The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

The Current State of Staking

While staking (and restaking) remains a crucial narrative in the current market cycle, recent on-chain data shows a slowdown in growth, revealing a paradoxical situation in the staking ecosystem:

On one hand, staking (and restaking) aims to unlock liquidity and enable more efficient capital circulation for additional yield opportunities.

On the other hand, the increasingly lower barriers to launching new chains have led to fiercer competition for liquidity among various networks, resulting in fragmented liquidity and limited user participation.

Breaking Through the Bottleneck

How can we overcome these challenges?

Fundamentally, assets are the cornerstone of liquidity. Therefore, focusing on asset innovation might be more direct and efficient than improving interoperability.

Is it possible to create an asset that combines usability, utility, and universality – one that not only bridges major L1s and L2s horizontally but also achieves vertical integration from native assets through staking to restaking, potentially connecting DeFi and TradFi to become a true cross-domain liquidity hub?

This is indeed an ambitious vision requiring both strong technical foundation and rich ecosystem support. The community has long speculated about which major player would emerge victorious.

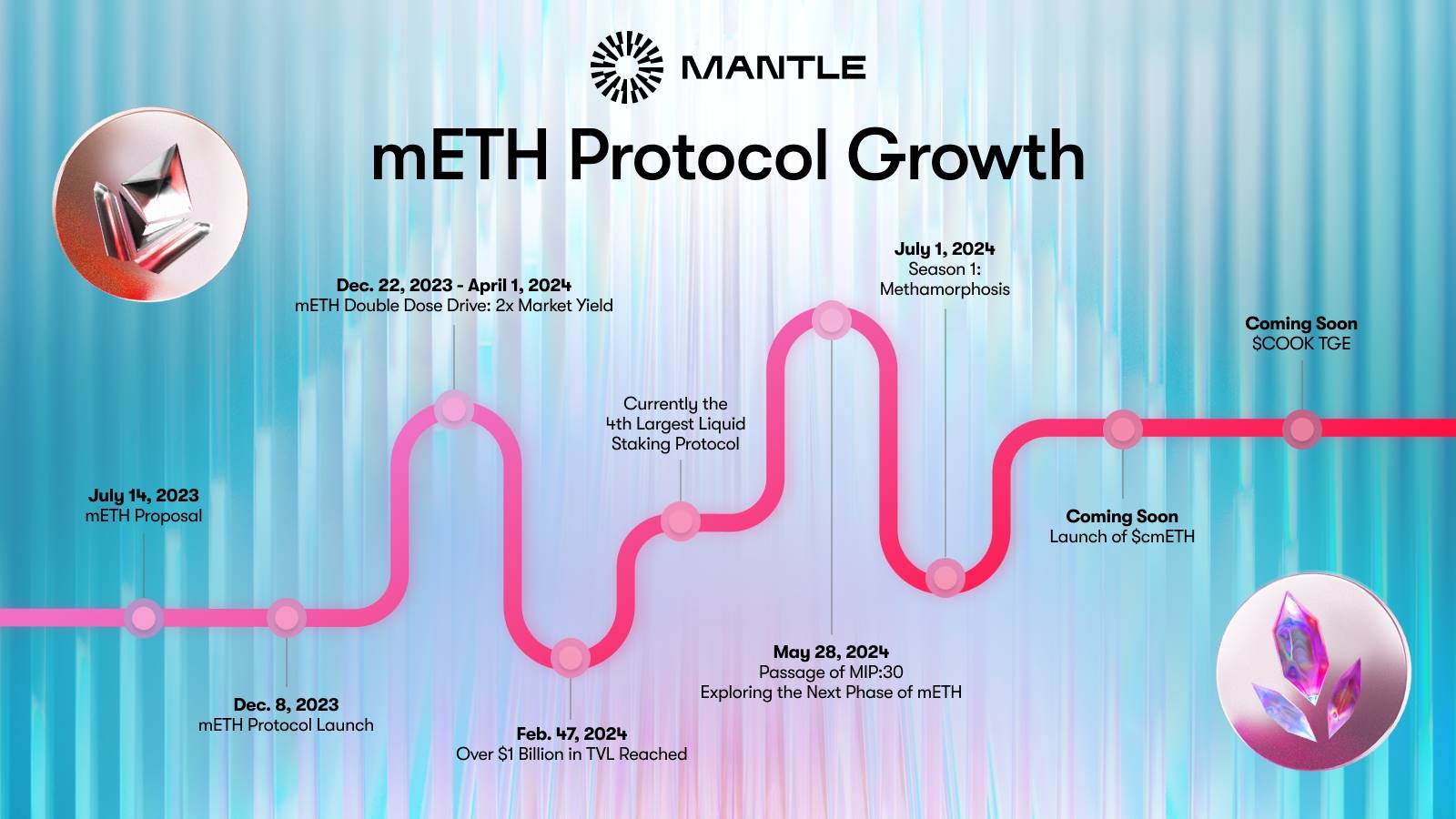

The Rise of mETH

With Bybit's official launch of cmETH on October 23rd, the community's attention has turned to the Mantle ecosystem. As Mantle's native LSD protocol, mETH has achieved rapid growth since its launch on December 4th, 2023, reaching a TVL of $1.28 billion and becoming the fourth-largest Ethereum LSD product.

The orderly progression of mETH's upgrade to cmETH, the upcoming COOK token (governance token for mETH and cmETH) TGE, and deep integration with chains like Berachain and Fuel have given the community a concrete focus for this grand vision.

This article aims to dive deep into mETH by examining its operational mechanics, core ecosystem advantages, and anticipated growth potential from upcoming milestones, while exploring the current competitive landscape of both the staking (restaking) sector and L2 ecosystem.

Source: X (formerly Twitter) @mETHProtocol

At its core, mETH is a permissionless, non-custodial ETH liquid staking protocol where users can stake ETH to receive mETH. As Mantle ecosystem's second core product, the protocol was initially named "Mantle LSP" but rebranded to mETH in August 2024 to emphasize its focus on the asset side.

Looking back to June 2023 when mETH was conceived, Ethereum had already transitioned from PoW to PoS, with Lido Finance dominating the market with a TVL of $13 billion, followed by competitors like Rocket Pool (rETH). The LSD sector was highly competitive, and mETH, just beginning discussions on the Mantle governance forum, clearly lacked first-mover advantage.

However, following thorough community governance discussions and technical preparation, the protocol officially launched for all users on December 4th, 2023, carving out an impressive growth trajectory:

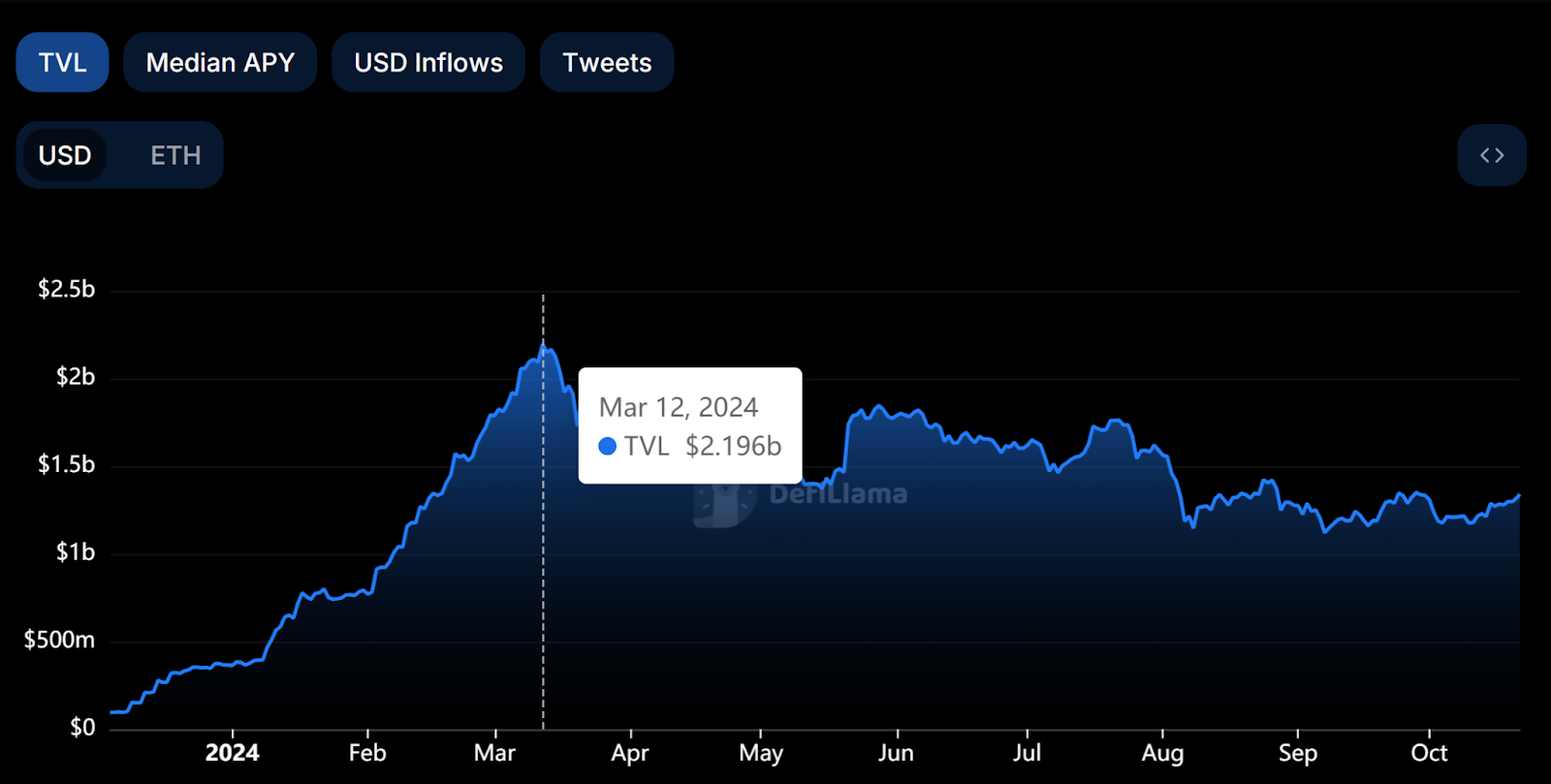

According to DeFi Llama data, within one week of launch, Mantle LSP's TVL exceeded $100 million, continuing to surge to a peak of $2.1 billion in March 2024. Currently maintaining a TVL of $1.34 billion, it ranks as Ethereum's fourth-largest LSD product. Official data shows mETH has over 8,000 wallets on Ethereum and 26,000 wallets on Mantle, demonstrating strong user adoption and activity.

Source: DeFi Llama

Technical Innovation and Security

The market doesn't favor homogeneous products without good reason. Looking at mETH's success from its foundational design, we can easily identify its distinctive features that set it apart from other LSD products.

Let's first take a brief look at how mETH operates:

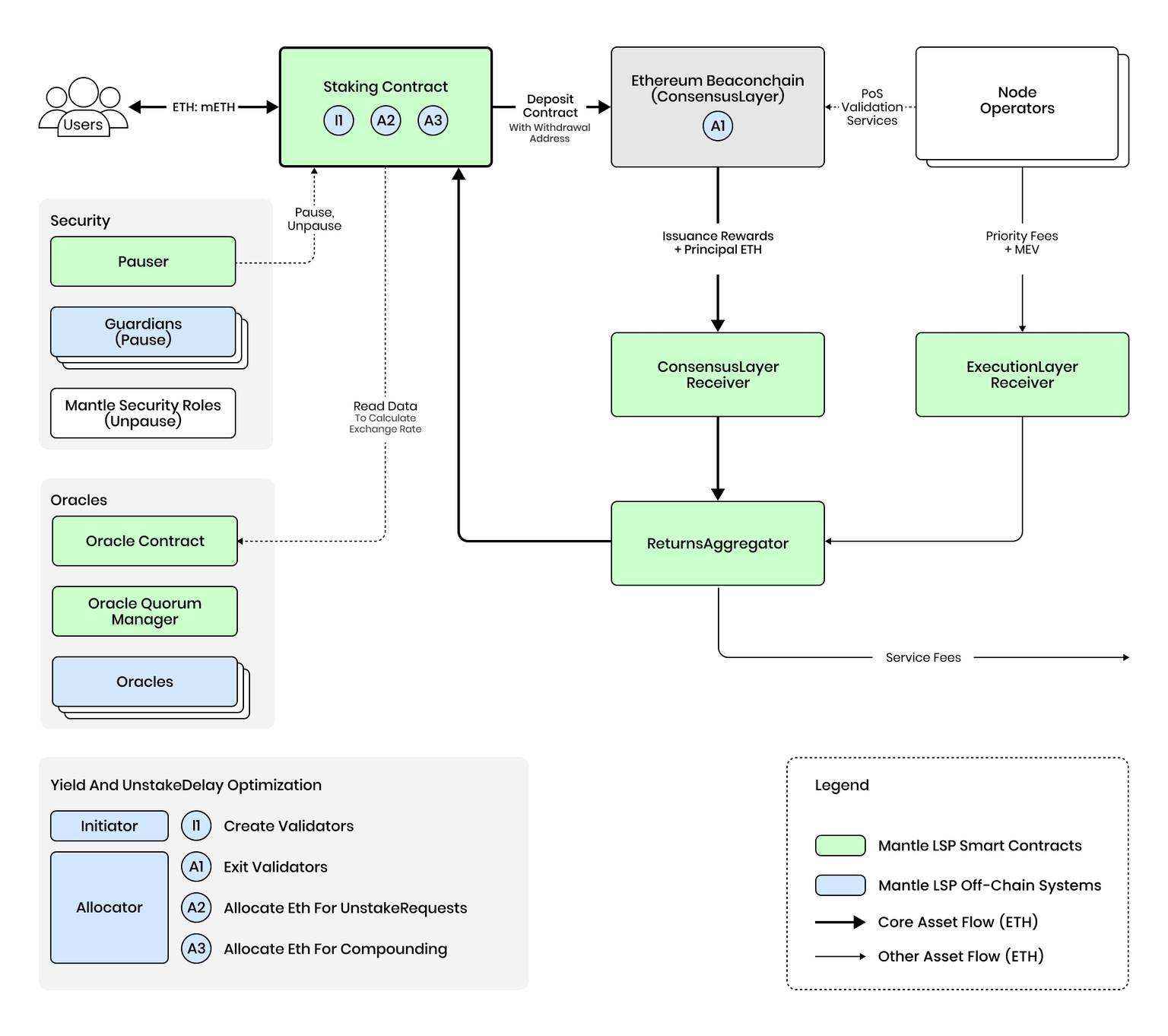

Users send ETH to the staking contract to receive mETH, with the contract handling staking, unstaking, and compounding reinvestment operations.

Oracle contracts and oracles provide essential external data, with the Oracle Quorum Manager ensuring consensus among oracles before data usage.

Node operators handle ETH staking on Ethereum and perform validation services for the network.

mETH offers diverse reward sources, including issuance rewards, staking rewards, MEV, and priority fees. All rewards are collected through Consensus Layer and Execution Layer Receivers into the Returns Aggregator and distributed to mETH holders after service fees.

Source: https://docs.mantle.xyz/meth

Security First Approach

mETH incorporates advanced design elements from Ethereum's Shanghai upgrade, where LST (Liquid Staking Tokens) can be directly redeemed for ETH. This feature ensures more stable LST-ETH price correlation, positioning mETH as a premium asset comparable to ETH. Combined with enhancements in smart contract functionality and underlying security from this upgrade, mETH has achieved improved efficiency and security.

As the first L2 ETH with native yield properties, this inherent yield-bearing characteristic has been key to mETH's distinctive competitive advantage in the LSD market: Through its permissionless ERC-20 receipt token design with value accrual, mETH automatically accumulates yields within the token itself. This natural yield-bearing asset property not only provides higher capital efficiency and holding returns but also enables seamless integration into applications and deeper incorporation into diverse ecosystem scenarios.

Security is fundamental to any DeFi protocol, and mETH is built on robust security foundations. The protocol's strong security framework stems from two key aspects. First, its permissionless and non-custodial nature ensures users maintain complete control over their assets throughout their participation, with strict management through smart contracts. Staked ETH remains within protocol-defined smart contract addresses, with core contracts enforcing reasonable boundaries and risk limitations.

Second, the protocol features a comprehensive security module design with three key roles:

The Pauser can suspend the protocol in case of anomalies

The Guardian can pause contracts preventatively

The Mantle Security Role is responsible for unpausing contracts once issues are resolved

These three security roles work in harmony to maintain protocol security.

These foundational design advantages have been the essential prerequisites and technical basis for mETH's exponential growth. Moreover, examining the impressive performance metrics more closely reveals that mETH's powerful ecosystem expansion, both horizontally and vertically, has been the primary driver behind its strong growth momentum.

mETH's vision statement captures its ambition:

"mETH aims to become the most widely adopted and capital-efficient ETH staking token."

This is not only a high-level summary of mETH's vision for itself but also, to a certain extent, clarifies its development path.

After all, whether it's achieving widespread adoption or maximizing capital efficiency, both require implementation within a rich ecosystem.

As the second largest core product in the Mantle ecosystem, mETH possesses natural advantages in deeply integrating with the Mantle ecosystem, particularly in the DeFi sector.

Deep Integration with Mantle Ecosystem

According to L2beat data, Mantle currently has a TVL of $1.45 billion, ranking among the top four L2 projects. Its ecosystem, particularly in DeFi, is well-established, with top projects like Agni Finance, INIT Capital, and Merchant Moe.

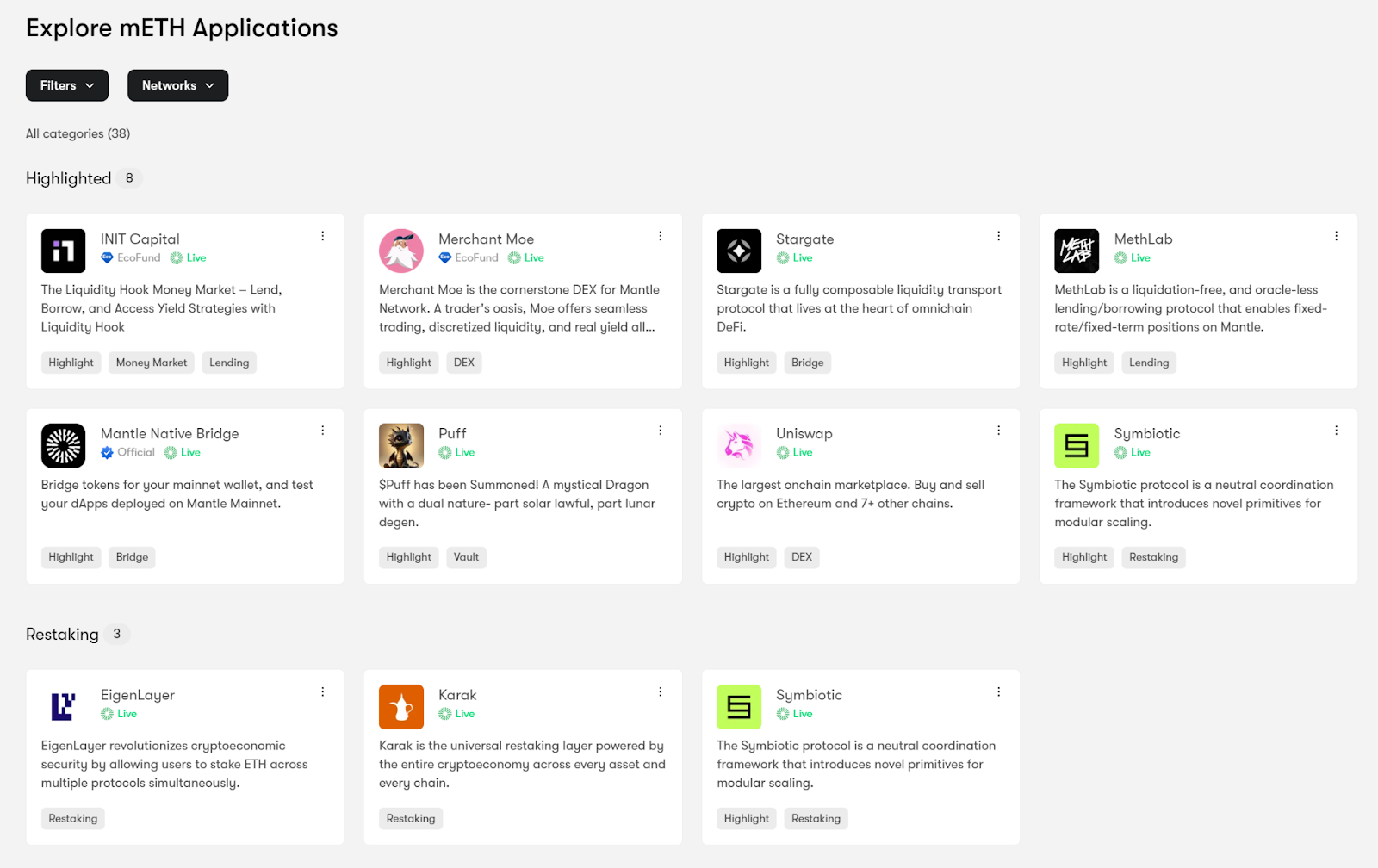

mETH has already partnered with 38 projects across Restaking, Lending, DEX, and MEME sectors, including leading protocols like Eigenlayer, Symbiotic, Karak, Zircuit, INIT Capital, and Pendle.

Notably, at the beginning of October, Mantle successfully distributed Phase 1 and Phase 2 EIGEN rewards to eligible mETH holders, totaling 2,098,636.67 tokens.

Mantle's ecosystem landscape not only provides mETH with more liquidity scenarios and diverse yield opportunities but also generates stronger demand for mETH. This healthy cyclic development model of positive feedback has further driven mETH's sustained growth and prosperity.

Source: https://meth.mantle.xyz/explore

Strategic Treasury Support:

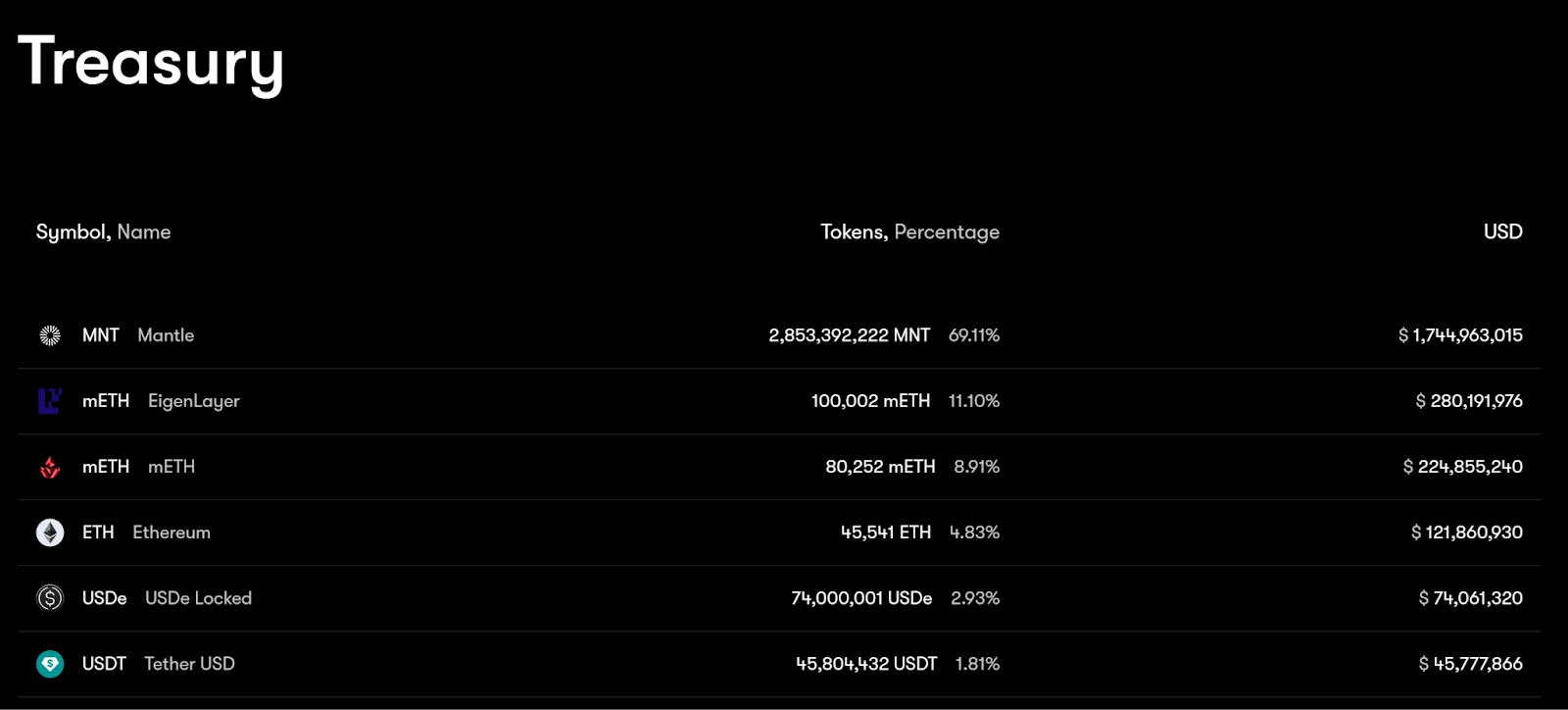

Another core competitive advantage that absolutely cannot be ignored comes from the support of Mantle's powerful treasury:

Source: https://www.mantle.xyz/

As the crypto industry's largest project treasury, which at its peak held over $5 billion in value, Mantle Treasury positions mETH as a crucial reserve asset. The strategic support from Mantle Treasury for mETH not only optimizes reward distribution, enabling mETH holders to earn more substantial returns, but also enhances protocol liquidity, providing holders with an improved trading experience.

Looking ahead, as Mantle Treasury continues to fulfill its commitment to supporting mETH's sustainable development, mETH will maintain its attractiveness in future market competition.

CeFi Expansion

mETH has established a deep partnership with Bybit, allowing users to directly stake their ETH to mETH on Bybit. Additionally, users holding mETH on Bybit can earn on-chain points, and mETH is supported as trading collateral.

As a leading centralized exchange, Bybit's support for mETH not only gives it a competitive edge in regulatory compliance but also brings more expansive CeFi narratives with greater potential: Bybit's massive user base and rich project resources further drive mETH towards its vision of "widespread adoption," bringing both incremental user growth and broader collaboration opportunities.

Source: Bybit Announcement

Cross-Chain and TradFi Integration

Leveraging its native yield properties, mETH can easily integrate with broader on-chain and off-chain applications beyond the Mantle ecosystem:

Looking ahead, mETH plans to collaborate with emerging L1/L2 networks including Avail, Fuel, and Berachain, becoming their initial LP assets to continuously deepen on-chain use cases. By using assets as the entry point to promote mETH as a "universal asset" compatible across all chains, it achieves fragmented liquidity aggregation. This positions mETH further as a universal "global liquidity hub," providing users with more efficient capital management and asset allocation solutions.

Notably, the rise of the RWA sector in the Mantle ecosystem has extended mETH's applicability into TraFi:

Previously, Mantle established a deep partnership with Ondo Finance, with USDY being widely adopted in the Mantle ecosystem (including Agni Finance, FusionX Finance, and others). This provides mETH with opportunities for further integration with RWA assets, enabling broader integration with TradFi institutions and capital. This trend will help mETH break down barriers between crypto assets and traditional finance, fostering the creation of more innovative financial products and services.

mETH's horizontal ecosystem expansion from Mantle to multi-chain, from DeFi to CeFi, and from crypto-native to traditional finance is gradually materializing. Meanwhile, with the arrival of cmETH, the vertical integration from Staking to Restaking is beginning to unfold.

The fourth quarter of 2024 marks a significant milestone with the COOK token TGE launch on October 23rd.

Source: Twitter @mETHProtocol

In June 2024, with the passing of governance proposal MIP-30, cmETH will become a new Liquid Restaking Token (LRT), marking mETH's official evolution from LSD (Liquid Staking Derivative) to LSD + LRT.

Specifically:

mETH functions as a Liquid Staking Token, where users stake ETH to receive mETH

cmETH serves as a Liquid Restaking Token, where users stake mETH to receive cmETH

Similar to mETH, cmETH will be highly composable within the Mantle ecosystem (including integrations with EigenLayer, Symbiotic, Karak, Zircuit, and more), enabling users to explore additional yield opportunities through L2s and DApps while maintaining the benefits of mETH.

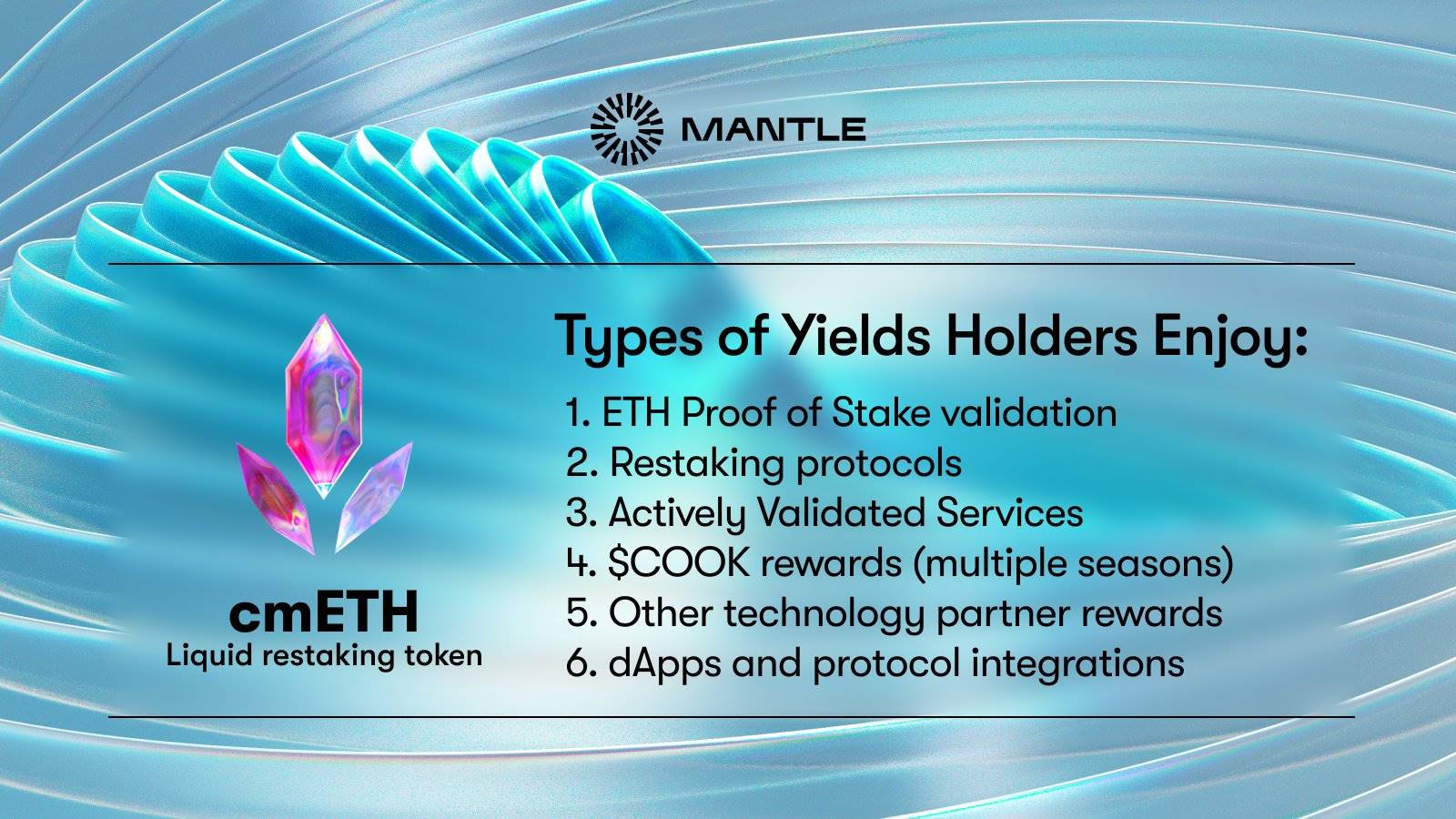

The cmETH upgrade introduces restaking capabilities to users while expanding the already diverse yield composition of mETH with additional revenue streams.

Six-Tier Reward Structure

cmETH participants can earn rewards from:

ETH Proof of Stake validation

Restaking protocols ((featuring diverse restaking options including EigenLayer, Symbiotic, and Karak))

Actively Validated Services

$COOK rewards (multiple seasons)

Other technology partner rewards

dApps and protocol integrations

Source: Twitter @mETHProtocol

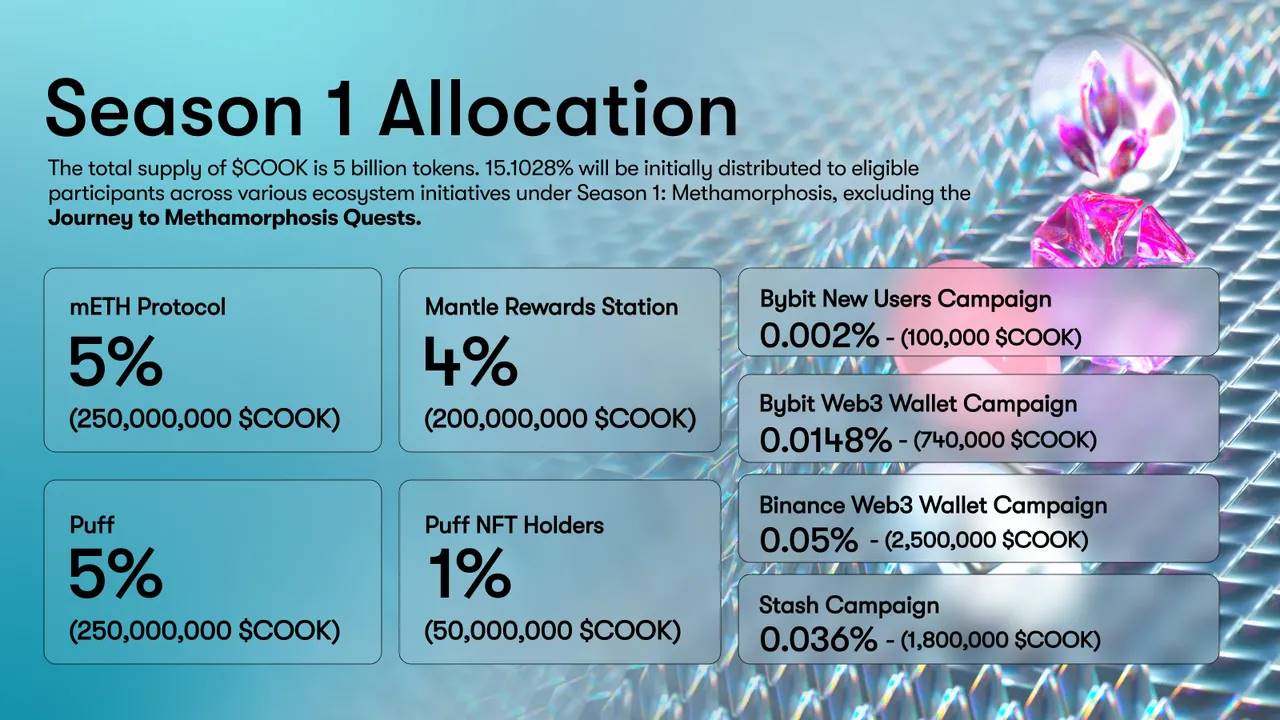

COOK token has been introduced as the new governance token for Mantle LSP. According to official documentation: the token has a total supply of 5 billion, and holders will be able to participate in ecosystem governance through voting and other mechanisms.

Notably, according to the allocation rules, 10% of COOK tokens will be allocated to the core contributor team, subject to a 1-year lock-up period with linear release over 3 years; 30% will be allocated to the Mantle Treasury; 10% will be distributed to private sale participants; and the remaining significant portion of 50% will be entirely allocated to the mETH protocol community.

The reason why COOK token's TGE is celebrated as a festival between the project and its community is largely due to COOK token's generous approach to community incentives.

Previously, to further stimulate community participation and attract broader engagement, mETH launched comprehensive community incentive campaigns.

Community Engagement and Growth

The first Methamorphosis campaign demonstrated impressive ecosystem growth over 100 days;

mETH once again leveraged its ecosystem advantages by directly announcing 23 partnerships, including renowned projects such as EigenLayer, Symbiotic, Karak, Zircuit, Pendle, and others. Users holding mETH can earn Power rewards by completing interaction tasks with these protocols. These Power points will be convertible to COOK tokens in the future - essentially, the more Powder accumulated, the more COOK tokens users will receive.

Power rewards vary across different projects, with each mETH/cmETH LP token eligible for up to 40 Powder rewards. Additionally, coinciding with the first phase of Methamorphosis, mETH launched a referral program where users can earn extra Power rewards for successfully referring friends.

5% of the total COOK token supply (250 million tokens) will be allocated to reward users participating in Season 1 of the Methamorphosis campaign.

Source: Mantle Medium

Mantle Rewards Station primarily considers MNT holders: Users can earn COOK token rewards by locking MNT tokens, with higher multipliers available for fixed-term lockups. 4% of the total COOK token supply (200 million tokens) will be allocated to reward participating users.

Users can also earn COOK rewards through participation in Mantle ecosystem's leading MEME project Puff and Puff NFTs, with 5% and 1% of the total COOK token supply respectively allocated for participant rewards. Previously, Puff announced that its holders could earn COOK tokens through burning, locking, and other mechanisms:

Users choosing to burn PUFF for COOK tokens can share in 4.5% of the total supply (225 million $COOK tokens), fully unlocked on TGE day

Users opting to lock PUFF for 6 months receive a free mETH loan and 22.5 million COOK tokens

Users who neither burn nor lock can still share 2.5 million COOK tokens

Furthermore, through partnerships with Bybit, Binance, Stash, and others, more users have become aware of and actively participated in these initiatives. From July 1st to October 9th, 2024, during these intense 100 days, mETH drove impressive on-chain growth for the Mantle ecosystem:

Mantle Network's cumulative active on-chain users increased by 67%, exceeding 4.39 million

Mantle Rewards Station's MNT locked amount grew by 125% net, surpassing 148 million

mETH TVL across Ethereum and Mantle Networks increased by 12.5%, reaching $1.21 billion

Participating users grew by 2,154%, from initial 1,600 to over 37,000 at activity conclusion

While the first phase of Methamorphosis has concluded, many community members are already anticipating the second phase.

Source: Mantle Medium

In the crypto world, the significance of TGE (Token Generation Event) launch strategies on a project's future trajectory is self-evident. Through robust on-chain growth, we can easily discern the widespread enthusiasm from both the community and users for mETH/cmETH, laying a solid foundation for the future development of both cmETH and COOK.

Certainly, in a space where many have witnessed cases of 'TGE being a project's final frenzy,' what makes mETH/cmETH different? The answer lies in its operational fundamentals: leveraging advanced underlying architecture and powerful ecosystem enablement, mETH has rapidly grown to become the fourth-largest Ethereum LSD product.

In this current cycle, characterized by increasingly pronounced liquidity fragmentation, mETH is horizontally aggregating liquidity from L1, L2, and even traditional DeFi, CeFi, and TradFi sectors. This drives its evolution into the most widely adopted and capital-efficient cross-chain asset, furthering its vision of becoming a 'universal liquidity hub' and opening up even more compelling growth potential.

As mETH initiates its vertical narrative upgrade from LSD to LSD + LRT, will cmETH, built on the same foundation, be able to quickly capture a significant share of the tens of billions in market value in the Restaking sector?

Rather than making simple historical comparisons, with the completion of the cmETH upgrade, the launch of COOK, and the achievement of multiple ecosystem milestones, the community anticipates whether mETH/cmETH can initiate its next phase of rapid growth.

Recommendation

Exploring Kontos: Simplicity Redefined, a Single Gateway to Seamless Blockchain Integration

Jul 07, 2024 14:32

JOJO Exchange: DODO founder creating the future of perpdex on BASE

Jun 06, 2024 21:37

In-Depth Analysis of BasedAI: Balancing Privacy and Efficiency in Large Language Models - The Next Bittensor in AI?

Jun 06, 2024 21:41