The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

Despite the MEME frenzy in recent months and market's lukewarm interest in DeFi, the community has renewed confidence in "DeFi's resurgence" following interest rate cuts. As one of DeFi's three pillars, decentralized lending's future development is highly anticipated. Even Trump's team has joined the fray, announcing the launch of the lending project WorldLibertyFinancial (WLF).

In discussions about who will lead DeFi's renaissance, Morpho is frequently nominated, having just announced $50 million in funding in early August, bringing its total funding to over $80 million.

Given this impressive funding scale, more people are curious:

With fierce competition in the lending sector, how did Morpho stand out? What is Morpho planning under this new round of massive funding?

The project name "Morpho" directly translates to "butterfly," and its logo resembles a butterfly spreading its wings. In fact, Morpho is undergoing a stunning metamorphosis: from Morpho Optimizer in 2021, a lending product based on Aave and Compound, to now focusing on combining decentralized finance with internet protocol layer infrastructure, promoting the transformation of private financial infrastructure into public goods.

How is this "metamorphosis" taking place? How can Morpho, as financial infrastructure, empower the development of lending, DeFi, and the entire financial industry?

This article aims to explore Morpho's transformation journey.

The Move Towards Financial Infrastructure: Why?

Morpho recognizes several issues in the current decentralized lending space: concentration of mainstream assets, low capital efficiency, suboptimal interest rates, and user experience deficiencies. Morpho aims to bring optimization, and while financial infrastructure is the fundamental system where multi-sided market participants come together to resolve financial operations, the current financial infrastructure stack faces challenges in accessibility, fragmentation, interoperability, efficiency, and flexibility.

To systematically improve the current lending sector, rebuilding the lending market from scratch is necessary. Therefore, Morpho aims to construct a universal infrastructure layer where anyone can participate and build, further breaking DeFi boundaries to unleash innovation.

From a project perspective, in the crypto world, people believe that becoming "infrastructure" rather than a single product not only demonstrates the project's strength but also offers a higher development ceiling. Decentralized lending TVL has surpassed DEX to become the sector with the largest capital capacity in DeFi, and becoming the infrastructure layer in the lending space gives Morpho more convincing future growth potential.

Why Does Morpho's Financial Infrastructure Need to Be a Public Good?

It's straightforward - privately owned infrastructure inevitably favors specific entities, compromising its ability to drive genuine industry advancement with pure intentions.

At its core, Morpho envisions financial infrastructure as a true "public resource." This means not just universal accessibility without degrading the service quality, but also complete transparency of all code and protocols. Users need only trust one thing: the verifiable technology itself.

So, what exactly does Morpho's vision of public-good financial infrastructure look like?

Morpho aims to build internet-style decentralized infrastructure that not only leverages blockchain advantages but can also extend its services to the global financial system through permissionless, highly flexible characteristics.

Therefore, Morpho's public goods financial infrastructure has the following features:

First, this infrastructure layer follows decentralized principles. It provides verifiable security, offering trustless security foundations for participants, and its accessibility and functionality operate stably without single points of failure, allowing participants to confidently integrate.

Second, this infrastructure layer is permissionless. It's open to anyone and provides high flexibility and freedom, allowing any developer to join and serve any user, thus further expanding service scope and innovation vitality.

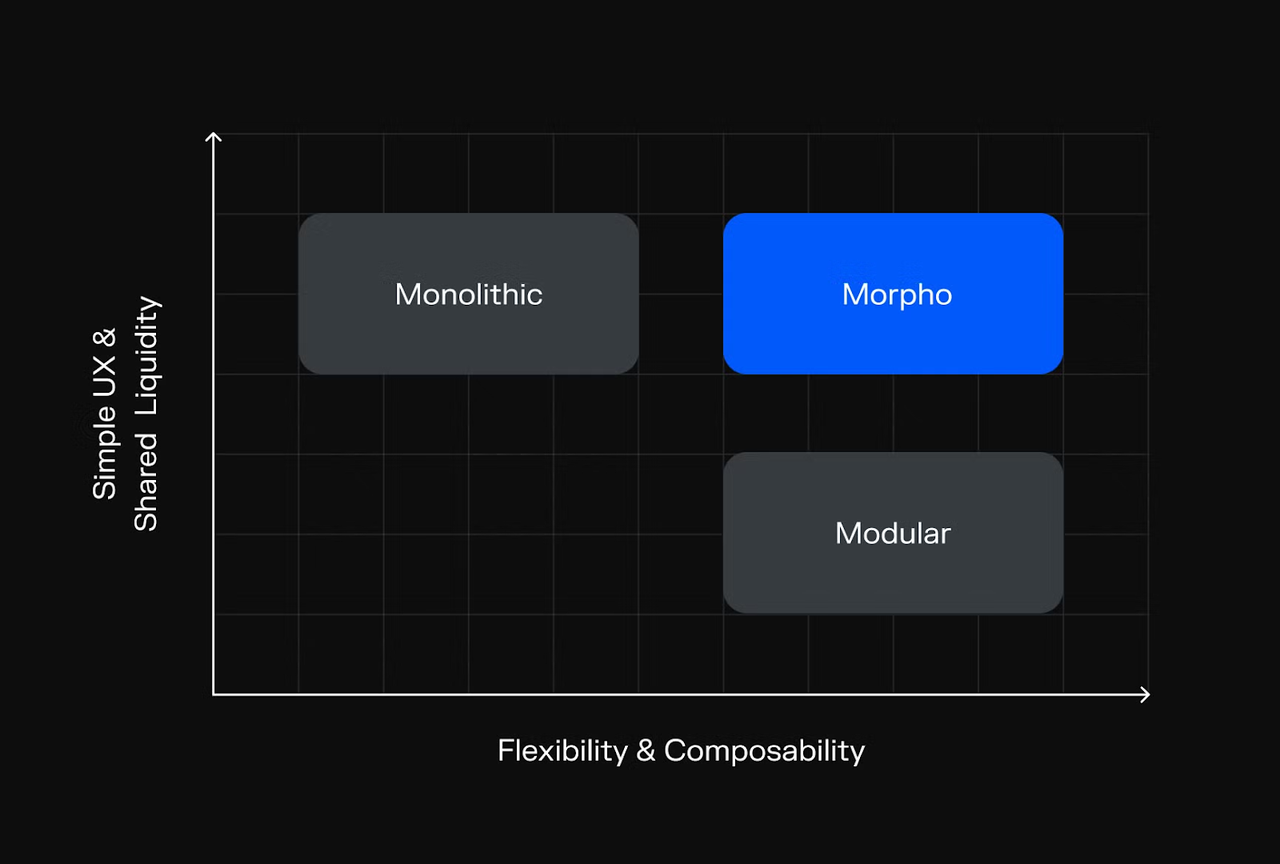

Most importantly, this infrastructure layer is primitive and aggregated. Many view Morpho as a modular solution, which is actually a misconception. In reality, Morpho is an aggregated solution that combines the advantages of both integrated and modular lending. The overall architecture is divided into two levels:

Primitive Market Layer: Adopts minimalist, immutable, and flexible design, not only giving this layer strong security advantages but also excelling at connecting various financial applications and supporting the reuse of the same instances across different use cases.

Modular Layer Based on Primitive Markets: Dedicated to providing personalized support in user experience, liquidity, and risk management.

This way, Morpho's lending solution achieves multiple advantages:

In terms of security, benefiting from a strictly audited, formally verified, and immutable codebase, various types of lending solutions are built on a robust security foundation, and upgrades or changes to individual modules won't affect other templates.

Regarding flexibility, Morpho is not only permissionless but also avoids the series of problems brought by single liquidity pools and risk management in integrated lending solutions, supporting anyone to easily participate and build lending with various assets, risks, and returns.

For liquidity, in traditional modular lending solutions, each pool has different logic and assets, leading to both liquidity fragmentation and complex user experiences. In Morpho's layered design, primitive markets can be reused, and different modules can aggregate liquidity through primitive markets.

Morpho believes that if financial operations can run on a truly decentralized, permissionless, and flexible public financial infrastructure, finance will experience a new wave of explosive development.

While such public goods-style financial infrastructure sounds extremely attractive, it seems more like an "all-in-one" vision. So how does Morpho achieve this transformation?

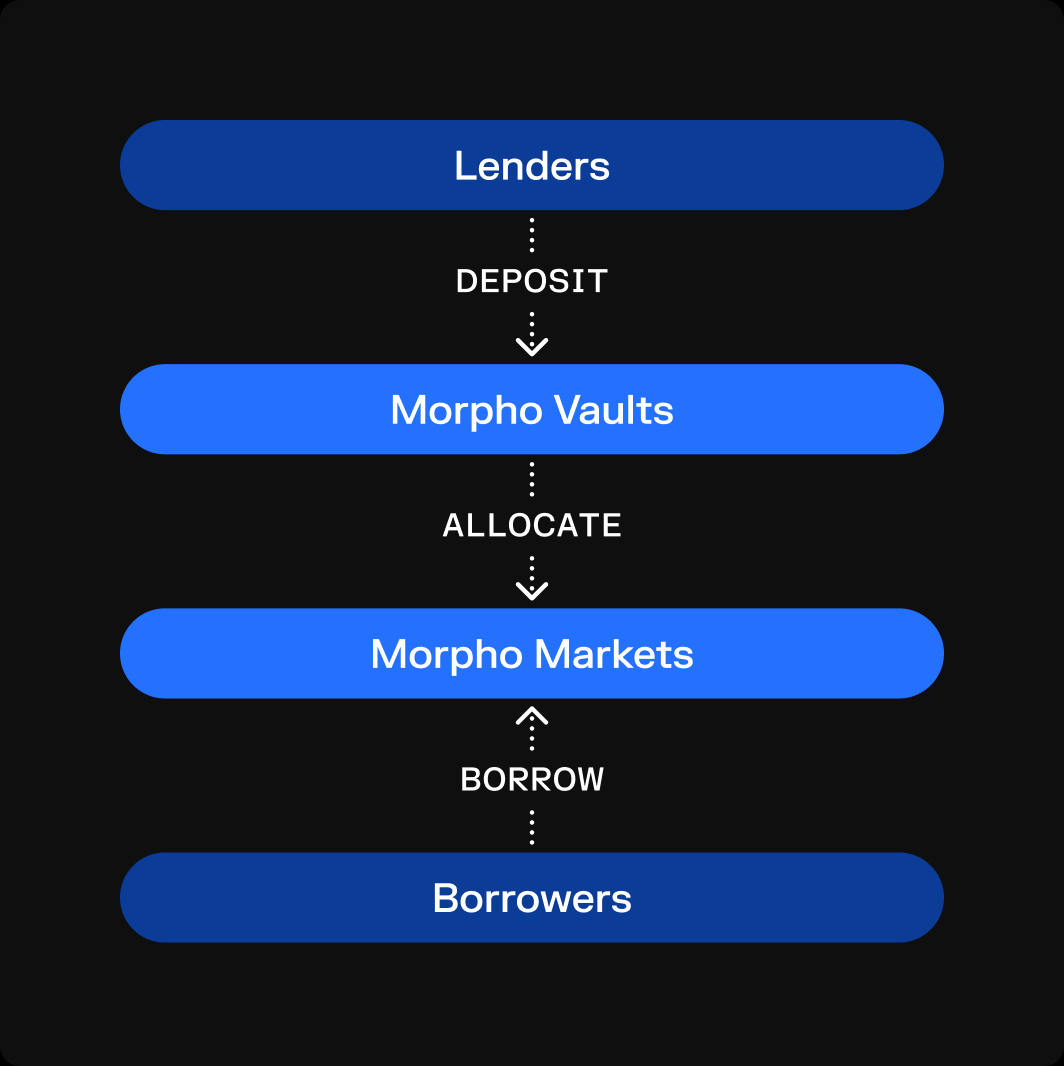

Lending markets essentially match the needs of "borrowers" and "lenders." Morpho aims to build an open, efficient, and flexible platform where anyone can earn yields and borrow any assets.

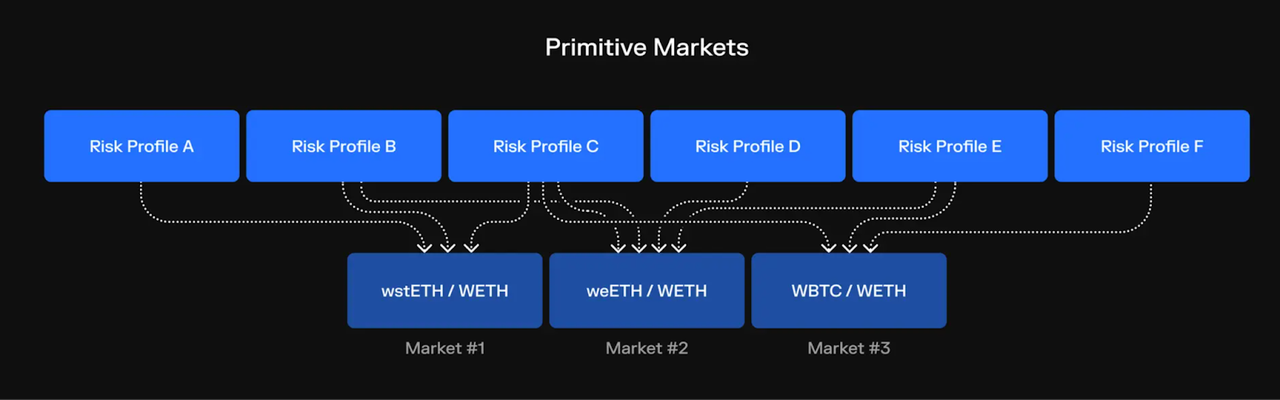

Morpho Markets is a simple, immutable single loan and collateral asset market (corresponding to the primitive market layer mentioned above), giving loan market creators a high degree of autonomy. Anyone can deploy independent lending markets by specifying one collateral asset, one loan asset, interest rate model (IRM), liquidation loan-to-value (LLTV), and the oracle to be connected.

Additionally, since Morpho Markets lending markets are isolated from each other, when losses occur, they are immediately shared among users who provided funds to that lending pool, without automatically sharing any risks among all users.

Morpho Vaults are professional lending vaults built on Morpho Markets and curated by external risk experts (corresponding to the modular layer based on primitive markets). Each vault contains one loan asset, with different vaults having different risk/reward profiles.

Users can deposit corresponding loan assets into vaults to earn yields based on their risk preferences, while vaults allocate liquidity into Morpho Markets to better match "borrower" and "lender" needs.

For regular users:

Users who deposit assets gain enhanced security, diverse participation options, and higher yield potential.

On the security front, Morpho Vaults' non-custodial nature gives users stronger control over their assets.

As for flexibility, users can choose different vaults based on their yield preferences. To attract more users to deposit assets, vault managers will not only strive to develop more scientific risk/reward strategies for vaults but also actively share profits with users. Under the rules, vault managers can receive up to 50% of the vault's interest as earnings, but currently, some vaults distribute all interest earnings to users.

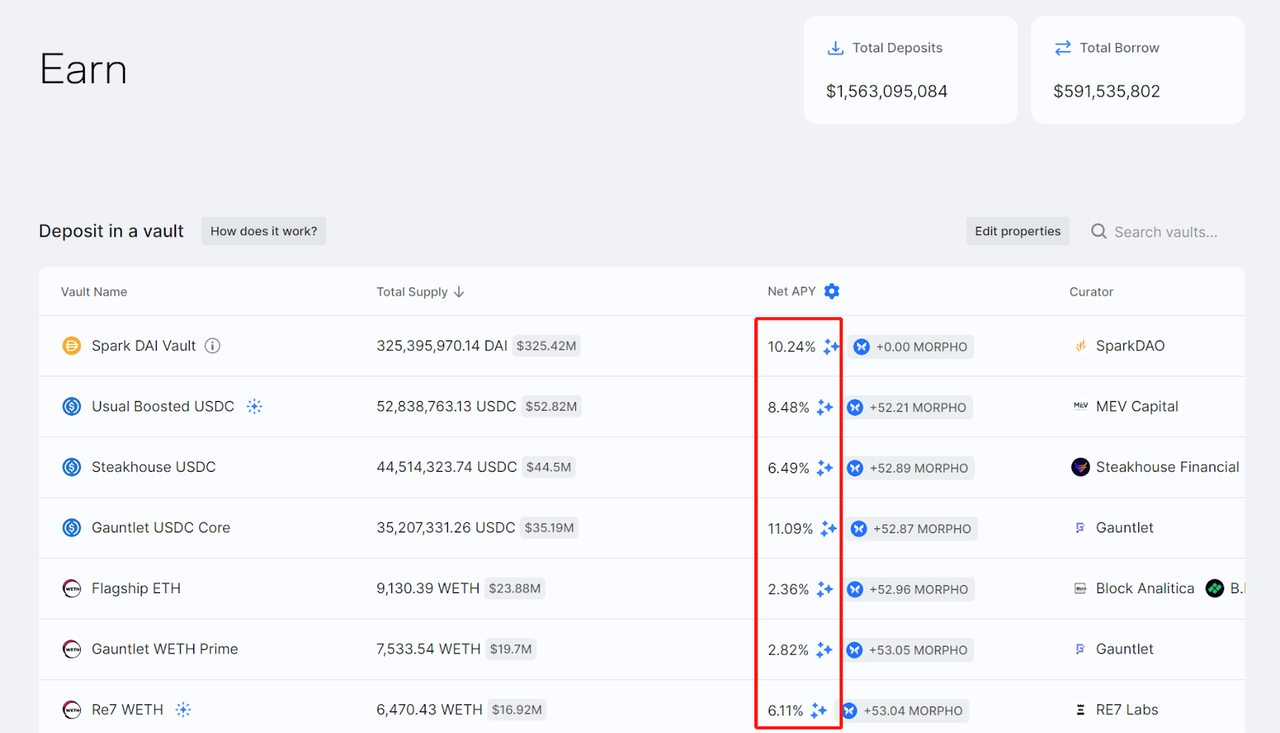

Currently, several Morpho vaults have annual yields of 4%, with some reaching as high as 11.4%, generally higher than other lending protocols.

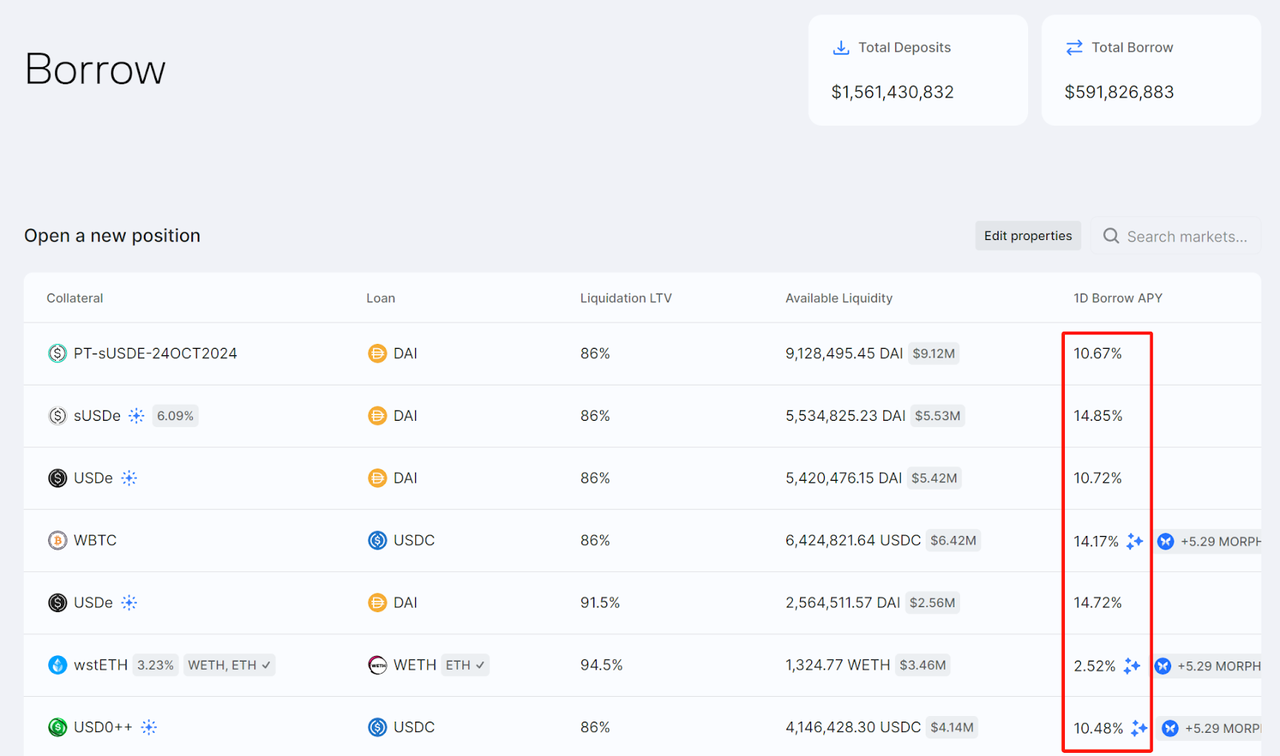

When choosing to borrow assets, users will get higher collateral ratios, allowing them to borrow more funds and maximize capital utilization. Although Morpho's current borrowing rates are only slightly higher than Aave's, Morpho currently doesn't charge platform fees, resulting in lower borrowing costs and smaller spreads.

For businesses and developers:

Based on Morpho, they can not only deploy vaults and markets that better meet actual needs (different assets, risks, yields) more quickly and simply but also achieve complete control over vaults and markets. More importantly, as public financial infrastructure, Morpho reduces development time and costs through shared infrastructure while achieving better liquidity aggregation.

Transformation is an important decision, but fortunately, market feedback further validates Morpho's choices.

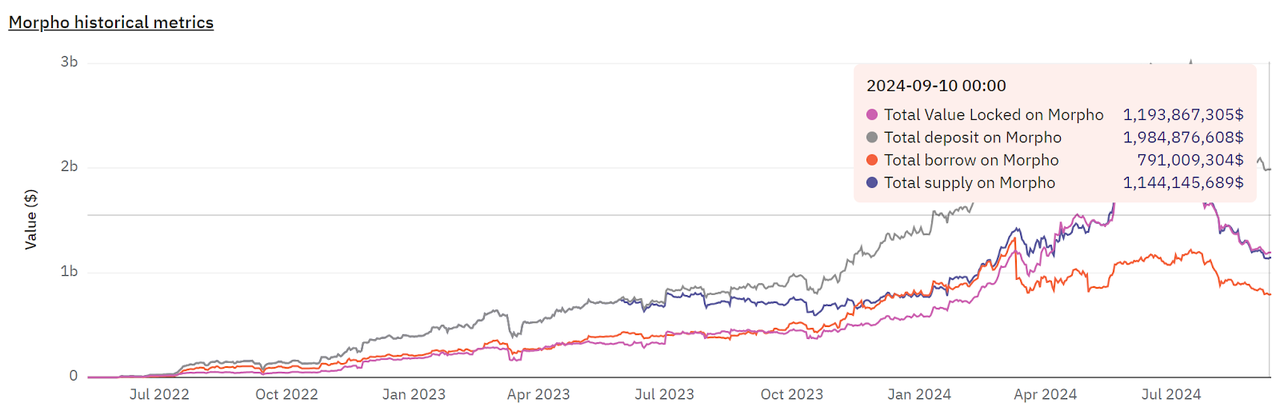

Over the past few months, we've seen Morpho's counter-trend growth in both on-chain data and ecosystem partnerships.

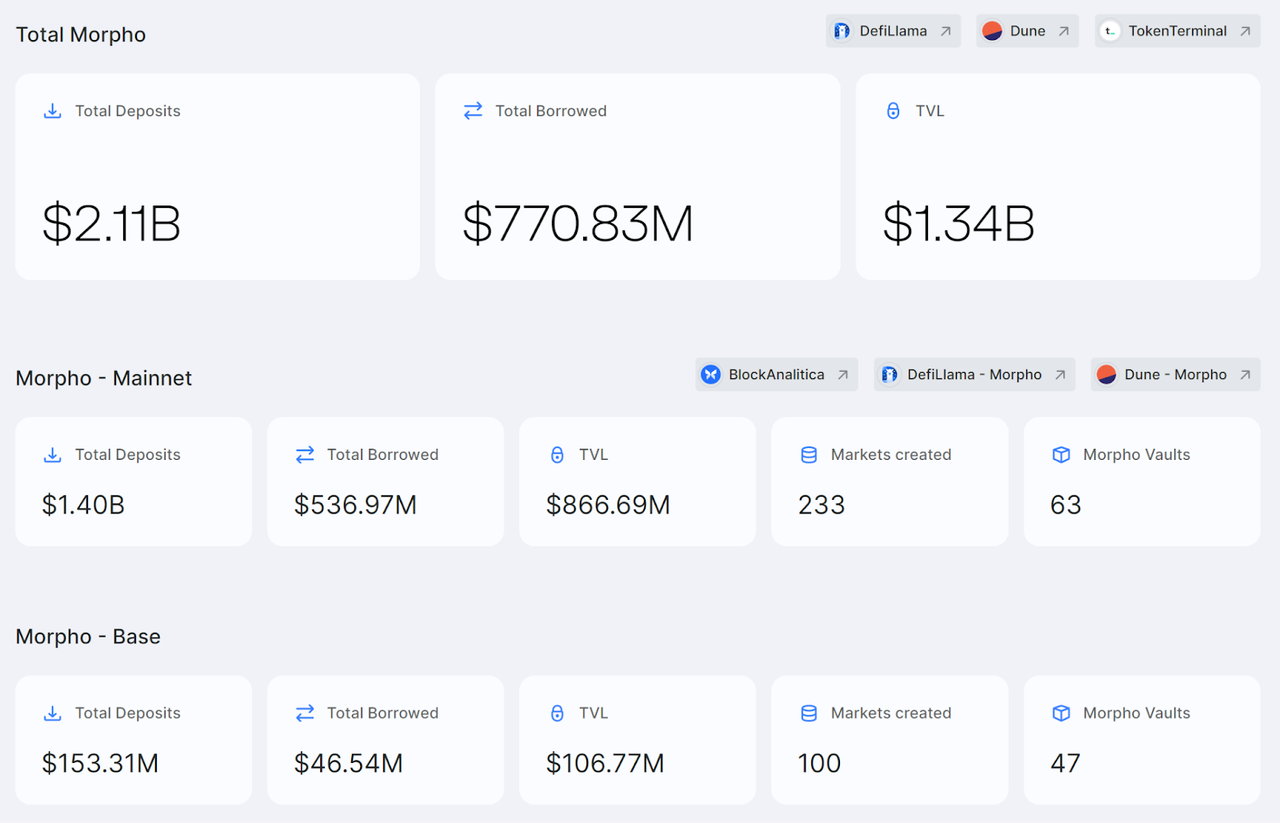

According to Morpho Analytics page data, current total deposits exceed $2.1 billion, total borrowing exceeds $770 million, and on-chain TVL exceeds $1.34 billion, representing a TVL increase of over 220% compared to $600 million at the beginning of the year. According to DefiLlama rankings, Morpho ranks sixth in the lending sector.

Regarding deployed Markets and Vaults, there are now over 333 Morpho Markets and 110 Morpho Vaults created on Ethereum and Base networks.

Notably, since announcing its entry into the BASE ecosystem in June, Morpho has become the fastest-growing DeFi protocol on BASE.

Currently, Morpho's total deposits on BASE chain exceed $153 million, total borrowing is $46.54 million, and TVL has broken through $100 million. Additionally, there are 100 Morpho Markets and 47 Morpho Vaults created on the Base network, fully demonstrating Morpho's activity in the BASE ecosystem.

The growth in on-chain data is inseparable from Morpho's thriving ecosystem support. As public financial infrastructure, Morpho is dedicated to integrating with fintech and enterprises, innovating traditional finance through decentralized power while introducing more incremental users to the crypto world through good user experience.

As Morpho says: Fintech in the frontend, Morpho in the backend.

We indeed see the practice of this philosophy in Morpho's ecosystem map.

According to the official website, Morpho's ecosystem currently encompasses 200+ projects, including major DeFi projects like Elixir, Aragon, Contango, Safe, SummerFi, and Stream who have chosen to build on Morpho.

As public financial infrastructure, Morpho not only empowers crypto world DeFi projects but also extends to traditional finance, achieving notable success in areas like RWA.

In the DeFi space, the most representative partnership is undoubtedly with MakerDAO (now known as Sky). In March, MakerDAO's lending protocol Spark deployed $100 million in new DAI liquidity through Morpho, with funds allocated to sUSDe/DAI and USDe/DAI markets. Users can borrow Ethena's stablecoins USDe and sUSDe through MakerDAO-supported efficient leverage positions and use Maker's liquidity to increase exposure to sUSDe and USDe. According to many KOL analyses, MakerDAO's move aims to respond to Aave's launch of its stablecoin GHO and consolidate its competitiveness in the DeFi space.

Morpho hasn't missed BTCFi as a hot narrative this cycle - recently launched cbBTC from Coinbase and LBTC from Lombard will also be deployed on Morpho.

In innovating traditional finance, Morpho has been particularly active recently:

In August, Morpho announced partnerships with blockchain technology company Centrifuge and top exchange Coinbase to launch an institutional real-world asset (RWA) lending market. This market is technically supported by Coinbase's Layer 2 network Base and Morpho Vaults system, using three tokenized US Treasury bonds including Centrifuge's Anemoy fund, Midas's short-term US Treasury bills (mTBILL), and Hashnote's US Yield Coin (USYC) as collateral, aiming to provide instant liquidity without needing to redeem Treasury bonds.

Earlier this month, SwissBorg, a fintech platform focused on cryptocurrency and serving the European market, announced the launch of a USDC yield product utilizing the Morpho protocol. The product is now available to SwissBorg application users, who can enter Morpho's WBTC/USDC and wstETH/USDC markets.

This partnership not only helps SwissBorg users enjoy higher security and risk-adjusted returns without touching high-risk assets, making it easy for crypto newcomers to access on-chain yield opportunities, but also promotes Morpho's ability to provide access to customized Morpho Vaults to broader Web2 users, demonstrating its huge potential in innovating traditional finance and bringing explosive growth.

As SwissBorg praised this partnership: Morpho Vaults provides customizable infrastructure enabling traditional finance platforms to develop proprietary products, thereby reducing risks associated with traditional Web3 lending protocols.

It's worth noting that the Asian market has always been an important sector in the crypto industry. At this year's TOKEN2049 conference in Singapore, many industry leaders mentioned in their speeches that Asia is leading crypto market development, with countries ranking in the top 40% of user adoption rates located in Asia.

Therefore, Morpho is also actively seeking cooperation with Asian markets and expanding its business in Asia, especially in China and Korea. In the future, we will see more of Morpho's movements in the Asian market, dedicated to promoting its public financial infrastructure services to broader Asian crypto users, bringing them more efficient and flexible lending experiences.

Actions speak louder than words - nothing beats actually participating to truly experience it.

Enterprises and developers can participate in Morpho through the Curate/Build page: Through Curate, participants can easily create vaults with custom strategies, permissions, and governance in seconds using public code, and earn returns through managing lending vaults. For more DAOs, fintech, applications, and CEXs, they can build any custom product using Morpho Stack, not only greatly reducing development time and cost but also enjoying the advantages of better security, flexibility, and liquidity brought by Morpho Stack.

Regular users can participate in Morpho through the Earn/Borrow page:

The Earn page lists various Morpho Vaults where users can choose vaults based on their risk preferences and deposit assets to earn returns. Each vault's returns differ and fluctuate with the market, specifically comprising three parts: native yields (interest paid by borrowers), reward APY (provided by third parties), and MORPHO token rewards.

The Borrow page supports users in providing collateral and borrowing assets, with simpler operations, higher capital utilization efficiency, and lower costs.

Participating in Earn or Borrow is currently the only way to earn MORPHO tokens.

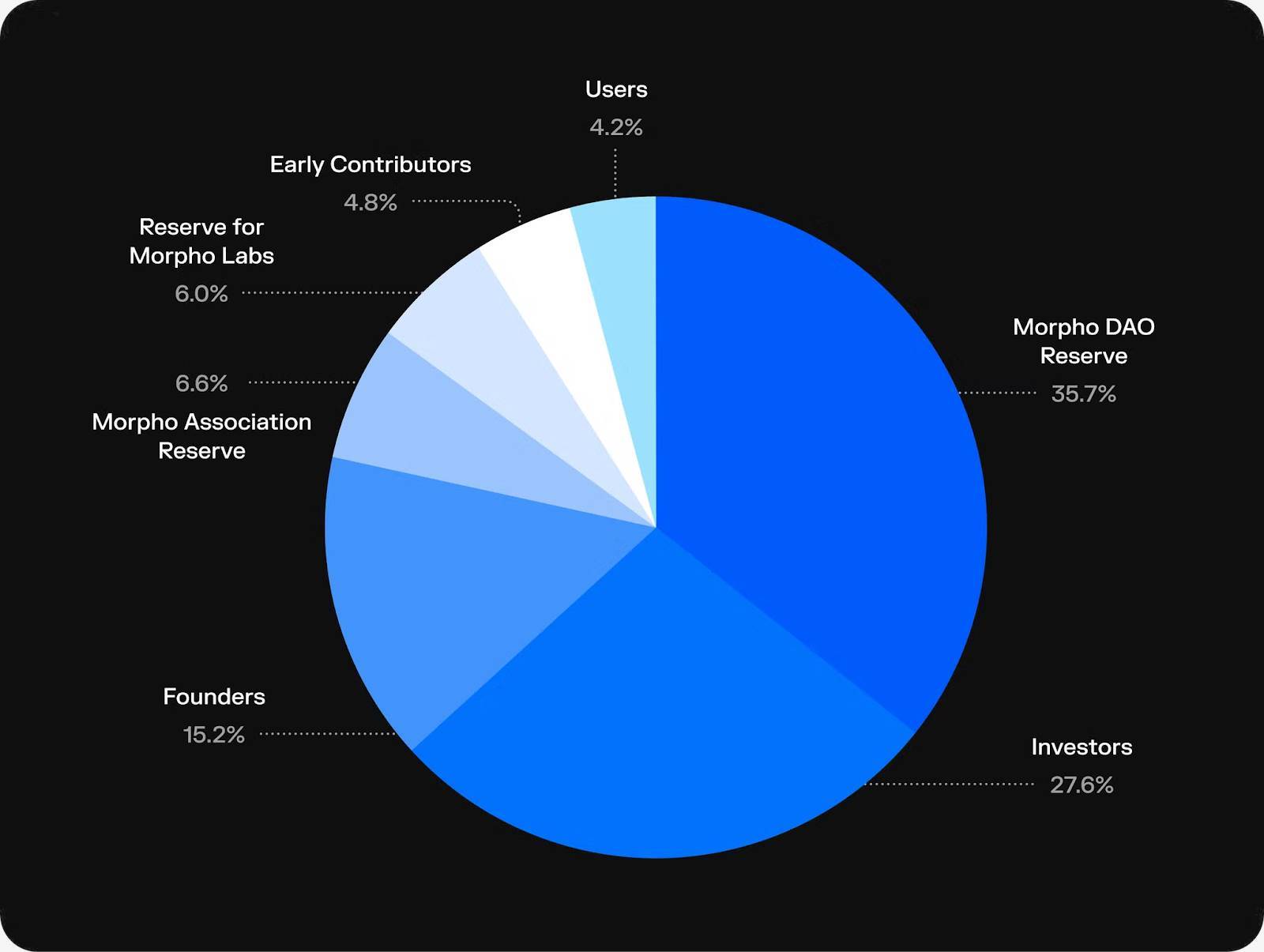

As a governance token, MORPHO has a total supply of 1 billion tokens. Morpho DAO, composed of MORPHO token holders and delegates, is responsible for managing the Morpho protocol. Holding MORPHO tokens will allow participation in ecosystem governance and voting on protocol changes.

MORPHO Token Distribution Breakdown as of August 2024:

It should be noted that MORPHO tokens are currently non-transferable, meaning they cannot be traded or listed on CEX/DEX. In late August, Morpho DAO initiated a discussion about opening up MORPHO token transferability and received broad community support. This means MORPHO tokens will likely officially launch before year-end, at which time Morpho may introduce user incentive activities such as airdrops. This important milestone has led to high user expectations for Morpho's future growth and greatly encouraged users to participate in Earn/Borrow now to accumulate more reward potential.

On the ecosystem side, Morpho's ecosystem has the huge advantage of being permissionless, supporting anyone to create innovative applications based on it. This gives Morpho itself tremendous innovation momentum. In the future, while continuously improving and optimizing Morpho Stack, Morpho will continue to focus on ecosystem cooperation, maintaining growth momentum by continuing to deeply explore the BASE ecosystem while continuing to promote cooperation with leading fintech companies, promoting Morpho's public decentralized financial infrastructure services to broader Web2/Web3 users.

In the crypto world, having the ability to traverse complete bull and bear cycles is largely a success, while maintaining long-term competitiveness requires continuous innovation based on market needs.

As a veteran DeFi player, Morpho has evolved from a single lending optimization product that unleashed innovation potential for Web3, to becoming a truly decentralized, permissionless, flexible, and efficient public financial system, breaking through Web3 boundaries to bring innovation to the broader global financial system.

In the foreseeable future, with continued ecosystem expansion and official token launch, Morpho will enter its next phase of rapid growth, becoming an important force leading DeFi's renaissance in this cycle.

Recommendation

Interpreting Everclear: The First Chain Abstraction Clearing Layer to Address Cross-Chain Liquidity Fragmentation through Net Settlement

Jun 06, 2024 21:56

Unpacking the MegaETH Whitepaper: The Non-Stop Infrastructure—What Makes This Vitalik-Supported, Massively Funded L1 Stand Out?

Jul 07, 2024 14:30

Sonic

Sonic: The First Gaming-Native L2 on Solana - Leading the One-Click Chain Deployment Revolution

Nov 11, 2024 15:42