The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

The market doesn't feel quite like a bull run, yet it's not exactly in bear territory either.

As BTC continues its slide, the primary market is buzzing with significant funding news.

Aside from the $85 million raised by the AI giant Sentient (see: Analyzing Sentient's Massive $85 Million Funding, Led by a Polygon Co-founder), another notable financing event this week involves Pi Squared, a project related to ZK technology.

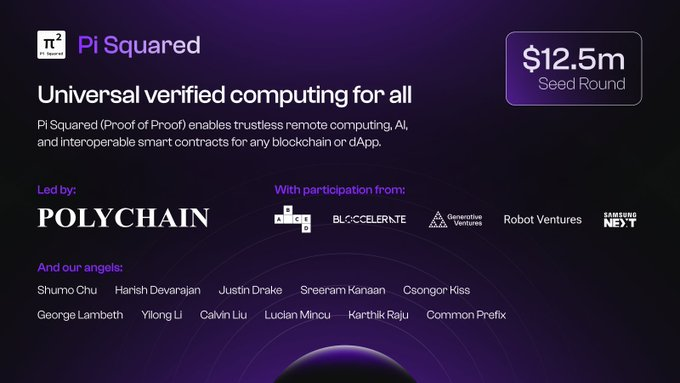

On July 2nd, Pi Squared announced it had secured $12 million in seed funding led by Polychain Capital, with contributions from ABCDE, Bloccelerate, Generative Ventures, Robot Ventures, and Samsung Next.

Angel investors include Justin Drake from the Ethereum Foundation and Sreeram Kanaan, founder of EigenLayer.

From what's publicly available, the name Pi Squared carries a deep mathematical allure—imagine squaring the infinite loop of pi, creating a vibe of hardcore, mysterious technology.

The project itself is dedicated to building a "universal ZK circuit" and "universal settlement layer", which can seem like jargon you recognize but can't quite understand.

It involves sophisticated infrastructure and the highly valued ZK technology, plus it's backed by major venture capitalists and notable figures as angel investors.

Although championing projects that defy elitism doesn't guarantee immunity from losses, ignoring a well-funded newcomer isn't wise either.

So, what's the deal with Pi Squared?

Drawing a squared pi on a blackboard might baffle many; however, when a distinguished academic does it, the effect is markedly different.

Pi Squared is actually led by Grigore Rosu, a Professor of Computer Science at the University of Illinois at Urbana-Champaign, who also serves as the project’s CEO.

By 2014, Grigore Rosu had already secured his position as a full professor, specializing in areas like formal verification and runtime verification. Put simply, formal verification uses mathematical methods to prove the correctness of software and hardware systems, ensuring they operate properly under various conditions. Runtime verification, on the other hand, involves continuous monitoring of system behavior to boost stability and security.

Wikipedia notes that Professor Rosu's numerous contributions to these fields have garnered top awards from the Association for Computing Machinery and the International Association for Automated Software Engineering.

But how does this relate to a cryptocurrency project?

If you look into Pi Squared's core business, it becomes clear that the project leverages zero-knowledge proofs (ZK) to verify the correctness of program executions without relying on specific programming languages (PL) or virtual machines (VM). It aims to provide a universal and efficient verification method designed to enable seamless interoperability across blockchains, languages, and applications.

This directly taps into Professor Rosu's verification research, making it a prime example of how academic expertise can be applied in a high-tech setting. Having a renowned academic at the helm significantly enhances the project’s credibility.

Moreover, Pi Squared’s CTO, Dr. Xiaohong Chen, who completed his undergraduate degree at Peking University before pursuing his PhD at the University of Illinois at Urbana-Champaign—the same institution as Professor Rosu—shares a similar depth of academic background. This likely points to a mentor-mentee or colleague relationship between them.

Another co-founder and COO of the project, Patrick MacKay, also graduated from the University of Illinois at Urbana-Champaign. He was previously the COO at Runtime Verification, a startup founded by Grigore Rosu, creating a smooth transition into his role at Pi Squared. Runtime Verification specializes in auditing virtual machines and smart contracts on public blockchains, closely aligning with Pi Squared’s focus.

With leading academics at the helm and a seamless transition of colleagues and alumni into new roles, it’s easy to see why Pi Squared has garnered attention from venture capitalists.

Let's dive deeper into what Pi Squared primarily aims to develop with its “Universal Settlement Layer” (USL). It's important to note that Pi Squared is not targeting end-users directly but is instead offering a platform for various crypto communities and developers.

The goal of Pi Squared is to establish a Universal Settlement Layer (USL) that simplifies interoperability across blockchains, languages, and applications. This layer aims to completely eliminate the need for traditional, error-prone implementations such as compilers, transpilers, or interpreters.

To simplify, think of it as a super-translator that facilitates seamless interactions among different blockchains, programming languages, and applications, making it much easier for developers to create applications that operate across chains and languages.

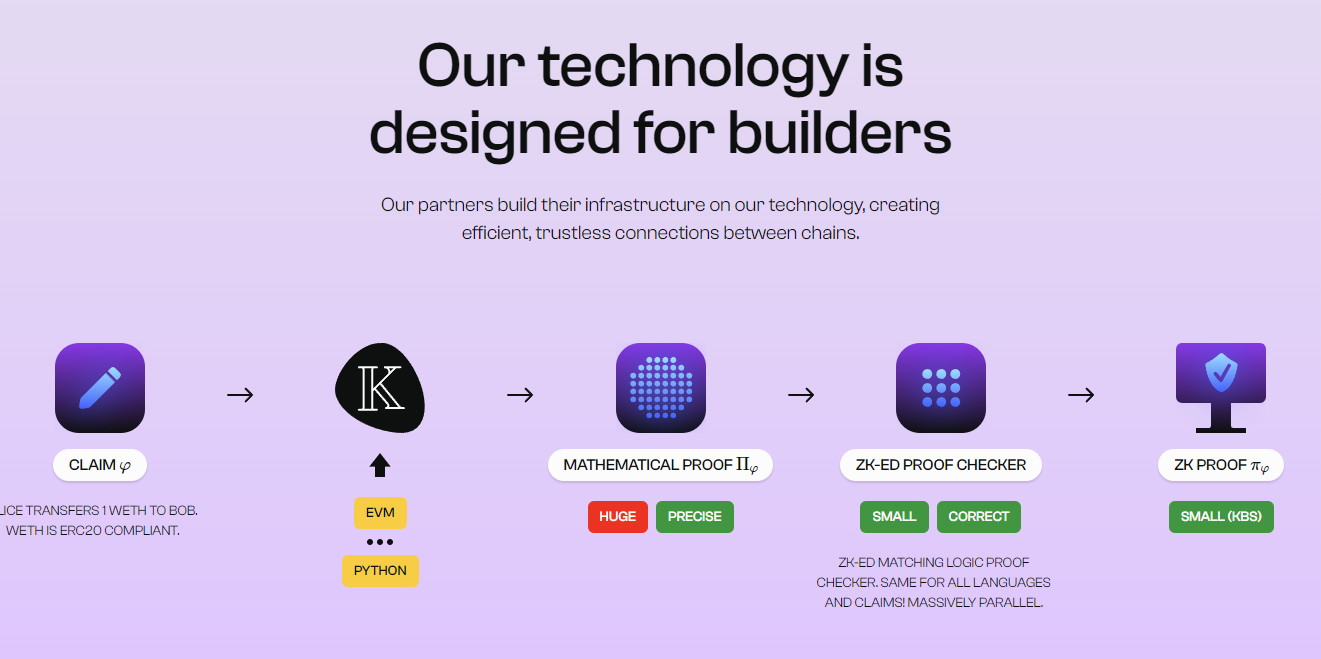

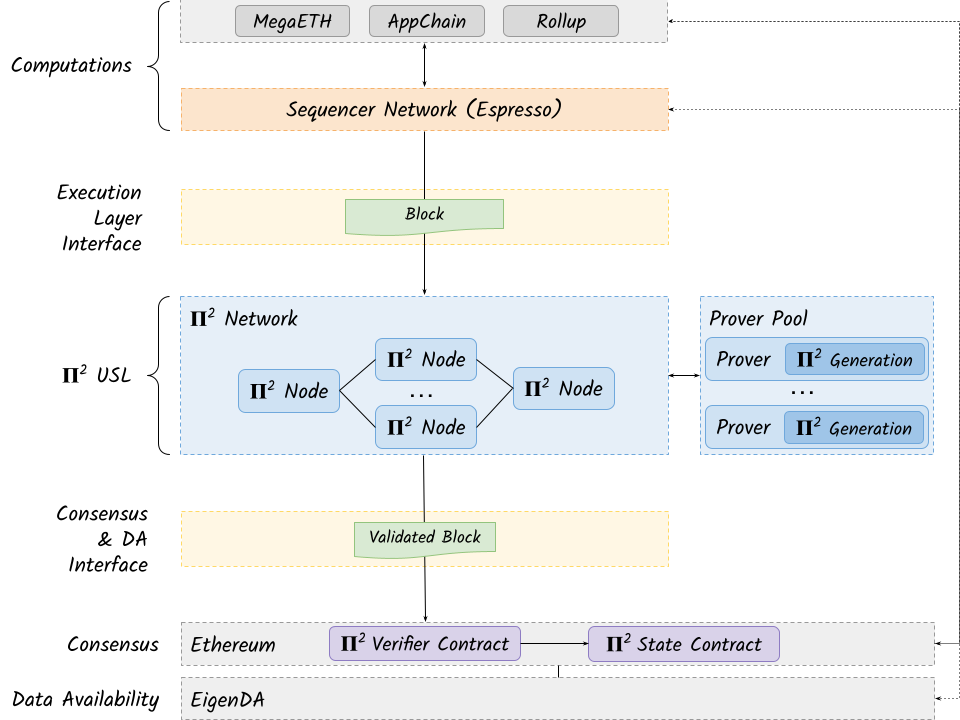

Pi Squared's website features a diagram that excellently illustrates the function of this super-translator:

Initiating a Transaction: A user, say Alice, initiates a transaction request, such as transferring 1 WETH to Bob, where WETH is an ERC20 standard token.

Universal Settlement: The transaction request is submitted to an environment that supports any virtual machine and any programming language, such as EVM or Python. This is the so-called Universal Settlement Layer—essentially, calculations can be expressed using any language or VM as long as formal specifications for that particular language or VM exist within the environment. Simply put, it's indifferent to the choice of virtual machine or programming language.

Generating Proof: For step 2, a mathematical proof is generated to verify the correctness of the transaction. This proof is precise yet potentially very large.

Proof Verification: Next, a ZK-ED (Zero-Knowledge - Efficient Debugging) proof verifier is used to validate the "large proof." This verifier is compact and capable of handling large-scale parallel processing.

ZK Compression: Finally, a zero-knowledge proof is created to certify the transaction's correctness. This zero-knowledge proof is small, making it efficient to transmit and verify.

The above process demonstrates how a simple transaction request can evolve through generating and verifying mathematical proofs, culminating in a smaller zero-knowledge proof that ensures the transaction's correctness and privacy.

The entire procedure supports multiple programming languages and execution environments, offering efficiency and trustlessness, suitable for cross-chain connections and other applications requiring high security and privacy protection.

From an ecosystem perspective, Pi Squared occupies a central position in the technology stack. Above it are the computational and ordering services layers, and below it are the consensus and data availability layers.

Pi Squared’s USL can be seen as an optimistic rollup layer that interprets and verifies the correctness of computational transactions, bridging the upper computation layers with the lower consensus layers.

Pi Squared also mentions plans to develop its own network, complete with nodes that run a consensus protocol, hinting at a staking-based economic model that might directly involve the project's own token.

However, as of now, the project's documentation hasn't disclosed any specifics about the token, simply suggesting that the network's structure could logically accommodate a token's presence. The exact details of how the token will be implemented are still to be announced as more information becomes available.

Currently, Pi Squared is in its proof-of-concept stage. Professor Rosu has stated that the project is scheduled to enter its testnet phase by the end of 2024, indicating that it is presently in a preparatory and promotional phase without any active tasks or engagement opportunities for the community.

We will keep a close watch on the project's progress. While it’s prudent to remain cautious about speculative ventures, there may still be promising opportunities to get involved as the project progresses.

Recommendation

Initia

Initia: Connecting All Rollups to Build a Layer 1+ Layer 2 Multi-Chain Interconnected World

Nov 11, 2024 15:24

Tranchess

Tranchess Strategic Analysis: DeFi Innovation Through Chess-like Gameplay

Nov 11, 2024 15:46

Tackling MEV: An In-Depth Exploration of Pyth Network’s New Product, Express Relay

Jul 07, 2024 14:32