The Next Trillion Dollar Wave - AI Narrative in Crypto: Who Are the Top Players?

Dec 12, 2024 21:40

Written by TechFlow

"One-Click Chain Deployment"

As deployment costs decrease, we're seeing a proliferation of Layer 1 and Layer 2 solutions. Whether or not you believe a new chain is necessary, it's undeniable that more projects will deploy their own chains to meet specific needs.

Just as the increasing number of DEXs led to projects building "DeFi liquidity layers"...

So when chains multiply, how can we connect them all?

This is where today's protagonist, Initia, comes in.

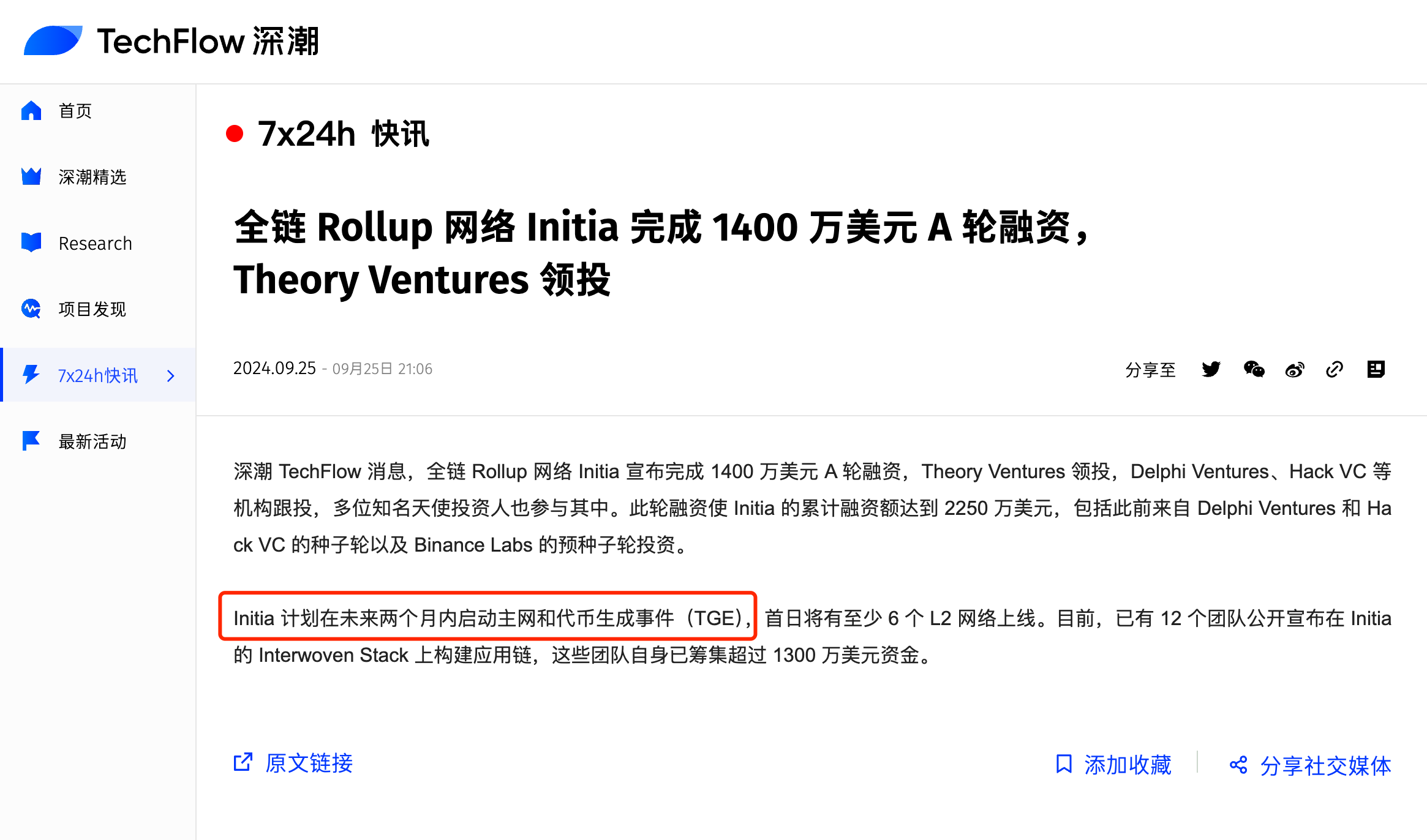

Last week, Initia announced the completion of a $14 million Series A funding round and a $2.5 million community round, bringing total funding to $25 million. This includes the $7.5 million Seed round from October last year, with participation from Binance Labs, Delphi Ventures, and HackVC. The team also revealed plans for mainnet deployment and TGE in Q4.

Yi He, Co-founder of Binance and Head of Binance Labs, commented: "Binance Labs continuously identifies and integrates infrastructure providers with innovative solutions to accelerate Web3 application growth. Initia's advanced architecture and development tools represent a crucial step in driving widespread developer adoption."

A year later, we'll dive deep into Initia's core philosophy, technical features, and progress as the gateway to multi-chain interconnectivity prepares to open.

When exploring Initia, you'll frequently encounter the term "interwoven."

This interweaving refers to the interconnectivity between different Layer 2 solutions, manifesting in consistent user experience, shared liquidity, and security. Since Initia supports EVM, MoveVM, and WasmVM, theoretically both Ethereum and non-Ethereum projects can seamlessly migrate to Initia and achieve interconnectivity.

While this currently doesn't include SVM, Initia co-founder Zon mentioned in a previous podcast that they would consider supporting SVM if demand increases.

Is Initia Layer 1 or Layer 2 ?

Initia = Layer1 + Layer2. To actualize Initia's vision, the team architected a comprehensive technical stack from the ground up, developing both Layer 1 and Layer 2 solutions.

According to official documentation: Having a complete technical stack enables Initia to implement chain-level mechanisms that coordinate the economic interests of users, developers, Layer 2 application chains, and the Layer 1 chain itself.

For more details, refer to the project documentation:https://docs.initia.xyz/

Before diving deeper into Initia's mechanisms and implementation logic, let's clarify some new concepts and terminology to better understand Initia's long-term vision.

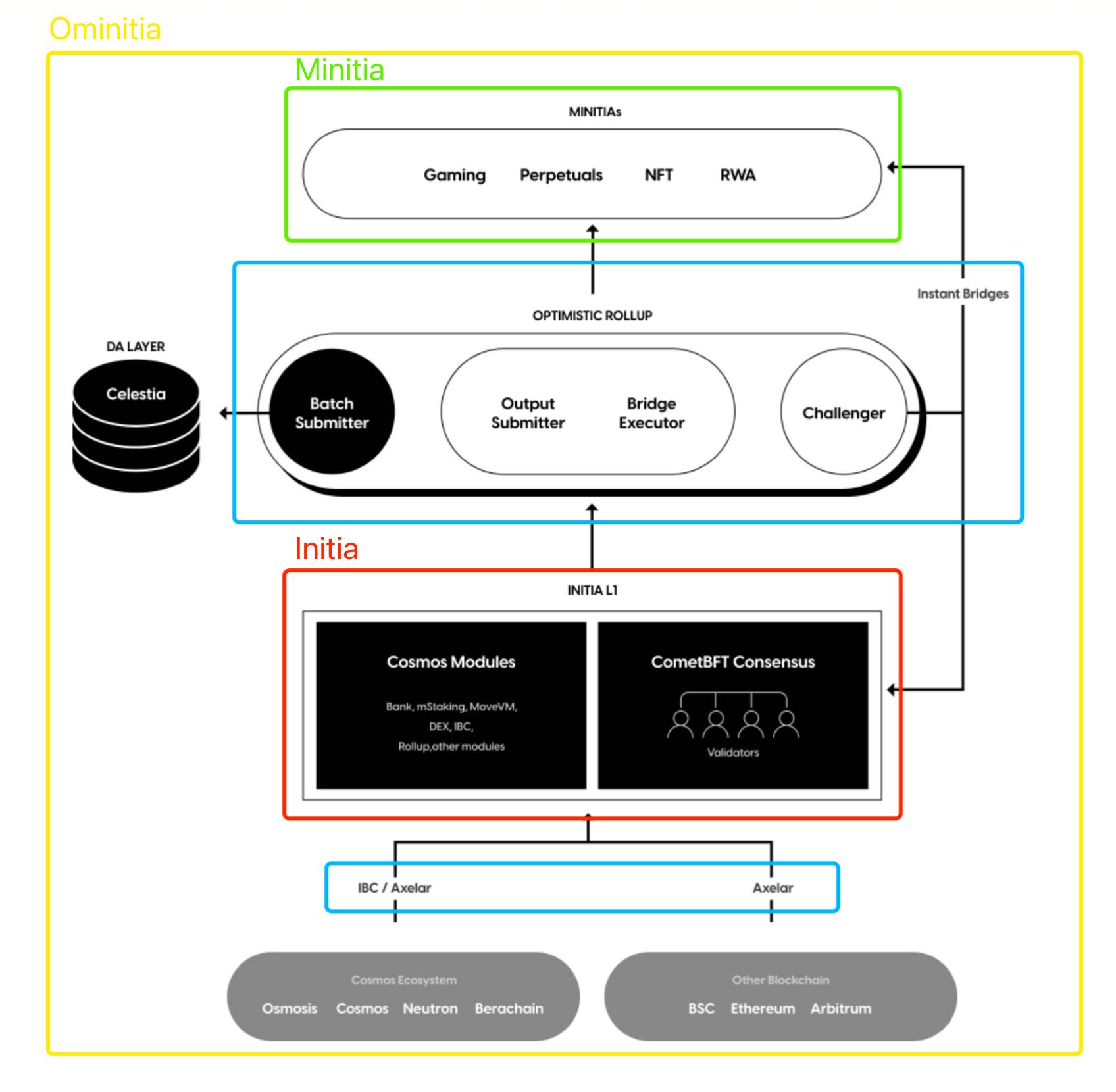

Ominitia / Initia / Minitia / OPInit Stack

Initia: Formally known as Initia Orchestration Layer (Layer 1), it's the foundation layer coordinating network security, consensus, governance, interoperability, liquidity, and cross-chain messaging.

Minitia: Initia Rollups (Layer 2), also known as "Minitia" or "mini Initias," are Layer 2 solutions built on Initia Layer 1 to enhance scalability and transaction throughput. They can run on EVM, MoveVM, or WasmVM, with CosmosSDK as the underlying framework.

OPInit Stack: Initia's Optimistic Rollup framework built in CosmosSDK, used to secure Initia Rollups through fraud proofs and rollbacks.

Ominitia: The comprehensive protocol architecture that integrates core components including Initia (Layer 1), Minitia (Layer 2s), OPInit Stack, and Bridging Middleware, forming a cohesive multi-layer blockchain ecosystem.

Enshrined Liquidity / InitiaDEX / VIP

Enshrined Liquidity: Initia's Layer 1 implements an innovative consensus mechanism leveraging Delegated Proof of Stake (DPoS) enhanced through the x/mstaking module. This module allows multiple tokens to be staked directly with validators for voting power, accepting either standalone $INIT tokens or whitelisted INIT-X (corresponding Token) LP tokens from InitiaDEX for staking.

This mechanism increases Layer 1 liquidity, facilitates Layer 1 & Layer 2 interaction, enhances LP staker rewards, and reduces security dependence on $INIT token volatility.

InitiaDEX: A cornerstone of the Initia blockchain, built natively on Layer 1 using Move language. InitiaDEX isn't just a trading platform; it's an integral part of the Ominitia ecosystem designed to facilitate liquidity and ensure seamless interaction between Layer 1 and Layer 2.

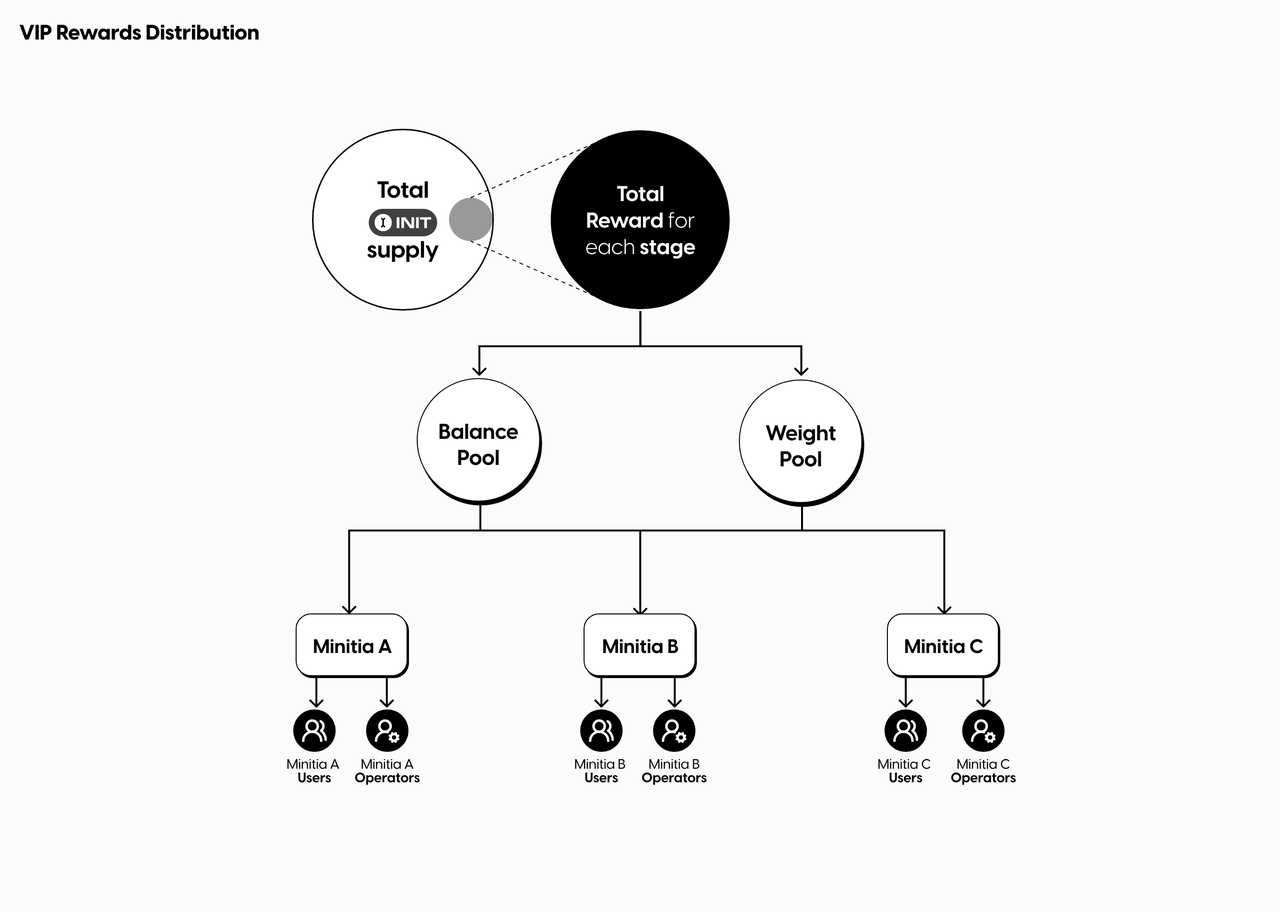

VIP (Vested Interest Program): Addressing the challenge of inconsistent incentive mechanisms, underutilized native tokens, and inefficient protocol-level incentive distribution as Rollups multiply. The VIP program aims to solve interest distribution issues for ecosystem Minitias (Layer 2s), coordinating benefits among protocol participants to promote healthy ecosystem development.

The above covers some of the key concepts. In summary, Initia has designed several unique mechanisms to guide the ecosystem in a unified direction and encourage truly valuable innovation. For more information, please refer to the official documentation.

For any public blockchain, both users and developers are crucial components of its ecosystem. While many public chains attract developers and users through rewards and hackathons, Initia's approach is to provide the best interaction experience (BEST UX/DX) for both groups.

In a recent technical presentation, Initia co-founder Stan explained their protocol design philosophy, emphasizing Initia's foundational concept of optimizing liquidity movement between different applications. While experienced Ethereum users can seamlessly transfer assets on mainnet, operations become complex when utilizing Layer 2 solutions.

Particularly for users less familiar with the ecosystem, transferring assets between Layer 2s can be challenging - they might need to consult DeFi analytics platforms just to understand the process, and even then, they might face confusion with various token standards.

Therefore, Initia architected a new ecosystem that simplifies cross-chain operations and enhances overall user experience, establishing an interwoven multi-chain network.

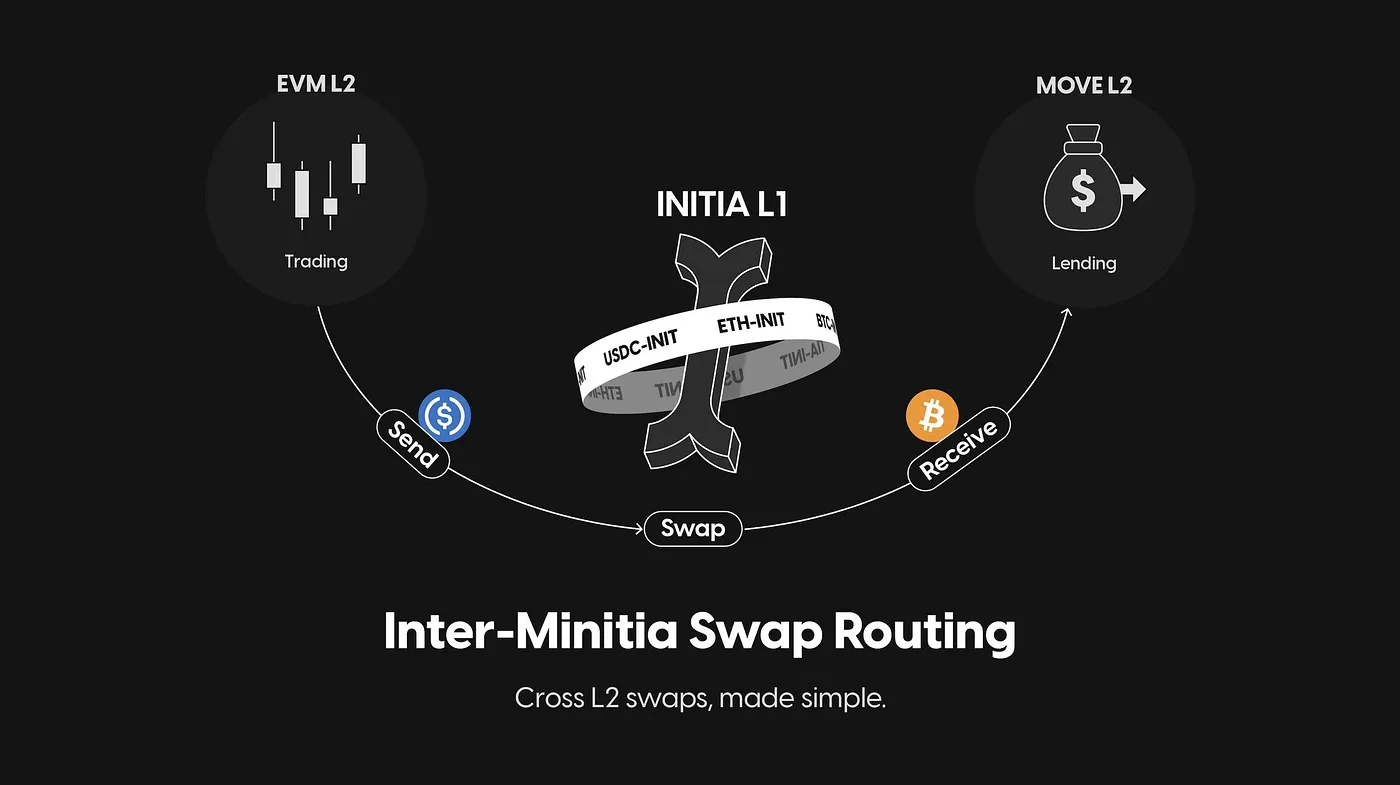

In implementation, we've covered Enshrined Liquidity, InitiaDEX, and Minitswap. For the user interface, the diagram below demonstrates how a user can transfer assets from Minitia A (EVM Layer 2) to Minitia B (MoveVM Layer 2).

Leveraging Initia Layer 1's native liquidity pools, users can execute single-click cross-chain swaps between USDC on Minitia A and BTC on Minitia B. Importantly, USDC maintains consistent standards across Minitias - eliminating confusion with variants like USDC.e.

This significantly reduces operational complexity for users, both in cross-chain bridging and token standard consistency.

A thriving ecosystem requires robust developer participation. While many chains implement aggressive grant programs, often attracting "grant hunters" with low protocol loyalty, Initia implements a different approach:

1. Multi-VM Support for Maximum Developer Coverage

As previously detailed, Initia supports three virtual machines:

EVM (Ethereum Virtual Machine)

MoveVM

WasmVM (WebAssembly Virtual Machine)

While EVM and MoveVM are established standards, WasmVM is particularly significant as it enables cross-chain compatibility and supports multiple programming languages including C, C++, and Rust, facilitating broader developer adoption and cross-platform development capabilities.

Recently, Arbitrum deployed Stylus, which will also integrate WasmVM support, highlighting this virtual machine's criticality for ecosystem development. Currently, Initia can potentially attract developers and smart contracts from virtually all mainstream blockchain protocols.

Modular Infrastructure for Developer Focus

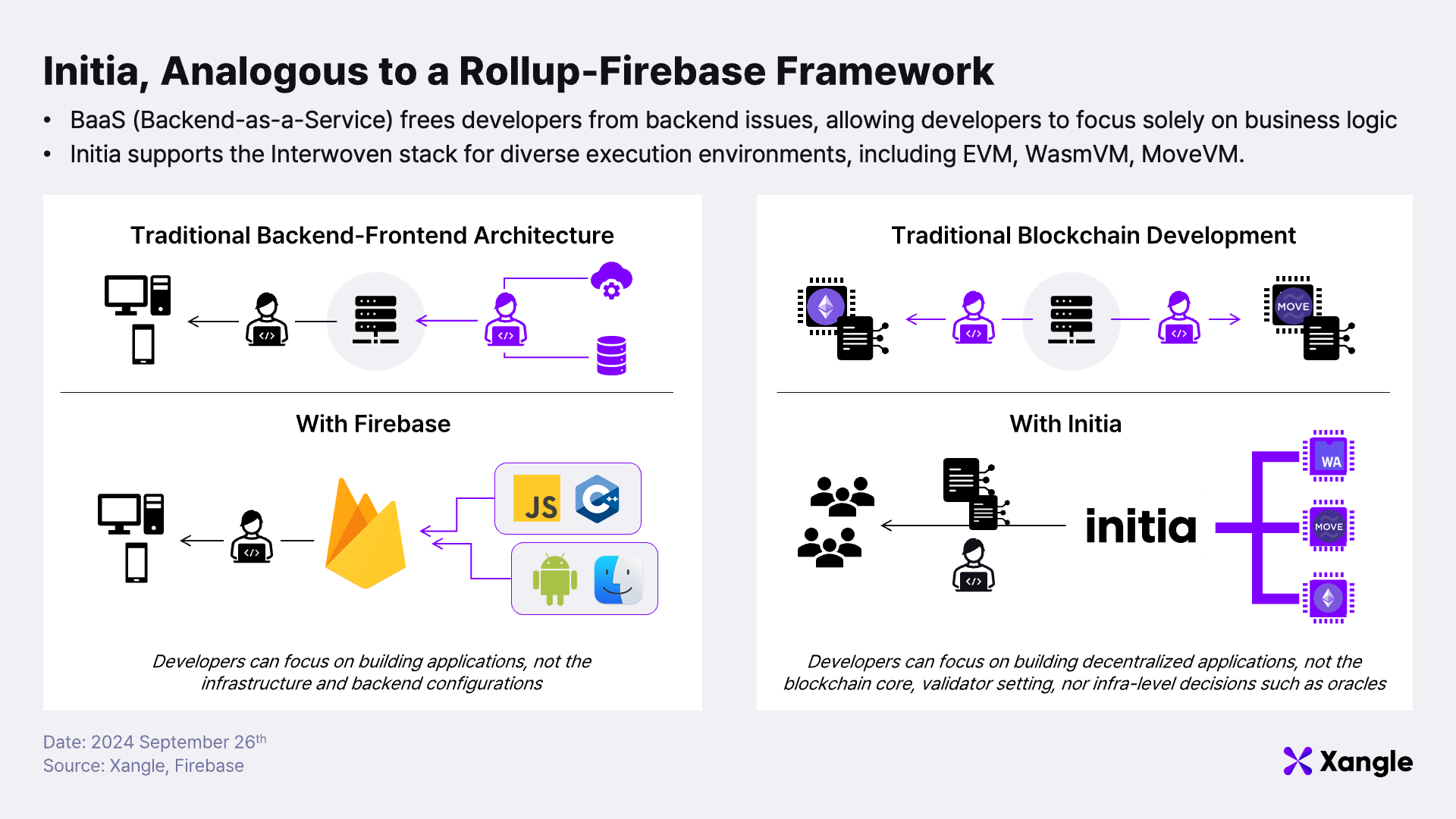

Initia co-founder Zon referenced their architectural inspiration from Apple's design philosophy. He compared Ethereum's Rollup ecosystem to Android's architecture, noting that while it provides infrastructure, developers face multiple integration decisions regarding bridge providers, oracle networks, and other protocol components. Conversely, Initia implements a more standardized approach, clearly defining the system's evolutionary path.

Within Initia's Layer 1 and Layer 2 framework, many components are standardized within the protocol. For example:

Cross-chain communication exclusively utilizes IBC and Layer 0

Data Availability (DA) integrates with Celestia

Oracle feeds maintain consistent standards

They maintain that all applications should align with Layer 1's development trajectory, maximizing value for users and the ecosystem.

Each Minitia deploys as a Layer 2 environment with comprehensive built-in infrastructure, enabling applications with diverse requirements to integrate via a "plug-and-play" framework, eliminating redundant infrastructure development.

Specifically, beyond high performance and interoperability, Initia's native infrastructure components include:

Unified wallet infrastructure

Standardized name service protocol

Integrated block explorer

Standardized oracle feeds

Economic incentive frameworks

Native USDC integration

Multi-chain SDK support

Through this modular infrastructure, each Initia Minitia provides an optimized environment for specific decentralized applications (dApps). This architecture not only reduces the technical barrier for developers but also accelerates dApp deployment and market integration, enabling developers to focus on application innovation rather than infrastructure development.

By Xangle

The previously mentioned VIP program is crucial for Initia's ecosystem development strategy. Here's why:

Initia allocates a dedicated portion of $INIT tokens specifically for the VIP program. These $INIT tokens are distributed to Minitia operators and users based on protocol performance metrics. Distribution parameters and allocation amounts are determined through on-chain governance.

User incentives are directly correlated with protocol engagement metrics. For instance, users maintaining consistent interaction with Layer 2 protocols can unlock additional token allocations. This incentive structure drives sustained ecosystem participation and protocol growth.

The protocol founders previously emphasized that VIP eliminates traditional grant program inefficiencies, ensuring incentives reach end users directly rather than being locked in protocol treasuries. Developers benefit through user acquisition metrics and protocol value creation.

The VIP program's core objective is aligning incentives across all protocol participants:

Minitia development teams

Layer 2 protocol users

Broader Initia ecosystem stakeholders

Ecosystem development presents both opportunities and challenges.

While attracting established protocols through incentive programs is straightforward, these forked implementations often lack long-term alignment and sustainability.

Initia's strategy differs from traditional ecosystem development approaches. Rather than incentivizing protocol forks, they support innovative teams building native implementations on Initia, providing comprehensive support:

Technical development resources

Protocol marketing initiatives

Ecosystem incentive programs

According to the protocol documentation, twelve ecosystem protocols (Minitias) are currently in development, spanning multiple sectors:

Decentralized Finance (DeFi)

Non-Fungible Tokens (NFTs)

Gaming Finance (GameFi)

Artificial Intelligence (AI)

Many of these protocols have secured backing from established blockchain investment firms including Binance Labs, Hashed, Polychain Capital, and HackVC, validating Initia's technical architecture and vision.

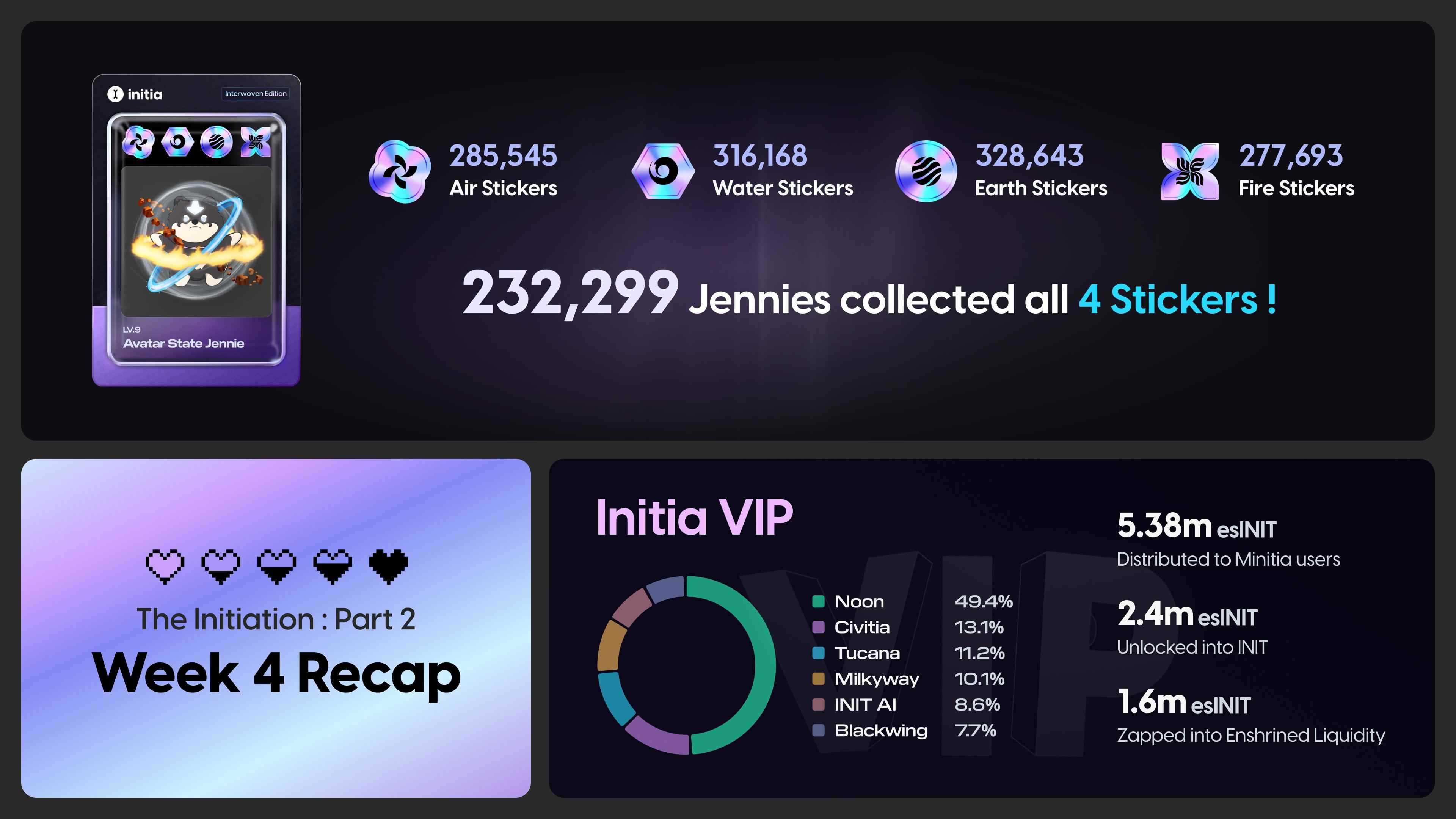

Recently, Initia completed a 12-week testnet campaign where users needed to fully complete multiple activities and maintain active participation to earn the final Jennie NFT reward (Jennie is Initia team's pet and the main source of various memes). Additionally, users who deeply engaged with the VIP program and interacted with MinitSwap, Minitias, and other protocols could earn special Stickers.

Below are the official campaign statistics: overall, the campaign attracted over 3 million active wallet addresses and generated more than 100 million transactions.

Based on my personal participation experience, Initia's testnet activities required long-term engagement and verification requirements (such as Github scores, Google scores, etc.), which to some extent prevented simple bot participation.

Significantly, Initia's recent funding announcement confirmed mainnet deployment and Token Generation Event (TGE) scheduled within two months.

While Binance Labs' early protocol involvement attracted initial attention, ecosystem development extends beyond venture capital participation. Recent blockchain ecosystem research indicates decreasing correlation between "established VC backing" and protocol success metrics.

Without a strong community foundation and the ability to engage with users and ecosystem projects, any project is destined to become a ghost town.

I initially became interested in Initia simply because I saw cultural elements I love - like Yu-Gi-Oh, One Piece, and Neon Genesis Evangelion , being actively incorporated into their team's social media presence.

It wasn't until I discovered how they infused these cultural elements into their team, community, events, and ecosystem projects that I truly grasped the importance of 'making it playful' and 'making the ecosystem fun' in community building."

We are all Jennie's fans.

Recommendation