The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Market ups and downs can make some altcoins disappear forever.

Similarly, some products and businesses might never come back.

Who even mentions Friend.Tech in daily discussions about what's trending now?

Yet, just a year ago, everyone was talking about it: Friend.Tech was seen as the next big thing in SocialFi, a favorite of investors like Paradigm, the subject of numerous analyst reports, hailed as a revolutionary force for KOL fan economies...

Now, it's like it's become something even dogs wouldn't bother with.

Attention is fleeting. Crypto products that were once the talk of the town can quickly fade into obscurity.

But the crypto market remembers. Let's take a brief look back to see just how Friend.Tech managed to completely mishandle what could have been a great opportunity.

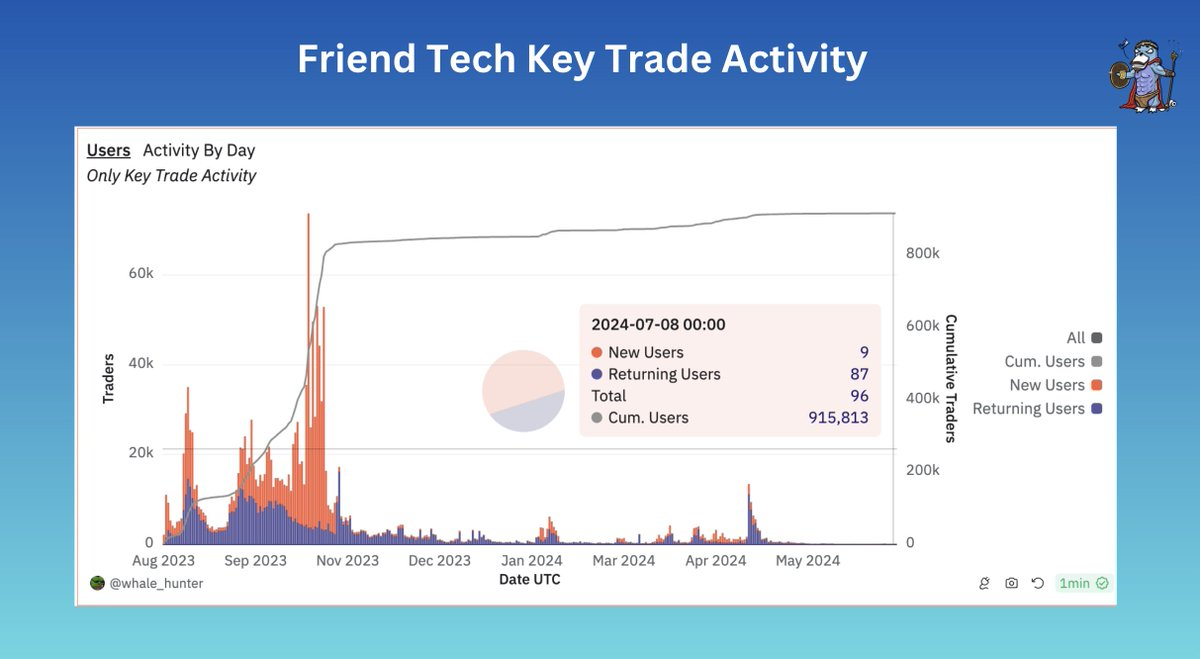

Here's a chilling fact: Today, Friend.Tech has fewer than 100 daily active users. During its heyday, it reached over 77,000 daily users, marking a staggering decline of 99.9%.

Just about a year ago, Friend.Tech suddenly burst onto the scene.

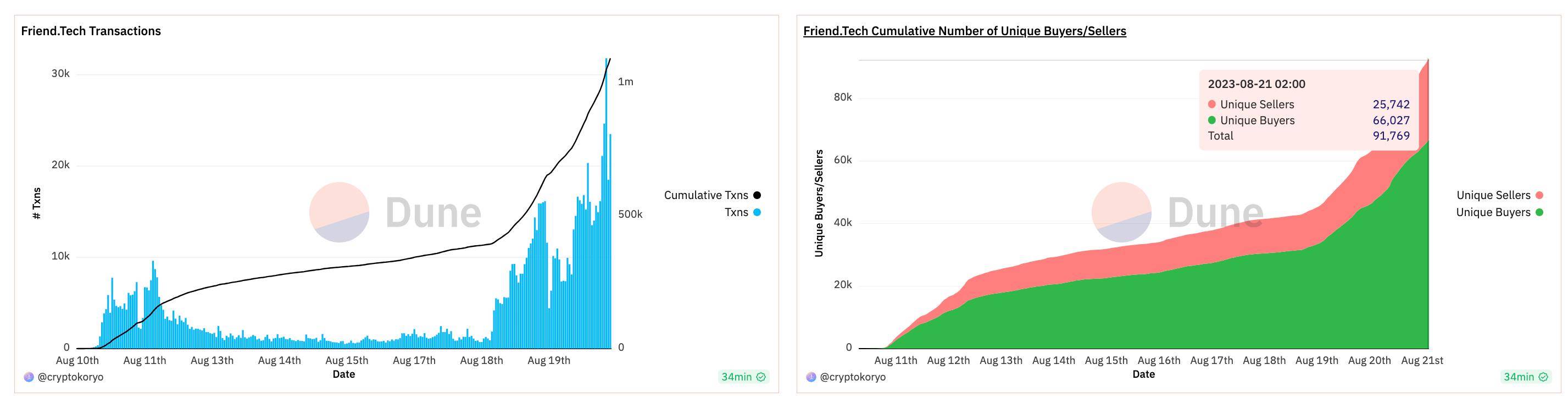

In mid-August last year, it really started to turn heads as its 'Key' trading volume rocketed past a million, drawing in more than 66,000 individual buyers and 25,000 sellers. It became another crypto phenomenon, nearly as ubiquitous as StepN.

At the height of its popularity, Friend.Tech's V1 version attracted over 100,000 users in just two weeks and generated about $25 million in revenue.

This notable financial performance even allowed for the distribution of approximately $6 million in earnings to its users.

Everyone was initially excited about this product for a straightforward reason: buying a key early seemed a surefire way to make money, and securing a spot in a celebrity KOL's fan zone was like finding a goldmine. Friend.Tech also had a points system that determined your rank based on activity, creating anticipation for lucrative airdrops.

In the midst of a rather dull bear market, it truly brought a lively liquidity celebration.

However, transparency in the crypto world naturally attracted institutional attention. During that same month, Friend.Tech also announced securing seed funding from the top-tier venture capital firm Paradigm, further fueling the FOMO with airdrop expectations and a significant capital injection.

New product model, robust user data, backing by a leading VC—back when the community wasn't yet jaded by debates over high FDV versus low liquidity, or viewing VCs with skepticism, Friend.Tech indeed seemed to hold a winning hand.

But as we both know, the inherent flaws and monotony of FT's key-selling model quickly turned off users once the initial rush faded.

The team clearly understood this too. With such a strong position, their immediate priority was to fine-tune the product, operations, and manage economic expectations to extend FT's lifecycle and vitality.

Yet, this winning hand was spectacularly squandered.

If we could turn back time, you'd notice that the signs of FT's fall were evident at various points—summarized perhaps too bluntly as: "Bold in action, weak in product."

Don’t misunderstand; it’s not to say that FT’s product lacked any redeemable qualities. In fact, it possessed unique capabilities for attracting traffic and liquidity that previous products did not. However, compared to the intensity of other operational moves and strategic choices, the product itself appeared lackluster.

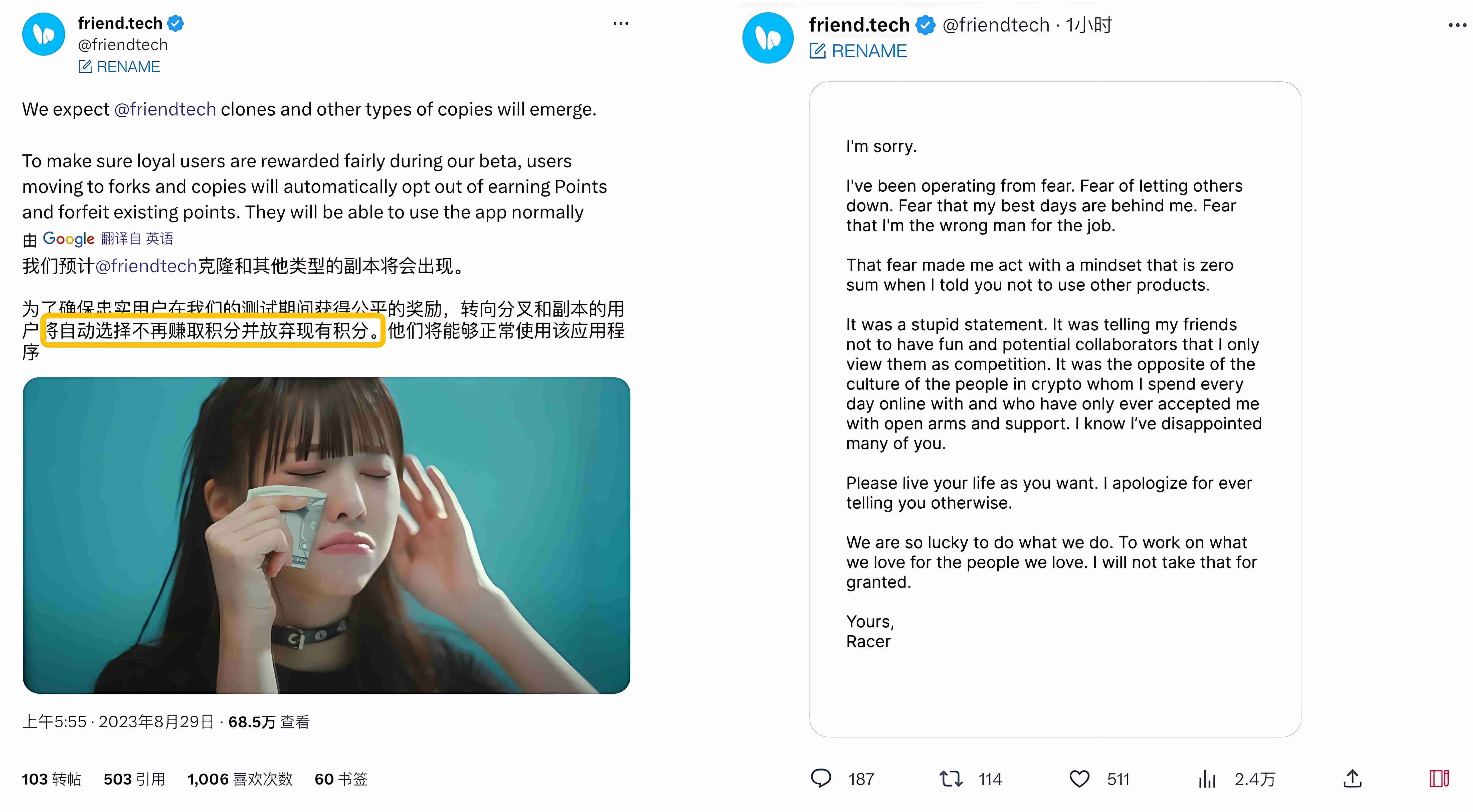

This overreach first became apparent last year, as we noted in our article "A Dramatic Reversal: friend.tech Concedes to Clones as Friends":

FT initially took a hard stance against users engaging with similar clones, explicitly stating that playing with clones would disqualify them from earning FT points. This rigid, insular view, when met with community backlash, led the founder to swiftly issue a public apology, reversing the policy so abruptly that it turned into a public relations nightmare.

It's likely that the Friend.Tech team hadn't fully figured out their operational strategy or how to deal with competitors at the time. For a product that had skyrocketed to fame, going into battle unprepared seemed amateurish, exposing some deeper issues.

Another aggressive tactic involved the V2 update.

By the end of April this year, after a lengthy quiet period, Friend.Tech announced that it would release the FRIEND token and the brand-new V2 version on April 29th, reigniting community excitement. However, the release was postponed to May 3rd. A slight delay was still within what the community could tolerate, but what really frustrated people was the requirements and experience around the FRIEND airdrop:

To claim the airdrop tokens, users had to follow at least 10 people on FriendTech and join one club. Clearly, the club feature was intended to boost user engagement with the V2 version, encouraging activity through club interactions and giving users new features to explore and keep them engaged.

However, the forced requirement to join before claiming tokens was already annoying. Add to that the difficulties many experienced during the claiming process on the day of the launch, with tokens not being distributed promptly. At the same time, due to insufficient liquidity added to the market, the FRIEND token's value halved before many could even claim it.

"I’ve lost half my coin’s value; how am I supposed to care about your latest pitch?"

A netizen quipped, "Eight months later, the only update we got is ‘clubs’, and everyone just used it to claim the airdrop."

The disconnect between incentives and product functionality led to a decline in confidence in Friend.Tech.

When it rains, it pours, and Friend.Tech's woes only deepened. Co-founder Racer made a public call to shift the product from the Base network, citing feelings of exclusion within the Base ecosystem.

Taking such a public stance against their supporting blockchain and airing grievances was a risky move, akin to playing with fire; unsurprisingly, the market reacted by walking away, leading to a further drop in both FT's user base and token price.

In June, to add to the challenges, FT announced its plan to launch its own blockchain, Friendchain, signaling a significant shift from being just an application layer to aspiring to be a key player in infrastructure.

But is the market ready to invest in such a transformation?

Against a backdrop of aggressive strategies and questionable decisions, FT's product hasn’t evolved much from a year ago—it still features a basic interface, lacks a dedicated app, and clings to outdated Ponzi tactics...

The product was underwhelming, and given the myriad internal and external challenges, it was inevitable for such a once-promising product to fall from grace.

In stark contrast, other social platforms like Farcaster have been innovating, introducing a variety of meme coins like FRAME, FAR, and POINTS, and riding a continuous wave of popularity. Next to these, FT noticeably lagged behind.

Perhaps FT was never destined for greatness.

Driven by a revised Ponzi scheme, it might have aimed high, but the fundamental flaws were too glaring to ignore.

While Ponzi schemes might grant a temporary ticket to ride, they don't ensure sustained success. FT’s market burst last year was influenced by a mix of factors—part chance, part necessity—but replicating such success is no small feat.

When greed peaks, everyone piles in; when interest wanes, they flee. The concept is simple, but FT's journey was drawn out.

At its heart, FT and similar SocialFi products failed to truly resonate with the market; they seemed more designed for quick speculation than for fulfilling real needs. Mixed with some questionable operational tactics, their outcome was hardly surprising.

But if every sensational crypto product ends up just a blip in history, then perhaps even the best among them are inherently speculative.

Recommendation

Who Will Take Over From Friend.Tech? Exploring 10 Noteworthy Consumer Crypto Apps on Base

Jul 07, 2024 14:24

Chinese Crypto Market

Deep Dive into the Chinese Crypto Market: Exploring Trading Habits, MBTI Profiles, and Trending Sectors

Aug 08, 2024 16:10

Understanding Solana Blink: One-Click On-Chain Operations Integrated with Social Media – Is Socialization the Endgame?

Jul 07, 2024 14:06