The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

Intent has been one of the hottest narratives this year.

From Paradigm coining the term last year to its implementation this year, many products are becoming "intent-based."

However, most current intent products still operate at the "technique" level, solving specific problems in specific scenarios, such as limit order flow optimization and operational experience optimization.

Ask yourself, what is your ultimate intent?

The answer will likely point to "asset returns." Currently, the way assets seek returns has not yet entered the intent era.

Intent means doing as you please, rather than being caught in a dilemma.

But as long as you have crypto assets, you'll definitely face a dilemma -- either store them as xxETH for nested yields, or convert them back to ETH for trading.

Your xxETH can neither be used in another protocol nor directly sold on CEX.

Why should you care about the difference between aETH and bETH? Why is your ETH different from their ETH... This isn't a hassle you should have to bear. What you want is the result of finding global returns, not getting stuck in local processes.

Therefore, true "principled" intent is actually about assets being smoothly usable, going where you want them to go, finding the returns you want to find, without any hitches.

And now, the asset efficiency and returns you want - dappOS's recently launched "Intent Assets" understands your needs.

Previously, dappOS was criticized as VCs creating concepts without much practical use. But recently, when you open Chinese CT and various research reports, almost all are discussing dappOS's intent assets. Even Binance's Web3 wallet has launched related activities encouraging users to experience the full process of intent asset operations.

So, what exactly are these intent assets?

Here's the TL;DR version:

Allow yield-bearing assets to be immediately usable on-chain. Whether withdrawing intent assets as native assets to CEX, or using them on-chain to buy meme coins, participate in lending, or staking, users can use them directly. No extra steps are needed, and there's no waiting time or high slippage to endure.

Why should you care about these intent assets?

For your own asset operations, you can find the most capital-efficient way to make asset yields intent-based. For alpha-seeking projects, those close to trading and solving real problems tend to be favored by the market. For yield farmers and airdrop hunters, dappOS is currently pushing intent assets to multiple on-chain protocols for cooperation, which might create a "golden shovel" effect.

In a relatively sluggish market with few hot topics, understanding and trying such projects early might lead to different discoveries.

What are dappOS's intent assets? Before answering this question, we need to understand what problems current crypto assets face.

As mentioned at the beginning, more convenient operations and easier-to-understand steps are just means, not ends.

The true purpose of intent is asset appreciation and return maximization.

Therefore, centered on intent, and more specifically centered on the intent of asset appreciation -- making assets flow more smoothly to complete appreciation and find more yield opportunities.

Why can't the intent of asset appreciation be fully realized currently?

First is the burden brought by ecosystem proliferation. Various non-directly interoperable L1/L2 chains, gas fees for each transaction with possible failures, multiple types of non-interoperable USD stablecoins...

Second is the friction caused by asset diversity. My aETH can't be used as bETH, my aETH can't be withdrawn to CEX to sell, and it can't be directly swapped on DEX -- the most ideal appreciation method I see always requires some friction to realize.

And after friction, the appreciation effect is greatly diminished.

For example, converting aETH to ETH often has a withdrawal period; DEX exchanges might have liquidity issues causing slippage losses, etc.

At its core, it's the contradiction between the "static" and "dynamic" nature of crypto assets.

When static, depositing into protocols essentially contributes to a protocol's TVL for yields; but when wanting to move, the protocol doesn't help solve the free exit problem, nor does it have the motivation to solve it (it very much hopes you'll stay).

So the xxETH and other assets in your hands are essentially individual tickets for each project, not an all-park pass.

If ticket exchange is troublesome, who would still want to come to the amusement park? Who would still want to be active in the park?

Ultimately, what you need is an asset that unifies static and dynamic:

Static: Coins can be placed in various L2s and application protocols as xxETH for yields, staking.

Dynamic: Coins can directly use xxETH to go anywhere you intend to find more returns, such as buying memes, doing other staking, performing swaps; without considering more friction-causing rules (like chain switching, gas switching, withdrawal waiting periods, etc.).

Your assets unify static and dynamic, have no state transition friction costs, and have high availability globally - this is the essence of the intent asset concept.

This is exactly what dappOS is doing: truly getting what you want at the returns level.

After understanding what intent assets are, let's see how dappOS actually implements them.

Seeing is believing - looking directly at the product's operation page is more intuitive.

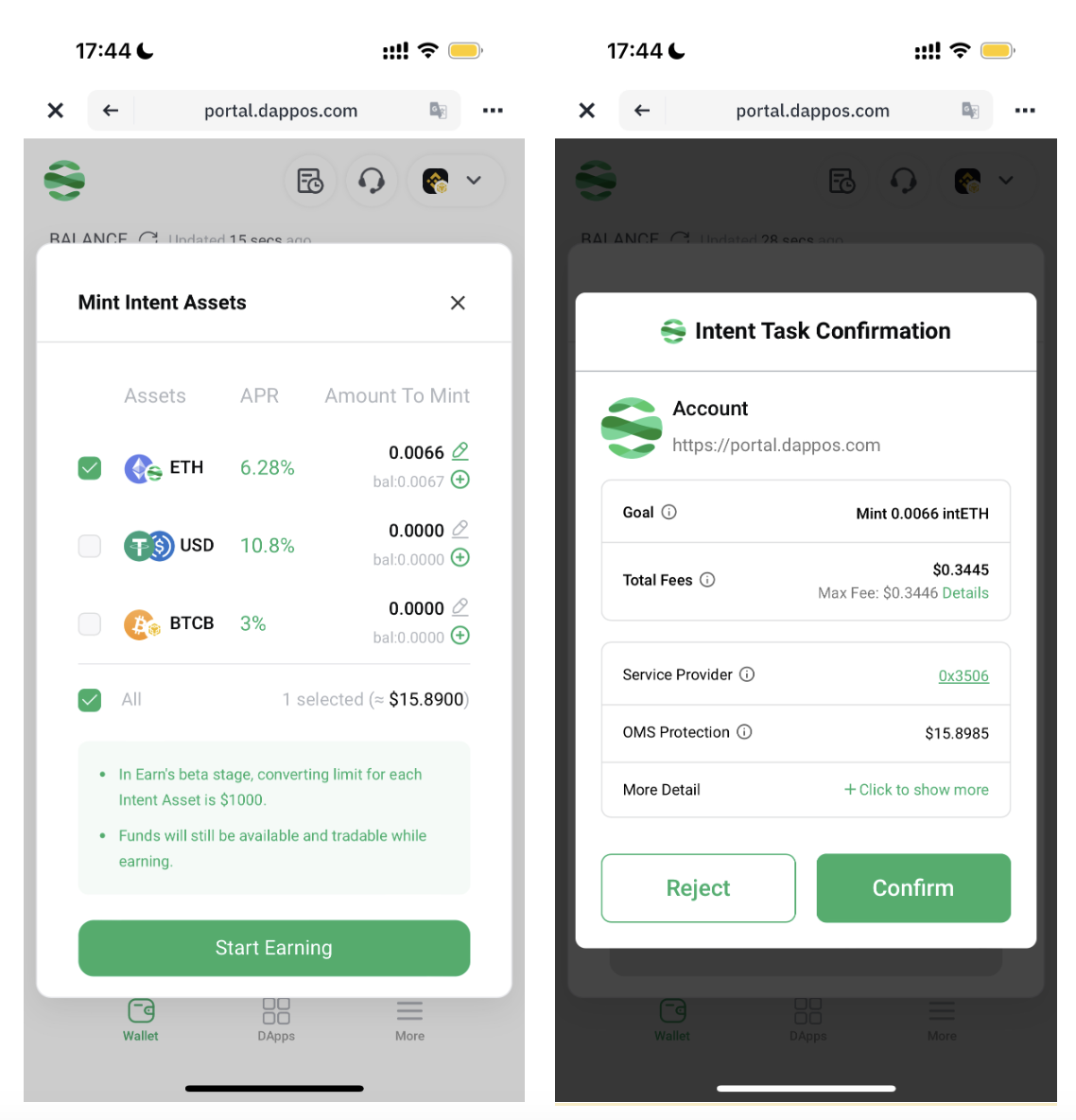

Suppose you have ETH assets on various L1/L2s, you can directly mint them into intent assets, i.e., intentETH, through dappOS's wallet page.

Subsequently, in traditional cases, when you want to redeem your xxETH back to ETH, you often need to find a DEX for exchange, where liquidity might not be sufficient; if converting back to ETH through the original route, there might be different redemption periods.

However, if you hold intentETH, you can directly use intentETH as ETH in supported applications under the DApps option on the above page, without considering redemption and conversion to ETH issues. When you need to operate on CEX, you can directly withdraw intentETH as ETH, with no lock-up period and low fees.

Similarly, you might want to convert back to ETH because there are more attractive profit opportunities on other chains.

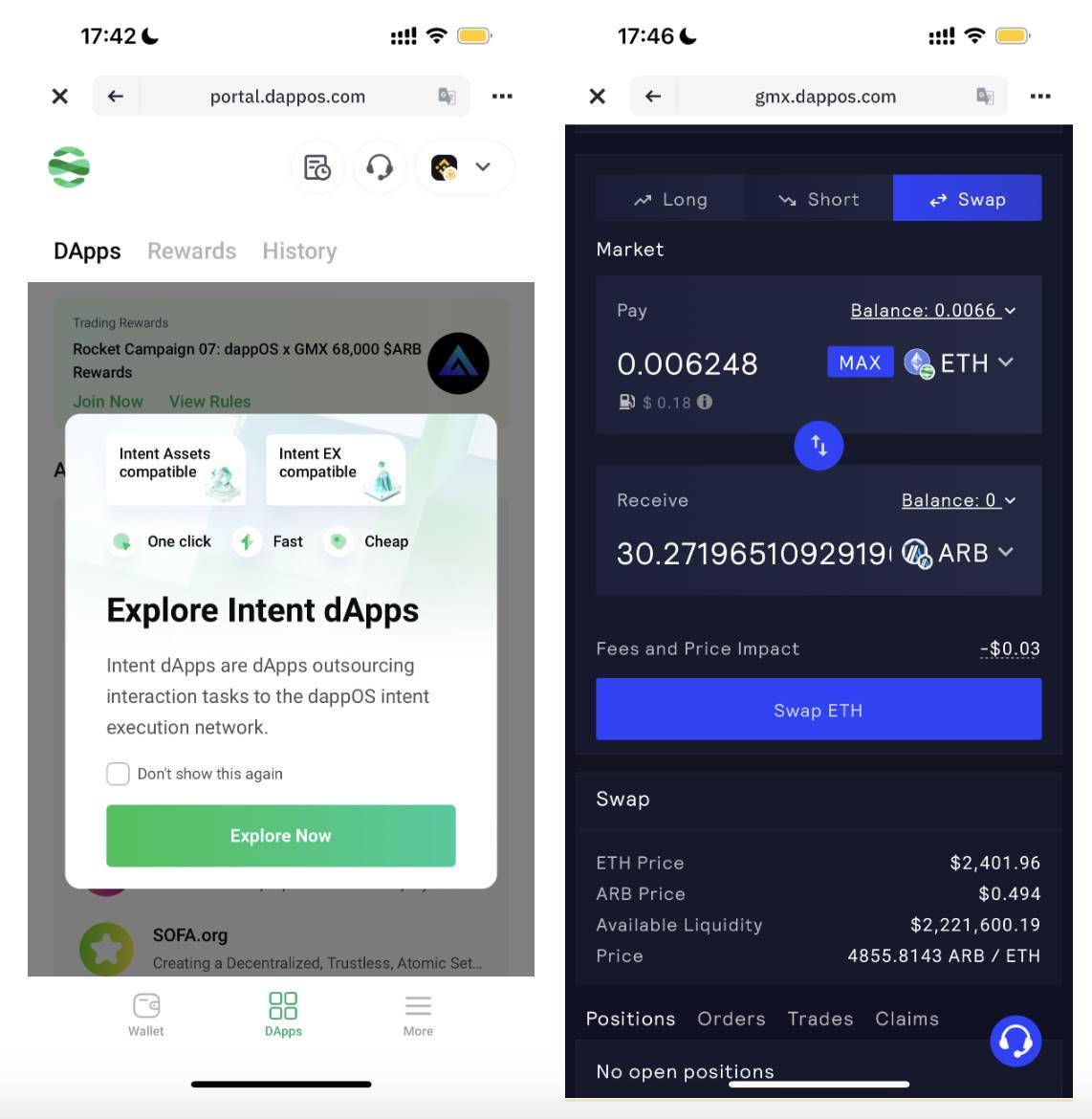

For example, if you want to do contract trading on GMX on Arbitrum, but currently have no money on Arbitrum. Traditionally, you might need to bridge this ETH, then interact within GMX; and if there are opportunities on several chains, you'd have to divide your ETH into several parts, leaving some gas and startup funds on each chain.

But with intentETH, you can directly use intentETH for contract trading in GMX, essentially using intentETH directly as ETH, without going through the planning steps of "ETH -- bridge -- target chain gas reserve -- target chain token exchange -- target chain App operation", considering fewer things, resulting in a better experience.

As shown in the figure below, the intentETH I minted on BNB Chain can be directly operated in GMX, with the entire process being almost seamless.

The intuitive experience is that intentETH doesn't have the "fragmentation feeling" of ETH on different chains - it's ready to use immediately. When flowing, it's a globally smooth ETH, and when static, just holding intentETH provides passive income.

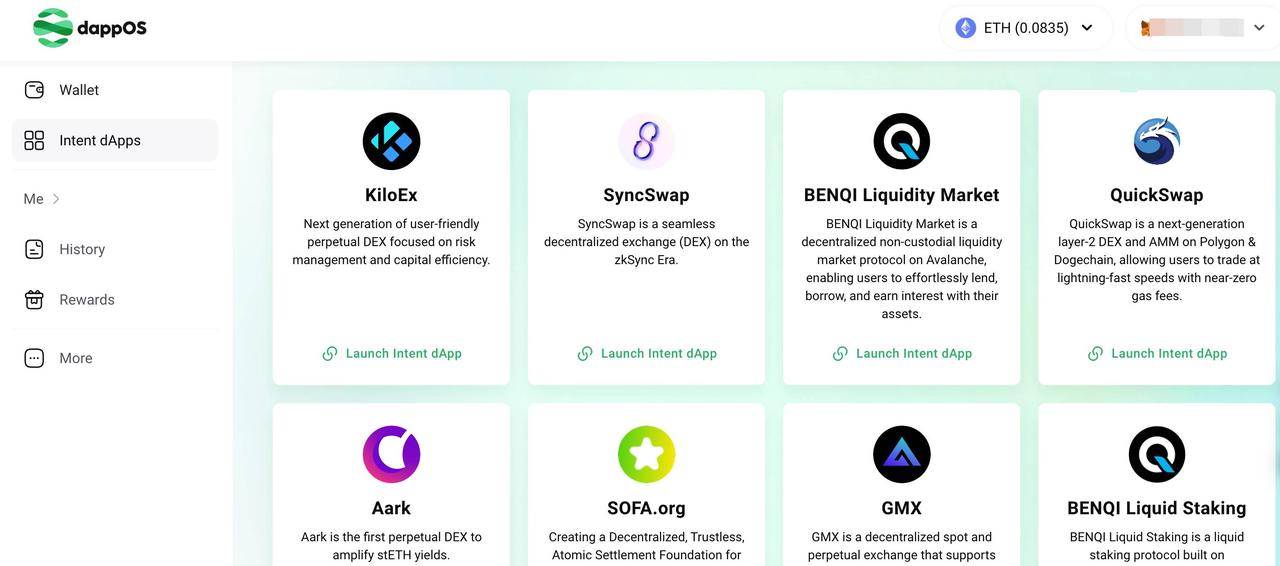

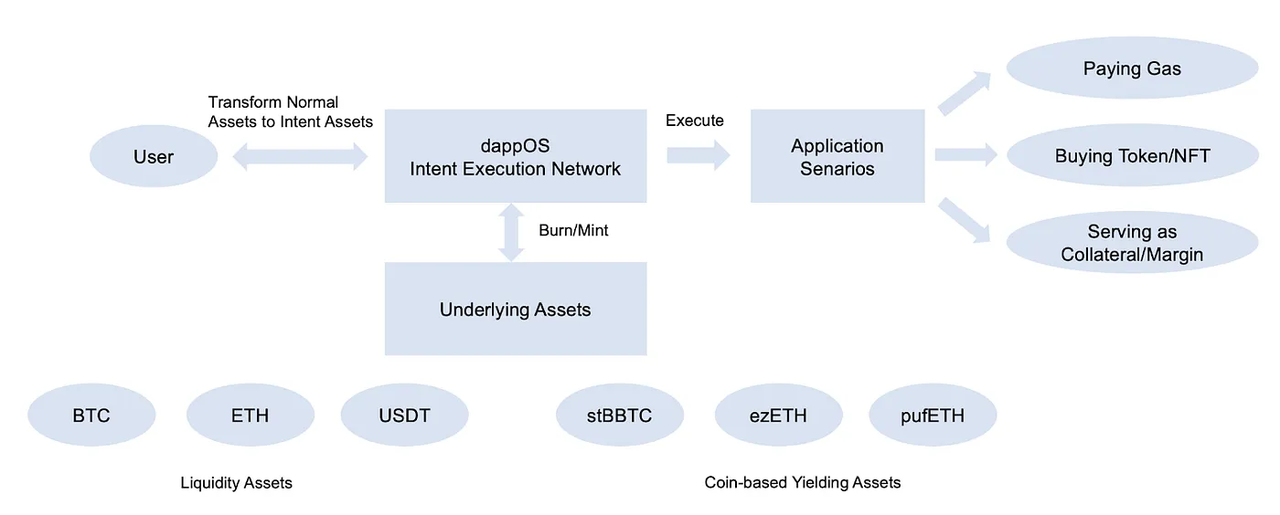

As shown above, dappOS now supports many dApps for direct interaction with intent assets, including many well-known dApps. How is all this implemented, from ordinary crypto assets to intent assets, to multi-chain scenario support?

The key secret lies in dappOS's own intent execution network.

The intent execution network is responsible for the transformation and application of intent assets, ensuring users can use their assets in various situations, and delegating complex minting, burning, and conversion tasks to backend service providers.

You don't actually need to care about whether this network exists, because its purpose is to keep the complexity to itself and simplicity for users.

Simply put, you express the ultimate intent, it handles the work.

This means users can choose their own methods of moving assets across different chains and seeking yield opportunities. However, in practice, the dappOS intent execution network handles the process for you.

Security-sensitive players will definitely ask, why let others operate on your behalf?

First, efficiency is prioritized.

The intent execution network can provide institutional-level cost efficiency for ordinary users, how should this be understood?

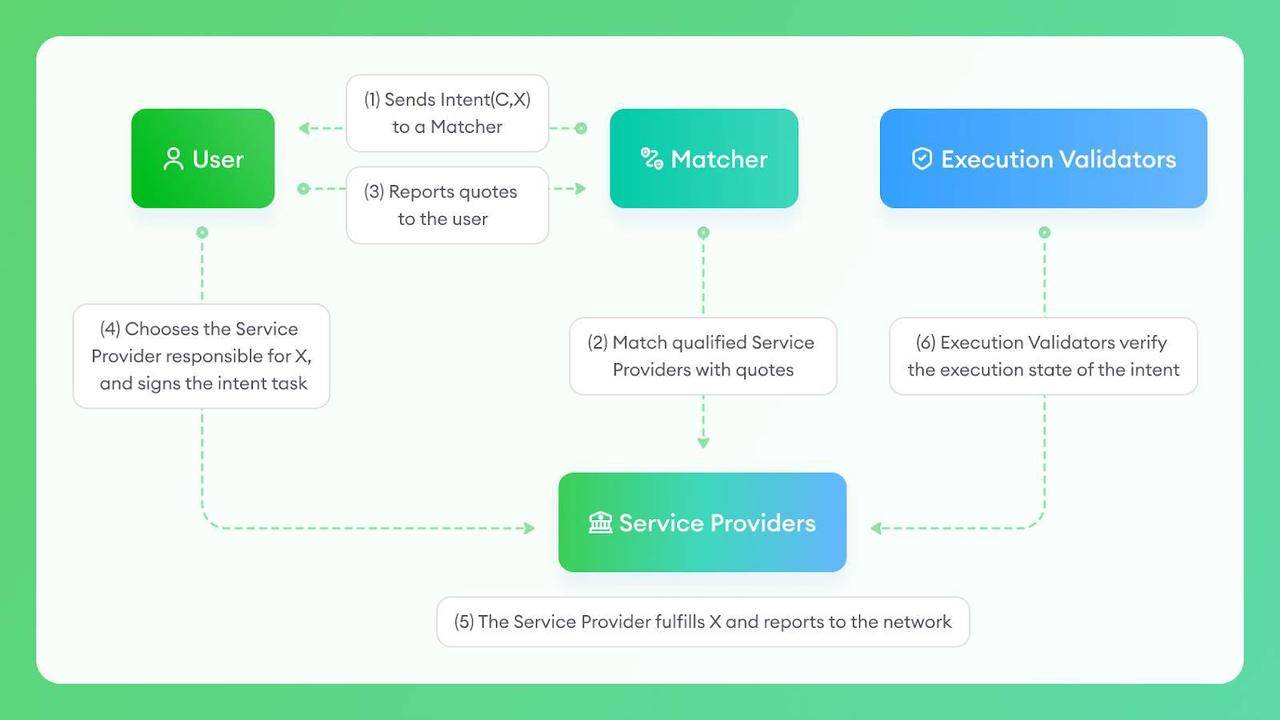

In the dappOS network, there are service providers helping you execute tasks, such as exchanging assets and finding optimal paths. Because node service providers in dappOS are a free market, they compete through bidding to get opportunities to execute user tasks. In such a competitive environment, only nodes with higher execution efficiency and lower execution costs can win.

These professional nodes often have execution solutions that ordinary users don't have, such as:

Multiple users' entries and exits offsetting each other; obtaining low-cost loans first, advancing funds needed for user redemption, gathering certain interest-bearing assets before redeeming from project parties as large accounts, thereby avoiding slippage losses caused by low liquidity on-chain DEXs.

The dappOS intent execution network essentially empowers users with institutional-level professional execution capabilities, giving users a good intent asset usage experience.

Second, security hasn't been compromised.

First, intent assets are composed of a series of underlying assets and are essentially withdrawal certificates, with users able to call contracts for minting/burning themselves. This on one hand ensures users can still redeem intents for underlying assets in extreme cases, and on the other hand means users are less affected when individual underlying yield assets have issues.

In the process of redemption and usage through the dappOS network, dappOS network adopts OMS (Optimistic Minimum Staking) as its core trust security mechanism. Each service provider's current total task value cannot exceed its staked amount. Additionally, users transfer risks related to redemption assets to service providers more capable of handling these risks, rather than signing multiple times themselves and executing in multiple places to achieve intent, thus reducing operational risk.

As shown above, users only need to publish intent. Then service providers execute intent, validators verify execution, matchers schedule task division, and under economic incentives and interest orientation, different roles perform their duties.

At this point, don't you think this thing is like a "decentralized Yu'ebao"? Indeed it is. There were many products previously claiming to be "on-chain Yu'ebao", but they were more like money market funds, only having the current interest-earning function, with very limited usage scenarios. But in the real world, "Yu'ebao" can meet people's daily usage needs, everyone can use the money in Yu'ebao for shopping and transfers; while money market funds often need to be redeemed before use, and even have a certain waiting period. This shows that the essential difference between Yu'ebao and money market funds lies in whether funds can be used immediately and the richness of usage scenarios. Compared to Web3 current financial products that can only "deposit/withdraw + earn interest", dappOS intent assets are not only decentralized and non-custodial, but more like a real Yu'ebao, able to solve the problem of low-cost, efficient use of intent assets in the vast majority of scenarios through the intent execution network.

From the aspects of usability, liquidity, and security, intent assets are clearly superior to previous similar products:

Low friction: You just express intent, crypto assets flow across ecosystems and chains with minimal friction everywhere;

High security: Assets are non-custodial and not controlled by a center. Signing rights remain with you, it's just outsourcing intent tasks to others, and if not completed, you'll receive corresponding compensation through the OMS mechanism.

If still not intuitive enough, the figure below clearly compares intent assets with other products from the perspectives of asset usage breadth, yield rate, and security.

The trifecta of efficiency, high availability, and security shouldn't be a pipe dream - it's what crypto assets were designed to deliver in the first place.

After looking at the product, let's see the possibility of dappOS succeeding.

For a project to succeed, both endorsement and ecosystem need to be considered.

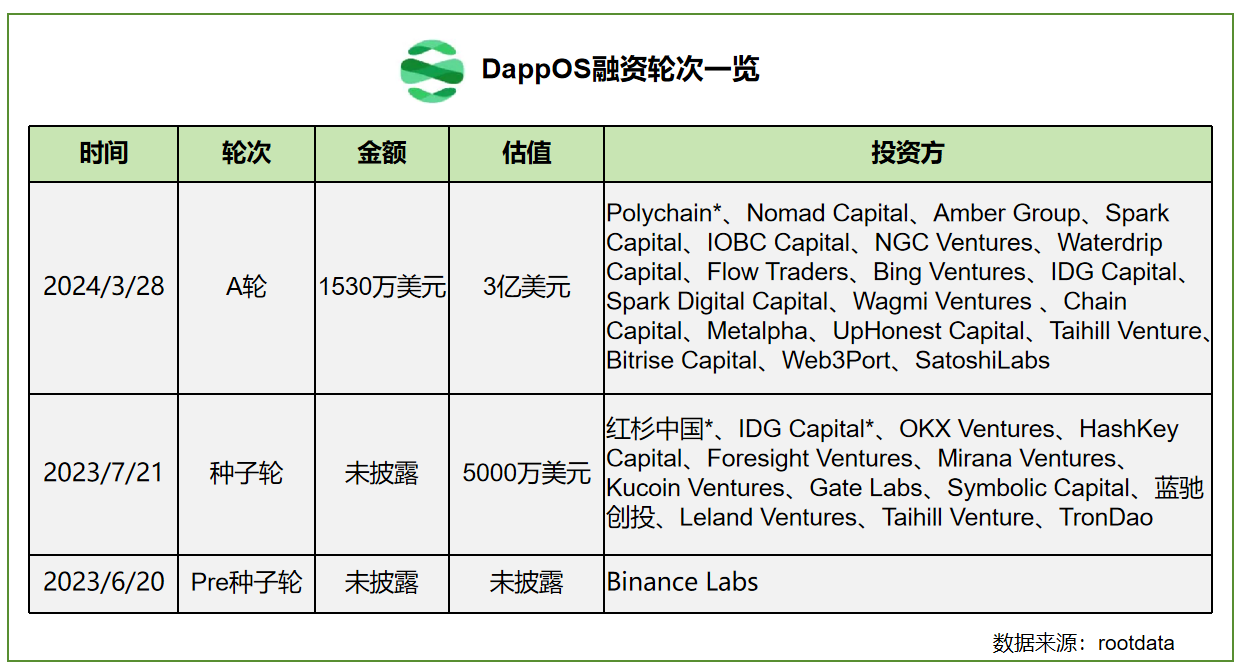

In terms of funding background, dappOS initially received funding support from Binance Labs, and in the recent two rounds of funding, it has gained the favor of well-known VCs such as Polychain, Sequoia China, IDG, OKX Venture.

Although the current market is gradually raising reflection and criticism about VC tokens, the influx of capital undoubtedly increases legitimacy and credibility from a project building perspective. Setting aside how the project token itself will unlock and perform, for players currently seeking yields and opportunities at different stages of project development, the endorsement situation can provide a powerful reference.

In ecosystem building, the flow of intent assets cannot be separated from the support of more partners. Currently, dappOS has established strategic cooperation with more than 10 partners shown in the figure below, including both applications and L1s and L2s. We can see that the underlying yield sources of intent assets are all top projects listed on major exchanges with TVL of tens of billions of dollars, ensuring both security and returns.

For a project primarily promoting assets, how many other projects and ecosystems support it directly determines the asset's influence and ceiling.

Currently, dappOS's intentBTC, intentETH, and intentUSD intent assets derive underlying yields from various LRT/Pendle PT assets (such as wstETH, sUSDe, sDAI, stBBTC) etc.

We can see that intent assets have already covered Bitcoin and Ethereum ecosystems in the initial phase; due to the network's marginal increasing effect, after an asset branches out, more partner support means multiplied increases in intent asset liquidity and usability.

Additionally, what players care about most is still returns and tangible benefits.

Recently, Binance Web3 wallet will jointly launch user incentive activities with dappOS, with a reward pool of 500,000 USDC.

This activity is divided into "intent asset minting" and "intent dApp interaction" tasks, encouraging users to experience intent assets and intent dApps based on the dappOS intent execution network through Binance Web3 wallet.

Interested players can learn more information through this link.

In the end, intent starts from narrative and lands in practice.

Products that solve asset high availability and capital efficiency, putting intent into practice, will actually be liked by both supply and demand sides of the crypto world.

For users on the demand side, assets need to find more returns. Better liquidity and more convenient use naturally leave no reason for rejection and barriers. If using dappOS can unlock more possibilities while ensuring security, why not?

And on the supply side, the hundred-chain war with thousands of projects has long become a red sea. Applications in the ecosystem want to attract users, and besides some rewards, of course hope users can smoothly transfer from elsewhere to here -- a small step in migration cost is often a big step in TVL.

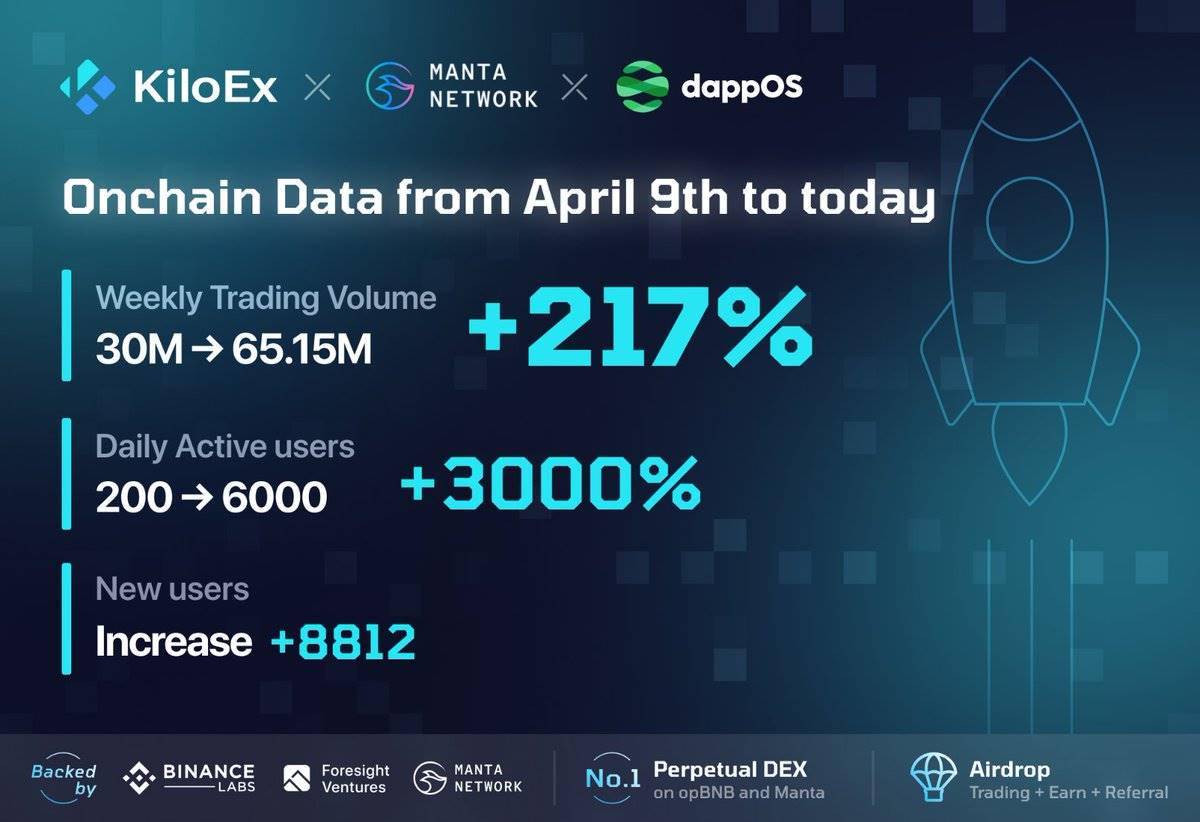

Looking at past data, other variables being constant, projects that integrated dappOS indeed showed significant growth in user numbers and TVL.

This also reveals the "principle" in the crypto world, which is to maximize capital efficiency and optimize trading experience. An inclusive intent is a better intent, rather than staying at the narrative and "technique" level.

Those who follow the right path gain much support, and those who drink water should not forget those who dug the well. We hope there will be more well-diggers like dappOS, benefiting the entire crypto ecosystem.

Recommendation

In-Depth Analysis of BasedAI: Balancing Privacy and Efficiency in Large Language Models - The Next Bittensor in AI?

Jun 06, 2024 21:41

Tranchess

Tranchess Strategic Analysis: DeFi Innovation Through Chess-like Gameplay

Nov 11, 2024 15:46

Understanding the Allora Whitepaper: A Self-Improving Decentralized AI Network

Jul 07, 2024 14:25