The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

The crypto market's volatility never ceases, and the DeFi sector continues to advance through these turbulent times. Global economic expectations of interest rate cuts are quietly changing investors' risk preferences and yield demands.

As market narratives become increasingly scarce, discussions about DeFi have once again intensified. DeFi projects that have weathered a complete bull and bear cycle are no longer satisfied with simply replicating traditional finance models but are beginning to deeply consider how to better meet market demands.

From MakerDAO's brand transformation to the emergence of various novel yield strategies, the entire ecosystem is undergoing a profound transformation. Meanwhile, industry giant Binance is actively seeking change. The Meme token surge on BNB Chain and the frequent listing of ecosystem projects... these series of actions are sending positive signals to the market.

In this wave of transformation, Tranchess, a BNB Chain OG DeFi protocol, stands out among competing products with its unique structured fund architecture. By cleverly combining structured fund concepts with DeFi innovation, it provides investors with a distinctive DeFi experience. As market demand evolves, Tranchess continues to advance product iterations and collaborates with multiple projects to match market needs.

This article will delve into Tranchess's multiple innovations and analyze how it leverages both inherent advantages and mechanism innovations to forge a unique yield path for investors in the current market environment. Whether you're a DeFi veteran or newcomer, this article should provide you with fresh insights.

Faced with the diverse crypto ecosystem, not just external users but even crypto veterans might wonder: with so many new ideas constantly emerging, why does DeFi still deserve focused attention?

Andre Cronje provides some insights in his recent article "Why DeFi is Key to the Future?".

The article points out that DeFi is essentially a liquidity hub and trading demand carrier. In every chain ecosystem, DeFi plays an indispensable role, providing necessary liquidity support for the market while meeting diverse financial needs from simple token swaps to complex derivative trading.

AC mentions: "Anyone willing to try can participate, which is a crucial cornerstone of economic growth." DeFi's openness and composability make it an ideal testing ground for financial innovation. Whether in bull or bear markets, DeFi remains the core engine maintaining ecosystem vitality.

Born during the 2021 DeFi wave at crypto's bull market peak, Tranchess has not only demonstrated remarkable resilience through extended cycles but has also injected new vitality through continuously iterating innovative mechanisms, fully showcasing its strength as an "OG."

According to the latest DeFiLlama data, as of September 2024, Tranchess's TVL on BNB Chain reached $183 million, growing nearly 500% year-to-date.

Professional Team

Tranchess's ability to maintain vitality through deep bear markets is inseparable from its professional team strength. Tranchess is composed of a team with rich blockchain and financial professional backgrounds. Core team members have extensive traditional finance experience including investment banking, asset management, and hedge funds.

Co-Founder Danny Chong, a graduate of Nanyang Technological University, has over ten years of banking experience, including trading, sales, and management across the Asia Pacific region.

The technical team also has impressive experience in centralized exchange and DeFi protocol network security, with team members from tech giants like Google, Meta, and Microsoft.

A DeFi Protocol Inspired by "Tranches"

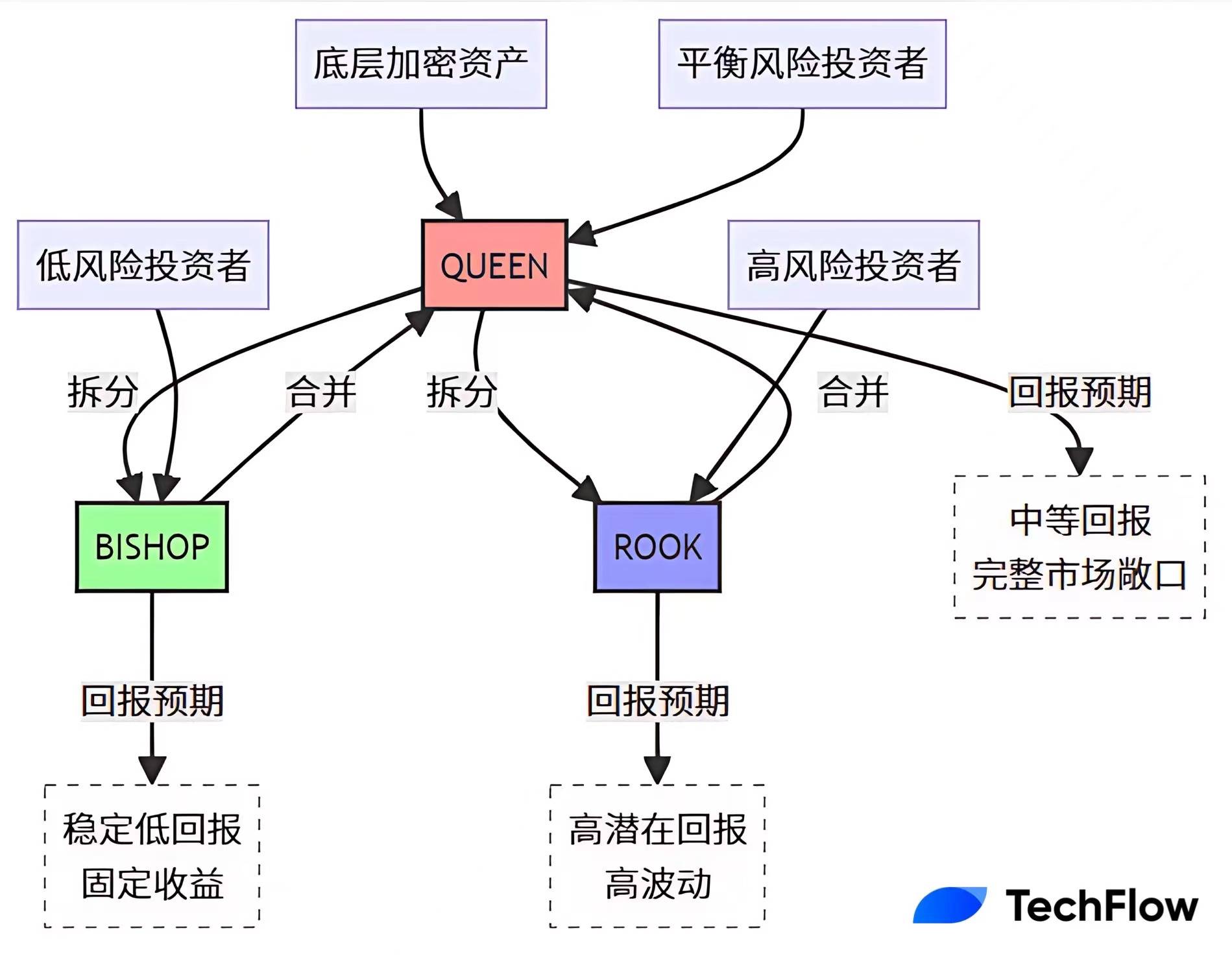

Tranchess was inspired by the concept of "Tranches" from traditional finance, innovatively providing tiered, multi-structured asset investment solutions for investors with different risk preferences.

Tranchess offers two core services:

Liquid: Staking Services: Primarily represented by nQUNEE on BNB Chain and qETH on Ethereum mainnet. Taking qETH as an example, users can stake ETH on Ethereum mainnet to receive qETH. While enjoying protocol staking yields, qETH can also be used as collateral in external DeFi protocols, improving capital efficiency.

Tiered: Return Products: Tranchess also provides diversified risk-return solutions based on the QUEEN fund, splitting QUEEN into two derivative tokens, BISHOP and ROOK, aimed at meeting the needs of investors with different risk preferences. Now, Tranchess has further optimized its product structure, upgrading it to a more flexible Turbo & Stable architecture.

Like an exciting chess match, Tranchess's evolution from tiered mode to Turbo & Stable represents precise responses to market changes with each move.

Opening Move: Structured Funds with Tiered Approach

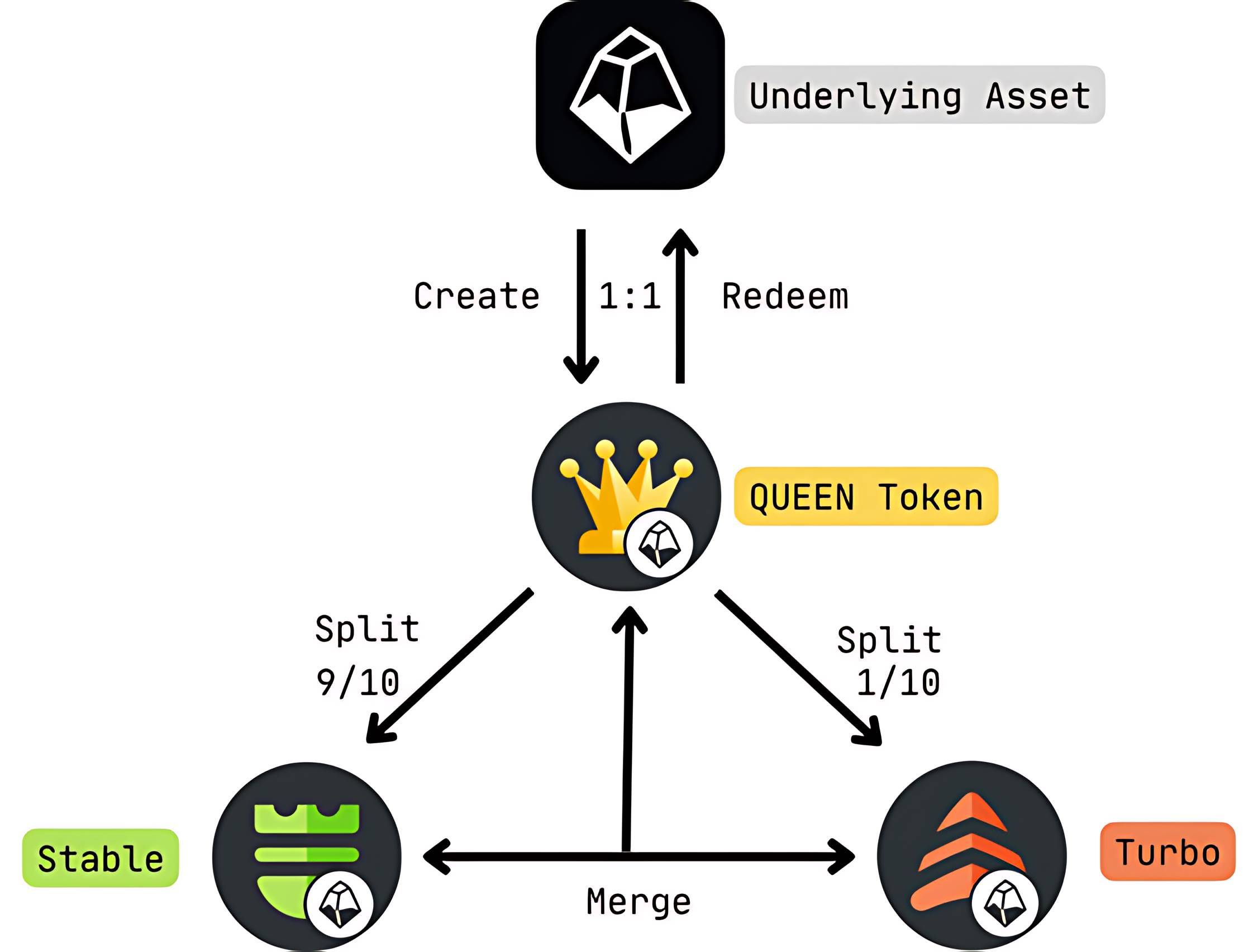

The structured design is Tranchess's core innovation, splitting single assets into derivatives with different risk levels. This structure allows investors to choose suitable investment strategies based on their risk preferences. Specifically, Tranchess divides assets into three tiers:

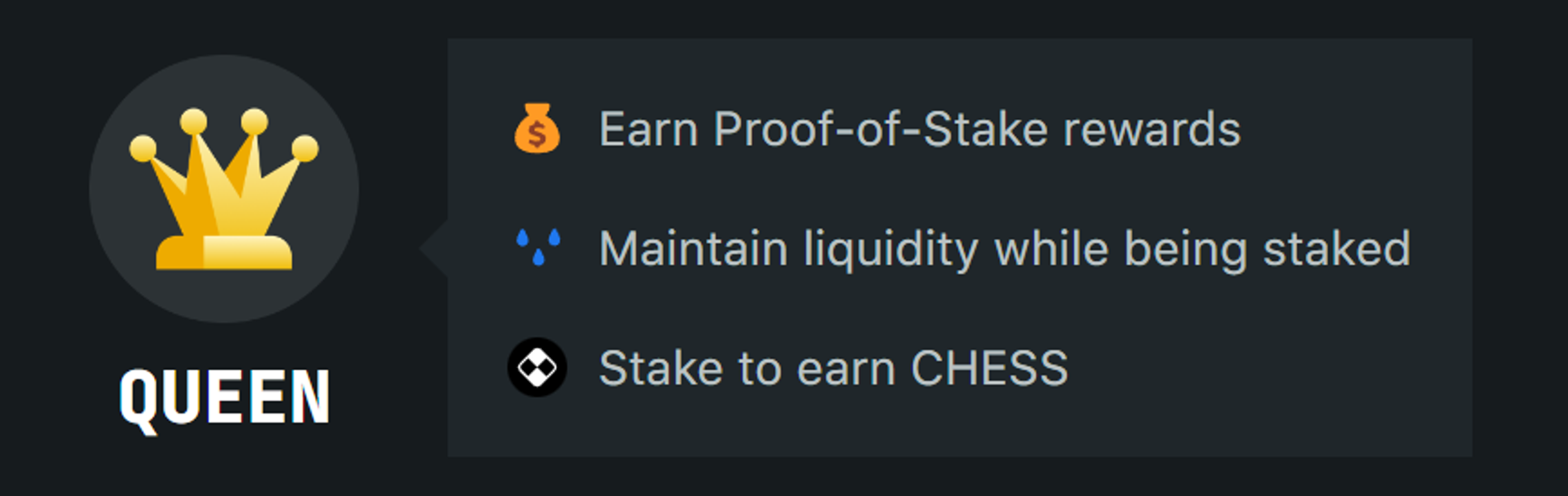

Main Fund Token QUEEN

QUEEN is the base asset, pegged 1:1 with the underlying crypto asset. As the primary fund unit in the structure, users can directly hold QUEEN for full exposure to the underlying asset. QUEEN can be minted, redeemed, and split into BISHOP and ROOK. QUEEN's yields come from underlying asset price movements, staking rewards (if supported by the underlying asset), and protocol revenue distribution.

Taking BTC as an example, QUEEN holders can enjoy both Bitcoin price movement returns and earn additional CHESS governance token rewards through staking. Investors can exchange BTC directly for QUEEN or purchase it with USDC on Tranchess Swap.

Derivative Tokens: BISHOP and ROOK

QUEEN splits into two derivative tokens, BISHOP and ROOK, representing different risk and return characteristics.

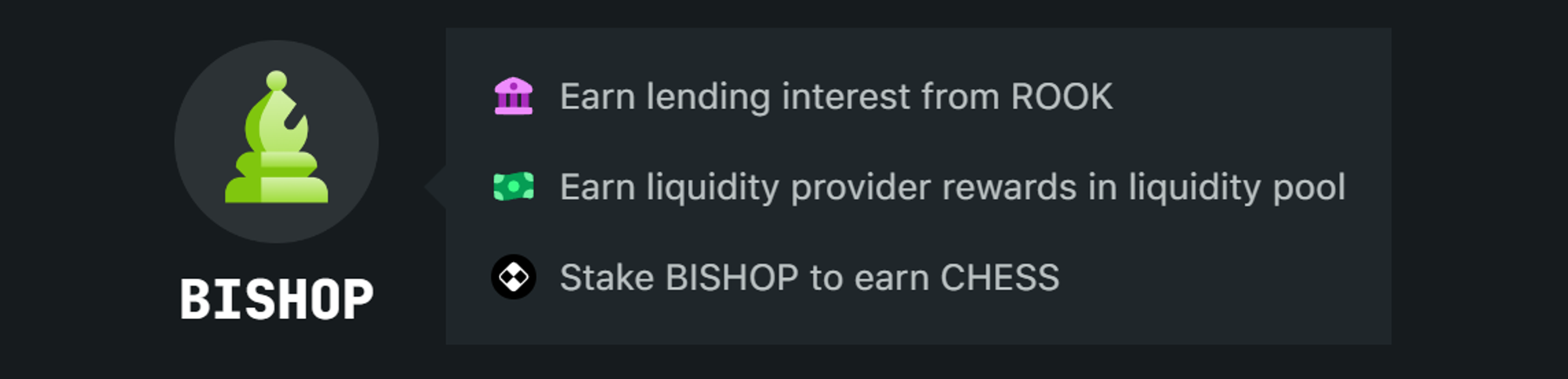

BISHOP is a fixed-income token with lower risk, providing stable returns similar to fixed-income products. Its yield comes from a fixed QUEEN rate, adjusted periodically by the protocol based on market conditions. BISHOP offers relatively stable returns during market volatility, suitable for risk-averse investors.

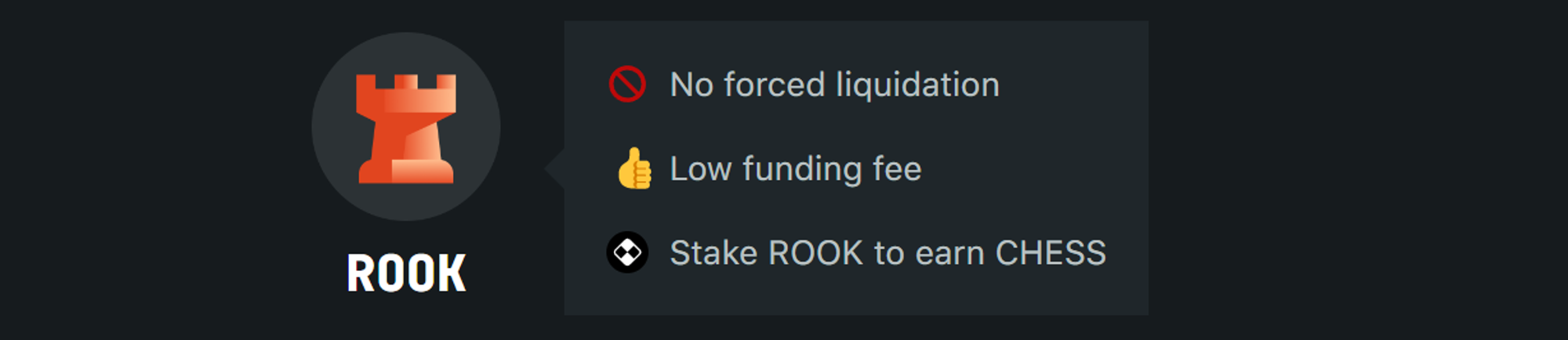

ROOK is a leverage token with higher risk, providing leveraged returns and greater sensitivity to underlying asset price movements. ROOK's yield comes from QUEEN's remaining total returns (total returns minus BISHOP payments). During market uptrends, ROOK can achieve excess returns but faces greater downside risk.

The structured fund design enables investors to dynamically adjust their positions based on individual risk preferences. Users can seamlessly switch between QUEEN, BISHOP, and ROOK tokens at any time, implementing personalized risk management strategies. For instance, investors can increase their ROOK allocation when anticipating market upside to maximize potential returns, or pivot to BISHOP positions during bearish outlooks to secure stable yields.

Tranchess's flexible tiered architecture enables future expansion into diverse crypto assets, broadening market participation opportunities. Whether it's BTC, ETH, or BNB, Tranchess demonstrates the capability to create corresponding structured products, catering to varied investor requirements.

Turbo & Stable: Tactical Innovation on the Board

With the launch of qETH liquid staking product on ETH mainnet, Tranchess introduced the "Turbo & Stable" concept into its product ecosystem.

The Turbo & Stable model is essentially an upgrade of the structured fund concept, with Turbo and Stable being enhanced versions of ROOK and BISHOP products.

Turbo (Enhanced ROOK): High-leverage, High-yield Offensive Tool

Like a rook's forward charge in chess, Turbo products offer higher leverage and potential returns, suitable for investors willing to take higher risks. It's like an bold offensive move that could bring significant returns while facing greater risks.

Stable (Enhanced BISHOP): Defensive Fortress for Stable Yields

Similar to the flexible bishop in chess, Stable products provide more consistent yields, becoming the defensive core of the investment portfolio. It offers an ideal choice for investors seeking stable returns with low risk preference, like building a solid defensive line in chess.

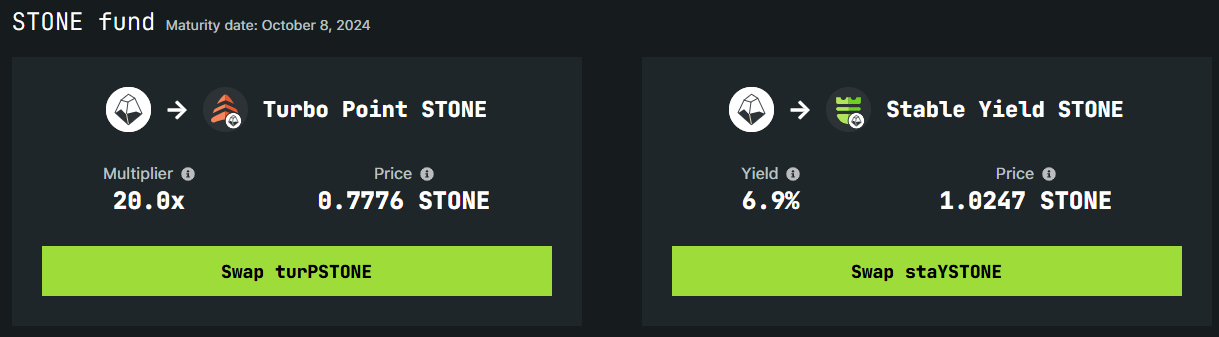

Deep Dive into Turbo & Stable: STONE Fund Example

Let's use Tranchess's collaboration with StakeStone's STONE fund as an example to explain how this architecture works.

Simplifying Complexity: Flexible Token Split

The STONE fund's core lies in its token split mechanism based on the Turbo & Stable architecture. Users can exchange STONE for stoneQUEEN at a 1:1 ratio, and each stoneQUEEN can be split into 0.1 turPSTONE (Turbo Point STONE) and 0.9 staYSTONE (Stable Yield STONE). This process is reversible – users can combine 0.1 turPSTONE and 0.9 staYSTONE back into 1 stoneQUEEN.

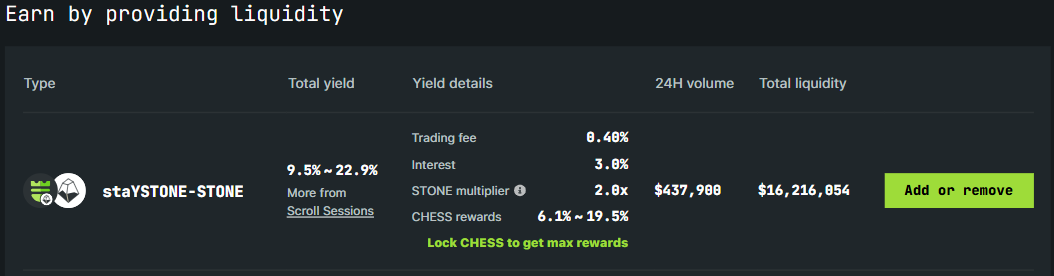

staYSTONE-STONE LP Diverse Yields

Tranchess introduced staYSTONE-STONE LP tokens to provide additional yield opportunities for ecosystem users.

LP token holders receive multiple benefit streams: CHESS token rewards, 0.05% of trading fee revenues, partial staYSTONE interest yields, and a 2x StakeStone points multiplier (applied to the STONE portion within the LP). Additionally, Tranchess provides LP stakers of STONE funds with supplementary weekly rewards of 150,000 CHESS tokens.

Different Point Rewards and Yield Structures

The Tranchess STONE Fund has a 6-month total staking period, ending October 8, 2024. At that time, different token types can be exchanged back to STONE based on their fair value, and Tranchess allows STONE holders on Scroll to earn Scroll Marks points while earning StakeStone points.

stoneQUEEN can be exchanged with STONE at a 1:1 ratio, and holding stoneQUEEN earns the same StakeStone points multiplier as holding an equivalent amount of STONE. However, splitting stoneQUEEN into staYSTONE and turPSTONE and holding both simultaneously enables users to gain a 2x points multiplier without loss, while earning Scroll Marks points based on holding value.

turPSTONE not only features a 10x fixed leverage ratio but also comes with a 2x StakeStone points multiplier, ultimately resulting in 20x StakeStone points. After deducting the cost of fixed interest payments to staYSTONE at fund maturity, turPSTONE:STONE < 1

staYSTONE offers a 6% fixed annual interest rate for stability-seeking investors but doesn't include StakeStone points rewards, while earning Scroll Marks points based on holding value. At fund maturity, staYSTONE:STONE > 1

Additionally, Tranchess collects a 3% fee from points generated by Turbo & Stable fund products, which is distributed 100% to veCHESS holders, enhancing the yield for veCHESS holders.

Disclaimer: All conversion rates mentioned between turPSTONE, staYSTONE, and STONE are preliminary estimates. Final conversion ratios will be determined and announced based on fair market value calculations towards the fund's conclusion.

Fast and Efficient: Rapidly Replicable Precise Architecture

Beyond the STONE fund, current Turbo&Stable products include the weETH fund in collaboration with eth.fi, the Staked ETH fund partnered with LIDO, the SolvBTC fund with SOLV, the slisBNB fund in partnership with Lista DAO, and the recently launched SolvBTC.BBN fund.

Not only does Turbo&Stable offer diverse yield strategies, it supports rapid deployment of any LST narrative across chains while flexibly adapting to corresponding asset yield changes. For example, the recently launched SolvBTC.BBN, being the project with the highest BTC staking volume in Babylon's early ecosystem, currently generates the highest points yield among Babylon's LRTs. As another component of user benefits, this advantage is preserved within the Turbo&Stable structure, fully demonstrating the flexible "fast and effective" nature of this sophisticated architecture.

Recently, CHESS's listing on Binance Futures has once again drawn significant attention. As Tranchess's governance token, CHESS and veCHESS not only serve as crucial bridges connecting the entire Tranchess ecosystem but also grow in value alongside the project's development.

Governance Token CHESS

CHESS has a total supply of 300 million tokens. Besides direct purchase, users can obtain CHESS through multiple channels, primarily through participating in liquidity mining or staking QUEEN, BISHOP, and ROOK tokens.

After locking CHESS to obtain veCHESS, users can unlock various ecosystem utilities: veCHESS holders gain access to voting rights, weekly protocol revenue sharing, and 3% of Turbo & Stable points revenue among other governance benefits.

Beyond liquidity and governance functions, CHESS currently supports cross-chain functionality across three chains: BNB Chain, Ethereum, and Scroll.

veCHESS Activation

Lock-up Conversion

Users can lock their CHESS for periods ranging from 1 week to 4 years, with the conversion ratio increasing linearly based on the lock duration. The specific veCHESS amount is calculated by multiplying the CHESS amount by the lock duration (in years) divided by 4.

For example, locking 100 CHESS for 4 years will yield 100 veCHESS, while locking 100 CHESS for 2 years will yield 50 veCHESS. The veCHESS amount decreases linearly over time, but users can increase their veCHESS balance by extending the lock duration or adding more CHESS.

Tranchess supports batch locking of CHESS, with each lock creating a new lock position. For easier management, users can merge multiple lock positions into one.

Multiple Layers of Additional Rewards

Beyond the previously mentioned 3% points revenue return from Turbo&Stable fund products, veCHESS holders will receive 50% of Tranchess platform's weekly revenue as additional staking rewards, while the other 50% goes to the Treasury.

Continuously Expanding Governance Rights

Users holding veCHESS can participate in all major decisions on the Tranchess platform, with voting power proportional to their veCHESS holdings, ensuring users with long-term commitment have greater influence in the decision-making process.

Recently, the Tranchess community passed TranchessDAO #9, which suggests expanding veCHESS voting governance rights to the decision-making level for all new Turbo&Stable project launches. This proposal not only broadens veCHESS use cases but also demonstrates the future scalability potential of the Turbo&Stable architecture.

Is It a Value Discovery Zone?

Through deeper exploration of the Tranchess ecosystem, it's evident that CHESS is not merely a simple governance token, but rather serves as the core value carrier within the Tranchess ecosystem.

The veCHESS obtained through CHESS staking not only generates substantial revenue sharing benefits but also empowers holders with voting rights in crucial platform decisions. This dual functionality makes CHESS an extremely attractive instrument for both value storage and appreciation.

With the platform's continuously growing TVL (Total Value Locked), the official launch of perpetual contracts, and several Turbo&Stable fund products approaching maturity, CHESS may be at a significant value point. The earning potential of veCHESS could well exceed the market's current price perception of CHESS. The true potential value of CHESS extends beyond market speculation in the DeFi sector or short-term "lottery mentality" focused on single-token exchange listings. Instead, it represents a long-term, fundamentally supported product yield.

From structured funds to Turbo & Stable architecture, veteran player Tranchess maintains excellence and flexibility in the competitive DeFi sector, providing diverse yields while offering more solutions for various ecosystems, embodying true DeFi Native spirit.

Tranchess's development trajectory proves that only through continuous innovation and maintaining a crucial advantage can one maintain an undefeated position in the grand chess game of crypto.

Recommendation

Catizen

Catizen: Beyond the Click-to-Earn Model - Whats Next in its Sustainable Journey?

Nov 11, 2024 15:40

dappOS

The Ultimate Intent of Web3: How dappOSs Intent Assets are Unlocking True Asset Appreciation for You

Nov 11, 2024 15:52

When 9 of the Top 100 Market Caps Are Memes, Embracing Attention Investing Is Clearly the Way Forward

Jul 07, 2024 14:12