The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

While the market remains subdued with a lack of breakthrough projects driving new narratives, Solana continues to be an ecosystem worth watching. User demand is evident, with transaction frequency and activity maintaining consistent levels.

As liquidity and attention accumulate, we need a catalyst to break through the market's stagnation.

Currently, gaming on Solana seems overshadowed by Meme trends, but the potential is enormous:

First, no game has yet matched the scale of ETH-related ecosystems. Second, against the backdrop of mobile adoption and narrative rotation, Solana's gaming sector remains largely untapped, ready to capture existing liquidity and attention.

As we transition from the "Summer of Silence" to a "Gaming Feast," which projects will emerge as key drivers, pushing forward technological, ecological, and financial developments?

Sonic emerges as a standout player - Solana's first gaming-focused Layer 2 and its first modular SVM chain.

The project introduces HyperGrid, a Rollup expansion framework that combines Solana's speed with game-specific rollup customization, creating conditions for gaming ecosystem explosion on Solana.

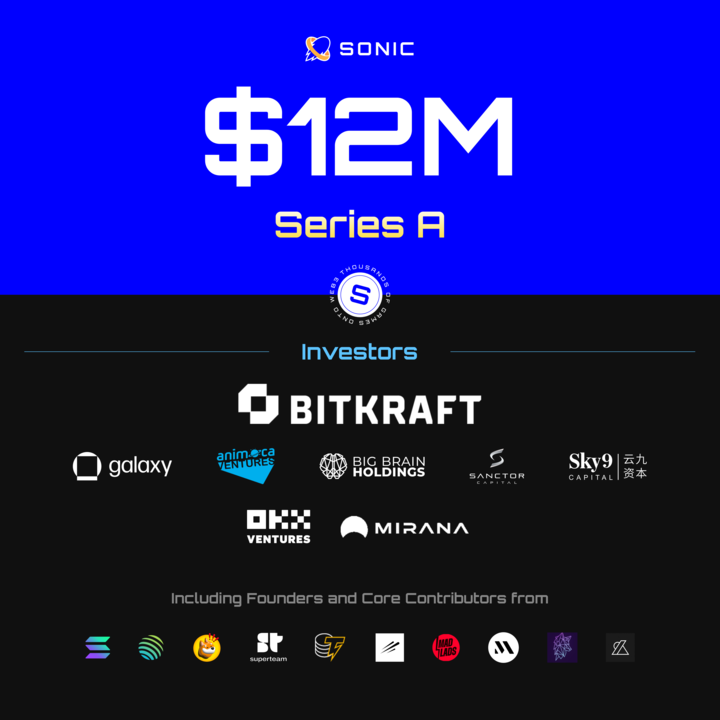

In June, Sonic secured $12 million in funding led by Bitkraft, with participation from Galaxy and Big Brain Holdings. With token generation event (TGE) scheduled for October, expectations are high. Public information reveals that Sonic is actively developing gaming and partnership programs, aiming to incentivize more games to join the Solana ecosystem.

For more DeFi-native users, Sonic's recent node presale adds another compelling reason to pay attention.

In this article, we'll explore Sonic's legitimacy and examine its product, technology, and ecosystem resources.

Let's not rush in.

A project's worth considering requires coherence in both demand and narrative.

Before diving into Sonic itself, you might wonder: Does Solana, already fast, really need an L2? And what capabilities does Sonic possess to meet these needs?

While stereotypes might raise questions, careful analysis reveals new market opportunities.

For instance, Solana's second-generation phone received 60,000 orders in three weeks, indicating significant mobile demand. With mobile devices in place, the ecosystem lacks games (setting aside whether Web3 games are enjoyable, having games at all is the prerequisite):

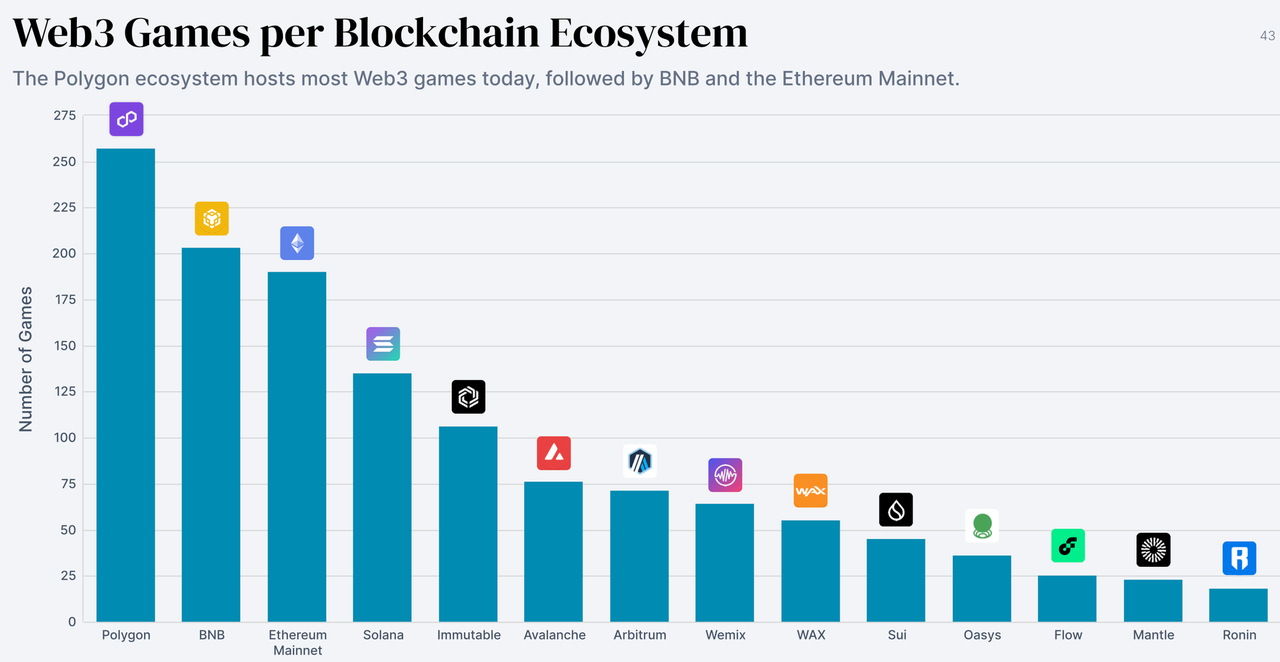

Currently, major Web3 games primarily run on Polygon/BNB/ETH. While Solana is known as the "retail chain," gaming categories closest to retail users remain underdeveloped.

DappRadar data shows none of the TOP25 UAW (Unique Active Wallets) games are on Solana; similarly, none of the TOP10 games by market cap are on Solana.

This represents two sides of the same coin - while highlighting the current absence of games, it also signals a significant opportunity to provide gaming infrastructure.

Regarding whether Solana needs L2, technical, public opinion, and application aspects all indicate demand.

Technically, Solana's mainnet L1 faces foreseeable performance pressure, requiring load distribution methods; L2 Rollup presents a viable option.

As dApp and DeFi activity accelerates on Solana, daily on-chain transactions exceeded 200 million in January 2024. Conservative estimates suggest transactions will surpass 4 billion by 2026.

Under this foreseeable pressure, Solana's TPS ranges from 2,500-4,000, with cluster ping times fluctuating between 6-80 seconds. When TPS approaches or exceeds 4,000, Solana's transaction success rate only reaches 70-85%.

Moreover, frequent Meme transactions affect other applications, and high-frequency game interactions can be hampered by L1 performance limitations.

In terms of applications, projects are already exploring Rollup-like designs.

Due to Solana's lack of game-oriented advanced data structures, project developers must implement these manually in smart contracts, increasing game development complexity. The absence of caching mechanisms also makes common gaming operations like cross-transaction calls and data account access challenging.

Non-gaming projects are already implementing L2-like solutions - Pyth is building application chains based on Solana, while Grass is using zk rollups to package high-frequency DePIN data into L1.

Similarly for applications (games), having their own L2 Rollup clearly benefits fee value capture, privacy, and real-time settlement capabilities.

In public discourse, founders of Solana ecosystem projects consistently discuss the need for L2 solutions.

From performance, ecosystem, application, and communication perspectives, Solana needs a gaming chain to expand its ecosystem.

From an investment research perspective, this information collectively suggests: whoever addresses Solana ecosystem's needs first has a higher probability of becoming the next Alpha.

This represents Sonic's coherence and timing opportunity.

Understanding the necessity, let's examine how Sonic approaches L2 implementation.

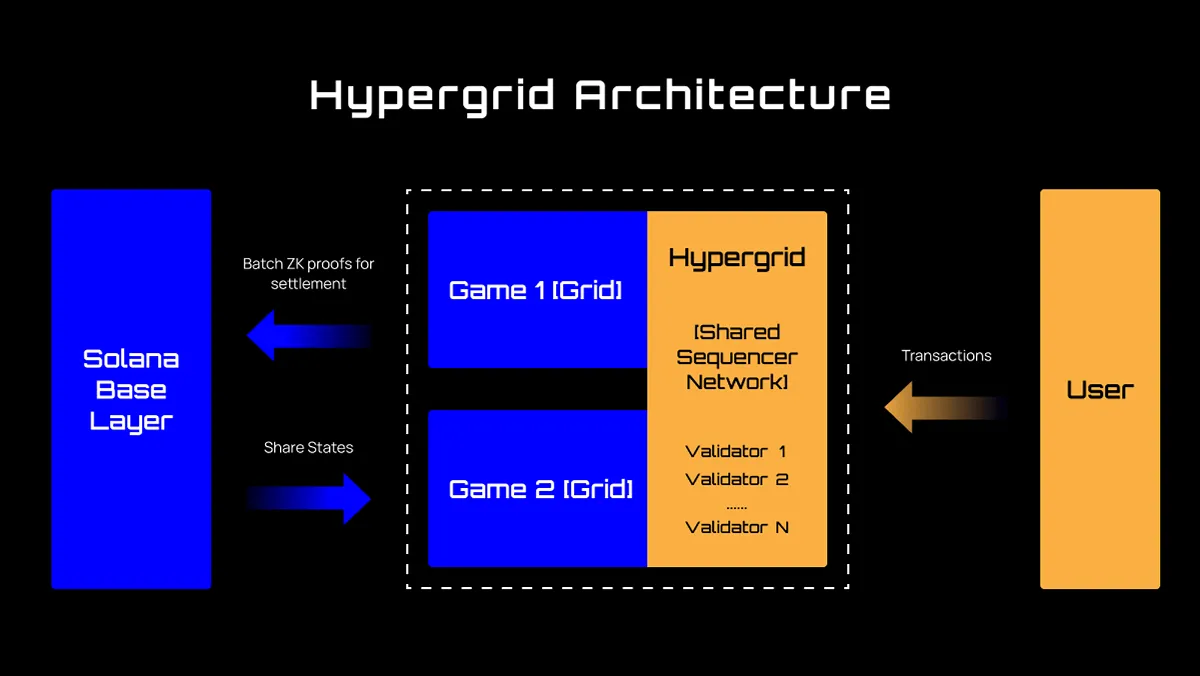

Sonic's uniqueness lies in HyperGrid, a horizontal scaling Rollup architecture specifically designed for Solana SVM.

Think of it as Sonic's L2 built on HyperGrid, Solana's first concurrent expansion framework. The "super grid" name implies multiple independent grids running simultaneously, each processing transactions independently while achieving consensus and confirmation through the Solana mainnet.

This design significantly enhances system scalability and performance.

Think of it as an "autonomous system" that's both independent and centralized:

Independent Operation: Each grid independently processes internal transactions, including validation, recording, and state changes. Applications within one grid don't affect others' operations.

Mainnet Connection: While grids operate independently, final consensus and confirmation rely on Solana mainnet, ensuring data consistency and security across all grids.

Flexible Scaling: Developers can choose between using public grids or creating independent ones for better performance isolation and control.

For better understanding, think of it like a shopping mall with independent stores.

HyperGrid is like a large mall, where each grid is an independent store. Each store (grid) operates independently, handling its own transactions and customers (application transactions).

The property (Solana mainnet) manages mall security and administration, ensuring each store's transaction records and state changes receive final confirmation. If a store becomes particularly busy, it can open new branches (create new independent grids) to ensure smooth operations without affecting other stores.

Specifically, HyperGrid consists of:

Solana Base Layer: Responsible for final consensus and data recording, receiving batch ZK proofs from HyperGrid for settlement and sharing state information.

HyperGrid: A shared sequencer network coordinating multiple grids, including multiple validators for transaction processing and validation.

Different Grids: Each grid functions as an independent application or service (like games), handling specific transactions and state changes.

Users: Interact with HyperGrid, which receives and processes transactions through validators before final settlement and recording on the Solana base layer.

HyperGrid's architecture requires supporting tools for maximum effectiveness.

First, an EVM interpreter allows existing Ethereum-based games to deploy on HyperGrid with minimal modifications. HyperGrid also developed a native game engine covering game runtime loop functions, game-specific types, and container/sandbox environments, reducing various barriers to game integration, development, and debugging.

For final asset interactions, HyperGrid provides comprehensive payment settlement infrastructure, including embedded NFT marketplaces, token swaps, bridges, liquidity pools, identity verification, and wallet tools.

Therefore, HyperGrid plus these tools enables developers to quickly build customized Rollups for their games without reinventing the wheel, using ready-made architecture and toolkits to handle all Web3 gaming requirements end-to-end.

Moreover, benefits to developers ultimately extend to all Solana ecosystem stakeholders.

Crypto gamers get better trading and gaming experiences without noticing technical changes, just faster transactions. For the broader Solana ecosystem, customized Rollups reduce mainnet performance pressure, encouraging projects to introduce more Solana games, each bringing users and liquidity for in-game assets, benefiting Solana's base layer.

Notably, HyperGrid as an L2 implements staking design - network validators must stake SOL to become nodes, enhancing SOL's value capture.

Ultimately, Sonic's HyperGrid design significantly improves system scalability and performance while ensuring data consistency and security, benefiting all Solana ecosystem participants - a rational choice that motivates multiple stakeholder participation.

While technology is crucial for an L2 infrastructure project benefiting multiple parties, more important is the number of partners willing to participate and the extent of business expansion.

Therefore, Sonic's backing resources, cooperation capabilities, community building, and market entry strategy become increasingly important.

In June, Sonic announced a $12 million Series A funding round led by Bitkraft, with participation from Galaxy Interactive, Big Brain Holdings, and others.

Sonic's developer, Mirror World, possesses even stronger capabilities. They secured $4 million in seed funding in 2022, with participation from CEXs like OKX and Bybit. Building on this foundation, Sonic's token TGE increases exchange listing expectations.

Additionally, Sonic and Mirror World maintain close connections with Solana.

Public information shows that Solana's APAC growth team, gaming team, and ecosystem technical leads are advisors and angel investors in Sonic, adding legitimacy to the project.

More official organizational connections mean broader networks and resources, facilitating cooperation within the Solana ecosystem and paving the way for project development.

Regarding cooperation manifestation, Mirror World's application development platform SDK has already deployed to 50 game clients as initial distribution nodes, establishing good relationships with existing games, making it easier to migrate existing games to Sonic and complete Sonic's ecosystem cold start.

Currently, over 10 on-chain games have successfully deployed on Sonic's testnet, including Zeebit, Solana ecosystem's first on-chain Casino, and Lowlife Forms, a top shooting game invested by Solana officially.

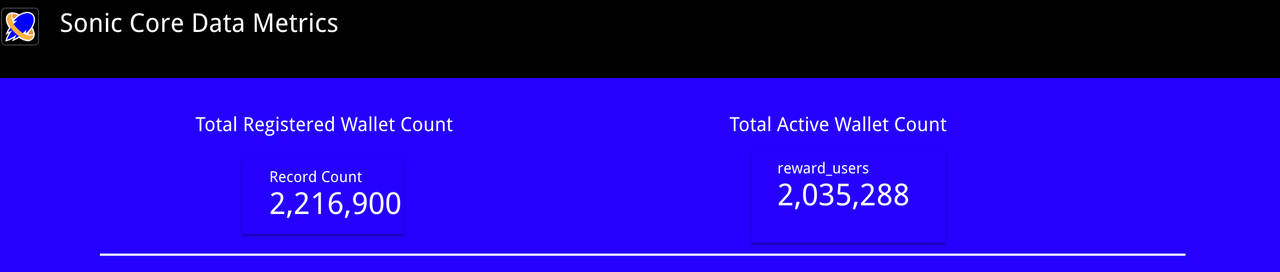

Meanwhile, Sonic's testnet has achieved significant scale.

According to official dashboard data, active wallets on Sonic exceed 2 million. With Sonic's mainnet launching in September, we might expect more game introductions - if a breakthrough game emerges, these numbers will likely only increase.

However, everyone knows Web3 games initially attract crypto natives rather than outsiders, making it more crucial to activate existing users and inject initial traffic and attention.

I've always emphasized that for an infrastructure project, the ability to organize and mobilize resources directly determines the project's lower limit. Sonic shows clear advantages here, with key cooperative advantages in establishing good relationships with non-gaming projects, providing liquidity, traffic, and security support for the chain.

For example, Backpack, OKX wallet, Metaplex, Solayer (over $25 million SOL staked), Jito, and other exchanges, DeFi, and LST projects have become Sonic partners, jointly supporting this L2.

Besides partner connections, Sonic has been continuously increasing its community influence to strengthen brand awareness.

As a global L2, Sonic has recruited promotional ambassadors in various countries and held community meetups in emerging Web3 markets like Turkey and Nigeria, strengthening the project's position in users' and developers' minds.

Recent actions show Sonic accelerating exposure frequency. Sonic co-organizes important ecosystem events like Solana's hacker house and breakpoint. They actively participate in guest sharing sessions in both Chinese and global Solana communities.

Through these incremental actions, we see Sonic as a project with multi-VC investment, Solana official support, global user reach, good activity levels, strong resource connections, and a maturing ecosystem.

More importantly, Sonic's narrative leadership (first gaming-focused L2 on Solana) combines with these factors to constitute reasons for attention.

Currently, Sonic's token $SONIC plans to TGE in October. While direct token participation isn't possible yet, we can understand its economic model and utility, and participate in the upcoming node presale.

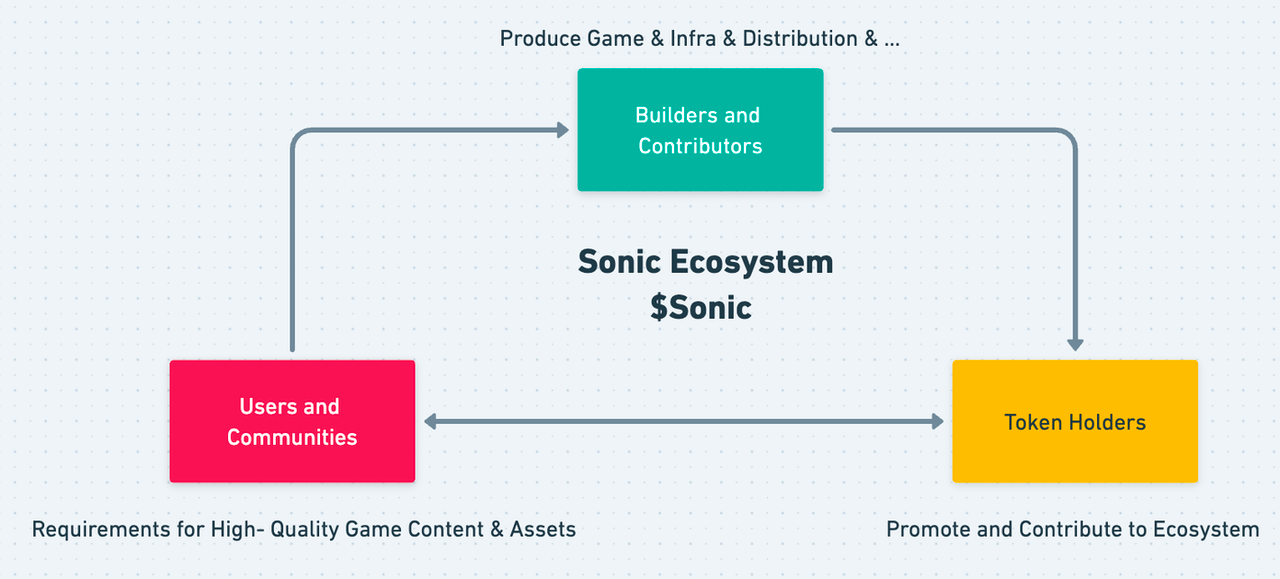

First, SONIC tokens target three roles: token holders, builders/contributors, and users/community.

Token Holders: Can exchange $Sonic for $veSonic at a 1:1 ratio for ecosystem governance voting or delegation to validators for additional rewards.

Builders and Contributors: Can participate in Sonic Partner Innovation Network (SPIN) and Sonic Acceleration Program for ecosystem support, jointly building quality games, infrastructure tools, or supporting other ecosystem development aspects.

Users and Community: Participate in ecosystem project interactions. Through Sonic activities, users can earn point rewards exchangeable for tokens or other ecosystem rewards.

So, what current participation opportunities exist for users to gain token reward chances?

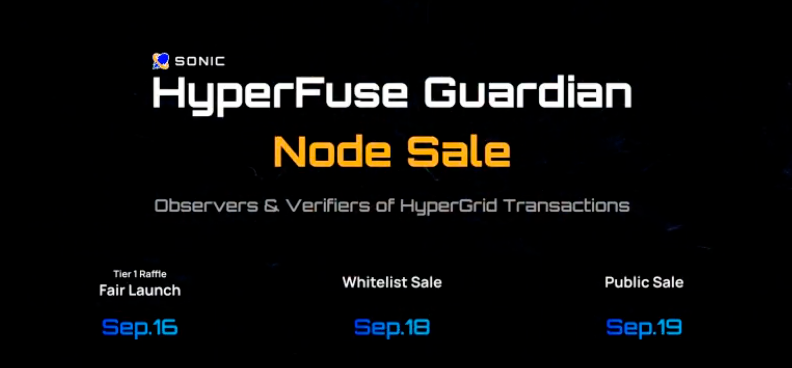

On September 16th, Sonic will launch the HyperFuse Guardian Node sale (visit here). This sale offers 50,000 NFTs representing node operation rights in Sonic's HyperGrid network.

Each NFT represents Guardian Node operation rights, with different NFT tiers corresponding to different node weights and reward ratios.

First, understand what running a HyperFuse Guardian node involves?

In HyperGrid, Guardian nodes are crucial for maintaining normal network operations. These nodes monitor network transactions and state transitions, detect anomalies, verify correct state submissions from HyperGrid Shared State Network (HSSN) to Solana, and ensure Grid rollup operations meet security standards.

Think of it as a "validator node" role.

Notably, users without technical capabilities can still purchase NFTs and delegate them to other operators, participating in network operations and earning rewards.

Additionally, node operation requirements are low, requiring only a browser for lightweight operation.

Therefore, participating in HyperFuse Guardian Node operation not only helps maintain network security but also brings potential economic returns.

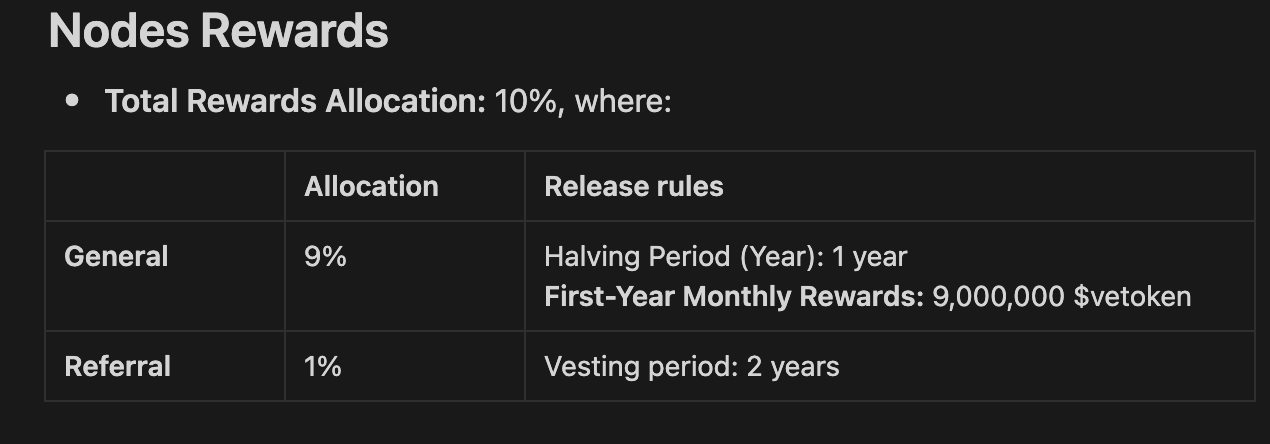

Token rewards: The project allocates 10% of tokens for rewards, with 9% for node operation rewards and 1% for network expansion rewards like referrals and invitations (unlock rules below).

Specifically, Sonic divides node NFT presale into three phases:

Lottery Phase: September 16, 2024, 13:00 UTC (24 hours)

Whitelist Sale: September 18, 2024, 13:00 UTC (24 hours)

Public Sale: Starts September 19, 2024, 13:00 UTC

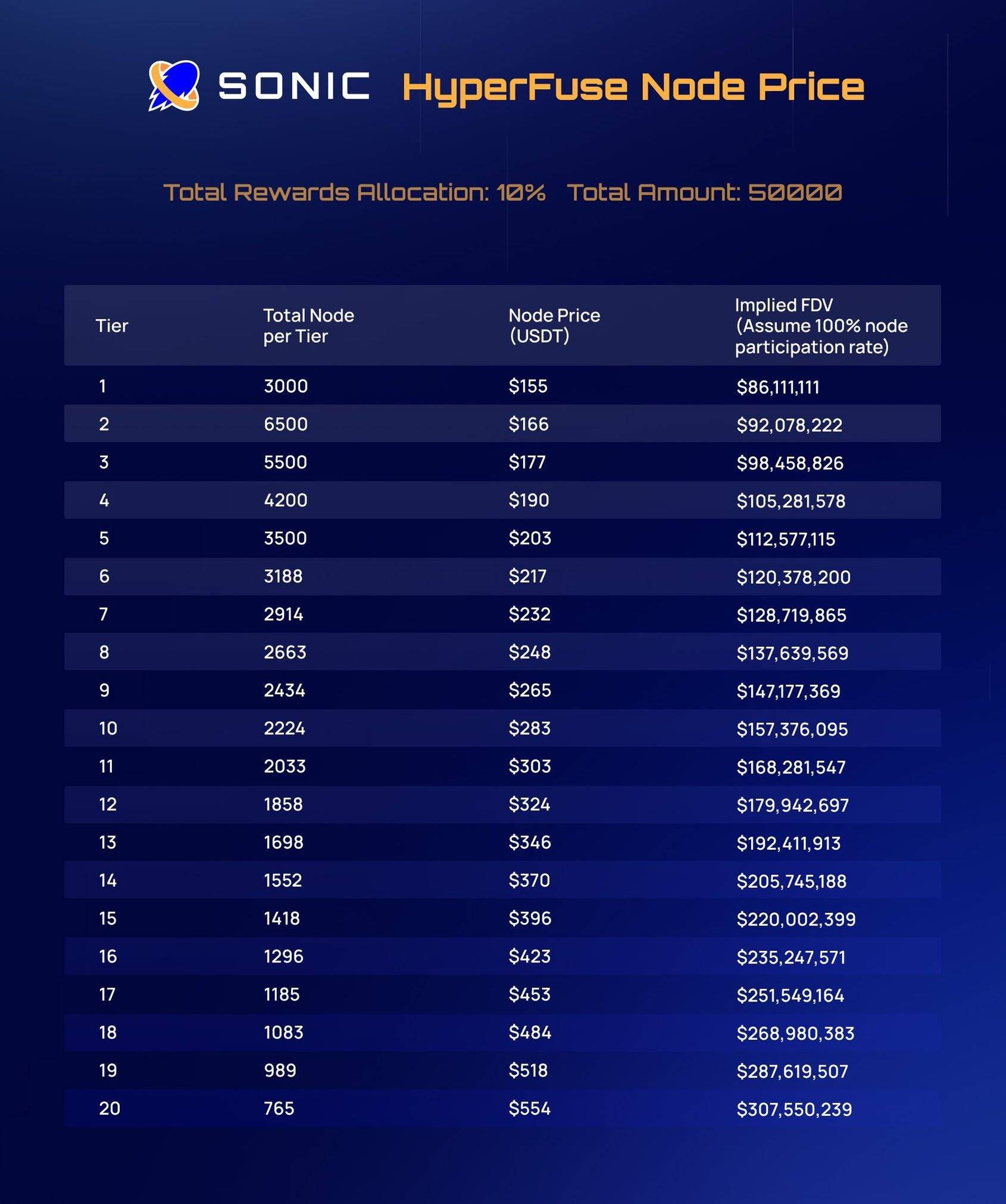

Different nodes use dynamic pricing, ranging from $155 to $554. Purchase supports SOL, USDT, or USDC on Solana network. Different tier NFTs have purchase limits ensuring broader community participation.

What's more,the initial node NFT sale prices are relatively low, starting at $155, with 70% of nodes under $300.

Level 1 nodes (cheapest) use Fair Launch model, relatively fair for most players, attractive at low prices - interested players should prepare for September 16th participation.

Level 2-8 nodes are whitelist-only sales, priced $166-248. Whitelists available through testnet odyssey activities and partner communities.

Known partner communities include MadLads, Solayer, Send, MonkeDAO, and other prominent Solana ecosystem communities, plus broader crypto communities.

Interested players can check here for more details.

Valuation-wise, node presale is good news for community and retail participants, as some nodes offer lower entry costs than VC funding rounds.

In the first 30% node sales, fully diluted valuation (FDV) remains below $100 million, lower than the previous VC round valuation. This means early participants can enter at relatively favorable prices with potential appreciation space.

Node pricing uses a tiered strategy. Early participants get nodes at lower prices, with prices gradually increasing as sales progress. This rewards early supporters while providing participation opportunities for different budget investors, helping expand community base.

Solana's Game Summer hasn't arrived yet, but those paving the way deserve attention.

Sonic's strong resource connectivity, specialized products, and activity development provide new destinations for existing liquidity and attention. Whether professional yield farmers, casual players, or game projects, new, user-friendly projects with sufficient expectations become market favorites.

However, sustained market favor depends on Sonic's operations and subsequent development - like water competing to flow first while maintaining constant flow, iterating oneself amid constantly changing market expectations and demands is the survival philosophy for Web3 projects to go further.

Recommendation

Exploring Kontos: Simplicity Redefined, a Single Gateway to Seamless Blockchain Integration

Jul 07, 2024 14:32

Unpacking Pi Squared: Academic Leaders from Elite Universities Spearhead a $12 Million Funding for a ZK Universal Settlement Layer

Jul 07, 2024 14:26

BTCFi

Comparing Bitcoins Top 4 Scaling Solutions: Which Will Unleash BTCFis Trillion-Dollar Potential?

Nov 11, 2024 15:15