The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Are you familiar with the real characteristics of Chinese crypto users?

Chinese participants have always been a pivotal force in the crypto market, contributing to the vitality in terms of active addresses, total value locked (TVL), and liquidity in secondary markets, as well as providing a significant number of developers for blockchain ecosystems. Understanding the investment behaviors and scale of this demographic is crucial for tapping into market trends, enhancing product offerings, and improving user experiences.

In response, TechFlow conducted a detailed survey titled "Investment Habits of Chinese Crypto Users" from May 22 to June 30, 2024. This survey was disseminated through social media platforms and community forums, collecting 2107 responses. After cleansing the data and removing 54 invalid responses, 2053 valid questionnaires remained. The information gathered during this survey was handled with strict adherence to privacy protections and was used solely for research purposes.

This report is based on the 2053 valid responses, aiming to deeply explore the behaviors and market needs of Chinese users within crypto investments. The analysis is segmented into four main areas:

Part 1: Demographics of the Respondents

Part 2: Market Focus within the Chinese Community

Part 3: Centralized Exchange Usage Preferences Among Chinese Users

Part 4: A Thorough Understanding of Investor Behavior

The respondent pool showed clear characteristics: predominantly male, aged 26-35, mostly with a bachelor's degree or higher.

In the MBTI personality assessment, the IN (Introverted Intuitive) type was most prevalent, a type known for their ability to spot trends, innovate, and possess a strategic vision.

Bitcoin and its ecosystem were the most favored and heavily invested sectors by the respondents, with the majority optimistic that Bitcoin's price will surpass $100,000 to $150,000 this cycle.

Independent research and purchasing were the primary influences on the respondents' investment decisions. Twitter (now known as X platform) served as the main channel for acquiring crypto market news and Alpha insights, followed by various blockchain-focused media.

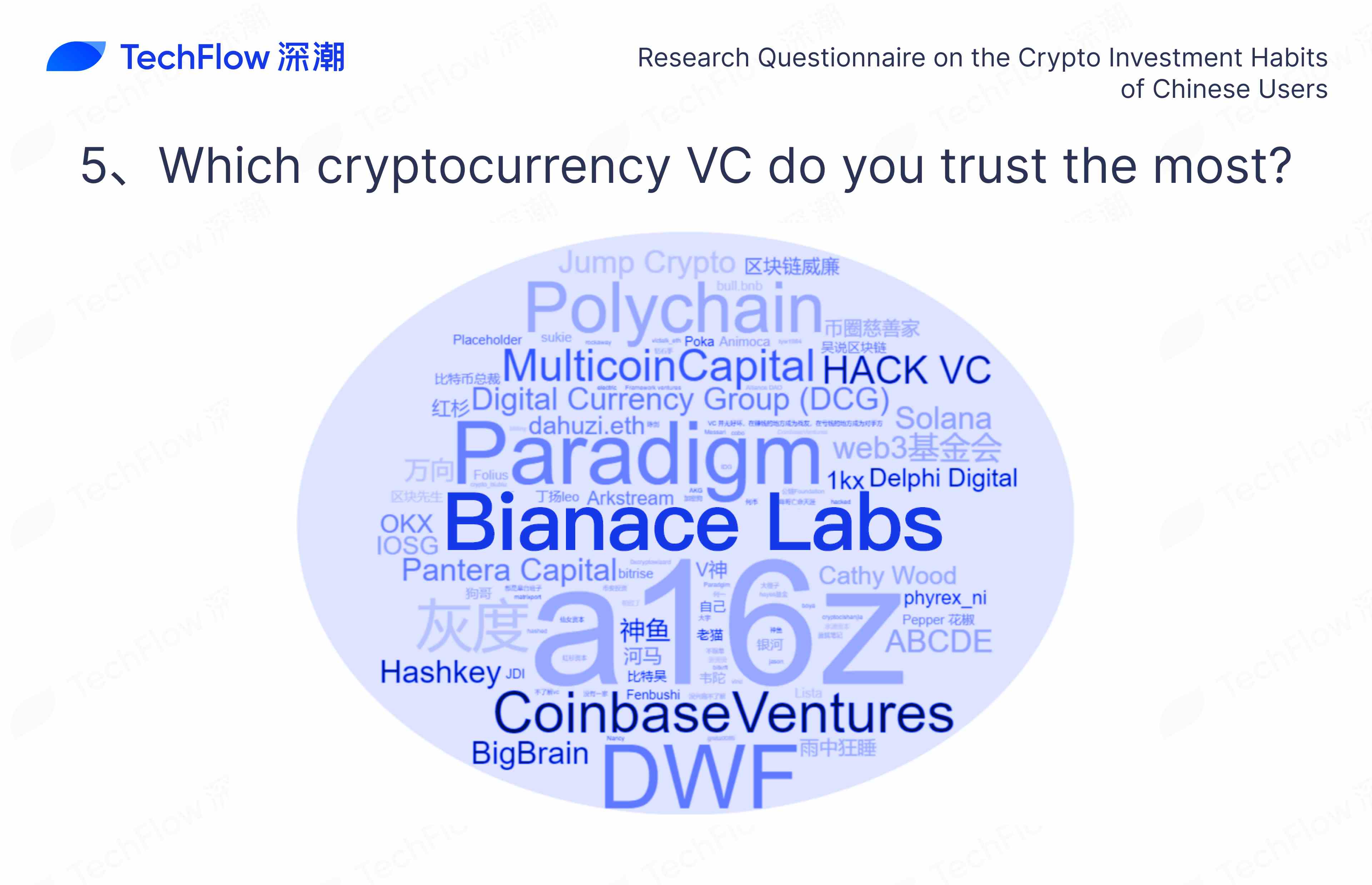

In the crypto VC recognition survey, a16z, Paradigm, and Binance Labs were the top three, as nominated by the respondents.

Binance dominated the centralized exchange landscape within the Chinese community, leading in categories such as frequency of use, largest crypto asset holdings, most profits made, and primary platform for participating in new offerings. In the "most frequently used centralized exchange" category, an impressive 96.72% of respondents opted for Binance, highlighting its strong influence and user base in the Chinese crypto market.

A significant majority of respondents (69.61%) stated that regulatory factors do not sway their preferences for specific exchanges, indicating a growing desensitization to government regulatory actions.

In today's superstitious environment, 40.04% of the investors admitted to engaging in behaviors like praying to the Wealth God for financial blessings.

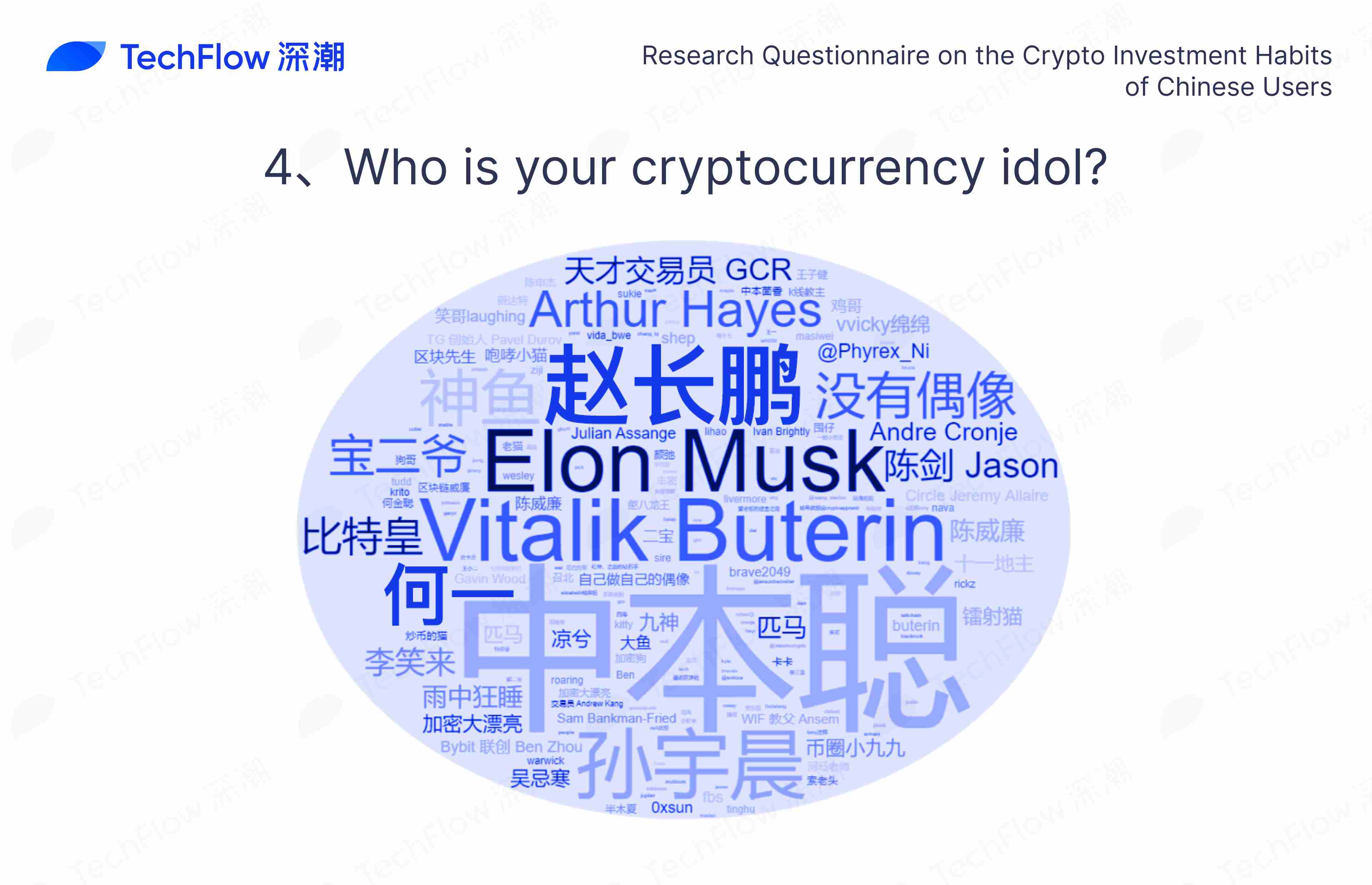

Among the crypto idols, Bitcoin's creator Satoshi Nakamoto, Ethereum's founder Vitalik Buterin, SpaceX's founder Elon Musk, and Binance's founder CZ were the most frequently mentioned personalities.

Exchanges are the preferred type of Web3 company to join for most respondents, valued for aggregating top-tier information resources and providing early access to potential wealth opportunities. Binance, in particular, was highlighted as the most desired place of employment.

On the topic of "earning enough to retire," the majority of respondents were opposed to the idea of quitting after making a certain amount, viewing Web3 as more of a commitment than a quick profit scheme. For the "how much is enough to retire?" question, over two-thirds believed that an asset value of over ten million was necessary.

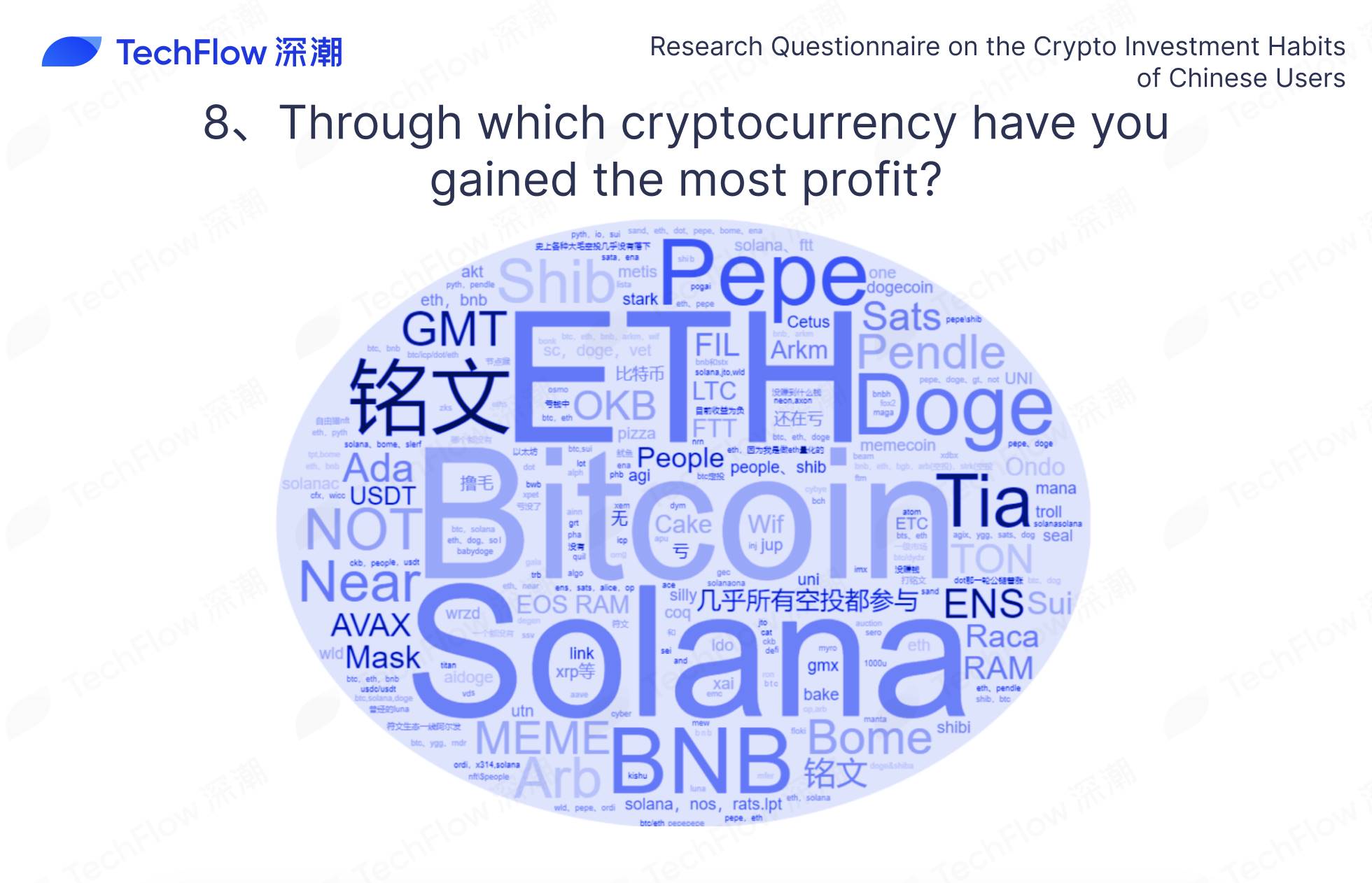

The cryptocurrencies that yielded the most gains for respondents were Bitcoin, ETH, Solana, BNB, and PEPE, reflecting the characteristics of this market cycle: dominance of Beta, lack of Alpha, with many altcoins unable to outpace the main cryptocurrencies.

This section delves into several aspects including the gender, age, educational background, length of cryptocurrency investment, and personality traits of those surveyed. The design of these questions aims to gain a thorough understanding of the participants' basic information. This will allow us to analyze the data more comprehensively and recognize the distinctive traits of various groups. By gathering and analyzing this fundamental information, we hope to sketch a detailed profile of the respondents to support further research and market analysis.

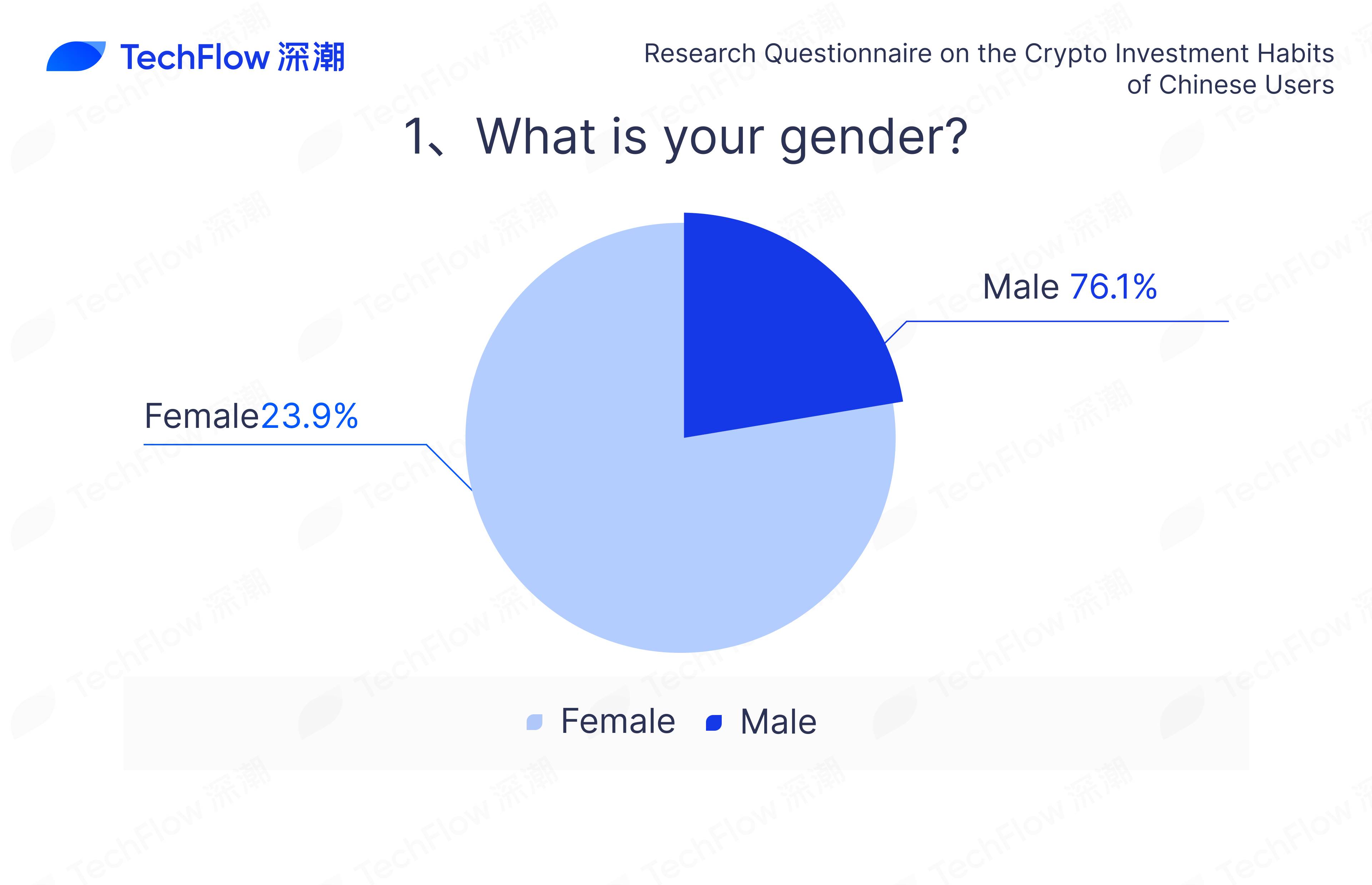

1. Gender Distribution of Participants:

The gender distribution of participants was analyzed during this survey, showing a predominant presence of male respondents. This highlights a greater participation rate among men.

Specifically, there were 1,562 male participants, accounting for 76.1% of the total, while female participants numbered 491, making up 23.9%.

2. Age Distribution of Survey Participants:

In this survey, a thorough analysis of participants' ages shows that the crypto investment landscape is dominated by the younger demographic, who demonstrate notable enthusiasm and activity.

The majority of respondents fall within the 26-35 age range, making up 57.42%. The 18-25 age group follows, accounting for 25.11%. Those aged 36-45 represent 14.19%. Interestingly, individuals between 18 and 45 years old comprise 96.72% of all respondents.

A smaller fraction, 2.46%, is made up by the 46-55 age group, and those over 55 years old are even less common at 0.45%. This trend suggests a decrease in crypto market engagement as individuals age.

Minors under 18 years old constitute only 0.36% of the total, reflecting their minimal presence in the market due to limited financial independence and investment capability.

3. Duration of Cryptocurrency Trading Experience Among Participants:

This survey also gathered detailed information on how long respondents have been engaged in cryptocurrency trading. The results indicate a well-balanced spread of experience levels among Chinese-speaking users, providing a stable and diverse user base that contributes positively to the market's sustained growth.

The largest group, those with 3-5 years of trading experience, makes up 34.67% of respondents. This is followed closely by individuals with 1-3 years of experience, accounting for 30.94%. Participants with 5-8 years of trading experience represent 21.29%. It is noteworthy that collectively, those with 1-8 years of trading experience constitute 86.9% of the survey population.

Moreover, newcomers with less than one year of experience make up 6.92% of the respondents. On the other end of the spectrum, veterans with over 8 years of trading experience account for 6.19%. The blend of newcomers entering and seasoned traders persisting underscores the market’s dynamic nature and vitality.

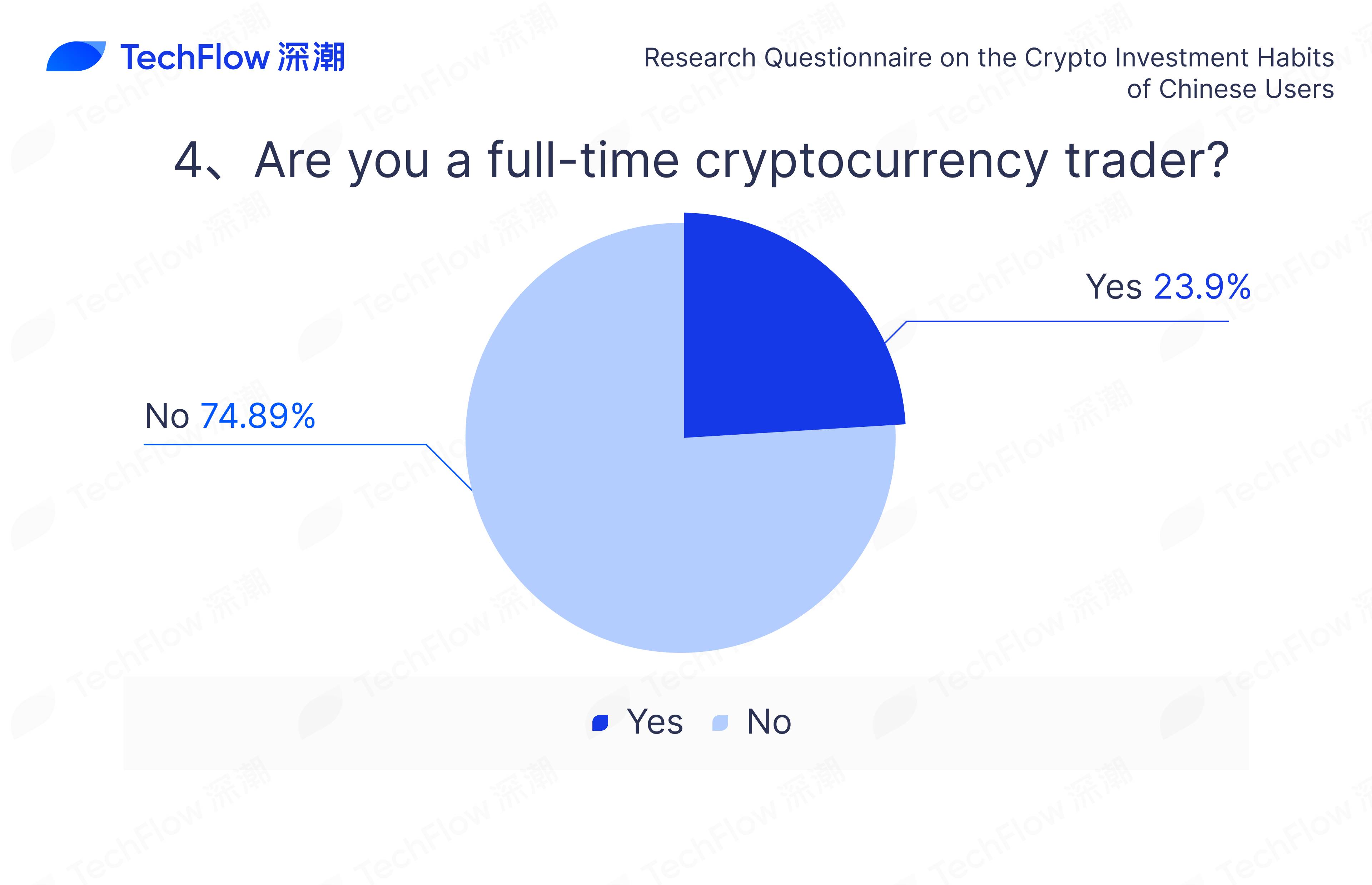

4. Full-time Cryptocurrency Trading Among Participants:

This section of the survey provides insights into whether respondents are engaged in cryptocurrency trading as their primary occupation. The data reveals significant variations in the level of involvement and commitment among Chinese-speaking users.

Specifically, 25.11% of respondents are engaged in cryptocurrency trading on a full-time basis. This indicates that a quarter of the participants consider cryptocurrency trading as their main profession and source of income.Conversely, a substantial majority, 74.89%, are not full-time traders. This suggests that most participants view cryptocurrency trading as a secondary activity or hobby, rather than their primary career path. For the majority, it is part of a broader asset allocation strategy.

The diversity in participation models highlights the versatility and flexibility of the cryptocurrency trading market: full-time traders can dedicate their attention to market fluctuations and adjust their strategies accordingly, while part-time traders can balance their crypto investments with other professional pursuits, maintaining sound risk management.

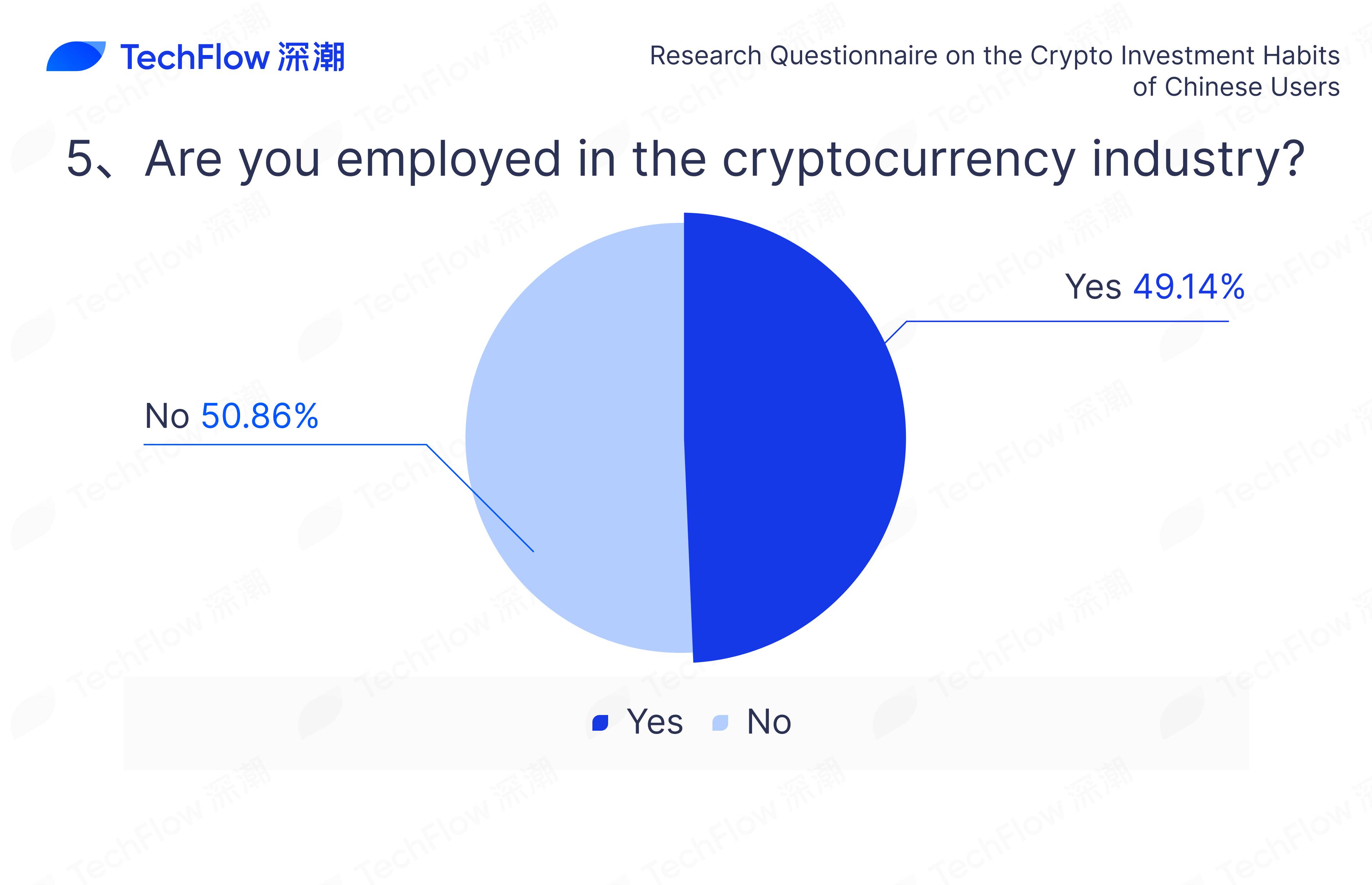

5. Cryptocurrency Industry Employment Among Participants:

This section of the survey analyzed whether respondents work within the cryptocurrency industry, revealing a balanced distribution of professional backgrounds.

Specifically, 49.14% of the respondents are employed in the cryptocurrency sector. This indicates that nearly half of the participants are deeply involved in the industry.Conversely, 50.86% of respondents do not work within the cryptocurrency field. They are more likely to engage as investors or enthusiasts, focusing on investment opportunities and market trends in cryptocurrency.

This balanced distribution of professional backgrounds demonstrates the diversity and inclusiveness of the cryptocurrency market: both industry insiders and outsiders contribute to the ecosystem, each from their respective roles.

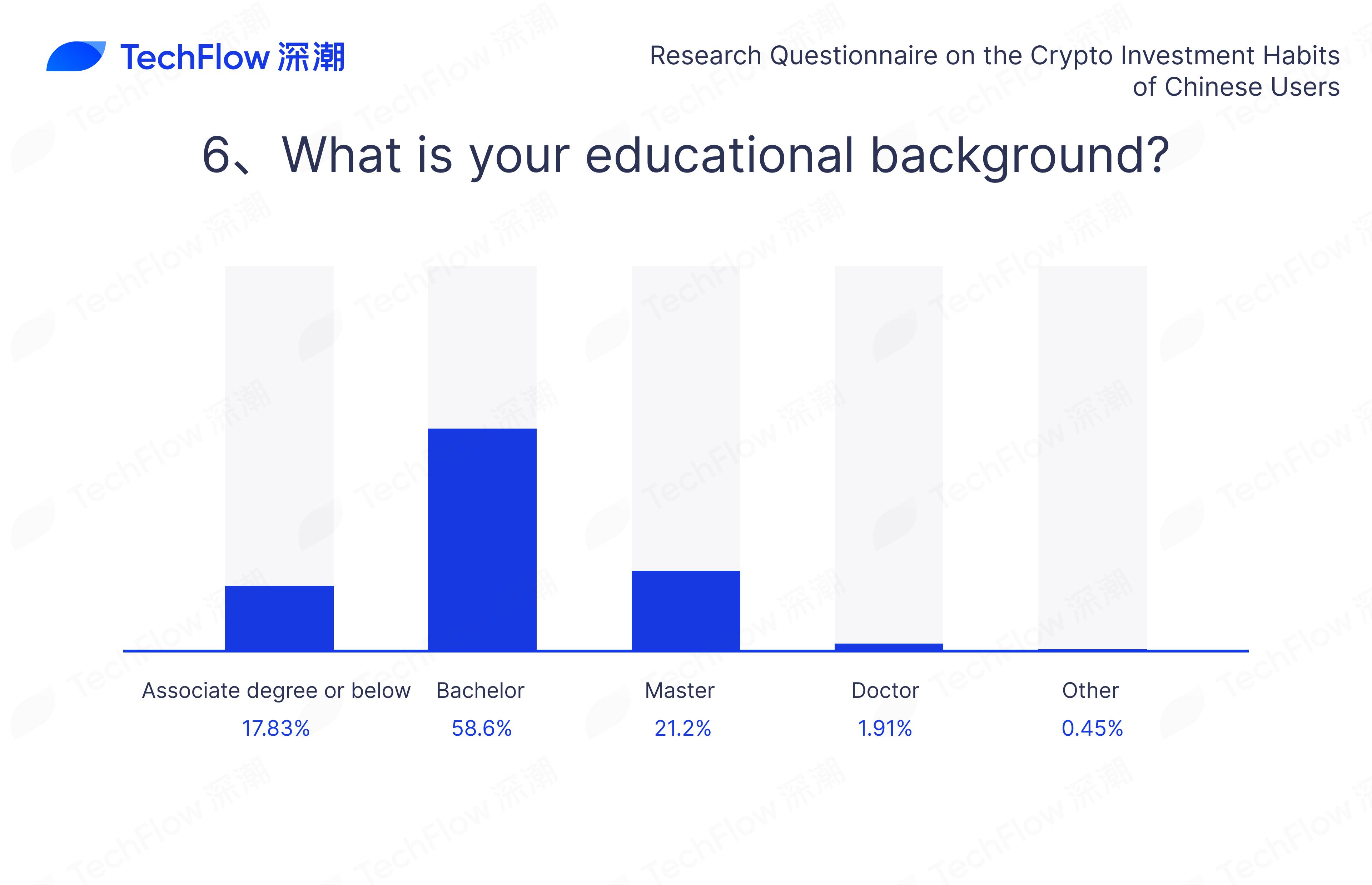

6. Educational Background of Respondents:

This survey section focused on the educational backgrounds of respondents, showing that participants generally have high levels of education, equipping them with significant professional knowledge and analytical skills.

Specifically, the majority of respondents hold a Bachelor's degree, representing 58.60% of the total. This suggests that most participants have received substantial formal education.Those with Master's degrees account for 21.20%, while PhD holders make up 1.91%, indicating that a significant portion of respondents possess advanced academic qualifications and research capabilities, which support rational decision-making in cryptocurrency investments.

Respondents with an associate degree or lower represent 17.83%, and those with other types of educational backgrounds account for 0.45%. These participants also contribute diverse perspectives to the cryptocurrency industry to varying extents.

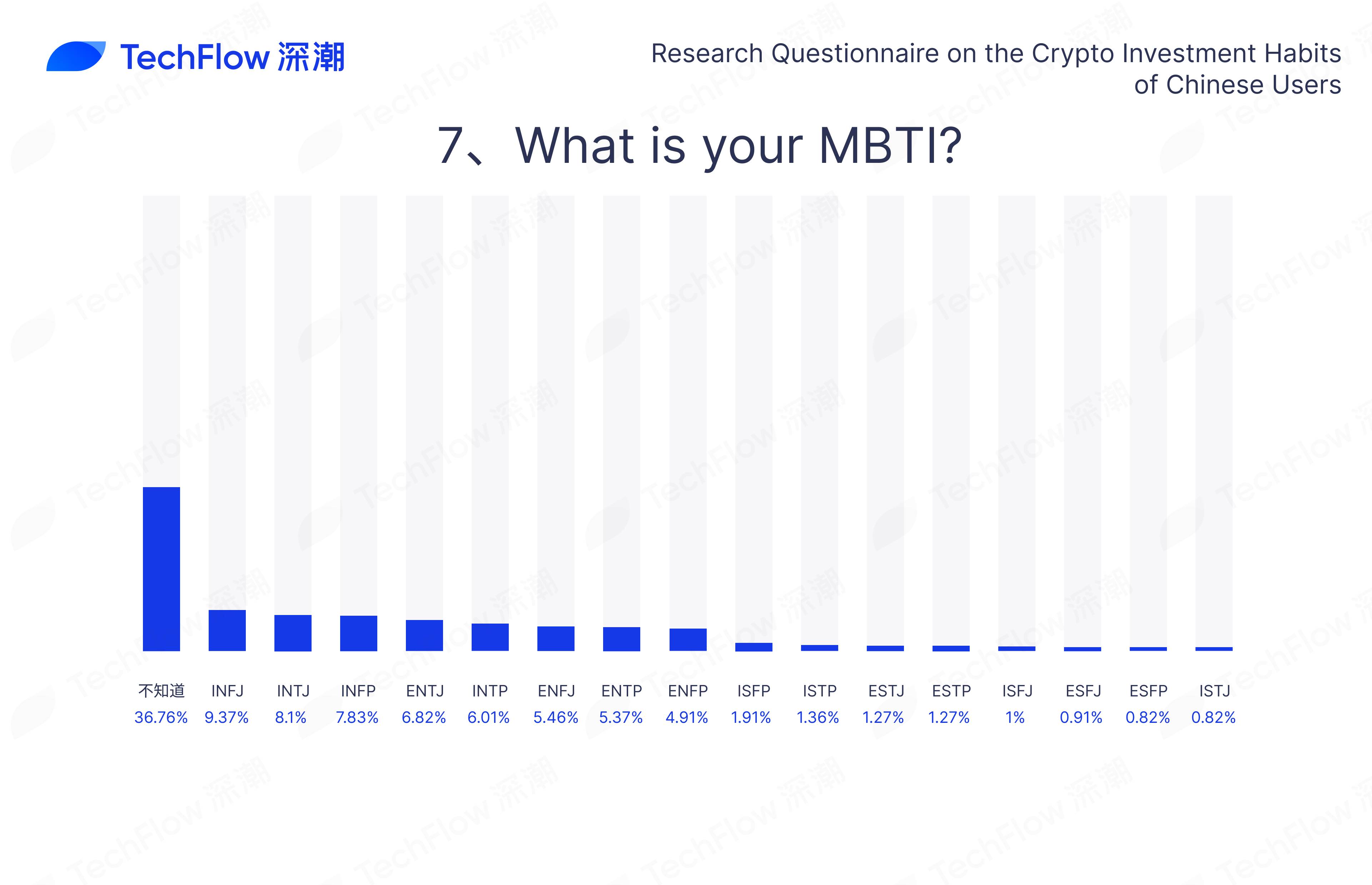

7. MBTI of Respondents:

This part of the survey focused on the MBTI personality types of the respondents. MBTI is a widely used psychological tool that helps individuals understand their personality traits and behavioral tendencies.

36.76% of the respondents did not know their MBTI type, indicating that while MBTI is somewhat popular within the cryptocurrency community, a significant portion of users have not yet taken the test to identify their personality type.

Among those who knew their MBTI type, INFJ (9.37%), INTJ (8.10%), and INFP (7.83%) were the most prevalent. These types are all considered introverted intuitive personalities, typically known for their strong innovative thinking, strategic planning, and empathy.

Extroverted intuitive types such as ENTJ (6.82%), ENTP (5.37%), and ENFJ (5.46%) also represented a significant proportion. These personality types are generally adept at leadership, communication, and decision-making.

In contrast, sensing and judging types had relatively lower representation. For example, ESFJ (0.91%), ESFP (0.82%), ESTJ (1.27%), ESTP (1.27%), ISFJ (1.00%), and ISTJ (0.82%) each accounted for around 1% of respondents. This suggests that the crypto industry might attract more intuitive thinkers than those who primarily focus on sensing and judging aspects.

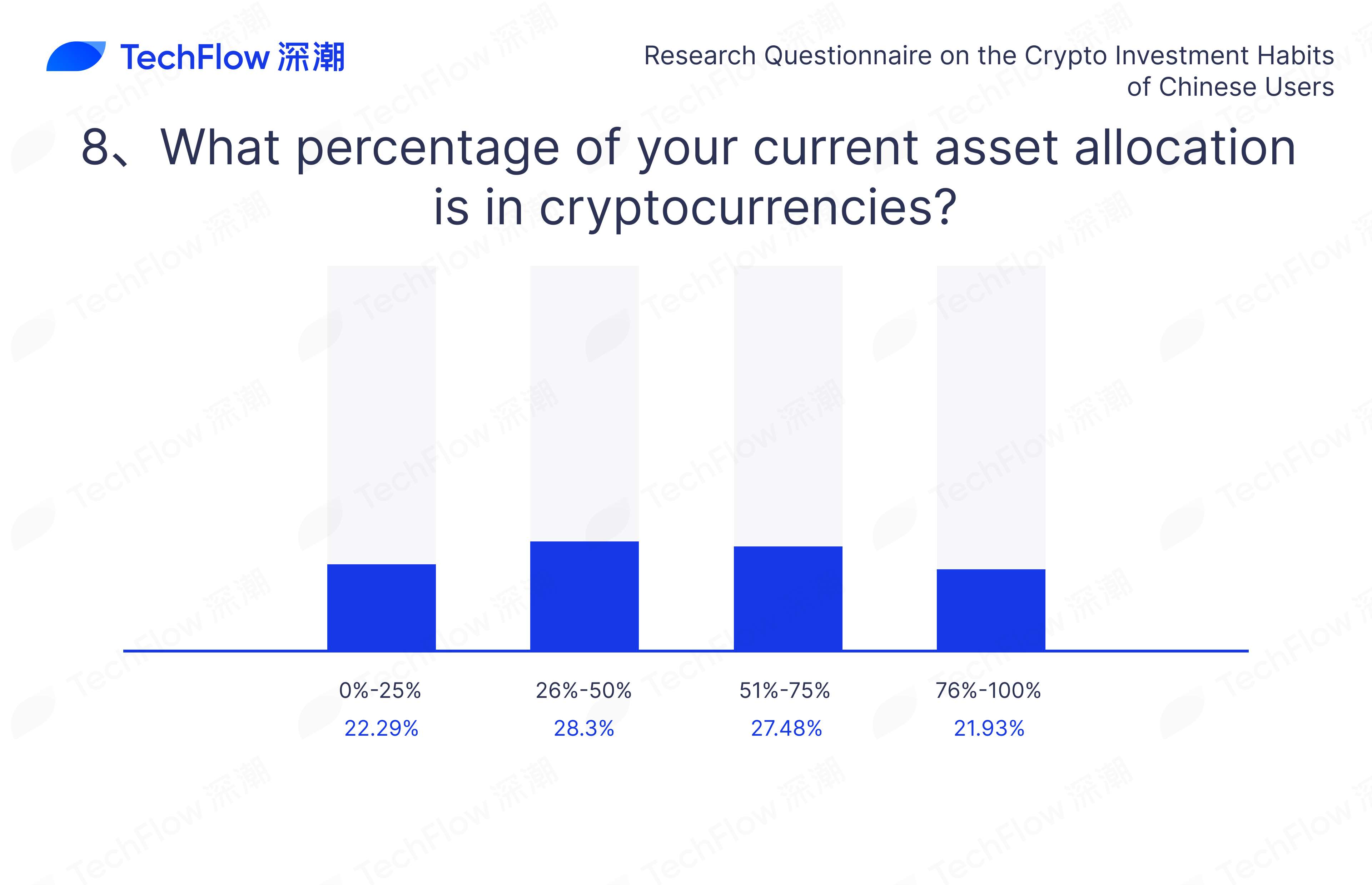

8. Proportion of Cryptocurrency Assets Among Respondents:

This part of the survey detailed the current cryptocurrency asset allocation among respondents, showing a balanced distribution which reflects different levels of risk management awareness in the cryptocurrency market.

22.29% of respondents have a cryptocurrency asset allocation of **0%-25%**.

28.30% have their cryptocurrency assets making up 26%-50% of their portfolio.

27.48% hold 51%-75% of their portfolio in cryptocurrency.

21.93% have a high exposure with 76%-100% of their assets in cryptocurrency.

The relatively close proportions across these intervals illustrate the varying investment preferences and risk tolerance levels among users. Approximately half of the respondents (50.59%) keep less than 50% of their portfolio in crypto, indicating a cautious approach to risk; the other half (49.41%) allocate more than 50% to crypto, showing a higher level of confidence and risk tolerance in the cryptocurrency market.

The cryptocurrency market is characterized by its rapid pace. As we are more than halfway through 2024, we have witnessed the rise of multiple hot narratives such as Inscriptions, Artificial Intelligence (AI), MEMEs, and BTCFi. With the market environment changing rapidly, investors' focus areas are also continuously shifting. Gaining a deep understanding of the sectors users care about, the ways they obtain information, and their confidence in the market not only provides valuable insights but also helps us make more forward-looking predictions, thereby responding more effectively to user demands.

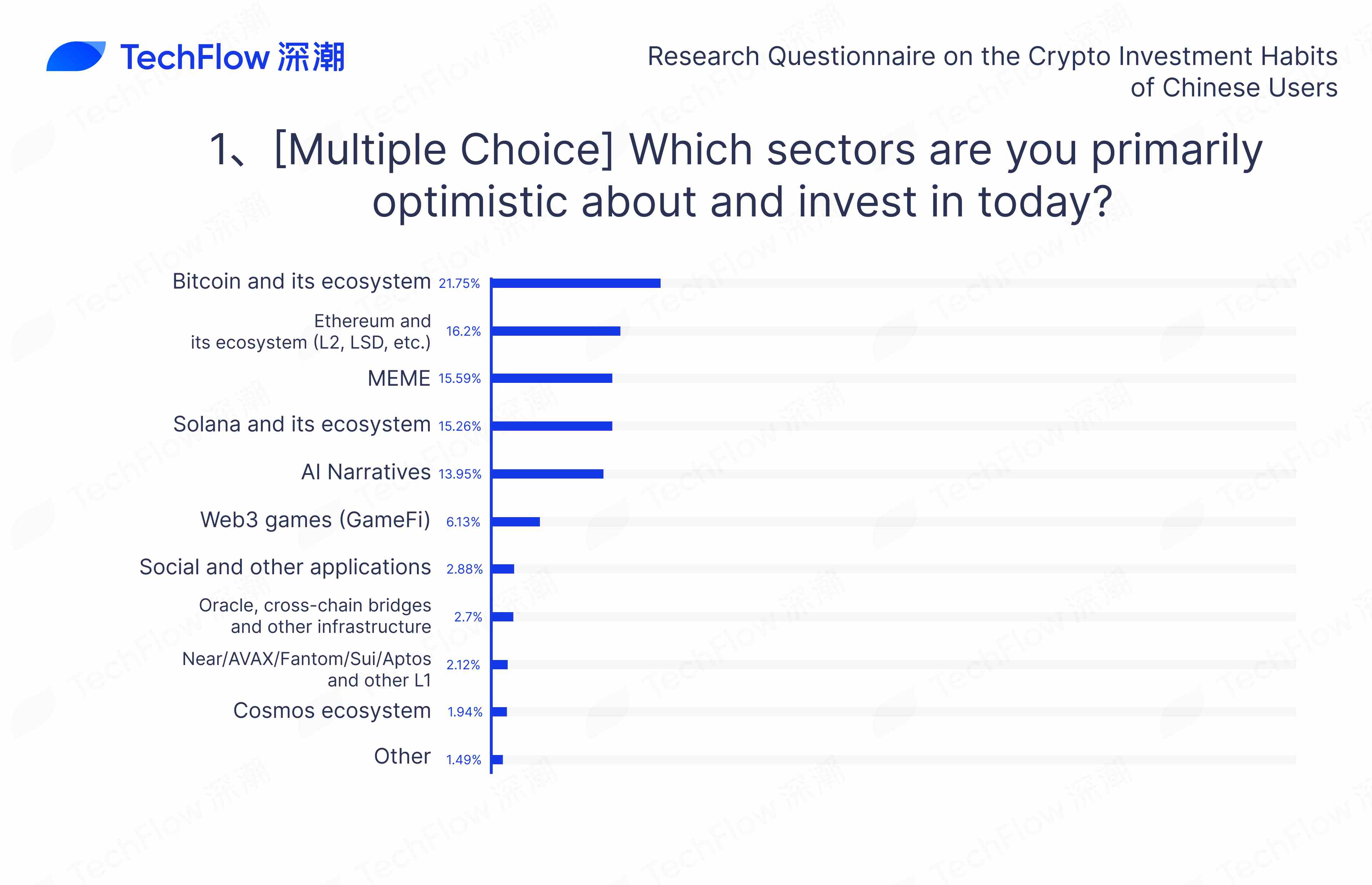

1. Sectors of Interest to Respondents:

In this survey, we detailed the crypto sectors currently drawing the attention of respondents. Participants were allowed to choose three sectors they are interested in, and the results for each option are as follows:

Overall, Bitcoin and its ecosystem are the most favored, with 65.24% of respondents selecting this option. The popularity of the Bitcoin ecosystem is evident as it undergoes rapid and profound transformations with the widespread adoption of inscription, the continuous development of Bitcoin Layer 2 solutions, and the rise of BTCFi, attracting significant attention from investors and developers.

The gap between the 2nd to 5th ranked sectors is relatively small, including Ethereum and its ecosystem (L2, LSD, etc.), MEMEs, Solana and its ecosystem, and the AI concept.

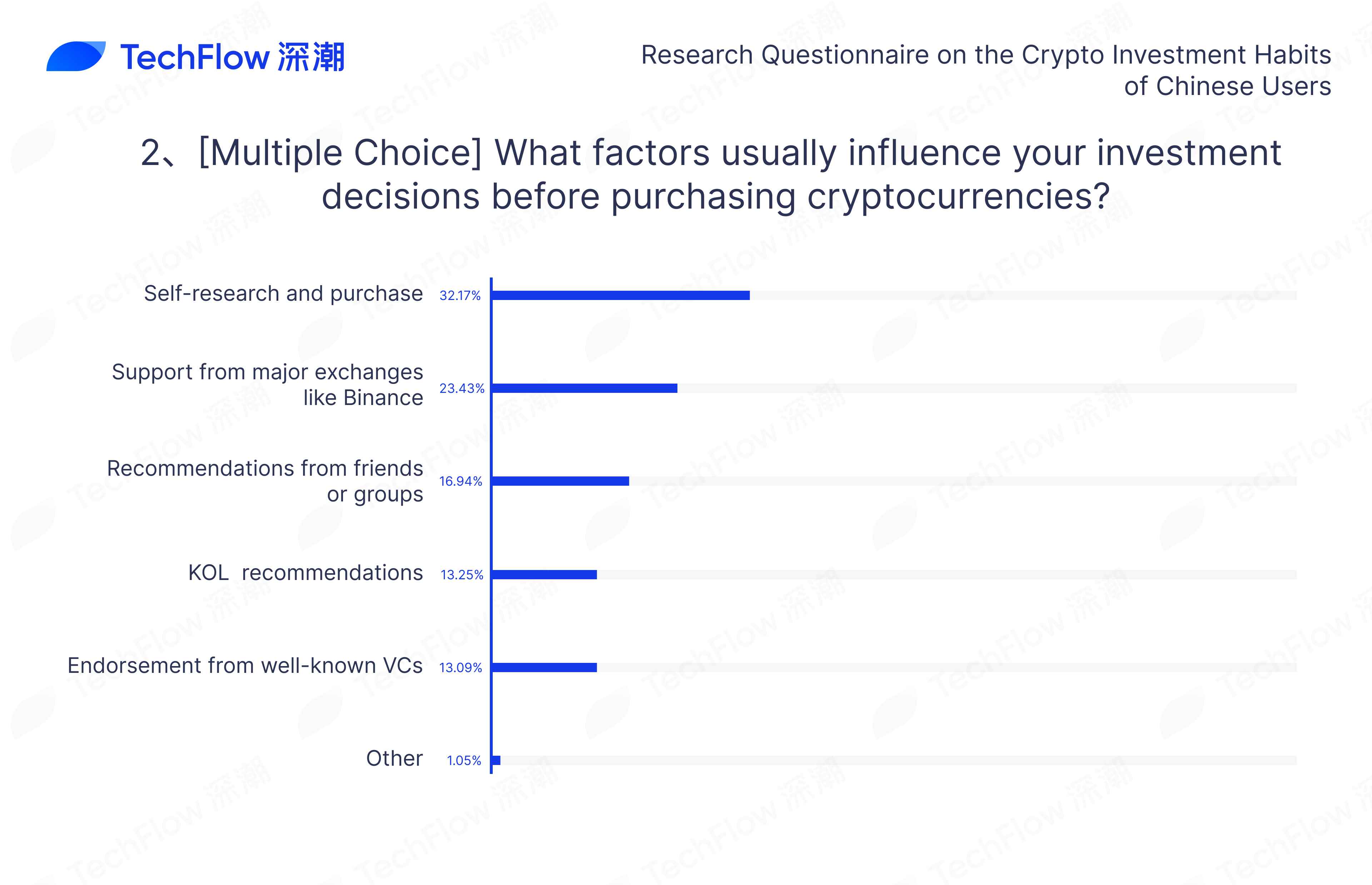

2. Factors Influencing Respondents' Investment Decisions:

In this survey, we detailed the current factors influencing respondents' investment decisions. Participants were allowed to select multiple options, and the results for each option are as follows:

Overall, independent research and purchasing are the main factors influencing respondents' investment decisions, with 77.71% selecting this option. In an environment where information channels are increasingly diverse, investors can delve deeper into the fundamentals and technical details of projects, making more rational investment choices.

Secondly, the ecosystem support from leading exchanges also holds significant weight, as these exchanges often have extensive industry resources and a broad user base. Investors value the exposure and resources that exchanges provide for new projects.

Additionally, recommendations from friends or group members, KOL endorsements, and VC backing rank third, fourth, and fifth, respectively.

3. Respondents' Predictions for Bitcoin's Price in This Cycle:

In this survey, we detailed respondents' expectations for the highest price of Bitcoin in the current cycle, showing a clear concentration of expectations.

Specifically, 59.51% of respondents believe that the highest price of Bitcoin in this cycle will be between $100,000 and $150,000, indicating that most people have a relatively optimistic but cautious outlook on Bitcoin's future trajectory; 22.20% believe that Bitcoin's highest price will be below $100,000, suggesting a more conservative view on market risks and volatility.

Moreover, 12.37% of respondents think Bitcoin's highest price will be between $150,000 and $200,000, while 5.91% believe it will exceed $200,000. This group is more optimistic about Bitcoin's potential price increase, believing it could reach new historic highs in this cycle.

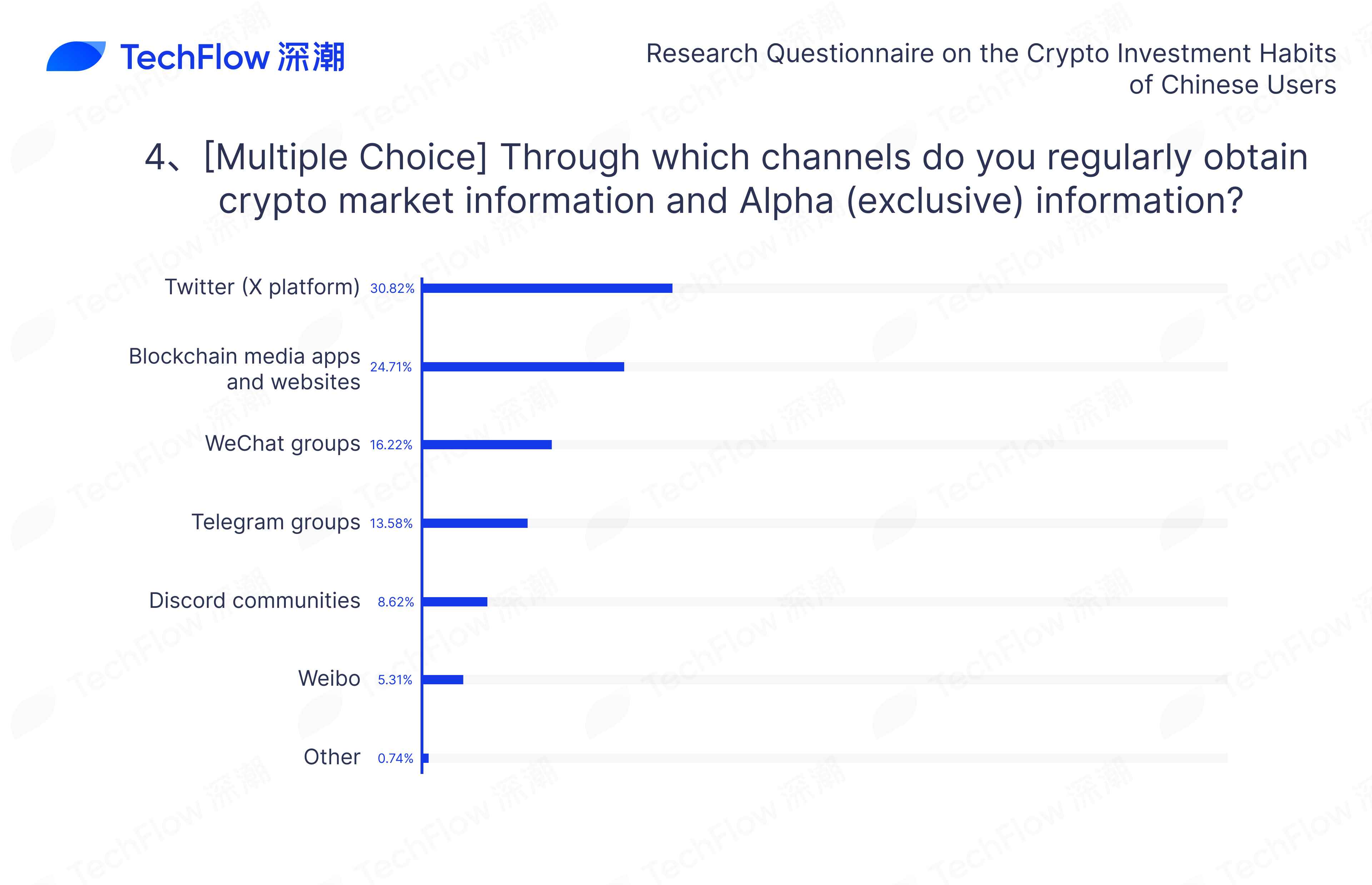

Sources for Crypto Market Information and Alpha Insights:

In this section of the survey, we examined how respondents acquire information and Alpha insights about the cryptocurrency market. This was a multiple-choice question, allowing each respondent to select several options. Here's a breakdown of the responses:

Overall, Twitter (now X platform) emerges as the principal channel through which respondents gather information and Alpha insights about the cryptocurrency market, chosen by 87.17% of participants. Blockchain media apps and websites also play a significant role, reflecting a substantial preference among respondents.

Additionally, community-based channels such as WeChat groups, Telegram communities, and Discord servers also hold significant positions, ranked third, fourth, and fifth respectively.

5. Most Respected Crypto VCs:

In this part of the survey, we collected data on the crypto venture capitals (VCs) that respondents respect the most. This question was optional, and interested respondents could mention the VCs they either support or view critically. Based on the frequency of mentions in the feedback, we created a word cloud to visually represent the most respected crypto VCs.

6.Most Respected Chinese Crypto KOLs:

In this survey, we also collected data on the crypto KOLs (Key Opinion Leaders) most respected by respondents. This was an optional question, allowing interested participants to submit their preferences. Based on the frequency of mentions in the feedback, we created a word cloud to visually display the most respected crypto KOLs.

Word Cloud Display of Most Respected Crypto KOLs:

Respondents believe the main "contrarian KOLs" are:

It's undeniable that approval or disapproval is more about subjective inclination, and the survey results are also influenced by the channels of dissemination; everyone has their own standards, so it's best to just smile about it.

8.Cryptocurrencies Yielding the Highest Returns for Respondents:

In this survey, we collected data on the cryptocurrencies that have yielded the highest returns for respondents. This was an optional question, and interested respondents could submit their answers. Based on the frequency of mentions in the feedback, we created a word cloud display.

According to the results obtained, Bitcoin, ETH, Solana, BNB, and PEPE emerged as the most frequently mentioned crypto assets, reflecting the hotspots of this market cycle, with many altcoins not performing as well as the mainstream coins.

Cryptocurrencies Yielding the Highest Returns for Respondents - Word Cloud Display:

Exchanges, as the main battlefields for trading, play a crucial role in the crypto market. Centralized exchanges (CEX), in particular, with their user-friendly interfaces and high liquidity, serve as the primary gateway for most users entering the crypto market. Understanding user preferences, feedback on services, and functional demands for centralized exchanges can help better identify the pain points and needs users encounter during trading, continuously driving the development of more comprehensive, efficient, and secure trading services.

Most Frequently Used Centralized Exchanges by Respondents:

In this survey, we collected detailed statistics on the centralized exchanges most frequently used by respondents. This question allowed each respondent to select up to three centralized exchanges, and the distribution of choices is as follows:

Overall, Binance is the most frequently used centralized exchange among respondents, with an impressive 96.72% selecting it. This reflects Binance's strong influence and user base in the Chinese-speaking crypto market. As one of the world's largest digital asset trading platforms, Binance offers a wide range of trading pairs, low transaction fees, and diverse financial products, making it the preferred platform for investors to enter and participate in the crypto market.

Following closely is OKX, selected by 83.53% of respondents, which is also a popular exchange among the Chinese-speaking community.

Beyond the two leading exchanges, Gate.io and Bitget also perform well compared to other exchanges.

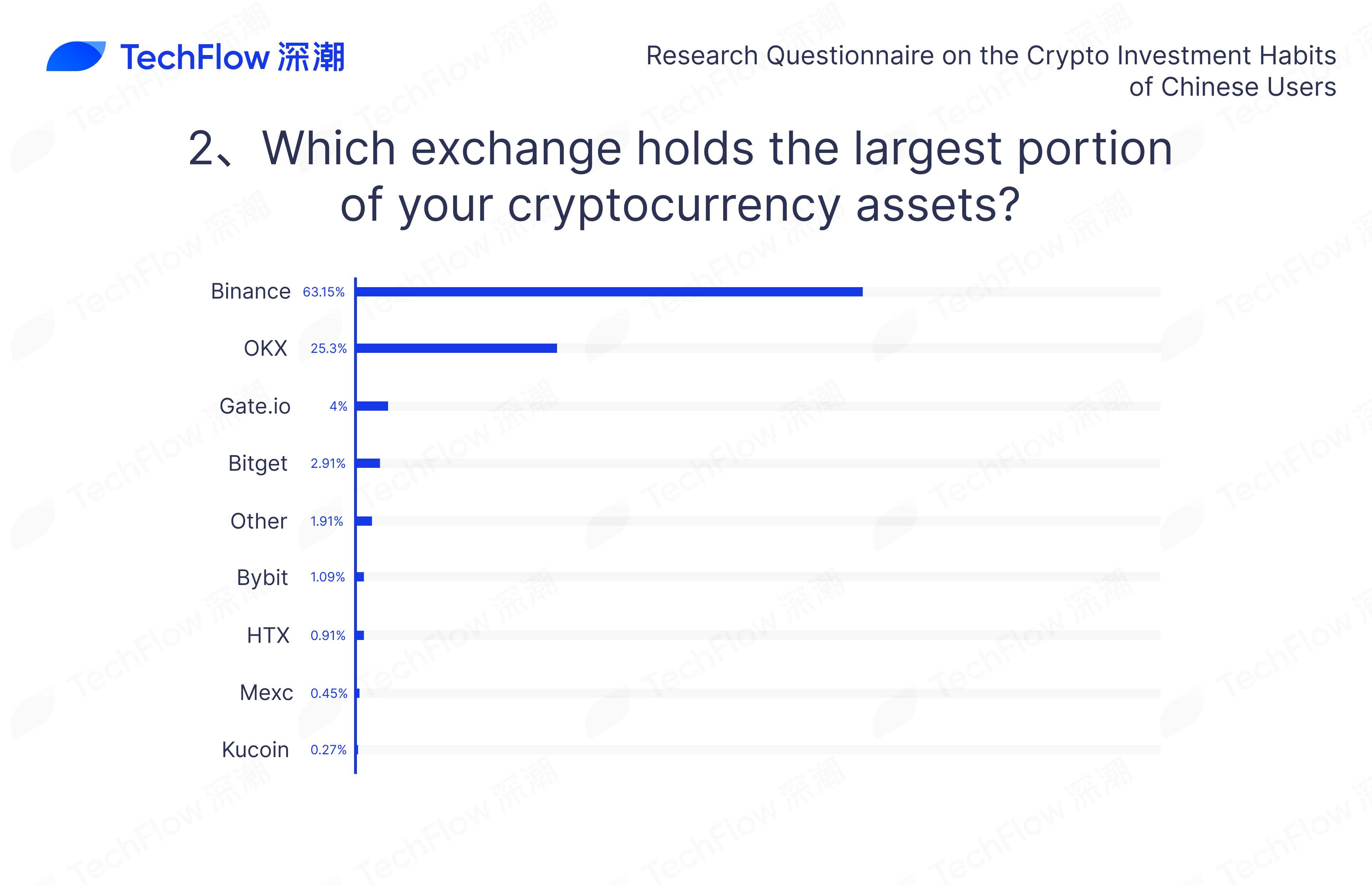

Exchange Where Respondents Hold the Largest Crypto Asset Positions:

This survey also detailed which exchanges respondents store their largest crypto asset positions in, aiming to gauge the security trust and market recognition of exchanges among users. The data shows a clear trend of concentration.

Specifically, Binance stands out, with 63.15% of respondents storing their largest positions there, indicating a high market share and trust level, with a considerable number of loyal users.

Following Binance, OKX also hosts significant positions for many respondents, with 25.30% storing their largest holdings there.

Other exchanges like Gate.io, Bitget, and Bybit, although having smaller user percentages, still maintain specific user bases.

The Exchange Where Respondents Earned the Most Money:

In this survey, we meticulously gathered data on the exchanges where respondents have made the most money, aiming to gauge the profitability that exchanges have brought to their users. The data again shows a significant concentration trend.

Specifically, Binance emerged as the exchange where most respondents have earned the most, with 60.69% reporting their highest profits there. This indicates that Binance not only holds a dominant position in market share but also offers substantial profit opportunities to its users.

OKX ranked second, with 24.11% of respondents achieving their highest earnings there. Other exchanges showed relatively weaker performance in terms of user profits: Gate.io, Bitget, Bybit, HTX, Kucoin, and Mexc had lower percentages, at 4.91%, 3.91%, 1.00%, 1.46%, 0.36%, and 0.55% respectively.

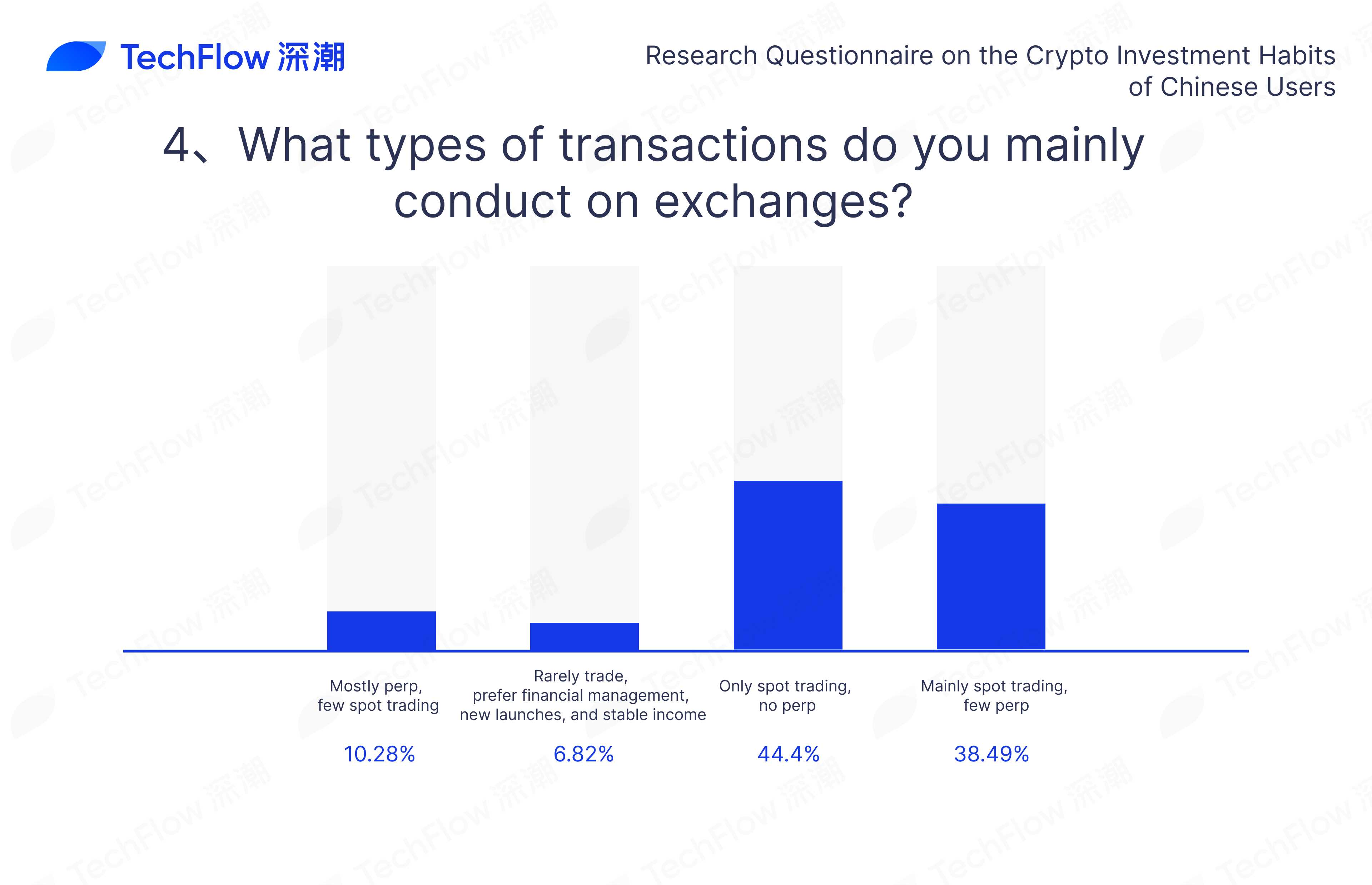

Main Activities of Respondents on Exchanges:

In this survey, we detailed the primary activities of respondents on exchanges, showing the following preferences:

"Only engage in spot trading, avoiding contracts" was chosen by 44.40% of respondents, indicating that nearly half prefer a conservative investment strategy focusing solely on the spot market to avoid the high risks associated with derivatives.

"Mainly spot trading, with a small portion of contracts" accounted for 38.49%, showing that a significant portion of users wish to secure additional gains through contract trading while maintaining a conservative approach.

"Mostly contracts, with a little spot trading" was preferred by 10.28%, indicating a preference for a high-risk, high-return trading style.

"Rarely trade, prefer stable returns through financial management and new offerings" was selected by 6.82%, leaning towards a more cautious investment strategy.

Overall, spot trading remains the primary operation for most users, accounting for over 80% (including the first two options), suggesting that a considerable number of users favor stable returns and engage less in high-risk contract trading.

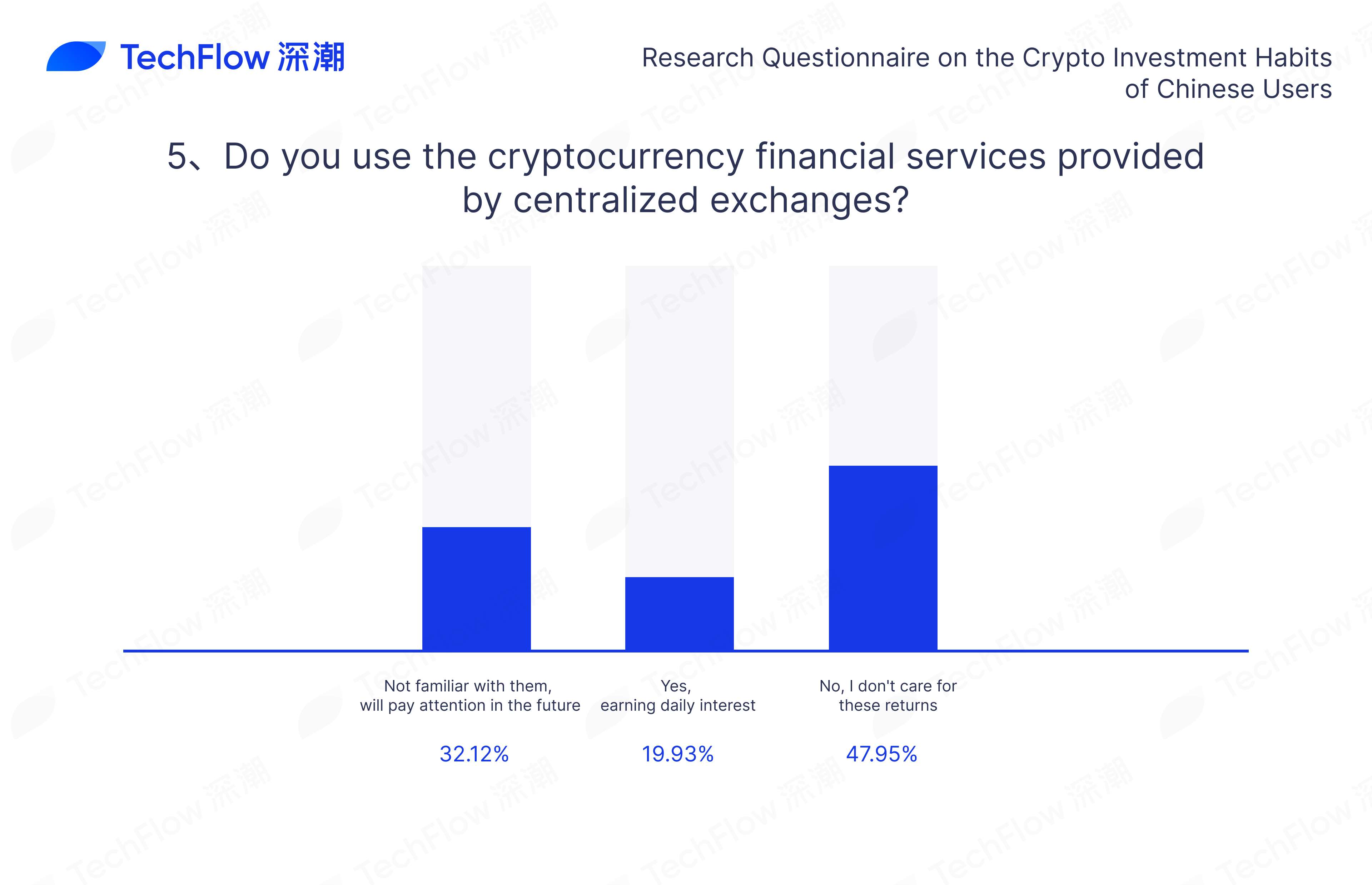

Use of Centralized Exchanges' Crypto Financial Services:

This survey also explored whether respondents utilize the financial services offered by centralized exchanges. The findings were as follows:

47.95% of respondents indicated that they do not use these services, expressing that the returns are too low to be of interest. This shows that nearly half of the respondents find the yield from exchange financial services insufficient to attract their participation.

32.12% of respondents stated that they are not very familiar with these services but would pay attention in the future. This group is currently less informed about financial services but might consider using them later. Exchanges could attract these users by enhancing their promotions and educational efforts.

19.93% of respondents reported actively using the financial services offered by exchanges, describing their participation as "collecting a salary every day." These users engage with the financial services to receive passive income on a daily basis.

Participation in Exchange Marketing Activities:

This part of the survey detailed participants' involvement in various marketing activities offered by exchanges. This was a multiple-choice question, allowing respondents to select several options. Here's a breakdown of the responses:

Overall, the participation in exchange marketing activities showed a relatively even distribution.

The option for "New Coin Listings/Initial Exchange Offerings (IEOs)" had the highest participation rate, with 57.53% of respondents selecting it. This indicates a significant interest among users in emerging projects and a willingness to engage with newly listed cryptocurrencies and investment opportunities, hoping to gain potential returns from early involvement.

Close behind were "Mining Activities" and "Airdrop Events," with very close participation rates, differing by only 0.18%. Moreover, "Sign-up and Referral Bonuses" also recorded a high participation rate, while other marketing strategies by exchanges were less popular.

A notable portion of respondents, 16.01%, indicated that they do not participate in any such activities, highlighting a segment of the community that prefers to stay clear of promotional engagements.

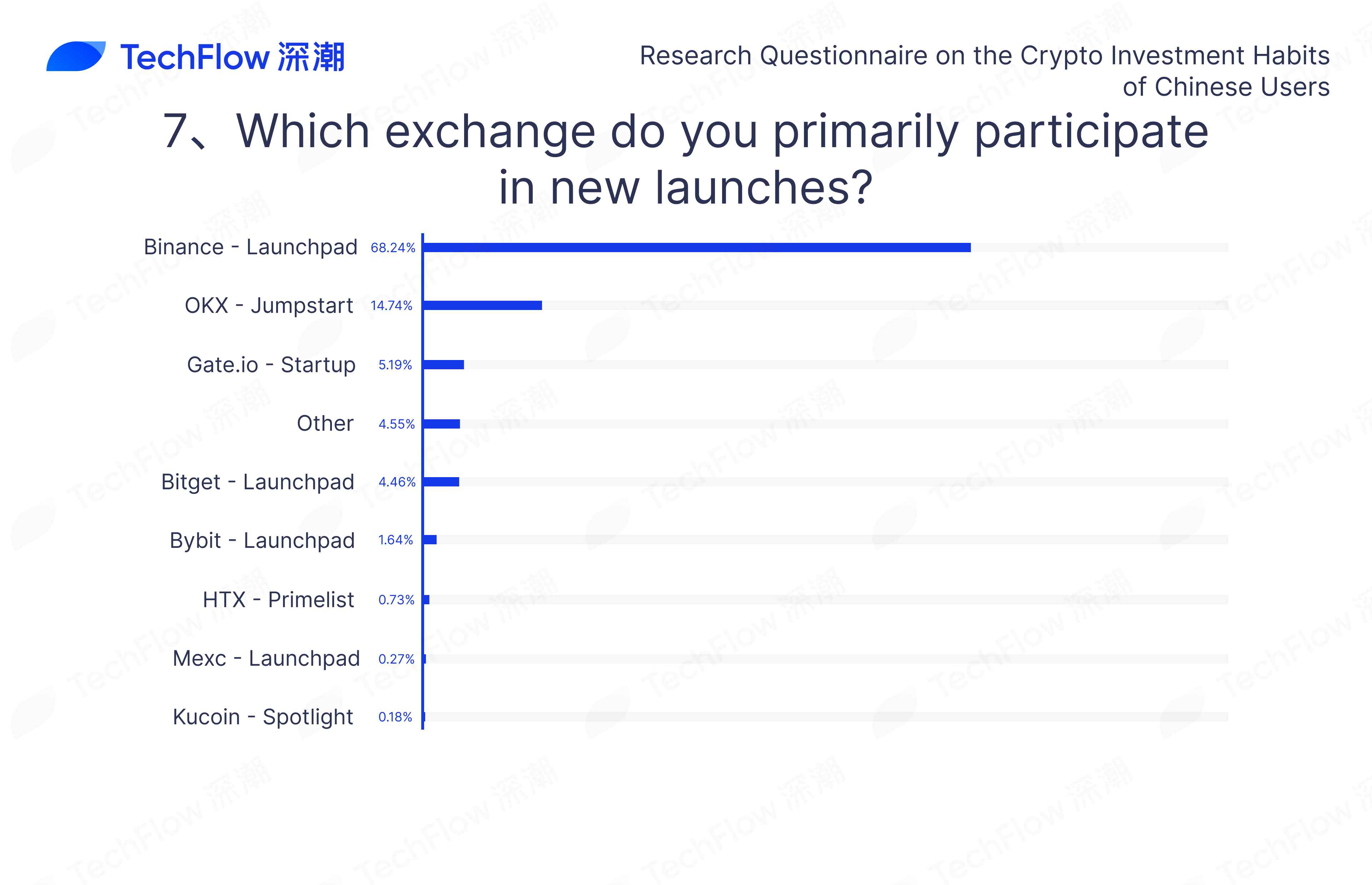

Participation in Exchange Launch Events:

This survey section gathered data on how respondents participate in new project launches through various exchange platforms:

68.24% of respondents use Binance's Launchpad platform. This shows that Binance's Launchpad is overwhelmingly the leading choice for users looking to participate in new project launches, demonstrating its dominance in this area.

14.74% of respondents participate through OKX's Jumpstart platform. Although there is a significant gap compared to Binance, OKX still maintains a slight advantage over other exchanges, which only capture a small share of the market.

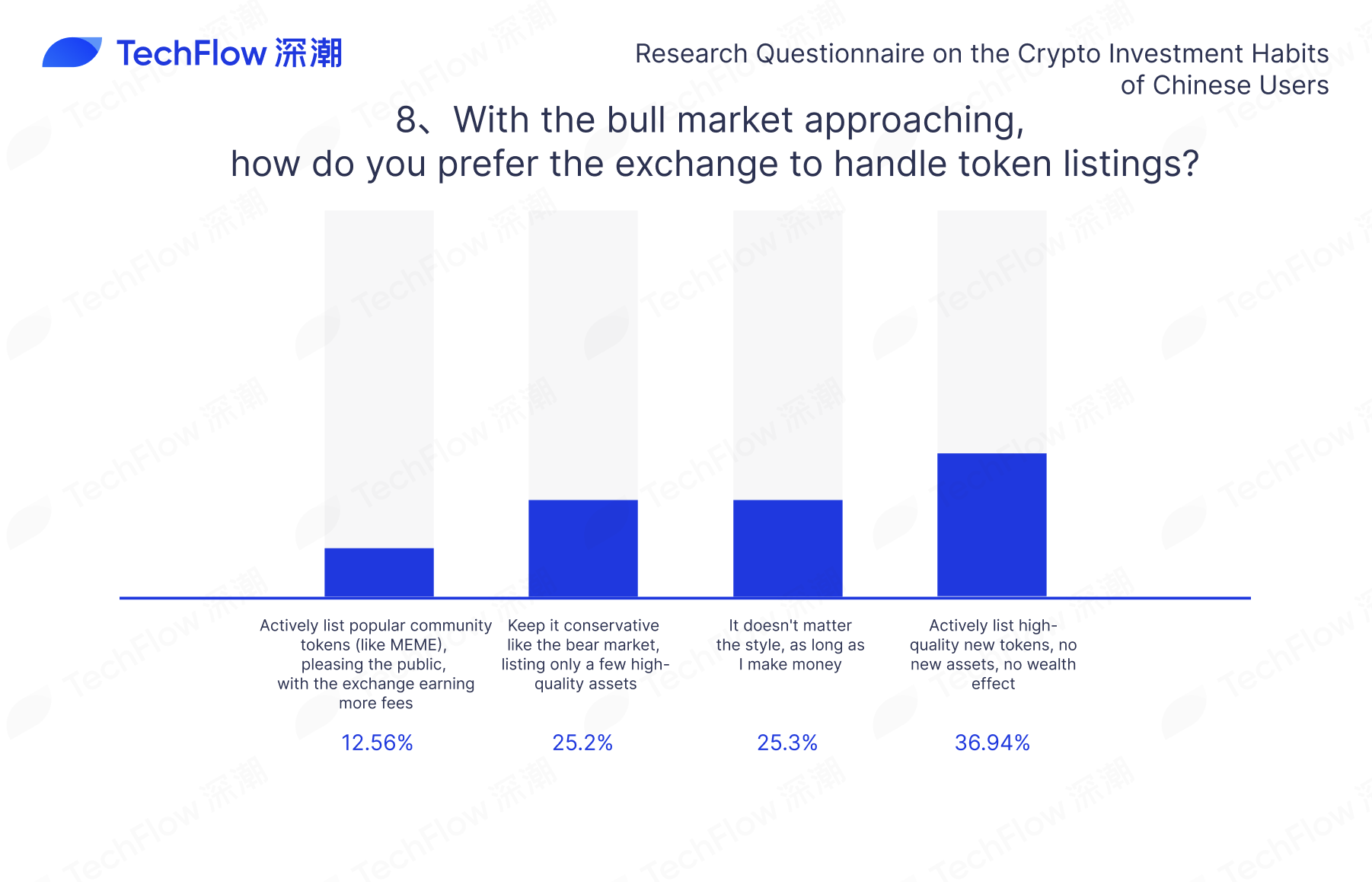

Preferred Exchange Listing Styles:

In this part of the survey, respondents provided their preferences regarding the listing styles of exchanges:

36.94% of respondents prefer exchanges that: Proactively list quality new coins. These users want exchanges to actively seek out and list new, high-quality projects to meet their investment needs in emerging assets.

25.30% of respondents are indifferent to the style as long as it is profitable: Whatever the style, as long as I make money. These participants focus more on the results in terms of profitability rather than the specific coin listing strategies of the exchanges.

25.20% prefer a conservative approach similar to bear market conditions: Restrained and quality-focused, opting to list only a few high-quality assets. These users value the quality of assets more than the increase in their number.

12.56% like exchanges that: Actively list popular community-driven coins (like MEME tokens), which are popular among the masses and help the exchange earn more in transaction fees. This group wishes for exchanges to capture market trends actively, aiming for a win-win situation for both users and the exchanges.

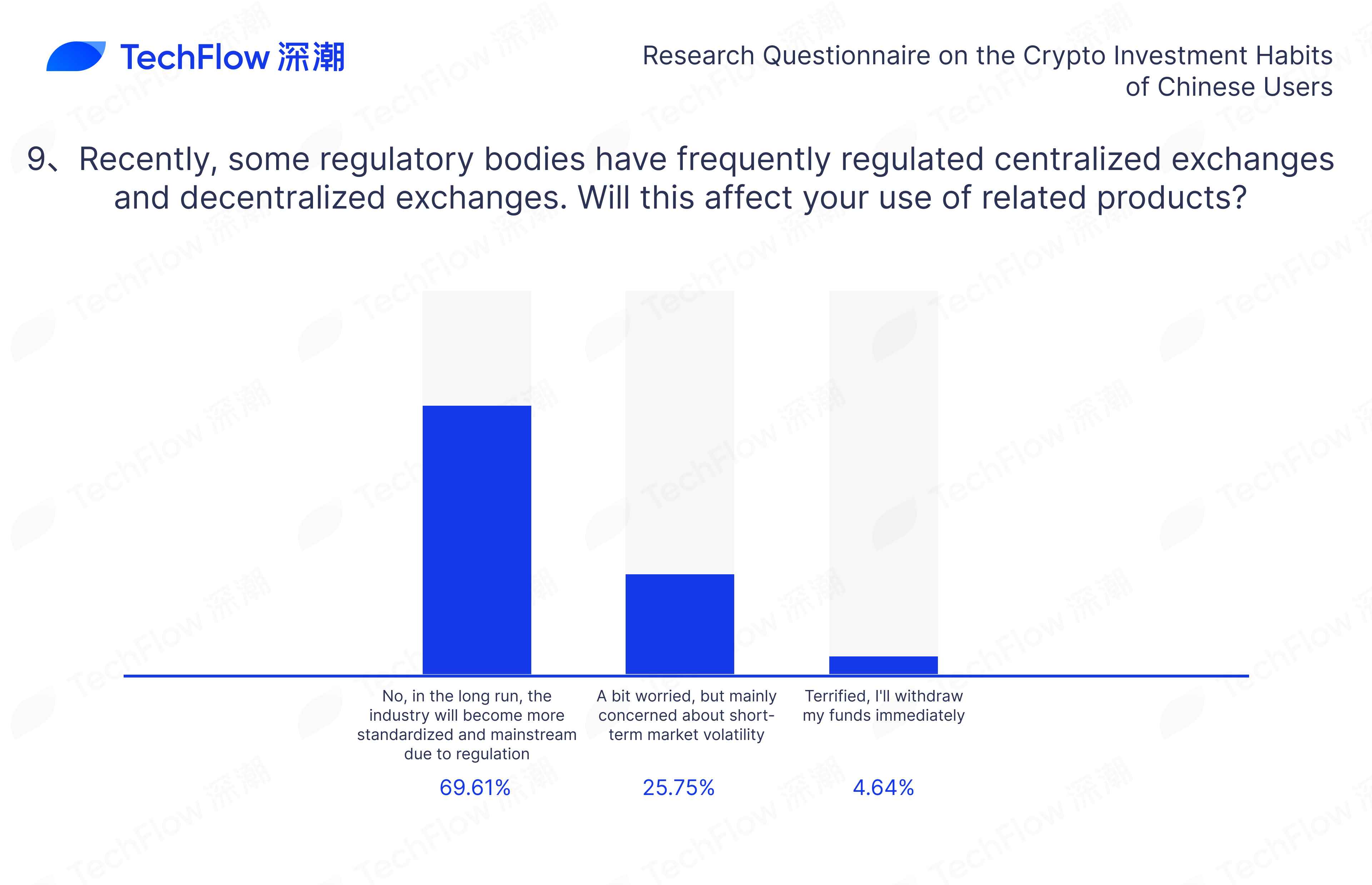

Respondents' Sentiments Towards Exchange Regulation:

In this survey, we gathered detailed insights into respondents' attitudes towards regulatory actions impacting exchanges:

A majority of respondents (69.61%) stated that regulatory factors do not influence their preferences for using certain exchanges. This indicates that investors are becoming increasingly desensitized to government regulatory actions.

25.75% of respondents maintain a cautious stance towards regulation, primarily concerned about short-term market fluctuations that might arise from such actions.

Only 4.64% of respondents express significant fear and distrust towards regulations, preferring to immediately withdraw their assets and exit the platform in response to regulatory news.

Beyond basic demographics such as gender, age, and education, this study aims to delve deeper into the lives of the Mandarin-speaking crypto community. By collecting and analyzing data on respondents' market anxiety, crypto idols, faith in Web3, and considerations about exiting the crypto space, we aim to provide stakeholders with a richer and more nuanced perspective, thereby showcasing the diversity and complexity of the Mandarin-speaking community.

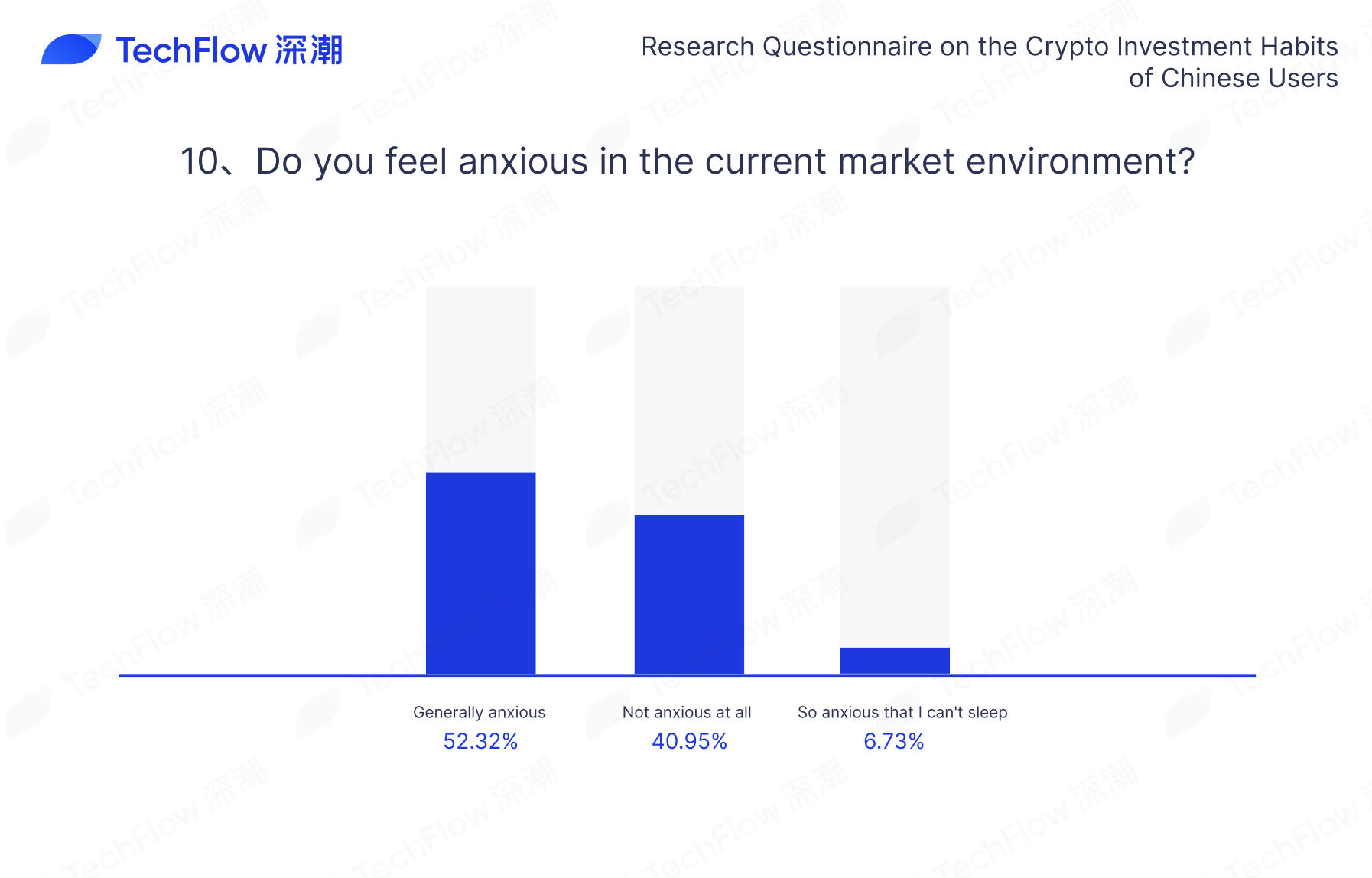

Respondents' Anxiety about the Current Market Environment:

In this survey, we gathered detailed insights into respondents' levels of anxiety about the current market environment:

A significant portion of respondents, 52.32%, report feeling generally anxious. This suggests that more than half of the participants experience some level of anxiety, though it remains manageable and does not severely impact their daily lives.

40.95% of respondents feel no anxiety at all, indicating a strong capacity to withstand market pressures and adapt effectively.

A smaller fraction, 6.73%, report anxiety severe enough to disrupt their sleep.

Overall, while the current market conditions do induce varying levels of anxiety among most users, the general sentiment remains within manageable bounds.

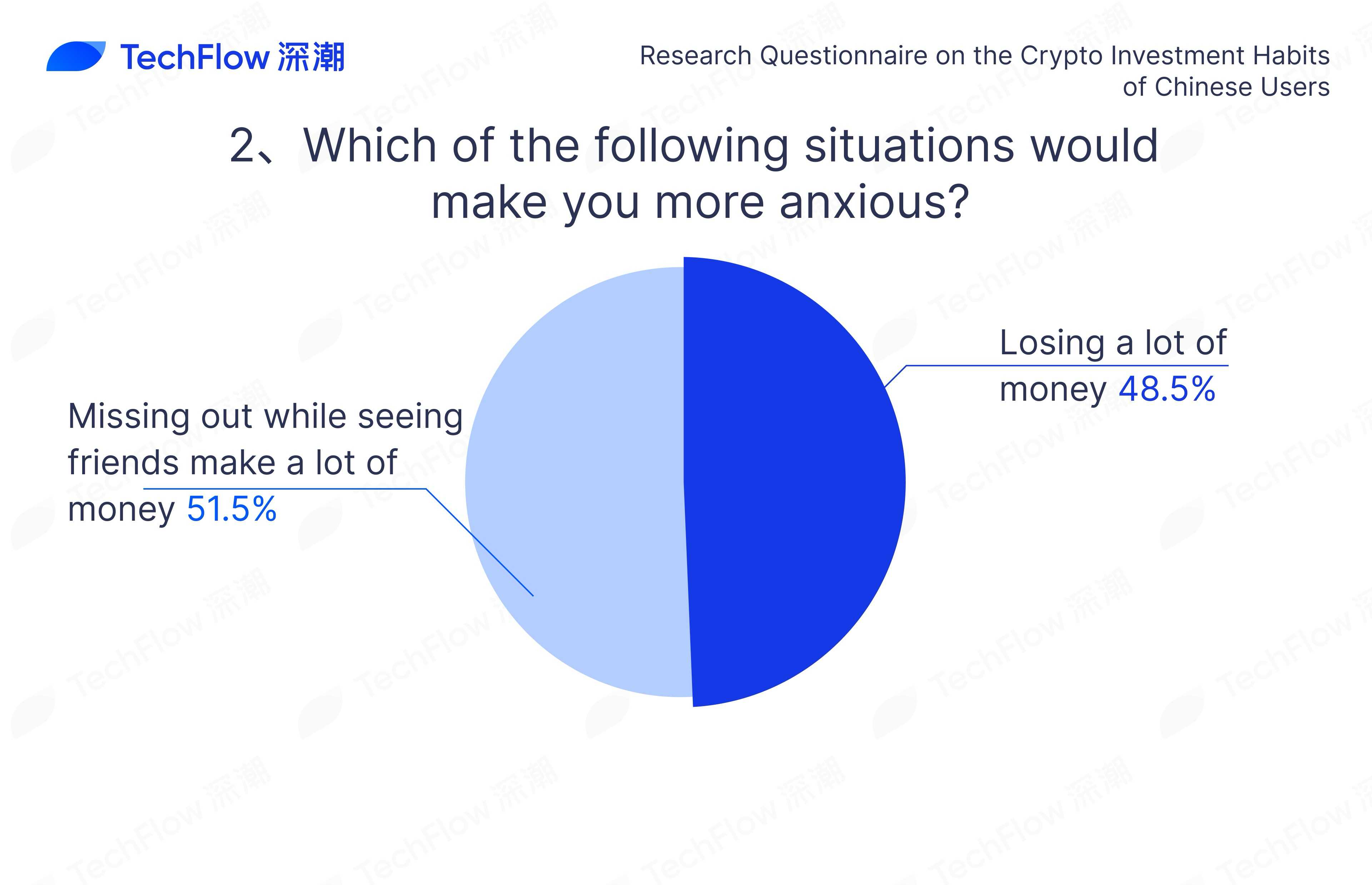

Factors Contributing to Respondents' Anxiety:

In this survey, we meticulously analyzed the factors that contribute to the respondents' anxiety:

51.50% of the respondents indicated that "missing out while others profit" significantly heightens their anxiety. This suggests that the majority of users are heavily influenced by "relative gains," where social comparisons might exacerbate their anxiety.

48.50% reported that "incurring losses" increases their anxiety. This group is more concerned with their "absolute gains" and is highly sensitive to personal financial losses.

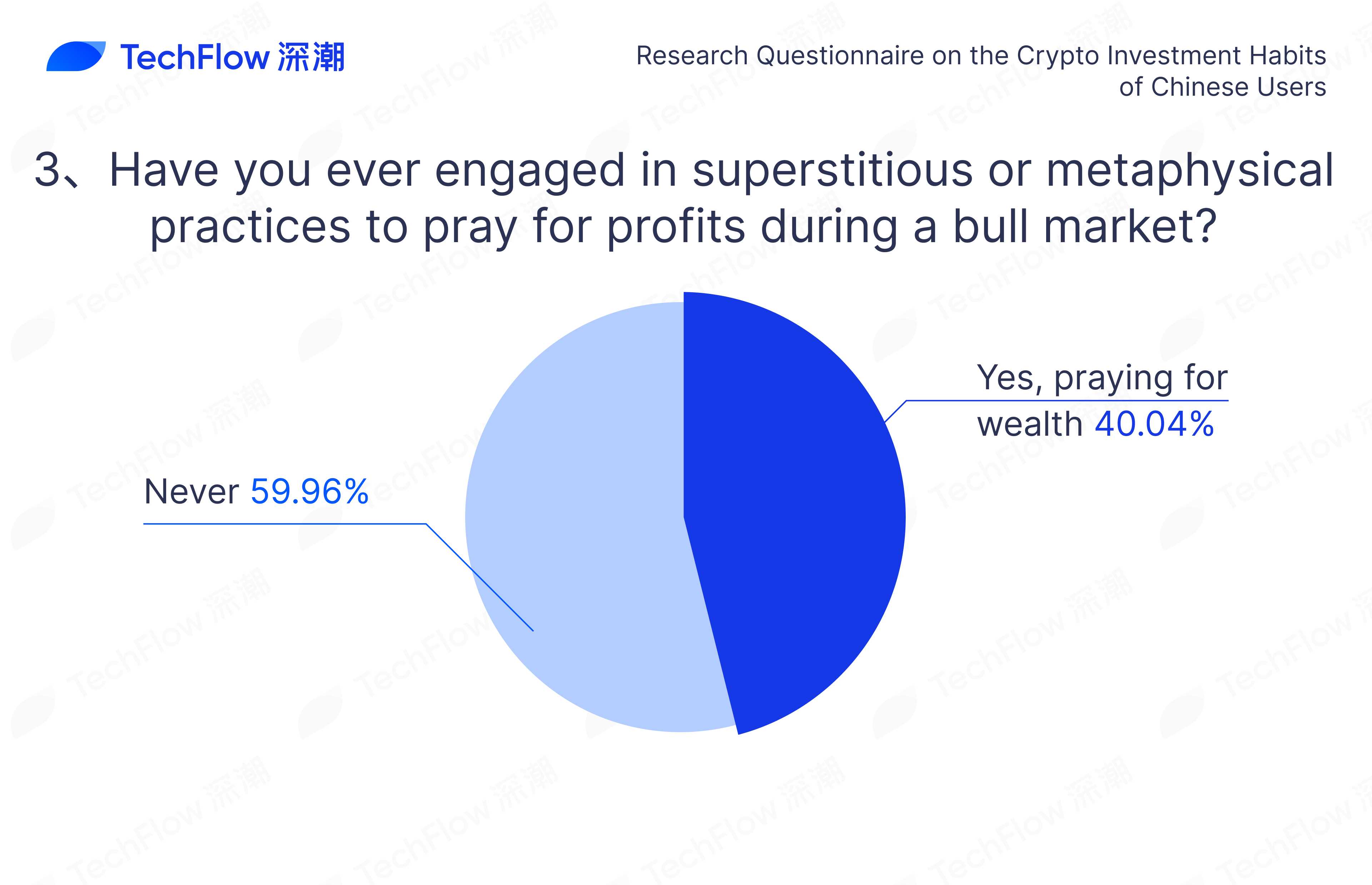

Respondents' Superstitious Tendencies:

This survey thoroughly assessed the superstitious tendencies among respondents:

59.96% of respondents have not engaged in superstitious or mystical behaviors; however, 40.04% admitted to having prayed to the god of wealth for blessings.

This disparity highlights the psychological and behavioral traits of different investors when facing market uncertainties. Some users lean towards rational analysis and objective judgment, while others may resort to superstitious or mystical behaviors as a coping mechanism.

Respondents' Crypto Idols:

In this survey, we collected data on the crypto idols admired by the respondents. This was an optional question where interested respondents could submit their answers. Based on the frequency of mentions, we created a word cloud to visually display the results.

Favorite Web3 Companies to Work For:

In this part of our survey, we asked respondents to share which Web3 companies they'd most like to work for. This was an optional question, allowing those interested to submit their preferences. We then created a word cloud to visualize the frequency of each mentioned company, highlighting the most popular choices among the participants.

In the feedback collected, exchanges emerged as the most desired workplaces for survey respondents, largely due to the perception that exchanges provide access to premium information and early financial opportunities. Binance was mentioned most frequently, with reasons for wanting to join including high salaries typical of leading exchanges, early access to potentially lucrative opportunities, its prominence in the Chinese-speaking market, the desire to work alongside top industry figures, and appealing employee perks. OKX was another popular choice among respondents, praised for its user experience and the perceived abundance of opportunities it offers to Chinese speakers.

Beyond exchanges, venture capital firms and crypto media outlets were also highly desired workplaces. The general consensus is that venture capital offers insights into market trends and direct access to talented developers and industry innovators. Working in media is seen as an opportunity to stay at the forefront of new information and develop rigorous, systematic research skills that produce high-quality content.

It's worth noting the influence of Web3's culture of remote working and the fact that many respondents are not full-time crypto traders, which might explain why many expressed a preference for entrepreneurship or becoming a KOL to monetize their knowledge, over traditional employment.

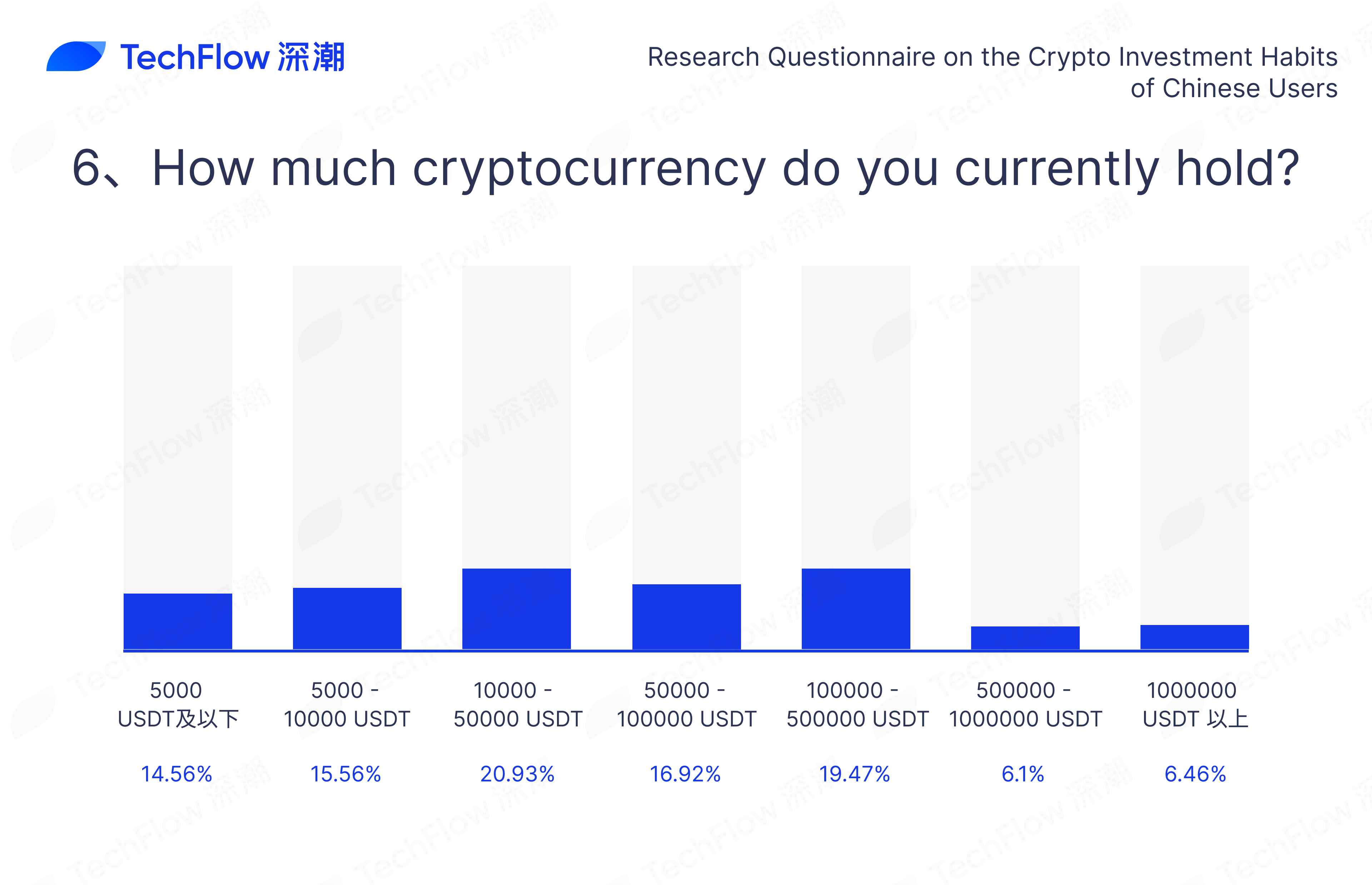

Cryptocurrency Holdings of Respondents:

The survey also detailed respondents' holdings in cryptocurrency, with the most common bracket being between $10,000 and $50,000, accounting for 20.93% of responses. This was closely followed by those holding between $100,000 and $500,000, and $50,000 to $100,000, cumulatively making up 57.32% of responses.

The least common were holdings between $500,000 and $1 million. Overall, the distribution of cryptocurrency holdings among respondents varied widely, ranging from small-scale investors to those with substantial investments.

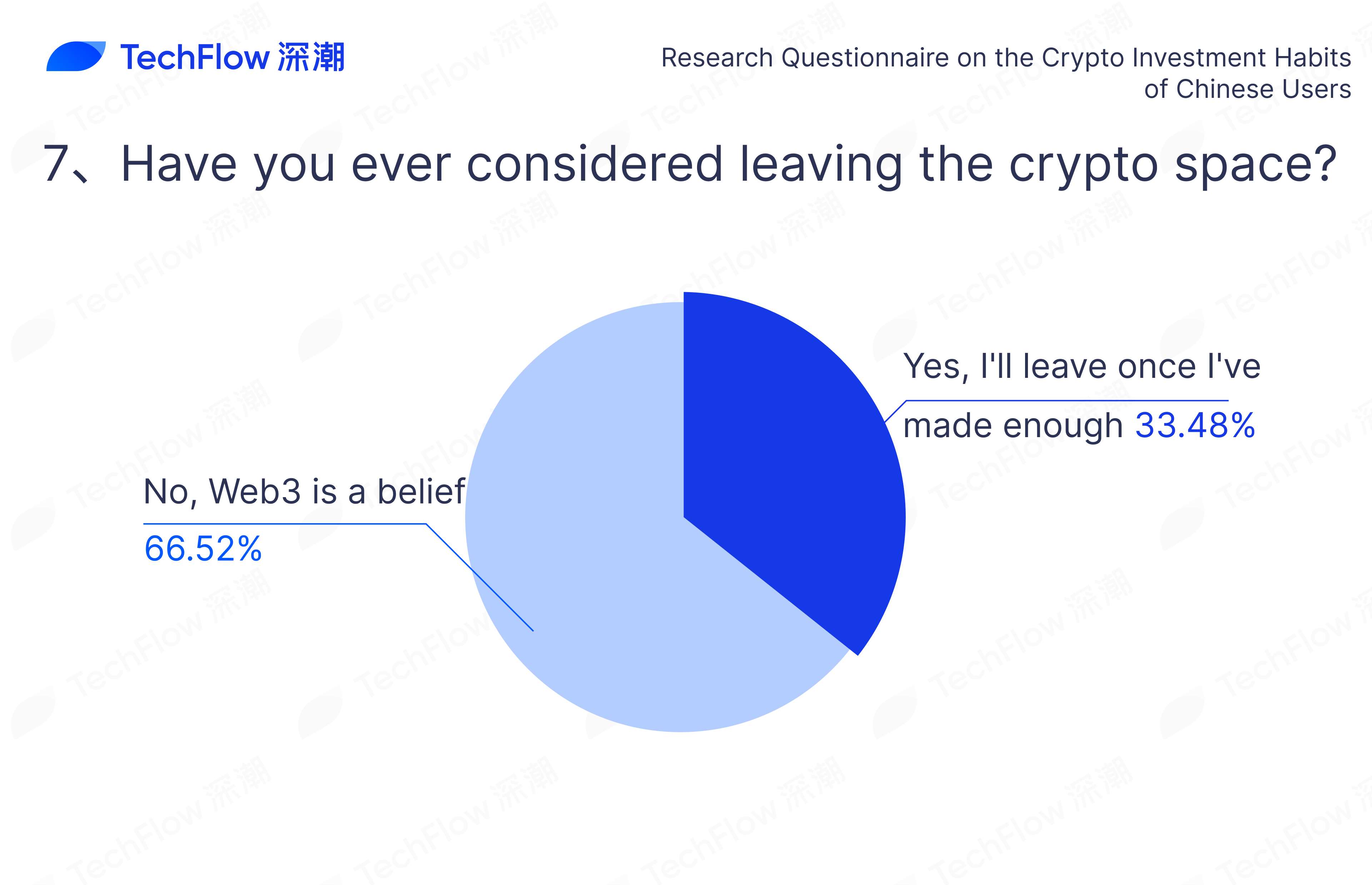

Considerations for Exiting by Respondents:

In this survey, we meticulously analyzed respondents' considerations about exiting the cryptocurrency space:

Overall, a majority of respondents (66.52%) have not considered leaving. They hold a strong belief in and commitment to Web3, viewing it as a long-term investment and a career path.

However, 33.48% of respondents admitted they have contemplated exiting the market. This group tends to focus more on achieving specific financial goals and may consider leaving once these targets are met.

This variation underscores the different psychological and behavioral traits of investors when confronted with the uncertainties of the Web3 market. Some users are filled with confidence and idealism towards Web3, while others prioritize short-term gains and practical considerations.

Respondents' Expectations for Financial Independence:

In this survey, we extensively analyzed when respondents would consider "lying flat" financially, based on the total assets they need to accumulate:

Among all options, the choice representing over ten million in total assets (A8) had the highest proportion at 34.94%; the option representing over five hundred thousand (A6.5) had the lowest at 1.55%.

Overall, respondents have varied expectations about the total assets required for financial independence, ranging from one hundred thousand to several billion. However, more than one-third (39.22%) believe they need assets exceeding one hundred million, and over two-thirds (74.16%) feel they need more than ten million to consider achieving financial independence. This highlights most users' high aspirations for financial freedom and quality of life.

Recommendation

When Blast Starts Calling Itself a Full Stack Chain Instead of an L2, “Ethereum Alignment” Gradually Becomes a Meme...

Jul 07, 2024 14:23

Korean

Insights from Korean Crypto: A Quest for Exit Liquidity

Sep 09, 2024 14:33

Decoding the Chinese Market: Market Size, Policy Analysis, VC Introduction, Influencer Mapping, and Marketing Strategy

Jun 06, 2024 18:55