prolonged transaction times. Even on the Ethereum mainnet, block times can take up to 20 minutes. To address this, our liquidity layer solutions include the development of a "fast transfer" product. This feature aims to offer users near-instant transfers by involving a counterparty to assume the finality risk, enabling faster fund transfers. Users opting for fast transfers would incur a small fee for the expedited service.

Lastly, I'd like to share an update on Wormhole's messaging activity. If you visit wormhole.com/stats and scroll down to the second chart, you'll find that today, we surpassed the milestone of 900 million messages, a notable industry record. We anticipate reaching a billion messages within the next month or two. This statistic serves as an insightful measure of our platform's extensive usage. For community members and readers interested in more statistics, the Wormhole scan page features additional compelling data.

Over 900M messages were transmitted by Wormhole messaging protocol

Recommendation

Lets Make the World a Better Place with Raullen Chai, IoTeX CEO

Jun 06, 2024 13:18

Interview with Lukas Schor: Call me Safe not Gnosis Safe

Jun 06, 2024 22:54

Vana

Conversation Vana Founder - Anna Kazlauskas: From High School Dropout to Web3 Pioneer: How a Federal Reserve Intern is Reimagining Decentralized Data with Vana

Oct 10, 2024 11:37