The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

With the market cooling off, it might be a good time to explore new Alpha projects.

Beyond AI and memes, cross-chain and chain abstraction have always been hot topics.

Recently, a new protocol called Universal has emerged, aiming to enable trading any token on any chain. What’s intriguing is that their official Twitter account is new with few followers, but it has caught significant attention with a16z following it.

In the crypto world, attention is never random; it’s driven by shared goals or interests.

Considering that Universal has not yet revealed much about its investors or listing strategies, it's clear the project is still in its early stages. Whether more investors are backing it remains to be seen. However, keeping an eye on it early is the right way to spot opportunities as soon as they arise.

What problem is Universal trying to solve?

One of the biggest challenges in the crypto market is fragmented liquidity. Chains, projects, and users all face the tough cold start problem:

L1 or L2 chains don’t have tokens/assets at launch.

Projects can’t manage liquidity across multiple L1/L2 chains when launching tokens.

Users need to lock liquidity on two chains when using bridges, not to mention the hassle of transferring assets between EVM and non-EVM chains.

Universal aims to tackle this by creating a protocol for wrapping assets, allowing any token to be traded on any chain. By offering a seamless on-chain trading experience, it simplifies the cold start process and removes complexities for the end user.

This can be seen as a form of chain or asset abstraction.

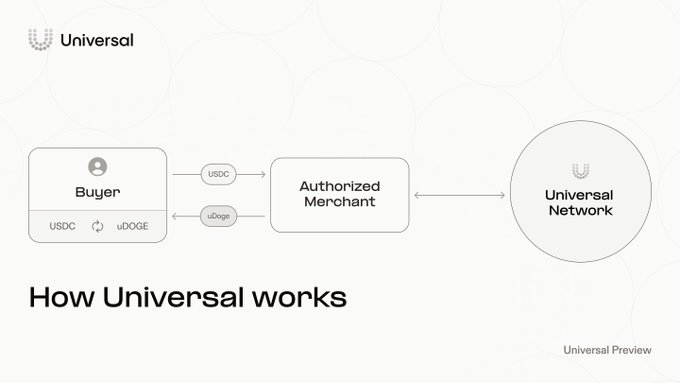

Universal uses a wrapped asset custody and issuance system to facilitate fast and reliable transactions:

Wrapped Assets, Universal Tokens, are special digital assets created by the Universal Protocol that represent the value of a native crypto asset (e.g., Bitcoin, Ethereum). Each wrapped asset is backed 1:1 by a reserve of the corresponding native asset.

For example, uBTC represents wrapped Bitcoin, and uETH represents wrapped Ethereum.

Universal supports issuing and trading assets on both EVM (Ethereum Virtual Machine) and non-EVM chains. This means users can trade supported assets seamlessly across different blockchains without needing to use cross-chain bridges or centralized exchanges.

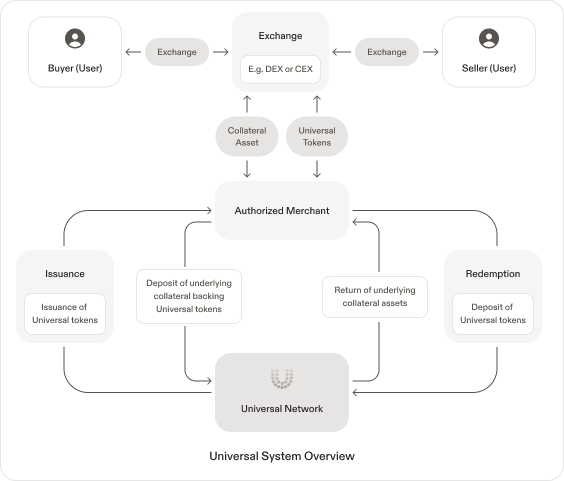

Below is an illustration of how wrapped assets flow across chains:

Issuance:

A user wants to obtain wrapped assets (e.g., uBTC).

The user provides native assets (e.g., Bitcoin) to an authorized merchant.

The authorized merchant deposits these native assets and issues the equivalent amount of wrapped assets (uBTC) on a 1:1 basis.

The user receives uBTC, which can be freely traded across different blockchains.

Exchange:

Users trade wrapped assets (e.g., uBTC) on exchanges (DEX or CEX).

Buyers and sellers complete the transactions through the exchange.

Redemption:

A user wants to convert wrapped assets (e.g., uBTC) back to native assets (e.g., Bitcoin).

The user provides the wrapped assets (uBTC) to an authorized merchant.

The authorized merchant receives the wrapped assets and returns the equivalent amount of native assets (Bitcoin) to the user.

A crucial role in this process is the "Authorized Merchant." When users purchase Universal Tokens, authorized merchants deposit the corresponding native assets as collateral and issue the same amount of Universal Tokens based on this collateral.

From public information, Universal has chosen Coinbase Custody as its authorized merchant. This means the original crypto assets are stored in Coinbase's custody accounts.

By combining wrapped assets with Coinbase Custody, Universal enables free, secure, and efficient trading of various crypto assets across different blockchains.

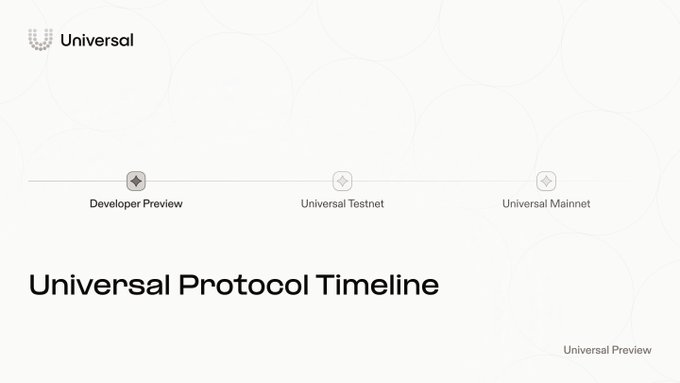

Universal is rolling out its protocol in three main phases: Developer Preview (now), General Testnet, and General Mainnet.

For regular users, joining the official Discord is required to access the preview version.

Although there are no publicly available testnet interaction rules or incentive plans yet, getting involved early by joining the Discord community is a good strategy.

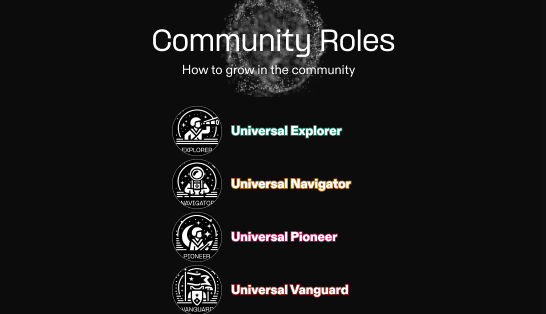

In the Universal community, new members can only speak in the general welcome channel, regardless of language or country. This measure is to limit scammers and bots. Real users need to introduce themselves, say hello, and interact with the official Twitter to earn different Discord roles, which will then grant access to other channels.

Currently, there are four types of roles in the official Discord, each corresponding to different levels of community participation and contribution. Interested users can join the Discord community here to begin their journey of "leveling up" and gain access to the product preview version.

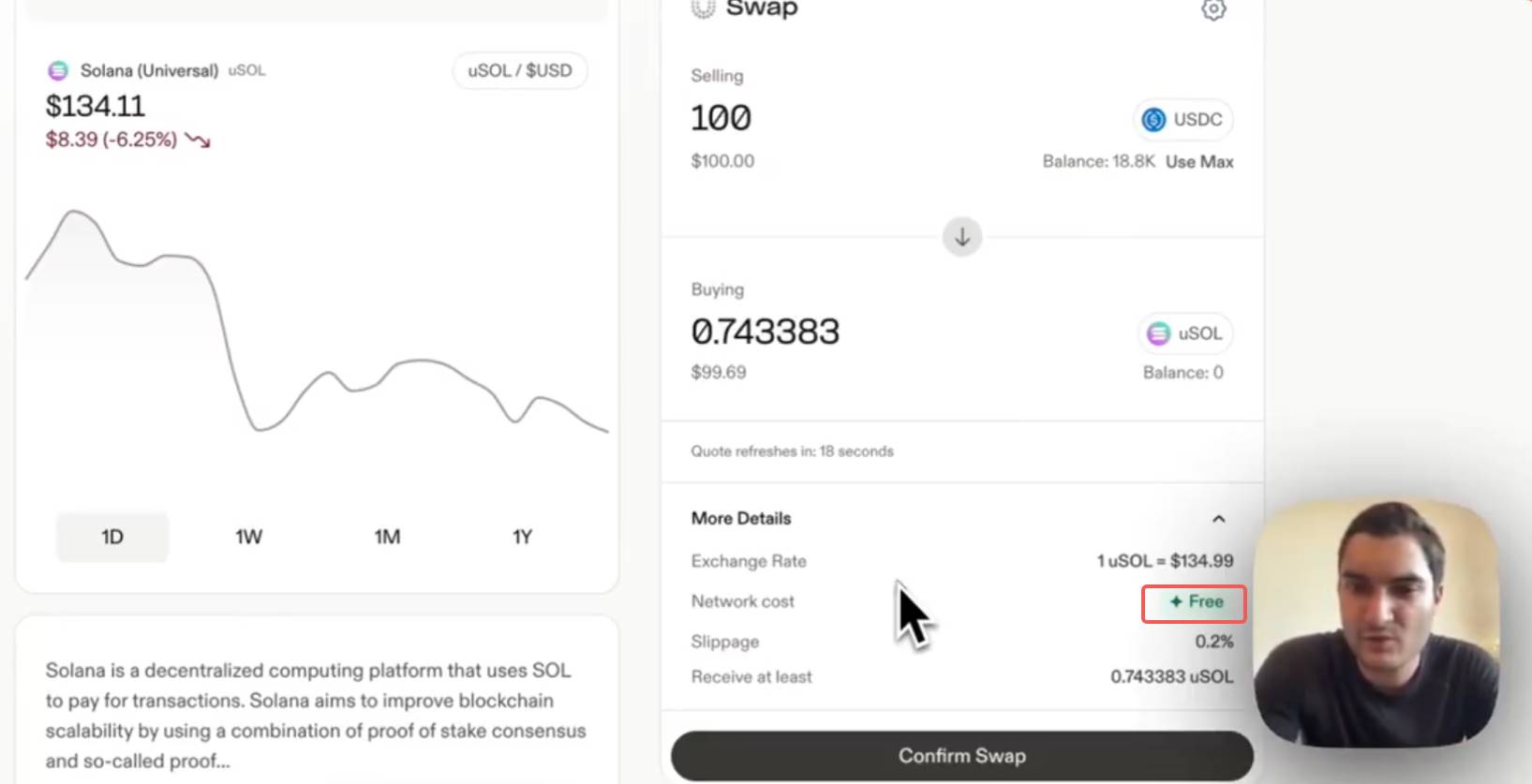

Based on the demo video shared on Twitter, the preview product interface is similar to most DeFi products. Users can choose assets from any chain to exchange for Universal's wrapped assets, and network fees are free.

While this may not represent the final version, with increasing liquidity fragmentation and the growing number of hotspots across different chains, a universal asset solution should find its own market.

We will continue to monitor the latest developments and future directions of this project. Stay tuned for more updates.

Recommendation

Unpacking Pi Squared: Academic Leaders from Elite Universities Spearhead a $12 Million Funding for a ZK Universal Settlement Layer

Jul 07, 2024 14:26

CARV

New Rules of Data Value Distribution: How CARV is Powering Millions of Users?

Nov 11, 2024 15:49

Tranchess

Tranchess Strategic Analysis: DeFi Innovation Through Chess-like Gameplay

Nov 11, 2024 15:46