The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

In 2011, when Li Xiaolai , a Chinese billionaire and Bitcoin investor, was still a teacher, he characterized Bitcoin with a phrase that translates to "This invention will turn the world upside down," marking it as the first time in human history that property rights were made inviolable through technology.

This expression might seem lofty, but by 2022 in Russia, the average person was starting to deeply understand its significance.

When financial sanctions hit hard, crippling traditional financial systems, cryptocurrencies like USDT emerged as a Plan B. These stablecoins became the new currency for international trade, and a multitude of Russian oligarchs began shifting their wealth into digital assets.

By legislation, the Russian government allowed the use of digital currencies for cross-border and exchange transactions starting from September 1, 2024, and legalized cryptocurrency mining beginning November.

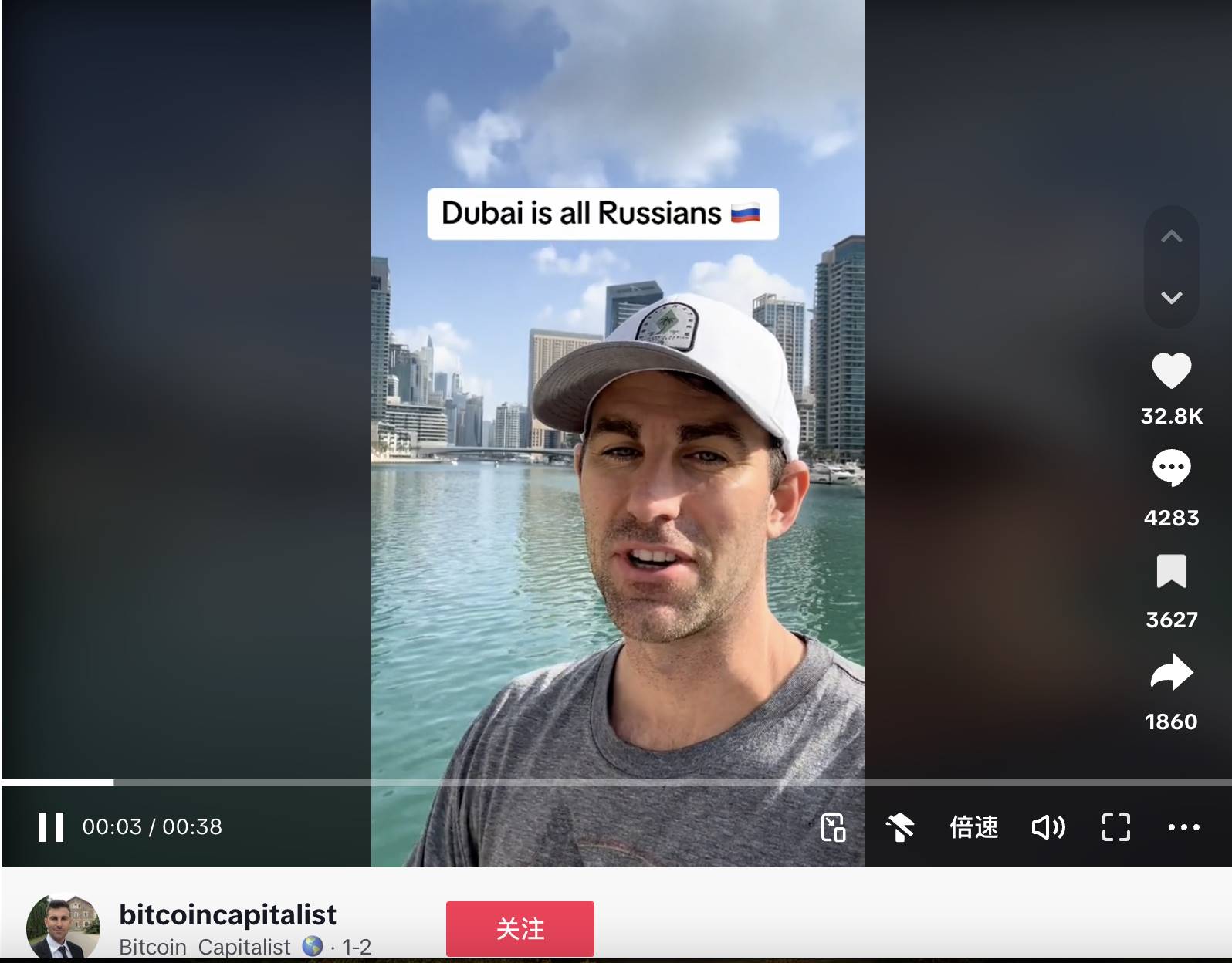

Unexpectedly, the epicenter of cryptocurrency activity in Russia today isn't Moscow—it's Dubai.

Amidst the Russo-Ukrainian War, cryptocurrency found its most fertile ground in Russia and thrived.

As early as the outbreak of the war, Reuters reported that numerous Russian tycoons were liquidating billions in cryptocurrency in Dubai, even directly purchasing local properties with Bitcoin. This was possible because the UAE hadn't joined the economic sanctions imposed by the US and EU.

When US financial sanctions forced many Western companies out of the Russian market and disrupted international banking settlements, cryptocurrencies like USDT stepped into the spotlight.

In April 2024, the US Deputy Secretary of the Treasury testified before the Senate Banking, Housing, and Urban Affairs Committee that Russia was using Tether’s USDT stablecoin to circumvent economic sanctions, an assertion that resonated even among Chinese merchants in Russia.

Post-conflict, with the West cutting off car exports to Russia, China became Russia's main car exporter. Many Chinese traders, like Lin Xiang, seized this wealth opportunity.

Typically, these traders would buy cars in Xinjiang, complete registration, settle insurance, then deregister them, and export them as used cars. These vehicles would travel from Xinjiang to land ports like Horgos, exit through places like Khorgos, reach Bishkek, the capital of Kyrgyzstan, and from there, due to a customs agreement with Russia, proceed to central Russian cities like Moscow or Saint Petersburg at more favorable tariffs.

For instance, China’s Li Auto L9, loved in Russia as a budget alternative to the Range Rover, saw significant sales, not in Beijing or Shanghai, but in Urumqi, Xinjiang during January and February of 2024.

The Tank 500 and Li Auto L9, selling for about 400,000 yuan in China, could fetch upwards of 9 million rubles (about 700,000 yuan) in Russia.

However, Chinese traders profiting in Russia faced a dilemma: their earnings were in rubles, which were difficult to convert to yuan due to significant exchange rate risks, hence their reluctance to hold rubles.

Some began converting rubles to USDT, or accepting payments directly in USDT, heating up the underground USDT-ruble trading market. Compared to the USD/RUB rate, the USDT/RUB exchange had about a 1% premium.

In July, Bloomberg reported that after the US expanded sanctions in June, using yuan for direct payments experienced increased freezes or delays, making trading with China seem more like a gamble. Increasing sanctions and threats of secondary sanctions led more Chinese banks to avoid facilitating payments and trade settlements with Russia.

Companies encountering issues usually found alternative payment methods, such as using cryptocurrencies or conducting transactions through former Soviet nations like Kazakhstan or Uzbekistan, though at increased costs.

At least two senior executives from major Russian metal producers revealed they had started using Tether's stablecoin and other cryptocurrencies for some cross-border transactions, primarily with Chinese customers and suppliers.

The spike in cryptocurrency usage helped Russia dodge financial sanctions, prompting the Russian government to adjust its cryptocurrency policies and promote the use of digital currencies.

On July 30, 2024, the Russian State Duma passed a law during its second and third readings, authorizing the use of digital currencies, including Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDT, for cross-border transactions and exchange trading from September 1, 2024. This marked a significant shift in Russia's stance towards cryptocurrencies.

Furthermore, Russia also passed a law that will legalize cryptocurrency mining in Russia from November, allowing Russian legal entities and individual entrepreneurs listed in the Russian Federation's Digital Development Ministry's register to engage in crypto mining.

According to Russian media Kommersant, Russia plans to establish at least two new cryptocurrency exchanges. One is planned to be based on the St. Petersburg Currency Exchange, focusing on foreign economic activities. The other is set to be established in Moscow, with the main idea of creating a stablecoin pegged to the yuan and a basket of currencies from BRICS nations.

Under financial sanctions, blockchain and cryptocurrencies have built a decentralized, relatively censorship-resistant financial infrastructure for Russians at minimal cost.

It can be said that today's Russia and cryptocurrencies have become symbiotic.

A lesser-known fact is that Russia's cryptocurrency capital is not in Moscow but in Dubai.

Here, political stability coexists with opaque legal frameworks, and sunny skies overshadow murky legalities. Buying property grants a residence visa, and there are no extradition treaties with Western countries, making Dubai the preferred destination for Russian oligarchs and the wealthy to evade sanctions and move their wealth, as well as a haven for cryptocurrency development.

As mentioned earlier, at the start of the Russo-Ukrainian War, numerous Russian oligarchs liquidated billions in cryptocurrencies in Dubai, even directly purchasing local real estate with Bitcoin, significantly driving up Dubai's property prices.

As crypto-wealthy individuals poured in, many local real estate developers in Dubai were also willing to accept cryptocurrencies as payment.

For instance, DAMAC Properties, a major luxury real estate developer in Dubai, has accepted cryptocurrencies since the beginning of the year. Emaar Properties, the developer of the world's tallest building, the Burj Khalifa, has also started accepting Bitcoin and Ethereum as payment for its properties.

In Dubai, due to the close association between real estate and cryptocurrencies, most real estate professionals have also dipped their toes into the crypto world. In Dubai's crypto circles, it's common to see real estate professionals, which has also led to the birth of several crypto projects with a Dubai flair—Web3 real estate.

Platforms like HouseLux and Directly, for instance, tokenize Dubai real estate, allowing investors to directly purchase RWA assets, effectively owning property in Dubai.

Meanwhile, a large number of Russian businesses and individuals have moved to Dubai.

Today, Russians are so ubiquitous in Dubai that many long-time residents exclaim, "The Russians have taken over Dubai."

Dubai's IFZA is one of many free zones created to attract foreign investments, and it has seen a significant influx of Russian entrepreneurs. Jochen Knecht, the Executive Director of IFZA, noted, "The number of Russian entrepreneurs and startups has increased tenfold compared to last year."

For instance, Telegram, the messaging app originated from Russia, has its headquarters in Dubai. Its founder, Pavel Durov, holds a UAE passport and often resides in Dubai.

Currently, the core of the entire TON (The Open Network) ecosystem is centered in Dubai. According to insiders, nearly all board members of the TON Foundation are Dubai residents. Moreover, The Open Platform (TOP), the most crucial development team for the TON ecosystem, is headquartered in Dubai. TOP's founder, Andrew, is also a member of the TON Foundation.

TOP has developed several key tools and projects within the TON ecosystem, including the Wallet feature in Telegram, the independent TonKeeper wallet, and Notcoin, which has attracted millions of users.

DWF, a renowned crypto market maker with Russian roots, also has one of its main bases in Dubai.

In Dubai, providing crypto-financial services to Russian elites has become a lucrative business. However, this activity has also attracted scrutiny under U.S. sanctions targeting businesses based in Dubai.

In 2023, the U.S. Treasury's Office of Foreign Assets Control (OFAC) sanctioned 22 individuals and 104 entities for assisting Russia in evading sanctions. This list included John Hanafin, founder of the Dubai-based financial company Huriya Private, who was accused of aiding Russians in transferring assets and securing citizenship investments. His Ethereum wallet, marked by OFAC, had received about $4.9 million worth of cryptocurrencies, predominantly USDT.

As regional conflicts and geopolitical tensions intensify, cryptocurrencies, often associated with the gray market, are becoming cleverly and fittingly intertwined with Russia, a nation seemingly enshrouded in a metaphorical frost.

The arrest of Telegram's founder in France is seen as part of the West's geopolitical strategy against Russia. In today's world of intensifying conflicts, cryptocurrencies are becoming intricately entwined with Russia's economic survival. Beyond physical battlefields, invisible wars are being waged on financial fronts, where Russia has become inextricably linked to cryptocurrencies

Recommendation

Opportunity Insight: A Comprehensive Overview of the L2 Movements Ecosystem Following Massive Funding

Jul 07, 2024 14:07

Liquid Restaking Token (LRT) Narrative Reignited: Seeking High-Potential Project Opportunities in the Endless Liquidity Loop

Jun 06, 2024 21:50

Korean

Korean Crypto Market Observations: The Great Liquidity Exit Feast

Oct 10, 2024 15:37