The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

BASE has become a popular Layer2 for gold miners due to its diverse ecological structure and active trading of MEME tokens.

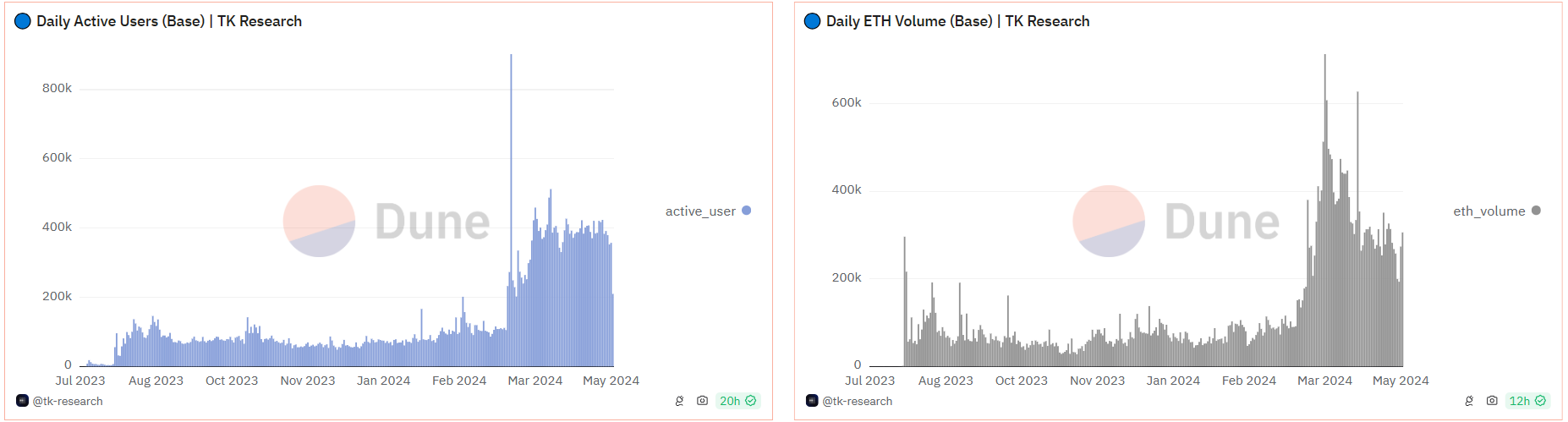

Despite the prevailing market sentiment, the BASE ecosystem has a high trading activity and plenty of daily active users. Following the Cancun upgrade, the BASE ecosystem has experienced an increase in diverse project development and sustained capital inflows, in contrast to the temporary surge in on-chain activity caused by pioneer builders and FriendTech last year.

*DAU and ETH trading volume of Base since last year*

BASE clarified at the beginning of the ecosystem construction that, unlike the others, no token was going to be issued. Many users choose to join the BASE ecosystem because its thriving ecology offers substantial profit opportunities.

From $DEGEN to $mfer, the outbreak of the BASE ecosystem is also attributed to the memecoin craze, which was inherited from the SOLANA ecosystem.

Using memecoin as a liquidity source for the influx of ecosystem funds is an effective method.

However, a long-term issue associated with the hype is that when the memecoin fades, the entire ecosystem will urgently need a new, diverse narrative to attract funds and retain users.

Some ecosystem projects and users view on-chain derivatives as a new investment opportunity. The BASE's on-chain derivative trading volume has increased over the past three months.

From the launch of the BASE mainnet, the ecosystem’s TVL and derivatives trading volume

After exploring multiple EVM chains, JOJO Exchange finally rapidly expanded the BASE ecosystem, aiming to fill the track gap and become the preferred Perpetual DEX of all traders on BASE.

JOJO Exchange is committed to on-chain derivatives and is backed by a strong technical team. With its innovative Turing-complete Hybrid liquidity model, support for multi-type asset mortgage mining, and 1000X functions, it provides new opportunities for capital growth and unique on-chain trading experiences for BASE users.

JOJO Exchange launched the mainnet in April and is actively preparing for the pre-mining event before the airdrop. At present, JOJO has established cooperation with many top-tier protocols in the BASE ecosystem, including Aerodrome and Moonwell, to promote the ecosystem's development jointly.

In this article, we will explore the layout of JOJO Exchange on BASE in depth and understand JOJO's technical innovation and unique ideas in perp dex.

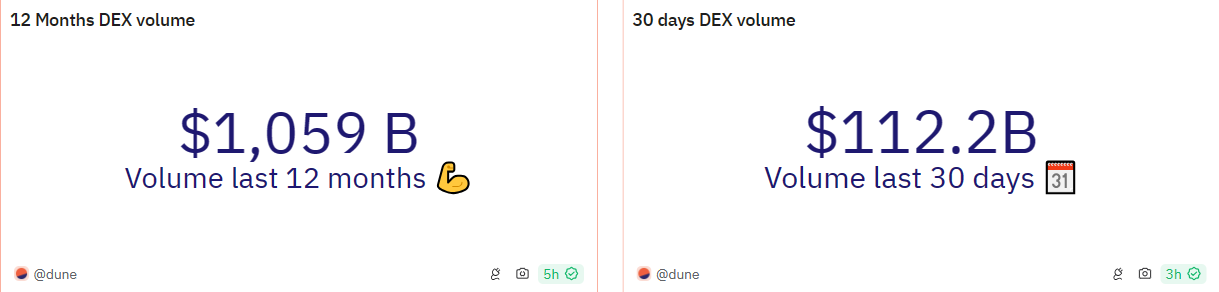

As the hub of on-chain perp trading, perpdex provides exchange services for huge funds, and mainstream protocols contribute a daily average of 2.9 billion USD in trading volume.

Mainstream DEX volume across the chain for the past 12 months and in a single month

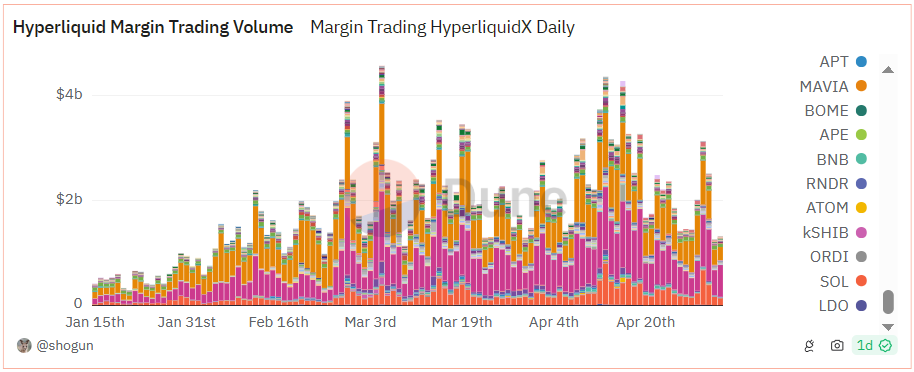

Perpdex offers futures perpetual contract trading services, catering to the high demand of on-chain users. Leading perpdex platforms like Hyperliquid often achieve a daily trading volume that exceeds the combined trading volume of mainstream DEXs.

Average daily margin trading volume on the Hyperliquid

It is evident that there is always a strong demand for Perpdex in the market. With the current activity and capital flow within the BASE ecosystem, JOJO, positioned to make a significant impact, has substantial room for growth.

As DEX becomes an indispensable infrastructure for on-chain users, it also faces a large amount of instant on-chain demand, poor liquidity, and trading efficiency easily affected by on-chain congestion and poor interaction experience. These are the real situations in the development of DEX, and the market needs a perpdex with a better user experience.

JOJO Exchange has provided its answers in response to a series of market problems and the new demands arising from them.

As a new force dedicated to Perpetual DEX, JOJO Exchange is committed to building the most liquid platform. To provide users with a better trading experience, JOJO has made some unique innovations in the liquidity layer and asset utilization direction:

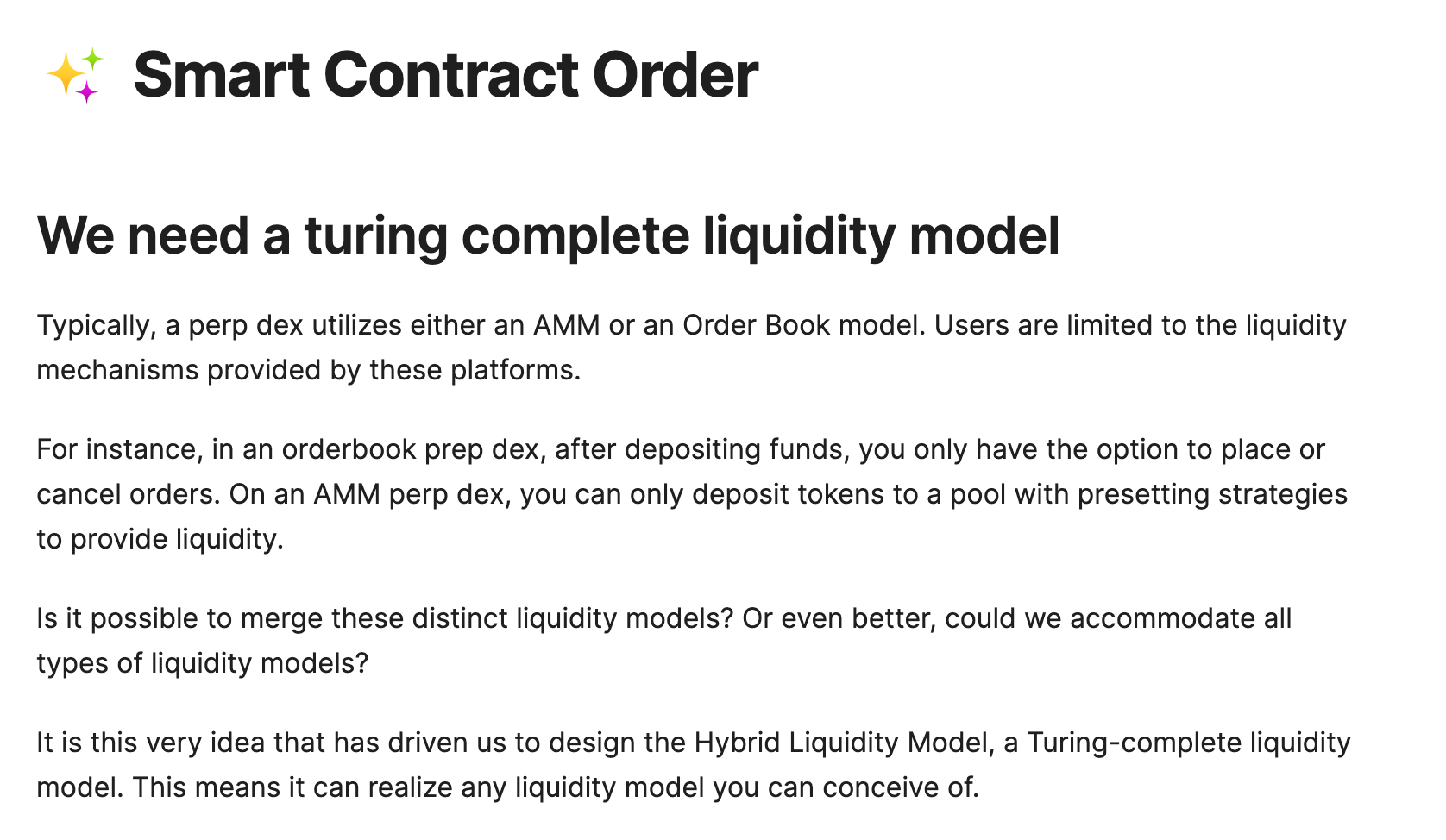

The leading DEX protocols, such as dYdX and Hyperliquid, have closed and non-expandable liquidity structures, significantly limiting the protocol's scalability and users' imagination. The main innovation of JOJO Exchange is the liquidity layer, which introduces Turing-complete smart contracts, enabling developers to embed any script into orders.

As a Maker, you can independently develop on-chain trading or arbitrage strategies, including the likes of Ethena's funding rate arbitrage and JIT (Just-In-Time liquidity), making trading flexible and efficient. By being a Taker, you can benefit from improved liquidity as order execution can make use of sophisticated strategies and customized logic to guarantee profits. In addition, JOJO provides the lowest fees in the industry: 0.03% for takers and -0.01% for makers, contributing to a superior trading experience for users. Through the Lego-like Perpdex architecture, JOJO entrusts the future of the liquidity layer to creative and actively developing users, providing JOJO and the entire Defi sector with boundless opportunities.

Multi-Asset Collateral JOJO allows users to use various types of assets as collateral. This includes BTC and ETH and various types of DeFi assets, such as LP tokens of various protocols and interest-bearing assets. When users use non-standard assets such as LP tokens as collateral, JOJO values various collateral assets through integrated price oracles.

Flexible Earn

When users deposit interest-bearing assets as collateral into the JOJO platform, they can earn JOJO platform points by taking part in trading activities. Additionally, they can pledge their margin (such as $cbETH, $mUSDC, etc.), which are already interest-bearing assets, in order to participate in the JOJO platform's token pre-mining and receive JOJO token airdrops. When participating in platform pre-mining, users don't have to worry about their mining funds being idle. They have the option to lend out the JOJO platform's stablecoin $JUSD through over-collateralization. Additionally, $JUSD can be used as a margin for perpetual contract trading and can be freely bought and sold. This achieves the purpose of maximizing returns from on-chain assets by combining original protocol interest, JOJO token rewards, and lending $JUSD for trading.

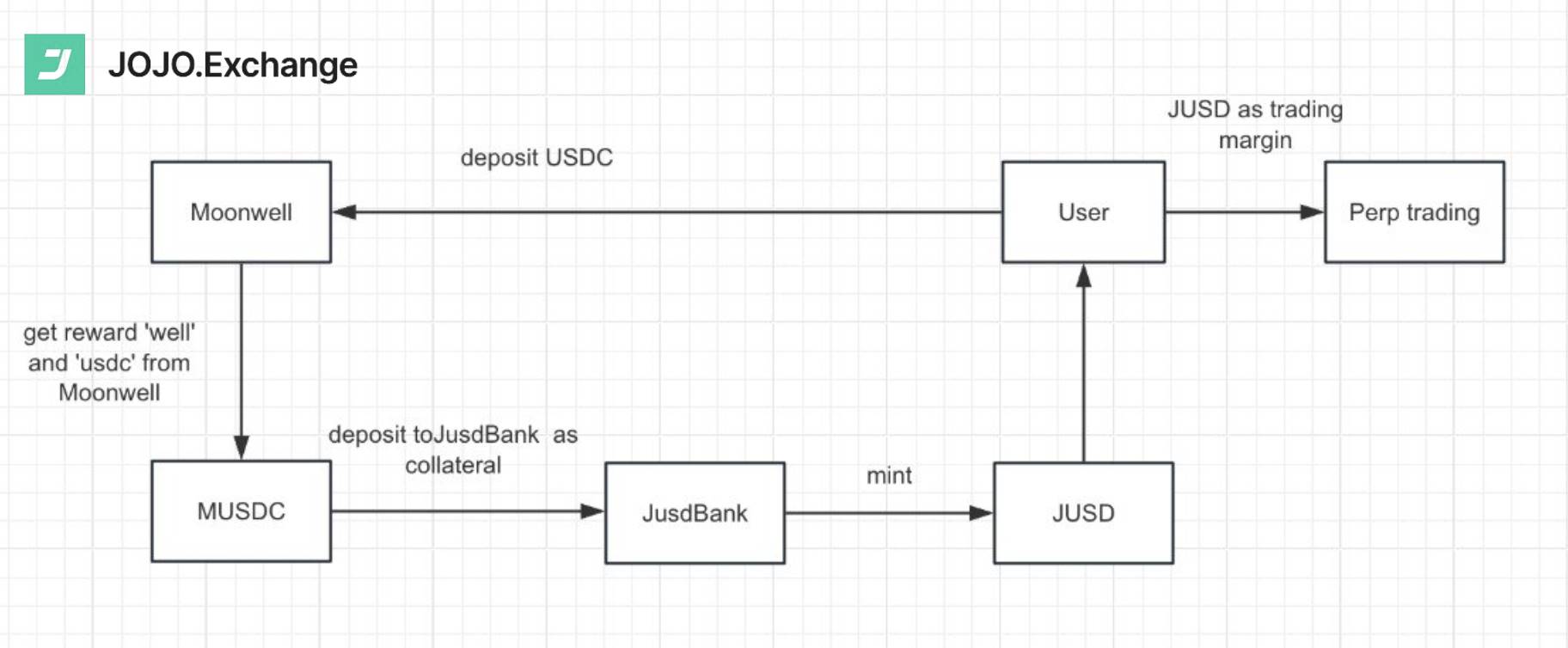

The specific operation process takes $mUSDC in the Moonwell as an example:

User deposits USDC into Moonwell → obtains a deposit certificate mUSDC → The user pledges mUSDC into the JOJO platform to obtain extra income Through a whole set of processes, users can use a sum of money to get:

This unique pre-mining mechanism encourages users to deposit a margin for mining first and then decide on the diverse uses of the funds according to their personal wishes.

Through the incentive margin deposit mechanism, JOJO simplifies the initial operation steps for users and enhances participation. It helps users increase asset efficiency, providing greater potential returns for users.

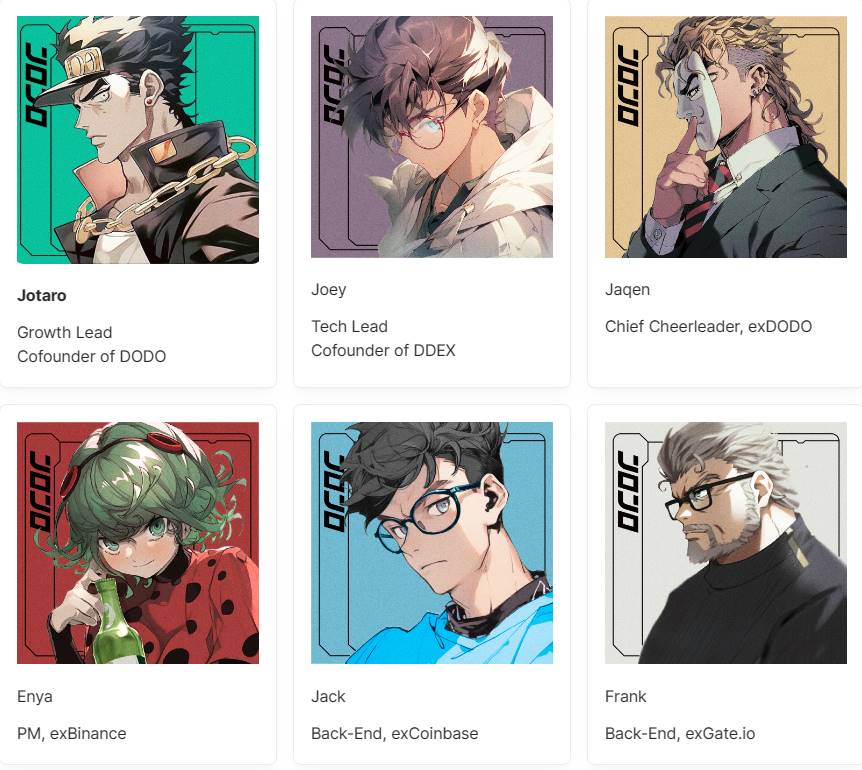

The most outstanding founding team members of JOJO come from well-known Web3 projects, such as DODO Cofounders, DDEX Cofounders, former Binance and Coinbase members, etc. The founders have been deeply involved in the industry for many years and have accumulated profound experience and excellent industry perception.

The JOJO team firmly believes that to succeed, DeFi projects must rely on the power of the community to do things that CEX can't, thereby changing the industry landscape of perpetual trading. This brave pioneering belief is the team's "golden spirit.”

If you want to learn more about the team, click on the link JOJO team.

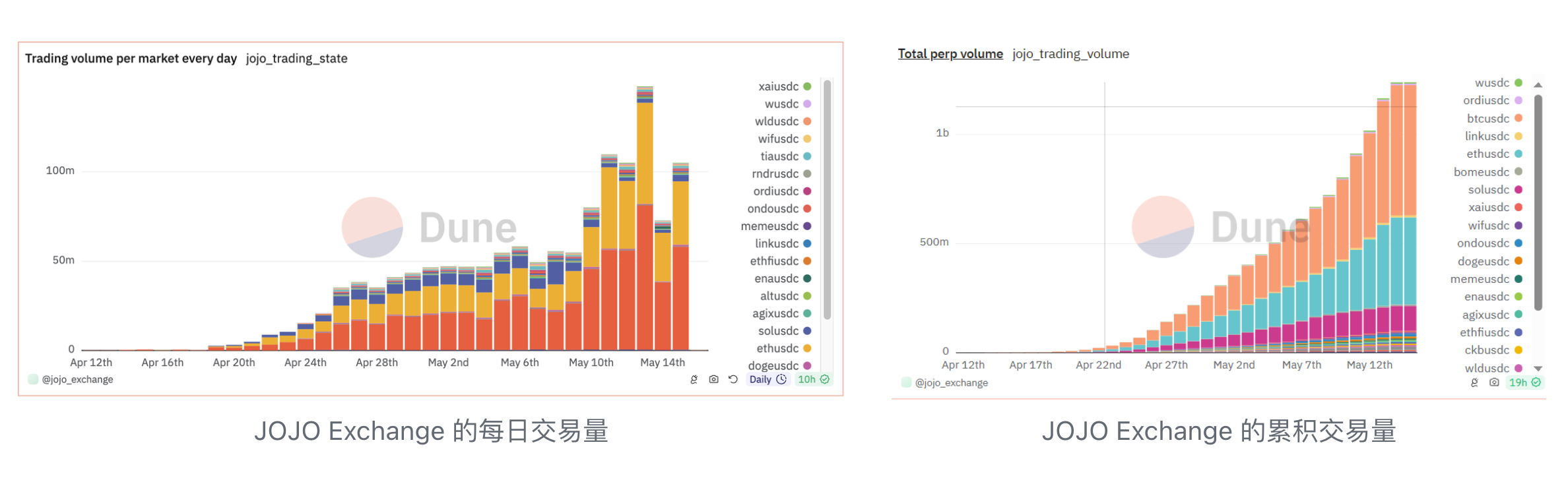

Since launching on BASE, JOJO Exchange has demonstrated impressive performance. Within one month of launching, JOJO's TVL exceeded 3 million USD. The daily transaction volume of perpetual contracts trading maintains a healthy upward trend, with cumulative transactions exceeding 1 billion USD. The number of DAU is also continuously increasing.

So, what features can users experience in the JOJO platform?

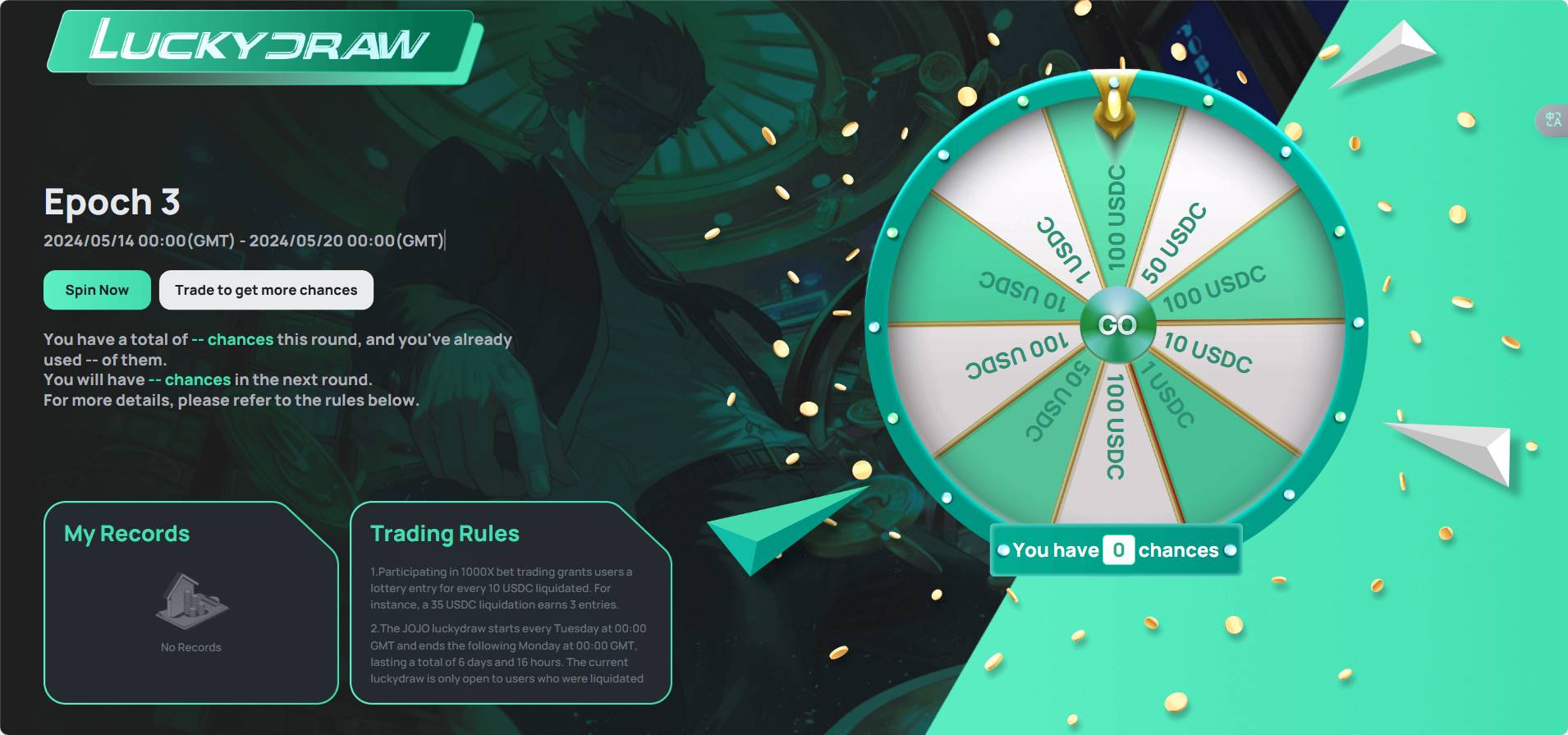

JOJO Exchange offers up to 1000 times leverage trading, allowing users to take on prominent positions with a small amount of margin. This provides a unique trading experience for users with high-risk preferences. JOJO also offers a special subsidy activity called LUCKY DRAW. When a user gets liquidated in 1000X trade, every 10 USDC liquidated can earn a chance to participate in a lottery. The rewards range from 1 to 100 USDC.

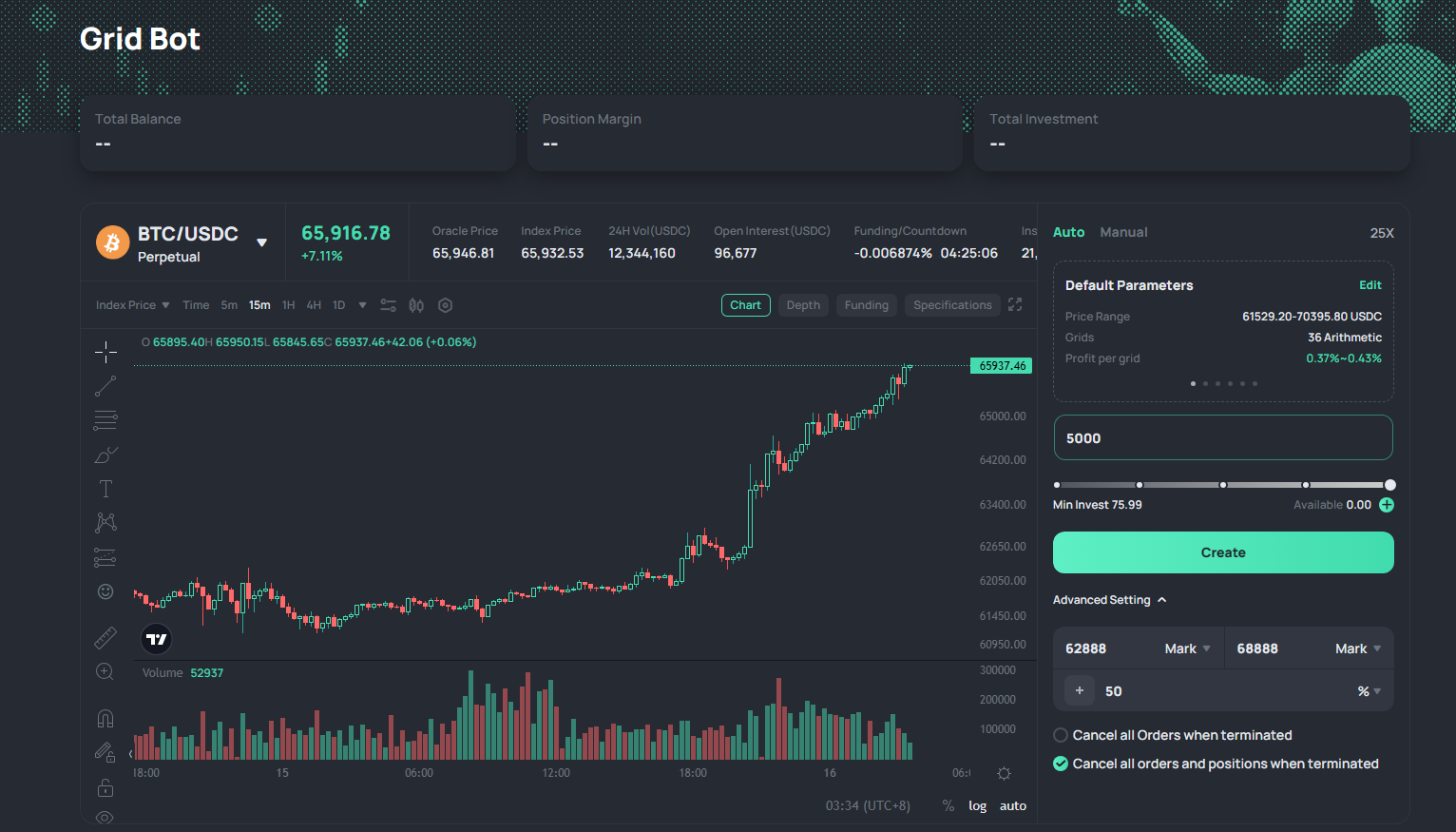

At JOJO Exchange, users can automate the buying and selling of futures contracts through the quantitative trading bot. Grid Bot can automatically buy and sell orders within the price range preset by the user. When the token price fluctuates within the set price range, Grid Bot will establish a neutral trading strategy at arithmetic or geometric intervals to achieve good profits during the fluctuation. JOJO Exchange's AI strategy includes the capability to recommend parameters best suited for current market conditions. This feature is particularly beneficial for novice users who are not familiar with Grid bots. In addition, users can utilize the Grid bots for hedging and range arbitrage to achieve consistent profits while also getting a share of the $JOJO airdrop.

During JOJO’s development on BASE, more users will learn about and try the JOJO Exchange. In the future, JOJO will introduce more and more trading pairs and expand to include a wider range of asset collateral.

Also, JOJO Exchange will issue tokens in Q3.

The demand for perpdex may gradually transition from the data-oriented "more features" to the user experience-oriented "good interaction." JOJO's pursuit of optimizing the interaction process and improving user experience will be a new focus for future development.

Since JOJO already has good data performance. We believe cutting-edge technological innovation and unique insights into the perpdex will attract more market attention to JOJO.

We will continue to monitor JOJO, which is experiencing positive growth, to assess if it can uphold its original vision and steadily achieve its goals.

Recommendation

Catizen

Catizen: Beyond the Click-to-Earn Model - Whats Next in its Sustainable Journey?

Nov 11, 2024 15:40

Initia

Initia: Connecting All Rollups to Build a Layer 1+ Layer 2 Multi-Chain Interconnected World

Nov 11, 2024 15:24

Understanding the Allora Whitepaper: A Self-Improving Decentralized AI Network

Jul 07, 2024 14:25